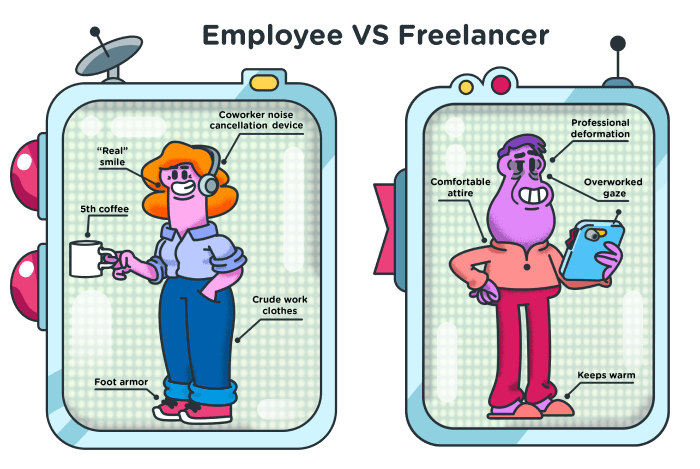

Difference between a freelancer, a contractor, and an employee

Last updated on: November 28, 2023

The labor market of today is evolving rapidly. We’re seeing jobs transform, and the lines between work titles overlap or even blur. Job opportunities have never been more numerous, but so have the possibilities of getting exploited, or running into legal trouble when it comes to your work status. One simple mistake in your contract can cost you, or the company a pretty penny, unless you learn how to differentiate between the three most common work categories: freelancing, independent contract work, and employment.

Table of Contents

Who is a Freelancer?

Freelancers are individuals who are self-employed, pay their own taxes (not their client), and usually have more than one employer for whom they work.

Their scope of work can vary:

- Setting up a newsletter template for a single small client;

- Supervising a project from start to finish;

- Doing a logo design for a startup, etc.

There is no real limit to the amount of their involvement, size and scope of the job, and the duration of their contract with a client. However, freelancers will rarely rely on a single client or a business as their income source, as they are aware of market fluctuations. For them, job security comes from a larger number of quality long-term clients.

Freelancers are most commonly paid by the hour, or per project.

While they do consult with their employers/clients, freelancers enjoy a much larger autonomy, and are normally given free rein to do their job and make decisions as they see fit.

Who is a Contractor?

Contractors operate much like freelancers: they are self-employed, pay their own taxes, and can be involved with several clients at a time. However, there are some key differences.

- Contractors can work solo, or through an agency;

- They can be hired as a temporary replacement to a full-time worker;

- They can work on the employer’s premises and use their equipment;

- More likely to work full-time and for a longer period of time for a single employer;

- Clients/Employers also aren’t obligated to pay health insurance or benefits.

They are the kind of middle ground between freelancers and employees, who enjoy some freedoms of independent work, but also have a more reliable pay.

Who is an Employee?

Employees are individuals working full time for an employer who pays their taxes, health insurance, pension (optionally), and regulates their sick leave and holidays. The differences between employees and contractors and freelancers are much bigger.

- They work exclusively on the work premises;

- They use company-provided tools, materials, and space;

- Employee work hours are regulated and managed by the employer;

- Their salaries are usually fixed, paid out on a monthly basis;

- The work they do is more guided, there’s less autonomy.

It’s important to mention that employees work under contracts, much like freelancers and contractors. However, their contracts specify how long they’re expected to work for a company, as they’re not hired per project, or paid by the hour. They also outline all the benefits the employer provides, which aren’t available to the contractor or freelancer.

Categories for distinguishing freelancers, contractors, and employees

Note: As a starting point in this discussion, we will look at how the IRS (Internal Revenue Service) in the United States distinguishes the three groups. Keep in mind that the laws in your country may differ in some regards, so it’s important to check your government website for details.

The way to distinguish what kind of worker you are depends on how much control or independence you have with the workflow. And it’s reflected in three categories:

- Behavioral control – how much control the employer has over how you work

- Financial control – how and when you are being paid

- Type of business relationship – the employer-worker relationship details

| Behavioral | Types of Instruction | The Degree of Instruction | Job Training | Evaluation |

|---|---|---|---|---|

| 1. When and where you work 2. How to perform specific tasks 3. Who you work with 4. Which tools you use | 1. Detailed out instructions 2. Having the process controlled | If you receive training on the specific type of work, it shows that the employer prefers it done a certain way. Ergo – more control | Any kind of evaluation of your work process implies you are an employee. Evaluating the end result only implies independent contract/freelance |

| Financial | Investment in equipment | Market availability | Opportunity for loss or profit | Evaluation |

|---|---|---|---|---|

| Whether you pay for your own equipment, space, and software, or the employer | If you are able to look for other work | Freelancers can lose out if their expenses are higher than earnings, whereas employees can’t | Receiving regular salary vs working for a commission |

| Business Relationship Type | Written contracts | Duration of relationship | Services | Employee benefits |

|---|---|---|---|---|

| The working conditions and elements laid out in a contract are the best show of your work status | Contractors and freelancers are hired per project, or for a brief amount of time. Employees are usually on a yearly or indefinite basis | The bigger and more important the role, the more control an employer wants. Freelancers and contractors will get smaller-scale jobs, or those that won’t represent the company as a whole | Health insurance, maternity leave, holidays, paid leave, sick leave, etc. |

Why correct classification is important for the employees

One should always be properly compensated for their work. Whether you are a salaried employee, or work as a contractor or a freelancer, you should be familiar with your rights and prerogatives as a worker.

And as an independent worker, you need to pay close attention to how you classify yourself. Accepting a job that treats you more as an employee than a freelancer can cost you and your client a potential fine or additional taxes.

Additionally, some businesses will find ways to bypass taxes by manipulating contracts, to your detriment. In these cases, you are eligible for legal action and potential damages.

For example, if you are an independent contractor in the U.S., and you believe a client has misclassified you as an employee, the IRS has provided a form you can fill out, to have them check if you’re eligible for compensation.

Why correct classification is important for the employers

Misclassification happens when a company treats a worker as a freelancer or a contractor, when they are actually an employee, or vice versa.

This leads to employees potentially missing out on certain benefits, or freelancers being locked in a contract that only damages their business practice (for example, working longer than required, or having supervised, fixed hours). And the law often sides with the workers, seeing how these misclassifications usually only benefit the employer.

For example, skirting these labor laws gives the business all the advantages of having a full-time employee, while not having to pay the person any benefits. Misclassification can be seen as neglect, employee mistreatment, or ultimately – exploitation. Should the worker sue the company, or tax auditors come knocking, the employer could stand to pay a hefty fine. While some businesses still operate in this way, genuine mistakes can happen.

Misclassification penalties for the employers

There are two kinds of penalties: those of the IRS and legal penalties

IRS penalties come down to:

- 1.5% of the employee wages;

- A fine for each wrongly filed employee form (or if you’ve failed to file it at all);

- 40% – 100% of FICA taxes the employer was supposed to pay.

Legal penalties include:

- Wage and tax audits – compensation for unpaid wages

- Class-action lawsuits

- Criminal penalties – if the misclassification was intentional

If you’re an employer unsure of how to classify a worker, you can file the SS-8 Form (Determination of Worker Status) to have the IRS help you with it.

How to prevent misclassification

Luckily, prevention is easy, and the government makes sure to equip every worker and employer with enough tools and help to protect themselves and their businesses from any misconduct.

The Common Law (or Right to Control) Test

In the U.S. the IRS uses what is known under multiple names as the Common Law Test (the Right to Control Test, or the 20 Factor Test).

It has a checklist of 20 factors that determine whether a worker is an employee or an independent contractor. The test itself isn’t a zero-sum game, and there are no right or wrong answers. It provides categories like the three we’ve mentioned earlier. In the end, as you assess your work relationship according to the checklist.

It’s important to mention that the IRS emphasizes that certain factors on that list hold more weight than others. So, your classification might not be that clear-cut.

For a more detailed overview of the 20 Factor Test, the State of Oregon website has a public document on the proper forms that need to be filled out and what to look out for.

Additionally, we’ve provided a resource on how to properly pay contractors and freelancers, which could be useful.

Always check your contracts

Before signing or formulating any contracts (as an employee or freelancer), be sure to check every point of it.

If possible, consult an accountant or a lawyer, who can spot potential legal loopholes more easily. Freelancers can also make a contract template for general work conditions that aren’t based on the type of work or client, but secure their classification, like:

- Hourly rates and projections of hours worked on a daily basis;

- Emphasis on your own equipment/tools/space being used for work;

- The type of evaluation and rapport you provide, etc.

Since contracts are an important means of protecting your assets and integrity as a worker, it’s best to learn how to read and write them.

Know your rights

We can’t emphasize enough how important it is to know your rights as a worker. No matter the classification.

For freelancers and contractors, the laws can differ from state to state in the U.S. alone. Websites like LawSoup.org digest all the important information on their website to help beginners start off their careers, and keep the “veterans” up to date with relevant information. However, even their information covers only certain regions, like Los Angeles, California, and San Francisco, with only general information for the whole country.

Looking up the official government website for labor laws, and their corresponding tax department, the lesser the odds of someone misclassifying you on purpose, or by accident.

International Labor Organization, an agency organized by the UN, contains all the information concerning labor laws by country. It is a great starting point no matter where you are from.

Conclusion

The distinction between the three employment categories comes down to the amount of control an employer has over the financial aspect of a worker’s job, their tools and equipment, workspace, time, and the manner in which they work. Freelancers and contractors are more autonomous, but require to pay their own taxes, insurance, and benefits, while employees have less control over their work processes, but with full paid benefits.

✉️Have any suggestions or personal examples concerning freelancing and contract work you’d want to share with our readership? Contact us at blogfeedback@clockify.me, and we might feature your story in one of our next articles.