How to pay contractors and freelancers in 5 simple steps

Last updated on: May 31, 2022

Paying your contractors and freelancers can be tricky, as you’ll have to:

- Make sure you’ve classified your workers correctly, and determined whether they’re legally contractors, freelancers, or regular employees

- Select a suitable payment method and agree on the payment terms with your worker

- Gather the right documentation for the IRS

To make sure you don’t miss anything, here’s everything you need to know about how to pay contractors and freelancers:

Table of Contents

Freelancer vs contractor vs employee

Before we dive into explanations about what you need to consider when paying contractors and freelancers, here are the basic definitions that will help you distinguish freelancers and contractors from regular employees.

Freelancers definition

Freelancers (aka independent contractors) are self-employed professionals who:

- Typically have their own business,

- Have no long-term commitment to one employer, and

- Have no other employees in their business but themselves.

They’re currently on the rise — one Statista report forecasts the number of freelancers in the US alone will skyrocket to over 90 million by 2028.

Freelancers often work remotely, take on multiple projects and clients at the same time, and then organize their work accordingly.

They make all the decisions about their work routine on their own, including:

- When they’ll work,

- Where they’ll work,

- What projects and clients they’ll take on, and

- What hourly rates they’ll charge their clients, depending on various parameters.

Once freelancers take on a project, they agree on the deadlines and project outcomes with the client.

But, freelancers always have sole control over how the work is handled (as long as the agreed deadlines and project outcomes are met in the end).

They’re often classified as 1099 independent contractors, who have to pay their own taxes, benefits, and insurance.

Contractors definition

A contractor is a person or organization hired to:

- Provide materials,

- Perform a service, or

- Do a job on a contract basis.

Contractors are similar to freelancers, but there are certain legal differences. They have less freedom in terms of what clients and projects they’ll take on, as they’re usually outsourced to certain clients by a base agency or company.

Contractors may or may not be self-employed, and the terms of their “employment” by a particular client, agency, or company depend on the contract they’ve signed.

When contractors are outsourced by a base company or agency, which provides them with some benefits and insurance, they’re paid as W-2 workers, just like employees.

So, from the perspective of their base agency, this type of worker is a regular employee.

However, from the perspective of the business that employs the services of the worker through their base agency, the worker is seen as a contractor.

Thus, these workers are often regarded as W-2 contractors.

As previously mentioned, unlike contractors, independent contractors (freelancers) are never tied to an outsourcing base company, and they handle their own taxes.

How contractors and freelancers differ from employees

Employees are individuals employed full-time or part-time, under a specific contract of employment (expressed or implied, oral or written) that specifies the employees’ rights and duties.

Employees are employed for a salary or wages, and classified as W-2 employees – all their taxes are handled by the employer they work for.

Several rules determine whether a professional is an employee or a freelancer:

- Behavioral — Is the company that hired the worker in control of how the worker does their job?

- Financial — Is the payer in control of the economic aspects of the hired worker’s job, such as how they’re paid and whether all their expenses are reimbursed?

- Type of relationship — How the payer and the workers see their relationship, whether it includes a contract and employee benefits, the permanency of the relationship, etc.

💡 Clockify Pro Tip

Check out our blog post for a more detailed explanation of the differences between these types of workers:

Before you consider the payment methods for your worker, always make sure they are legally classified as W-2 contractors, 1099 independent contractors, or regular employees, to avoid problems with the IRS.

If you’re still not sure how to correctly classify a worker, you can file Form SS-8 with the IRS, which will officially determine the status of your worker.

For more clarification about taxes, worker classification, and other legal matters, consult the official IRS website.

How to pay W-2 contractors

W-2 contractors are similar to employees, who have their insurance and benefits paid by the employer.

In other words, W-2 contractors are assigned to a client of the base company or agency, and the base company or agency:

- Provides some of the benefits,

- Handles employment taxes, and

- Takes a cut of the hourly rate for a particular client.

For example, if the client is billed at $100/hour, the W-2 contractor may earn $70/hour, while the rest of the hourly rate goes to the base company.

How to pay independent contractors in 5 easy steps

If you hire a 1099 independent contractor, aka a freelancer, you’ll have to take the following steps when paying them.

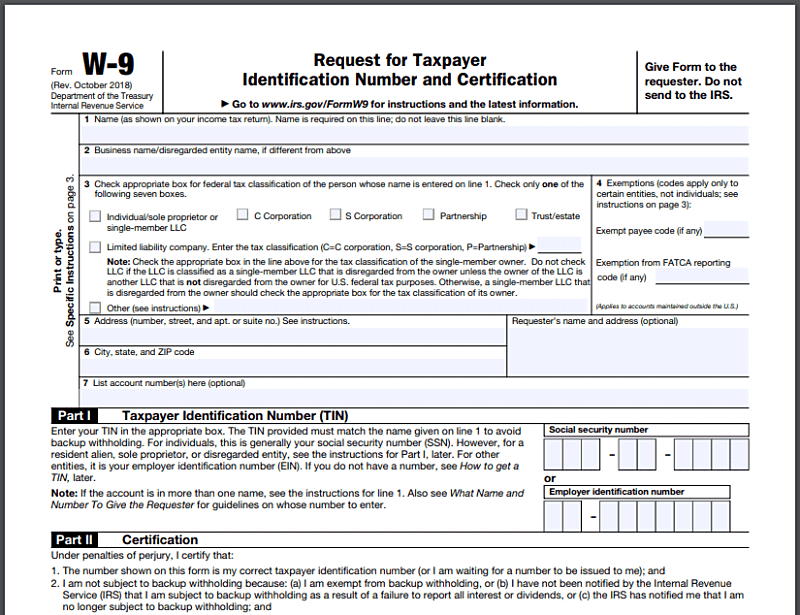

Step #1: Have the independent contractor fill out a W-9 form

In essence, the W-9 form is meant to help you get all the independent contractor’s identifying information, including:

- Name

- Type of business (Sole Proprietor, Corporation, Partnership, etc.)

- Taxpayer Identification Number (TIN)

- Certification

If your independent contractor doesn’t provide their TIN, you’ll have to deduct backup withholding taxes from their earnings at the rate of 24%.

Backup withholding is important as, otherwise, you’ll be responsible for any uncollected taxes from the contractor.

Step #2: Consider payment terms

You and the independent contractor usually determine the payment terms between yourselves – and there are no prescribed rules here.

Most likely, you’ll get a cost estimate beforehand (which will include materials used and any additional services).

Then, you can agree on how you’ll parse your payments. You can:

- Pay the freelancer upfront – Bear in mind that you should only consider this if you already have a relationship with the freelancer and trust them to do the job as agreed.

- Pay the freelancer after the job is complete – This is where the contractor’s trust in you comes into play. Bear in mind that not all contractors will be willing to be paid only after project completion. Also, smaller contractors simply don’t have the means to pay all project costs without getting paid for the materials upfront.

- Pay one half upfront, and the other half upon completion – This is always a great option, both for you and the freelancer.

- Pay per each milestone — This option works for both parties. Freelancers don’t risk doing the entire project and not getting paid for it. On the other hand, you get to follow the freelancer’s progress and not risk getting sloppy work.

Things to consider when setting payment terms

Remember, many freelancers will need the first half of the fee to purchase any necessary materials (and be reimbursed for them after completing the project).

If you’ve commissioned a larger project that might span months, you can parse payments differently, for example:

- Pay one third upfront,

- Pay the second third on a large milestone, and

- Pay the rest upon project completion.

In any case, make an agreement with the independent contractor to send you the receipts for any costs incurred while working on the project. This way, they provide you with documentation and proof of how they spent their advance payment.

For the best possible client/freelancer relationship, it’s best that you and the freelancer lay out the ground rules about what will happen if:

- The client doesn’t finish the work on time

- The contractor doesn’t deliver work by the agreed deadlines and expected project outcomes

- Payments are not delivered on time

This way, neither of you has to worry about the other side not fulfilling their part of the deal.

Step #3: Pay them what they’re due

If you’re hiring an independent contractor, you’ll have to agree with them about the payment method you’ll use in advance.

The payment method may often depend on the location of your freelancer. Some regions don’t support certain payment methods, and some payment methods ask for large transfer fees you’ll probably want to avoid.

We’ll discuss the best payment methods to pay your independent contractor in the next section.

Step #4: Get any backup withholdings to the IRS

Once you’ve agreed on the payment terms and method, you’ll have some other legal payment matters to look into.

In case your contractor hasn’t provided you with their TIN and you’ve had any backup withholdings, you’ll need to get the withheld money to the IRS.

Also, make sure you get all withheld state taxes to the right state tax authorities.

Step #5: Fill out Form 1099-NEC

You report any non-employee compensation to the IRS by completing Form 1099-NEC.

You, as the client, must complete the form if you’ve paid $600 or more to an independent contractor during the course of the year.

You need to fill out the form and send copies both to the IRS and your independent contractor by January 31 of the following tax year.

How to issue 1099

Filing Form 1099-NEC is fairly simple.

Just follow these steps:

- Collect the required information about the contractor through Form W-9 (See Step #1).

- Fill out Copy A and Copy B of Form 1099-NEC — the former is for the IRS, the latter for the contractor.

- Send Copy A to the IRS — you can do it either by mail or electronically, through the IRS FIRE (Filing Information Returns Electronically) system.

- Send copy B to the independent contractor — you can do so either via mail or email (for the latter, you need to obtain consent from the contractor).

- Send a copy to the state tax department, if needed — there’s also a Copy 1 of the document you can send to your state, if required.

- Submit Form 1096 — if you choose to submit 1099-NEC by mail, you’ll also need to send Form 1096 to the IRS, which is used for tracking all the physical copies of the 1099 forms you submit for the year.

6 best ways to pay independent contractors (best payment methods)

If you’re wondering about the best payment method to use when paying out your contractor, you may want to consider one of the following.

Checks

Checks are a great payment option because they don’t require deposit fees.

But, some contractors you’re working with may be wary of checks because they have to wait for the check to clear, and checks generally take longer to arrive (as they’re sent via post).

However, you can eliminate the time it takes to mail a check if you go for eChecks. These work exactly the same way as regular checks, except they’re sent via email.

Online payment systems

Today, there are many online payment systems that make it easy to carry out transactions, both domestic and international.

Some of them are:

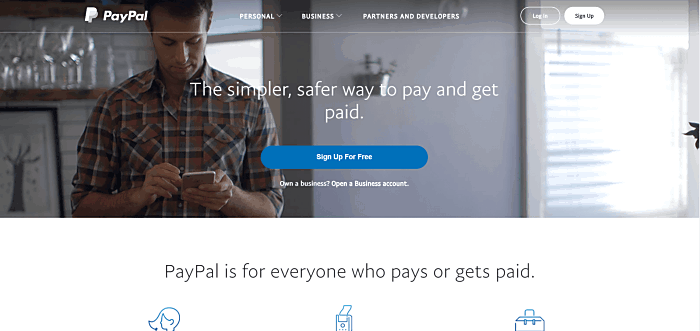

- PayPal

- Payoneer

- Bill.com

- Transferwise

- Venmo

PayPal is probably the most popular payment system among freelancers, and your contractor will likely have a PayPal account.

PayPal is a faster option than a check, considering that the entire transaction is carried out online.

However, PayPal is not supported globally, so you’ll have to check with your freelancer whether they’re able to accept PayPal payments at all (check out this guide to understand whether your freelancer’s country is viable to accept PayPal payments).

If PayPal payments are available, they’re an efficient option because the money transfer usually takes about one business day (though this may also depend on your region).

One con of PayPal and similar online payment systems are their often steep fees. For example, payment processing fees for PayPal can go up to 3.5% of the transaction.

Direct deposit (ACH payment)

Direct deposits are a great way to transfer money domestically. So, if you and your contractor are in the same country, direct deposit is a safe and convenient way to pay them.

In the US, direct deposits are arranged through the ACH system, which allows you to transfer money directly to your contractor’s bank account.

Wire transfer

Another type of bank transfer is wire transfer, which is a great alternative to ACH payments when you work with contractors internationally.

Wire transfers are a great option for time-sensitive payments as they are quite fast. Typically, a domestic wire transfer will process within 24h, and an international transfer might take a couple of days.

The downside is that fees can be costly, so if you’re not in a hurry, you may want to consider other options.

Credit Card

Credit card payments are appealing because they are highly secure and often easily reversible.

Since you’re paying with a line of credit, you don’t have to worry about fraud affecting your actual money. Moreover, many credit card companies offer zero fraud liability.

However, to be able to pay your contractor via credit card, they need to have a merchant account with the bank or alternative merchant service, so this might not be an available option.

Accounting software

There are various accounting software solutions you and your freelancer can use to process payments and have payroll and invoicing handled automatically.

Some popular accounting tools include:

- Google Wallet

- Wave

- Gusto Payroll

- QuickBooks

- FreshBooks

Once you agree with your freelancer about the hourly rate for the project, you can instruct them to track their time working on your project and invoice you based on their billable hours.

How to track billable hours

Your independent contractor can easily track their billable hours in Clockify.

They can use the app in the freelance time tracking tool in the following way:

- Define their hourly rates,

- Start the timer when they begin working on your project,

- Have their earnings calculated automatically with Clockify,

- Get a report on their billable time, and

- Use the report to create an invoice for you.

Then, you can instruct the freelancer to use reliable invoicing software to create invoices so that you’ll have complete documentation for payroll.

If they’re on the STANDARD Clockify plan, they can even generate invoices directly within the app.

Check out how to easily track billable hours with Clockify in the video below.

In any case, when paying your independent contractors, make sure not to take the taxes out before sending them the money.

💡 Clockify pro tip

Want to try a different payment method for paying contractors and freelancers? Check out our guide for more great payment tools and options:

Conclusion: Paying contractors and freelancers doesn’t have to be complicated

In the end, correctly classifying workers before paying them is most important – you can choose your method of payment and agree on the payment terms with your worker. But, proper classification isn’t such a variable.

You’ll have to distinguish whether your worker is a W-2 contractor, a 1099 independent contractor, or a regular employee to understand whether you need to cover taxes, insurance, and benefits for your workers.

But, when paying your independent contractors, remember to follow these steps:

- Have them fill out a W-9 form

- Choose the payment method that works best for both of you

- Pay them on time

- Get any backup withholdings to the IRS

- Report the compensation through Form 1099-NEC

Hopefully, this blog post has helped you understand the steps necessary to pay your contractors and freelancers, as well as choose the best payment method to use.

✉️ Do you track your time? Have you found time tracking helpful for project management? How do you keep track of your time as a project manager? Is there anything that you’ve found particularly useful? Write to us at blogfeedback@clockify.me for a chance for your answer to be featured in one of our future articles.