What is fixed cost: Definition, examples, relevance

Last updated on: September 12, 2023

Making their business as profitable as it can be is a goal for any business owner. Understanding fixed costs is an essential part of running a profitable business and preparing for the future!

To help you make sure you’re always on top of your fixed costs, in this article, we’ll cover:

- The definition of fixed cost,

- Common fixed costs examples,

- Formula for calculating fixed costs, and

- The difference between fixed costs and other types of expenses.

Table of Contents

What is a fixed cost?

According to the US Small Business Administration, “fixed costs are costs that do not change with sales or volume.”

In other words, a fixed cost is any expense that remains the same regardless of the company’s sales and volume, such as rent, loan payments, leases, etc. These costs remain constant throughout time and can usually only be changed when renegotiated.

A fixed cost is necessary for calculating the average fixed cost and total fixed cost. These elements can help companies:

- Calculate and predict monthly costs,

- Estimate the level of production efficiency,

- Determine profit stability, and

- Make informed business decisions.

What is the total fixed cost?

Total fixed cost (TFC) is the sum of all expenses that remain the same no matter the sales or production volume. To put it simply, it’s the sum of all fixed costs of a business.

These costs remain constant throughout time. Thus, the main purpose of TFC is to help companies understand the expenses they have to cover to continue operating.

Let’s say that you run a bakery and you want to calculate your monthly TFC. You should add up all of the fixed costs you have during the month, such as rent, utilities, employee salaries, marketing, and loan interest to get your total fixed cost.

What is the average fixed cost?

The average fixed cost (AFC) showcases fixed expenses needed to produce one product unit. AFC helps businesses understand their permanent expenses compared to the level of production. The main purpose of the average fixed cost is to help businesses understand how efficiently they’re using their fixed resources.

The average fixed cost is calculated by dividing the total fixed cost by the number of goods or services a business produces.

As production and quantity increase, fixed costs are distributed to more units. As a result, each unit’s share of fixed costs becomes cheaper to produce, leading to more efficient use of fixed resources.

Let’s get back to our bakery example and assume that your total fixed cost for a month is $2,500 and you produced 500 cakes. To get your AFC, you should divide $2,500 by 500. So, your monthly average fixed cost would be $5.

What is an example of a fixed cost?

Fixed costs vary from business to business. Still, there are common fixed costs present in nearly every company.

Example #1: Rent

Rent is a common fixed cost. Regardless of how much product you sell or produce, the rent you’re contractually required to pay remains unchanged while you stay within the same office or production space.

The only way you could affect this expense is by negotiating it with your landlord. So, if you suspect that this fixed cost is making your production less efficient, you can always contact your landlord and try lowering it.

Example #2: Salaries of permanent full-time employees

Permanent full-time employees present a fixed monthly expense to your business. That’s because their salaries don’t automatically change when the company’s volume changes.

💡Clockify Pro Tip

To make sure your employees are paid fairly, you should make an employee compensation plan. Here’s how to do it:

Example #3: Depreciation

Depreciation is a drop in value that happens when items are used over time.

Every piece of equipment and machinery loses its value after a certain period. This loss is a fixed cost you need to take into account.

Example #4: Loan payments

If you own a company, you likely took out a loan to help you start the business.

These loan payments include principal payments and interest, and they don’t change as your business volume increases.

Example #5: Lease payments

Lease payments are fixed monthly payments for renting assets.

If you’re renting equipment or anything else that you use in your business operations, you have to include lease payments when calculating your total fixed cost.

Example #6: Insurance premiums

Insurance is an integral part of any business operation.

You likely have a contract with your insurance provider and have to pay a certain premium that doesn’t change with your production level — this is a fixed cost, too.

Example #7: Regular maintenance

If you have to pay for regular equipment maintenance, that’s another fixed cost to consider.

Aside from equipment maintenance, regular maintenance of your website (and app, if you have one) is also a fixed cost you need to take into account regularly.

Example #8: Licenses and permits

Depending on their nature, licenses and permits are typically fixed costs.

Licensing fees for intellectual property, or the ones you pay to the government for operating in a certain line of business or performing specific services, usually come as fixed costs.

That’s because business permits and licenses have a fixed fee you need to pay regularly no matter how your business operations go. Thus, they present a fixed expense.

Example #9: Subscriptions

Subscriptions (for software your business uses, for example), usually don’t change as your business grows unless you change your subscription plan. They present a fixed monthly or annual expense.

Example #10: Property tax

If you own a production space or an office, you’ll need to include property tax as your fixed cost, too.

Not all taxes are fixed costs. But, property tax almost always counts as a fixed cost as it doesn’t change based on the occupancy of the property.

What is the fixed cost formula: Calculating total and average fixed cost

The formula for fixed cost depends on whether you want to calculate the total or average fixed cost.

Regardless of the type of fixed cost you’re calculating, your first step will be finding the period for which you want to calculate your fixed cost.

Most businesses calculate their fixed cost for every month or 6 months. But you can also use a year as your period.

How to calculate the total fixed cost?

Once you decide on the period you want to calculate your costs for, you can calculate the total fixed cost for that period by following these steps.

Step #1: Make a list of fixed expenses

Your first step in calculating the total fixed cost is listing all of your fixed expenses.

You should also take into account subscriptions and rents that are due after the time period you’re calculating your expenses for. That’s because you’re using them during that time despite the fact that you’re not actually spending any money on them during the calculation period.

For instance, let’s say that the software you use comes with an annual subscription and you want to calculate your monthly TFC. In this case, you should divide your annual subscription by the number of months during a year to find the monthly fixed cost of your software subscription.

💡Clockify Pro Tip

Do you find keeping track of your expenses difficult? Check out these tips:

Step #2: Find the total sum

The total sum of all of your fixed costs is your total fixed cost:

Fixed cost 1 + Fixed cost 2 + Fixed cost 3 (…) = Total fixed cost

If you calculated your total amount and believe your fixed costs are too high, you can try to renegotiate some of them.

How to calculate the average fixed cost?

The average fixed cost depends on how many units you produce. That’s why the production quantity is essential for calculating this type of fixed cost.

Step #1: Find the total fixed cost

You can use the calculation above to find the total fixed cost of running your business.

Let’s say you own a company that manufactures earphones and want to calculate the average fixed cost of producing them.

Your total fixed cost during the year was $100,000.

Step #2: Take the number of units you produced

Once you calculate the total fixed cost, you should get the production quantity (the number of units produced) for the period you want to calculate your average fixed cost for.

In our example, let’s imagine that you produced 50,000 earphones last year.

Step #3: Find the average fixed cost

Lastly, you should divide the total fixed cost by your production quantity:

Total fixed cost / Number of units produced = Average fixed cost

Now, let’s calculate the average fixed cost for our example:

$100,000 / 50,000 = $2

Your average fixed cost equals $2.

If your average fixed cost is too high, you can lower it in two ways:

- By renegotiating some of your fixed costs, or

- By increasing your production quantity.

💡Clockify Pro Tip

Are you looking for a way to showcase all of your business expenses in one document? Expense report templates are the way to go. You can try them out here:

Fixed cost vs. variable cost: What are the differences?

According to the Managerial Accounting and Cost Concepts book, variable costs are costs that vary in “direct proportion to changes in the level of activity.”

Unlike fixed costs, which don’t change with production levels, variable costs change automatically when you make changes to production. The changes include:

- Increasing quantity,

- Achieving higher production efficiency,

- Reducing waste, or

- Improving material sourcing.

Common examples of variable costs include:

- Raw materials,

- Shipping,

- Production supplies,

- Commissions, and

- Packaging costs.

This table shows the main differences between fixed and variable costs:

| Differences | Fixed cost | Variable cost |

|---|---|---|

| Production influence | Don’t change with production | Change with production |

| Management | Can change only when negotiated | Change automatically with better material sourcing, reduced waste, and higher production efficiency |

💡Clockify Pro Tip

Tracking both fixed and variable costs are crucial for any project. Learn more about expenses and project accounting in general here:

FAQ about fixed expenses

To help you fully understand the term, we’ll go over some of the most common questions regarding fixed expenses and how they differ from other types of costs.

1. Which is not a fixed cost?

Any expense that changes depending on production levels is not a fixed cost.

Some common examples of costs that aren’t fixed are:

- Supplies for production,

- Shipping and delivery expenses,

- Packaging supplies,

- Raw materials, and

- Commissions.

2. Is fixed cost relevant for break-even analysis?

Fixed costs are a crucial component of a break-even analysis. This analysis helps businesses determine their profitability by establishing their break-even point.

According to the US Small Business Administration definition, “the break-even point is the point at which total cost and total revenue are equal, meaning there is no loss or gain for your small business. In other words, you’ve reached the level of production at which the costs of production equals the revenues for a product.”

If your revenue is above the break-even point, your business is profitable. On the other hand, in case your revenue is below that point, you’re operating at a loss.

The formula for the break-even point is:

Total fixed cost / (Sales price per unit — Variable costs per unit) = Break-even point

If the business becomes less profitable, renegotiating some of the fixed costs can help with the profitability in the long run.

3. What are overhead costs?

Overhead costs are indirect costs necessary for running a business, but are not directly related to production.

Overhead costs include:

- Administrative expenses,

- Accounting fees,

- Rent,

- Utilities,

- Legal fees, and

- Office supplies.

💡Clockify Pro Tip

Interested in learning more about overhead and other types of project costs? Check out this article:

4. Is salary a fixed or variable cost?

In most cases, salary is a fixed cost. That’s because it doesn’t change as the production or sales increase or decrease.

But, a portion of the salary can be a part of variable business costs.

This happens when employee compensation includes bonuses based on production or sales levels, profit-sharing, or commissions, which depend on sales or production. In these cases, a part of the salary will be a variable cost.

5. Are fixed costs indirect costs?

Indirect costs are expenses that are not directly part of the production of a unit.

Common indirect production costs are:

- Utilities,

- Equipment maintenance,

- Depreciation, and

- Rent.

As indirect costs are not directly related to production, they tend not to change based on quantity or sales levels. Thus, most of them are fixed costs.

💡Clockify Pro Tip

Indirect costs are essential for cost accounting. Learn more about understanding your costs here:

6. Is fixed cost sunk cost?

A sunk cost is any cost that already happened and can’t be retrieved.

Variable and fixed costs can become sunk costs. For example, salaries or money spent on marketing and research are sunk costs.

But not all fixed expenses are sunk costs. For instance, equipment is usually not a sunk cost as equipment can be resold or rented out.

On the other hand, all sunk costs are fixed as they can’t be changed with changes in production.

7. Is there a way to track fixed costs?

To successfully manage your fixed costs, you need to keep track of your expenses. Luckily, there are great tools and apps that make this process much easier.

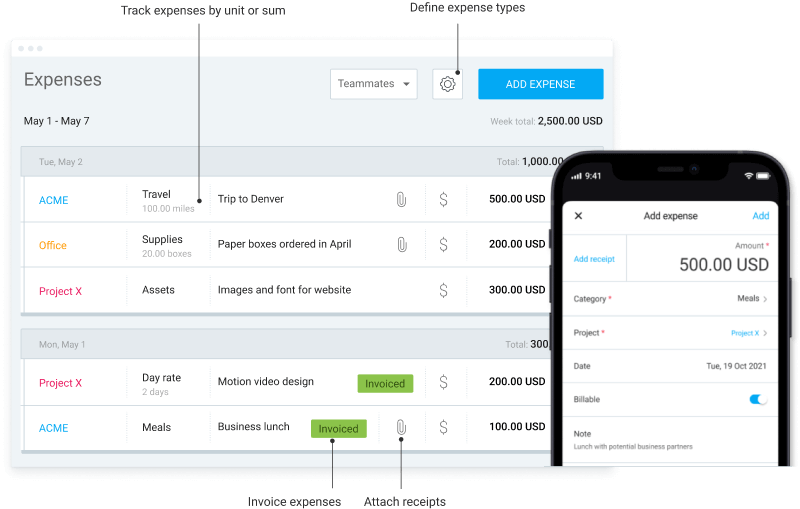

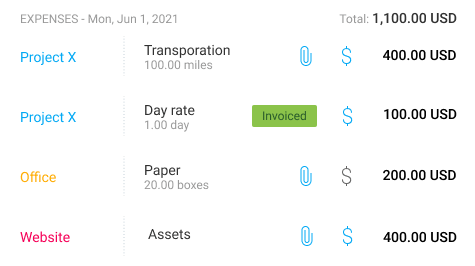

For instance, Clockify is a time tracking tool that not only helps you track employee time and tasks but also enables you to have a clear overview of your expenses.

With the Clockify expense tracking app, you can easily record every expense relevant to your business as well as set budgets and run reports.

With Clockify, you can track expenses by sum or unit and attach receipts related to your business.

You can also add a unit number for each expense. Clockify makes staying on top of expenses much simpler by automatically calculating the final amount for that category based on the prices you input.

You can also easily edit and delete existing expenses and view their receipts when you click on the attachment icon.

Conclusion: Fixed costs exist regardless of production levels

Fixed costs are a fundamental part of any business.

Knowing their relevance, as well as how to calculate both average and total fixed costs, enables you to:

- Better understand the costs of running your business,

- See what costs can be renegotiated for more profitability, and

- Find the ideal production quantity for the most efficient use of your resources.

However, to make sure you’ve obtained the most accurate numbers for your calculations, you’ll need to carefully keep track of all of your expenses. Once you do, you can use calculations from this article to stay on top of your total and average fixed costs.

✉️ Were you able to calculate your fixed costs? Do you have any tips on renegotiating fixed expenses? Feel free to share your tips with us at blogfeedback@clockify.me. Also, if you liked this article, be sure to spread the word to your friends and colleagues!