Back Charge: Benefits, Disadvantages, and Tips

Last updated on: October 27, 2023

What exactly are back charges and how do they affect your business?

In this blog post, we will take a closer look at what back charges are and how they work, with some real-world examples.

We will also highlight their drawbacks and benefits before listing 6 smart strategies to maximize your chances of success with back charges.

Table of Contents

What is a back charge?

Back charges are the billings one party (such as a retailer or a contractor) sends to another party (such as a wholesale supplier or a subcontractor) if they incur losses as a result of the second party’s actions or mistakes.

However, to issue back charges, the two parties should have a legally binding contract in place that specifies what situations attract back charges.

In their book titled Construction Accounting Deskbook, authors Louis P. Miramontes and Huge L. Rice define back charges in the context of construction as:

“Billings for work performed or costs incurred by one party that, in accordance with the agreement, should have been performed or incurred by the party to whom billed. Owners bill back charges to general contractors, and general contractors bill back charges to subcontractors.”

While typically seen in the construction industry, back charges are also common in retail, manufacturing, and finance industries.

For example, consider this real-life scenario — a retail store orders a batch of 500 designer bags from a wholesale supplier and specifies that the bags should arrive by a certain date for a planned promotion.

However, the bags arrive 3 days later than the agreed-upon delivery date. As a result, the retailer misses the promotion window resulting in a loss of sales amounting to $1,000. Expressing disappointment over the delay, the retailer requests the wholesaler to compensate for the loss in revenue by sending an invoice for $1,000.

In other words, the retailer is using back charges as a means to recover the lost revenue from the wholesaler.

A credit card company can also issue back charges to a customer if the latter fails to pay their dues on time. In the context of credit cards, you may have also come across the term ‘chargebacks.’

We don’t blame you if you’re wondering if chargebacks and back charges are synonyms. The following section throws light on the topic.

Back charges and chargebacks: What’s the difference?

Unlike back charges that are used in several industries, chargebacks are typically used in the credit card industry. The chargeback process aims to protect consumers against fraudulent, unwanted, or incorrect credit card charges, according to the Federal Trade Commission.

To understand more about the difference between back charges and chargebacks, we contacted Francis Fabrizi, AATQB (Association of Accounting Technicians Qualified Bookkeeper) at Keirstone Limited.

According to Fabrizi, the distinction between the terms revolves around who issues the charges and who settles them. Opposed to back charges, where the responsible party (a merchant, a vendor, a customer, or a subcontractor) makes the payment directly to the party claiming back charges, chargebacks are usually settled by banks only after an unsuccessfully resolved dispute:

“Chargebacks are typically used to resolve disputes between merchants and customers when the customer has already tried to resolve the issue with the merchant directly and has been unsuccessful.”

Fabrizi explains how chargebacks typically work with an example. Let’s say a customer buys a product from a store with their credit card and finds that the product is defective. They then ask the store to refund the amount, and the merchant refuses to do so. The customer now files a complaint with their bank, which issues a chargeback to the customer to refund the amount.

The bank later recovers the amount from the merchant.

Similarly, a customer can also dispute incorrect or unwanted charges issued by their credit card issuer. In this case, the issuing bank (the bank that issued the credit card) reverses the charges temporarily while they investigate the matter.

💡Clockify Pro Tip

Learn how to master the art of getting paid from the pros! Check out our detailed project billing and invoicing guide:

How do back charges work?

Let’s see how back charges work in practice with an example from the construction industry.

A building contractor (one party) enters into an agreement with a subcontractor (another party) for the electrical wiring of a building.

If the subcontractor fails to finish the work within the agreed time, it results in project delay as the other tasks are dependent on the completion of electrical work. These delays can translate into additional costs for the contractor who may need to retain labor for a longer period of time than originally planned.

In this situation, the contractor can bill these additional costs of labor as back charges to the subcontractor.

In general, back charges help:

- Allocate costs fairly,

- Promote accountability,

- Facilitate dispute resolution, and

- Enhance project management.

By holding parties accountable for their actions, back charges promote transparency and financial fairness.

Now, you might wonder if back charges are a legal right. The next section focuses on the legal aspects of back charges.

Are back charges a legal right?

As there are no specific laws related to back charges, they are typically regulated by the contract between two parties, such as:

- The contractor and subcontractor,

- The retailer and wholesaler,

- The credit card company and consumers, or

- The manufacturer and distributor.

Properly drafted contracts that are mutually agreed upon are legally binding. This means that if one party violates the terms of the contract, the other party has the legal right to take action, such as seeking back charges or initiating legal proceedings.

However, in the construction industry, there are some laws, such as the Prompt Pay Act that indirectly affect back charges. The Prompt Pay Act ensures contractors and subcontractors get paid on time.

Many states (Colorado, Texas, New York, Illinois, Maryland, and South Carolina, to name a few), have adopted a trust fund model where the money owners pay to the contractor is held in trust. The contractor can only use the trust fund to pay the subcontractors for the work performed.

In other words, the contractor cannot withhold the trust funds as back charges for any deficient work performed by the subcontractor in another contract.

It’s important to note that most US state laws give contractors or subcontractors the right to deny payment when another party fails to perform the agreed tasks. For example, if the subcontractor fails to provide the right materials as agreed upon, resulting in defects in the building, the contractor can issue back charges to the subcontractor.

Now, you might be wondering how much a party can claim as back charges.

According to the National Law Review, the party seeking back charges (in the above example, the contractor) can only bill an amount equal to what they spent to rectify the work that was done incorrectly.

💡Clockify Pro Tip

Simplify compliance with labor laws and protect your business with our comprehensive guides:

What is an example of a back charge?

Some of the common reasons for claiming back charges include:

- Delays,

- Property damage,

- Defective materials or workmanship, and

- Lack of compliance with safety and health regulations at the job site.

We will discuss real-world examples for each scenario to help you better understand how back charges work.

Example #1: Back charges for delays

In the above section, you saw how failure to complete work on time can result in back charges. Back charges can also be incurred if a supplier delivers goods late or a customer fails to make timely payments for services or goods they purchase.

In addition, credit card companies can also impose back charges whenever cardholders fail to make their credit card payments on time. These charges are the penalty for not adhering to the payment due date specified in the agreement.

Back charges can also be used by wholesale and retail sellers when another party delays payments. For example, XYZ is a wholesale seller of condiments. John runs a retail store and regularly buys condiments from XYZ, so the wholesale store sends invoices to John on a monthly basis.

However, in July, XYZ delivered the condiments to John as usual but missed billing for a few items. As a result, XYZ’s owner added these items as back charges to the bill they sent to John in August.

Example #2: Back charges for property damage

These are the expenses incurred by one party as a result of property damage caused by another party. The charges are typically invoiced to the responsible party and are used to recover the costs of repairing the damage.

For example, if a hotel guest causes damage to a hotel room, such as broken furniture or vandalized property, the hotel can issue back charges to recover the cost of repairs or replacement of damaged items.

Example #3: Back charges for inadequate workmanship

One of the common causes of back charges is poor workmanship.

Shea Connelly Development (SCD) hired Revive as a subcontractor for two construction projects, one at Park Place and the other at Glendale.

SCD claimed that Revive’s work at Park Place was not up to standard, so they fired Revive from that project. SCD said that they had to hire another subcontractor to rectify Revive’s poor quality of work at the Park Place project. As a result, they would deduct the amount they spent to fix Revive’s work from any payment they owed to Revive.

Here’s another scenario from the real estate industry. Let’s say a property owner has hired a property management company to maintain their apartment building. The contract between these two parties specifies certain responsibilities and quality standards.

After a routine inspection of the apartment building, the property owner discovers that there are issues, such as broken security equipment and unrepaired damage to the building’s exterior.

The owner contacts the property management company to inform them of the issues and asks the company to rectify the issues within a certain date. But, the company fails to do so despite reminders.

The property owner rectifies the issues by hiring another company and calculates the costs of fixing the issues. The owner then bills these expenses to the property management company as back charges.

Example #4: Back charges for safety issues

Let’s say a food supplier enters into a contract with a food processing company to deliver certain food ingredients of the highest quality.

The supplier delivers the ingredients and as it is the first batch of ingredients, the food processing company conducts a thorough quality inspection. The company finds that some ingredients are contaminated which can lead to health hazards.

The food processing company issues back charges to cover the costs of conducting quality checks and disposing of contaminated products.

Back charges for safety issues are also common in the construction industry.

London-based Multiplex Construction Europe Ltd, a contractor, hired Bathgate Realisations Civil Engineering Limited, a subcontractor for concrete works for a construction project.

Multiplex also hired another subcontractor, BRM Construction, to design the slip-form rig (construction equipment that continuously pours and shapes concrete) that was used for the concrete work performed by Bathgate.

At a later date, Multiplex terminated its contract with Bathgate which had gone bankrupt and hired a new subcontractor. After inspecting the work done so far, the new subcontractor said both the slipform rig and concrete work were defective and unsafe.

Multiplex claimed the cost of replacement of these unsafe equipment and concrete work as back charges of over £12 million (approx $14.6 million) from both BRM and Bathgate.

Advantages of back charges

Back charges can have many advantages in certain situations — especially in construction and contractual relationships where issues need to be addressed promptly. Here are some of the most common advantages of using back charges.

Advantage #1: Back charges could help with cost recovery

According to Tom Zauli, senior vice president and general manager at SOFTRAX, the top benefit of back charges is that they help a company recover revenue that might otherwise slip away:

“The main benefit to back charges is that the process allows a company to retrieve revenue that would otherwise be lost.”

Back charges can provide a level of protection in case a subcontractor or vendor fails to meet their obligations. These charges are a way to recoup costs that can run into millions in the case of complex projects.

To increase your chances of recovering back charges, make sure to always invoice other parties promptly and accurately.

💡Clockify Pro Tip

Effortless invoicing starts here. Download our free, multi-purpose invoice templates for quick solutions:

Advantage #2: Back charges promote accountability and responsibility

Back charges can help promote accountability by discouraging breaches of contract and deterring subpar work. This encourages all parties involved — be it vendors, subcontractors, credit card issuers, or customers — to act responsibly to avoid back charges.

For example, a food manufacturer enters into a contract with a retailer to supply food products on time. Thanks to the inclusion of the clause on back charges, the manufacturer knows if they don’t supply good quality products or fail to deliver them on time, they will be hit with back charges.

As a result, the manufacturer takes extra care to avoid delays or quality issues.

Similarly, the retailer understands the need to diligently monitor the quality of products and track the expenses, if any, of addressing delays or defective products. This vigilance ensures that they can rightfully seek back charges should the other party fail to meet their obligations.

Advantage #3: Back charges can result in improved project management

By tracking and documenting back charges, project owners and accountants can gain insights into the total receivables and payables. Account receivable refers to the money customers owe to a company and account payable is the money a company owes to its vendors or creditors.

Project owners can also notice the areas where costs are escalating due to errors or omissions on the part of vendors or subcontractors. They can then address these areas to optimize project cost management.

Advantage #4: Back charges can help prevent disputes

According to Tom Zauli, back charges can play a vital role in preventing the common causes of disputes in the business world:

- Poor quality work,

- Project abandonment,

- Fraudulent activities, and

- Payment-related issues.

Citing the example of the construction industry, Tom explains that back charges deter subcontractors from doing anything other than the best job:

“As a deterrent, a back charge would need to be included in the subcontractor’s contract, ideally with the subcontractor acknowledging the potential for back charges. How this could play out is that the back charge clause keeps a subcontractor on time in meeting an aggressive deadline, because they realize that any delay on their part would result in a back charge.”

Tom also highlights the importance of “clear and timely communication” to resolve the matter that necessitated back charges.

Other than that, we should emphasize the importance of documentation as a tool for resolving disputes — both parties need to draft the contract terms clearly and document any deficient work meticulously.

For example, if one party can thoroughly document deficient work by the responsible party, it can justify the grounds for imposing such charges.

If there is a legal dispute related to the back charges, accurate and comprehensive documentation can help both parties substantiate their claims.

Advantage #5: Back charges help rectify quality issues

As we saw above, back charges can act as deterrents to poor quality work.

These charges also provide a mechanism to address and rectify quality issues or deficiencies in:

- Workmanship,

- Materials, or

- Compliance with contract requirements.

This can help ensure that the project meets the desired quality and standards. By using back charges as a tool to deter poor-quality work, project managers can minimize the cost of quality (the total cost a company incurs to ensure the quality of its products or services).

Disadvantages of back charges

Back charges do come with several drawbacks that can affect both parties involved in the contract. Here are some of the most common disadvantages of back charges.

Disadvantage #1: Back charges can lead to disputes

As you may recall from the earlier section on benefits, we highlighted how back charges can aid in dispute resolution. It might seem contradictory to mention that they can also be a source of disputes.

Nevertheless, the accuracy of both statements depends on:

- The clarity of the contractual terms regarding back charges,

- How thorough the documentation is regarding back charges, and

- The way the back charges are implemented.

In the finance industry, disputes related to credit card charges (or chargebacks) are common, with the chargeback rate being 0.60%. This means that 6 out of 1,000 credit card transactions are disputed.

According to Fabrizi, given that back charges can lead to legal disputes and affect business relationships, they should only be used as a last resort after trying other means of resolving or preventing disputes:

“It is important to note that back charges can create a negative and adversarial relationship between the parties, leading to distrust and resentment. They can also be subject to legal disputes and challenges, especially if they are not supported by sufficient evidence or documentation, or if they violate the terms of the contract or the applicable laws and regulations.”

As you can see, meticulous documentation is the key to preventing such disputes.

Disadvantage #2: Back charges can be difficult to recover

There are many reasons why back charges can be difficult to recover, such as:

- Delay in billing for back charges: When back charges are not sent in the current billing cycle, the receiving party could end up being unpleasantly surprised. The latter, in this case, may not remember the reasons for back charges or not be prepared to pay these charges.

- Insufficient documentation: Lack of documentation (or poorly maintained documents) can make it difficult for the party claiming the back charges to prove their claim. This is particularly important if the recipient files a lawsuit disputing the back charges. Generally, the burden of proving that the other party owes back charges lies with the claimant (the one claiming the back charges from another party).

- Lack of communication: If the recipient of the back charges comes to know about the charges only when they receive the bill, the likelihood of their being able to pay the amount immediately is low.

In addition, as back charges are often disputed, recovery can be a complicated process and can often involve lengthy legal battles.

Disadvantage #3: Back charges can be misused

The possibility of misusing back charges is high particularly when the contract terms are vague or poorly drafted.

A party may abuse back charges by inflating costs, alleging poor work quality without evidence, or adding additional charges that were not part of the original agreement.

Here’s another way of misusing back charges. Some contractors hire the same subcontractors for multiple contracts. These contractors add illegal clauses in the contract that if the subcontractor carries out deficient work in one contract, back charges will apply to all the other contracts.

This means that if the subcontractor performs deficient work on the current project, the contractor can levy back charges for all other projects that the subcontractor carries out for the contractor.

In some cases, back charges are used as a form of retaliation. If one party is dissatisfied with the performance or actions of another party, they may resort to issuing back charges as a punitive measure, even if the charges are not justified.

Disadvantage #4: Back charges can be a bottom-line killer

If the party that is at the receiving end of back charges refuses to make the payment, the one issuing these charges may have to end up covering these costs.

For example, if a supplier refuses to pay back charges to a retailer for delayed delivery of goods, the latter has to bear these costs.

Even when vendors or subcontractors do agree to pay up the back charges, the ones claiming the back charges lose time and money in the pursuit of payment. Lengthy dispute resolution processes can lead to financial strain on the party seeking back charges, affecting project timelines and budgets.

We can look at the data from a study by Arcadis to get an idea of the costs and timelines.

The study found that while the value of disputes in the construction industry reached an average of $54.26 million in 2020, these disputes took 13.4 months to resolve.

Tips on how to be successful with back charges

Whether you are a business owner, project manager, or a vendor looking to issue back charges to another party, you can maximize the chances of recovery with these tips.

Tip #1: Draft a foolproof contract

Most disputes on back charges arise from poorly drafted contracts or a lack of understanding of what the contract entails.

So, the first step to recovering back charges is to draft a foolproof contract that clearly defines the:

- Scope of work,

- Expected quality standards,

- Timelines, and

- Payment terms.

Most importantly, outline the conditions under which back charges can be applied (such as low-quality materials or failure to clean up the job site), the process for issuing them, and the associated costs.

Tip #2: Ensure ongoing communication

By keeping up a steady flow of communication, you can avoid misunderstandings and improve relationships with your vendors/subcontractors. Ongoing communication can also boost the chances of recovering back charges, if any.

Schedule regular project meetings with vendors, subcontractors, or other third parties as the case may be to review progress, address concerns, and discuss issues that may potentially lead to back charges.

Open communication will also help prevent unpleasant surprises in the event of sending a bill on back charges, according to Tom Zauli.

“A company should have open and proactive communication with the customer/affected party during all parts of the back charge process, including why the charge is being incurred. Communication will help in setting expectations, stopping the matter from escalating, and keeping the customer relationship intact.”

Tip #3: Conduct regular quality checks

Periodic quality inspections can help ensure that work is being performed according to the specified standards.

Moreover, if you find any deficiencies, you can create formal deficiency reports and share them with the responsible party. If the responsible party does not rectify the deficiencies within the specified timeline, you can use the reports as the basis for back charge claims.

Tip #4: Document everything

Maintain meticulous records of all project-related activities, such as work progress, change orders, and the results of your quality inspection.

Take photographs to document the status of work at various stages, especially if there are concerns about work quality or compliance.

This documentation is important for supporting any back charges.

Above all, don’t forget to document the communication you have had with your subcontractors or vendors including verbal agreements that may not be recalled accurately later.

Tip #5: Take a stepwise approach to claiming back charges

Although there are no specific laws that regulate back charges, it is important to know what steps to follow when claiming back charges. This can improve your chances of recovery in case of a dispute.

In the construction industry, the National Law Review recommends that the one claiming back charges should first provide a written notice of deficient work to the vendor or subcontractor. The notice should describe all issues related to the services or materials in great detail.

This process can also work in other industries and contexts.

If the contract defines a time period for the responsible party to rectify these deficiencies, ensure you provide them with the opportunity to do so.

If the responsible party fails to take action despite your notice, be sure to inform them in writing as to what corrective measures you will take to address the deficient work.

While providing the responsible party the opportunity to be present when you carry out the rectification work, ensure you document the remediation process. For instance, you can take photos or videos of the repair work you carried out.

Once the rectification is complete, provide all the relevant invoices, cost estimates, and other documents to the responsible party.

Tip #6: Track and invoice back charges promptly

Failure to promptly invoice back charges may result in the responsible party forgetting about the outstanding dues. Tom Zauli emphasizes the importance of prompt and accurate billing to maximize the chances of recovery of back charges:

“I encourage all companies to make sure all billing is done correctly and on time, having proper automation and controls in place in the billing process.”

One way to ensure the invoices are accurate and prompt is to use time tracking and invoicing tools, such as Clockify.

Clockify lets you create projects for each contract or subcontract where back charges may apply. This helps track time and expenses accurately.

You can add time entries (both for billable and non-billable work) whenever you perform work related to a specific project or task in Clockify. The time entries can include hours spent addressing deficiencies, rework, or any other activities related to back charges.

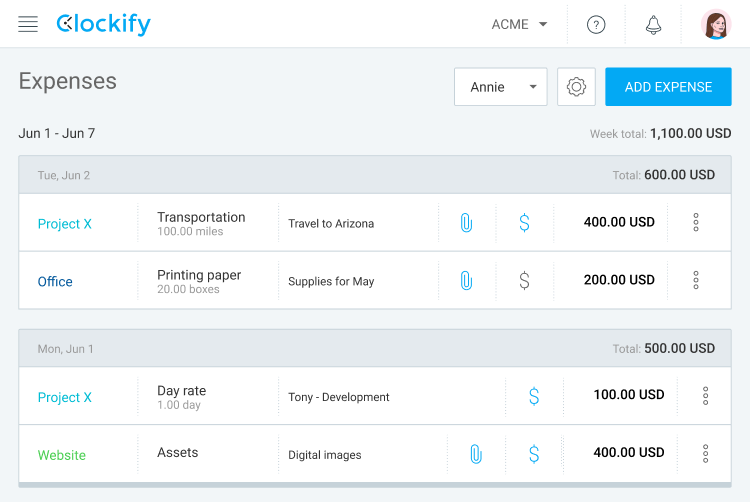

Apart from tracking time, with Clockify, you can also record expenses for each project you work on. For each expense, you can include detailed notes describing the work performed, the reason for the back charge, and any relevant supporting information, such as receipts. Expenses may include material costs, subcontractor costs, or any other expenses directly tied to the back charge issue.

This documentation is crucial for substantiating the back charges.

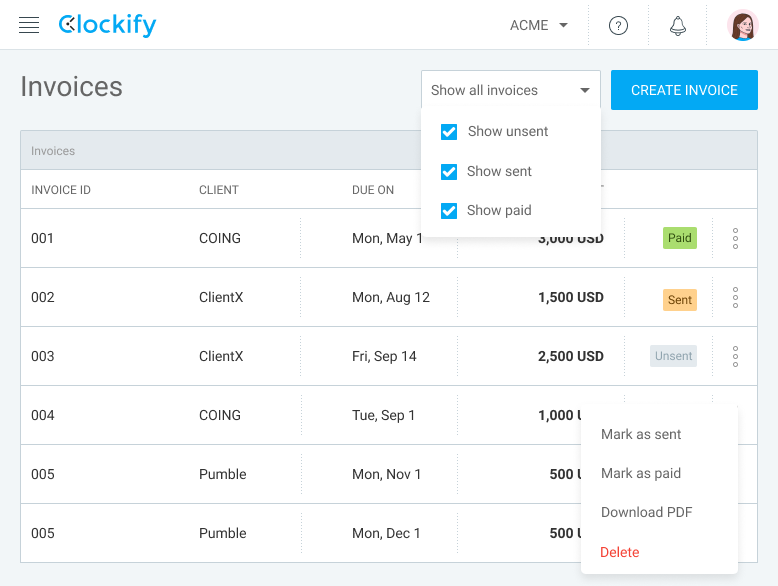

Later, you’ll be able to present all expenses in an invoice.

What’s more, you can generate customized reports related to each project or subcontract. These reports can serve as a comprehensive record of the time and expenses incurred — making it easier to present a clear case for back charges.

Conclusion: Documentation and cost tracking are the keys to back-charge success

Back charges can be a great way for businesses to keep track of their finances and make sure that everyone is held accountable. You can use back charges to prevent or resolve disputes and enhance project management.

However, the caveat is that they should be used responsibly, keeping in mind the contractual obligations and applicable laws.

Ultimately the effectiveness of back charges depends on drafting clear contracts, meticulous documentation, and cost tracking.

By following the tips we have listed above, you can improve your success with back charges.

Still, we encourage you to seek legal advice before implementing back charges into your business strategy.

✉️ Do you have any tips on improving the chances of recovery of back charges? Perhaps you faced unique challenges when invoicing back charges. We invite you to share these tips and experiences with us at blogfeedback@clockify.me and we’ll make every effort to throw the spotlight on them in our next article. If you found this article enlightening, please consider hitting the share button and spreading the knowledge to others.