How to make an employee compensation plan (with templates)

Last updated on: July 5, 2023

As much as 70% of organizations claim that they either have a compensation strategy or are working on building one. Here’s what you need to know about developing a compensation strategy and making suitable compensation plans for your organization.

Table of contents

The Basics About Compensation

In this section, we’ll explain what employee compensation is, what are its main components, as well as how compensation is calculated. We’ll also talk about compensation plans, the advantages of establishing a fair compensation system, and the three types of compensation, with a special emphasis on the four direct types of compensation.

What is employee compensation? What are the main components of compensation?

According to the definition, employee compensation (also referred to as remuneration outside of the US) is the total amount of payment in any form an employee can expect to receive in exchange for the services he or she provides for the employer.

The purpose of employee compensation is to help companies:

- recruit top talent

- increase job performance

- increase job satisfaction

The two main elements of employee compensation are base pay and variable pay:

- Base pay is the clean rate of compensation the employee receives in exchange for the services he or she provides for the employer. It may be represented as an hourly rate or a salary calculated on a weekly, monthly, or annual basis. It is the minimum, basic pay the employee will receive at the start of his or her employment, and doesn’t include benefits, bonuses, or raises. In contrast, a basic salary is a range that starts at the base pay and is expected to gradually increase during a predetermined time period.

- Variable pay is the part of employee compensation determined by the performance of the employee or triggered by reaching a certain milestone. It may be represented as bonuses, commissions, or other forms of incentive pay.

Variable pay and base pay are forms of monetary compensation. But, employees also receive various forms of non-monetary perks and benefits, in exchange for their services.

The main components of employee compensation include the following forms of monetary and non-monetary compensation:

- Hourly wages

- Salaries

- Long-term incentives such as stock options

- A 401(k) retirement plan

- Health insurance

- Life insurance

- Disability insurance

- Paid time off for sick leave

- Paid time off for vacations

- Flexible schedules

What’s a compensation plan?

A compensation plan includes all the components of your employee compensation packages. This includes a direct form of compensation such as hourly wages, salaries, commissions, and bonuses, as well as employee benefits, and other types of incentives.

Compensation plans are somewhat flexible, as it’s up to the employers to decide what they want to offer to their employees in order to stay competitive on the market.

How is employee compensation calculated?

Total employee compensation represents the sum of the main components of your employee compensation plan for each employee — i.e. the total worth of the employee compensation package. The costs of employee compensation are the highest expenses an organization has.

According to a recent data study by the US Bureau of Labor Statistics, private industry employers spend $34,72 per hour worked on average for total employee compensation.

What are the advantages of a fair compensation system?

So, we’ve established what a compensation plan is — now let’s see why having a fair compensation plan is crucial for the success of your business.

A fair compensation plan is an objectively-defined, unified system, based on clear standards. One of its main characteristics is that it’s developed and implemented without any prejudice or favor to anyone or anything. It is flexible and simple enough to be transparent and clear to interested parties.

A fair compensation plan is based on job descriptions, job analysis, and job evaluation. It provides both internal and external equity:

- Internal equity — the employee’s perception of how their pay stacks up when compared to the pay their colleagues receive.

- External equity — the employee’s perception of how the pay in your company stacks up when compared to the pay other companies offer for the same or similar positions.

A fair compensation system has several benefits for both the company and the employees:

- It helps you attract top talent through competitive compensation packages

- It helps employees understand exactly how valued they are within the company

- It motivates employees to perform better at work

- It raises the morale and cooperation level among the employees

- It elevates employee satisfaction for a job well done

- It becomes easier to apply a compensation system across your organization

What are the three types of compensation?

The 3 types of compensation to be included in your compensation plan are direct, indirect, and non-financial compensation.

Here’s what each entails:

Direct compensation

Direct compensation is a form of financial compensation. It involves the money paid to employees in the form of hourly wages, a weekly, monthly, or annual salary, as well as commissions and bonuses.

As previously mentioned, hourly wages and salaries fall under base pay, while commissions and bonuses fall under variable pay. It’s more common for sales teams to receive compensation in the form of commissions. Moreover, companies may choose what kind of bonuses they want to offer to their employees, or whether they want to offer them at all.

Indirect compensation

Indirect compensation is another form of financial compensation. But, instead of involving direct cash, it involves the benefit packages that usually come with a job position.

These benefit packages usually include employer contributions to a 401(k) retirement plan, health, and dental insurance. Some companies may also offer company stocks and profit-sharing in their benefits packages.

Non-financial compensation

As its name suggests, you cannot put an exact monetary value to the non-financial type of compensation — but, this type of compensation still has a particular value to employees.

One of the most common types of non-financial compensation is paid time off. But, it may also include flexible work hours, training programs, using the company car, etc.

Bear in mind that some organizations may view the indirect compensation they offer as non-financial compensation, especially if they don’t have the practice of:

- sharing the monetary value of their packages with the employees

- calculating the monetary value of their packages for each individual employee

Bonus compensation type: Incentives

Incentive pay is also a form of employee compensation, one that doesn’t strictly fall under the above-listed categories.

It is a form of compensation that is usually either indirect or non-financial, and is based on performance rather than on time worked. Incentives serve as a form of encouragement and motivation for employees to strive for excellence in their work. They usually imply a specific goal — if an employee reaches the said goal, he or she gets the incentive, which may be in the form of travel, merchandise, or even cash.

What are the four direct types of compensation?

As mentioned earlier, the 4 major types of direct compensation are hourly wages, salaries, commissions, and bonuses.

Here’s what each entails in more detail:

1. Hourly compensation

Hourly compensation is a direct type of compensation associated with base pay, one that mandates employees get paid per hour worked.

Unless additional rules apply, hourly employees are treated as non-exempt. This means they are entitled to get paid overtime (1.5 times their standard hourly rates) for each hour they spend working past 40 hours per week — this is legislated by The Fair Labor Standards Act (FLSA), the US federal labor law.

The required federal minimum wage in the US is $7.25. However, as much as 29 states mandate higher minimum wages.

In order to keep an accurate log of the hours employees spend working during regular hours or overtime, you can instruct your employees to track their work hours with a time clock app. Clockify is an efficient solution that can help you with that, as it allows employees to track their work time in real-time (with a timer), add it manually afterward, or enter it in a timesheet-like form. You’ll also be able to define hourly rates for each employee and have their pay calculated automatically, based on the number of hours they worked in a given time period.

Instead of receiving overtime compensation, hourly employees who work in public sectors are also eligible to receive compensatory time.

2. Salary compensation

Salary compensation is another direct type of compensation associated with base pay, one that mandates employees receive a fixed salary amount on a weekly, monthly, or annual basis. This fixed salary is always based on a salary range defined for a particular job position.

A salary range is the pay range defined by the employer that describes the minimum and maximum pay rate for a job position. It also includes a series of mid-range pay increases employees may expect to get during their time at a company.

If salaried employees are exempt from the FLSA, they DO NOT get paid overtime for the hours they spend working past 40 hours per week. This is the case if they earn more than $684 per week or $35,568 per year (as legislated by the US Department of Labor starting from January 1st, 2020). If they earn less than this amount, they are treated as non-exempt and are entitled to overtime pay.

To calculate the base hourly rates on which you will base the 1.5 overtime for non-exempt salaried employees, divide the annual salary of an employee with 52 weeks per year and 40 hours per week (e.g. $35,300 / 52 / 40 = $16,97 base hourly rate).

Salaried employees who make less than $684 per week and work in public sectors are also eligible to receive compensatory time instead of overtime compensation.

💡 To learn more about the differences between hourly and salaried employee compensation, as well as their pros and cons, check out our blog post on the subject:

→ Salary vs hourly employment: pros and cons

3. Compensation based on commission

Compensation based on commission is a direct type of compensation associated with variable pay. It is usually people in the sales industry who get paid in this manner, based on the sales quotas, sales percentage, and goals they reach.

These sales goals on which commissions are based may be:

- Connected to revenue — for example, if a sales professional gets 5% worth of commission for each sale, and she makes a $50,000 sale, she gets $1,000 worth of commission for that sale.

- Connected to gross margins or profit — the higher a sales professional sells a product or service, the higher the commission rate.

- Connected to a commission fee — the sales professional makes a fixed commission amount regardless of the monetary value of the sales she made.

We distinguish between several types of compensation based on commission:

- Straight commissions — the employee makes only a commission.

- Salary + commission — the employee has a compensation package that includes both a fixed salary and a specific commission.

- Residual commission — the employee makes an ongoing commission through ongoing customer accounts.

- Graduated commission — the employee makes a commission that increases with the increase in sales volumes.

- Variable commission — the employee makes a combination of the listed commissions.

4. Compensation based on bonuses

Compensation based on bonuses is another direct type of compensation associated with variable pay. This type of compensation is often associated with professionals who have precise goals to reach — such as managers and salespeople.

Bonuses are usually paired up with other types of compensation, such as commissions or salary — it is less appropriate to pair them up with hourly compensation as that would require compliance with the FLSA, which would, in turn, require hourly pay recalculation.

In some companies, bonuses may be implemented as an incentive meant to help employees reach higher performance standards at their jobs. In such companies, employees usually receive bonuses when they live up to certain metrics (such as company OKRs or KPIs).

In other companies, employees may receive this type of compensation when the company reaches certain milestones, like after closing a profitable deal or at the end of the year (in the form of Christmas bonuses).

*Employee compensation is taxable — for more information on what elements of compensation are taxable, check out this guide.

How to design an employee compensation plan?

In this section, we’ll talk about the steps you need to undertake in order to properly design a competitive compensation plan — one that will help your organization stay competitive on the market and attract the top talent professionals you need:

- Define the company’s compensation philosophy

- Research and analyze the job market

- Decide whether you want to implement salaries or hourly wages

- Defining employee salaries

- Define employee hourly wages

- Bonus tips: Calculating commissions

- Bonus tips: Calculating bonuses

- Select the benefits you’ll offer

Here’s what each step is about in more detail:

1. Define the company’s compensation philosophy

Competitive compensation is based on market pay rates, which are, again, based on market pay studies and surveys that include compensation for professionals who:

- Perform similar work

- Work in similar industries

- Work in the same region of a country

When defining the compensation in your company, you can choose to lead, lag, or match the market:

- Leading the market would mean that you’re offering higher compensation than competitor companies.

- Lagging behind the market would mean that you are offering lower compensation than competitor companies.

- Matching the market would mean that you are offering the same amount for compensation as competitor companies.

In case you are lagging behind the market, you should rethink your compensation strategy and readjust your compensation packages so that they at least match the numbers on the market. The reason behind this is simple — you’ll want to be able to attract top talent who will, in turn, recognize that you understand their value.

Within this step, you’ll also need to consider the following questions:

- What type of direct compensation will you offer? Hourly pay, salaries, commissions, or a specific combination? Will you offer bonuses?

- What benefits will you offer?

- Are your employees full-time or part-time employees?

- Will you tap into the gig economy and employ contractors and freelancers? What are the average hourly rates you’ll need to offer to your freelancers and contractors?

- Are your employees exempt or non-exempt from FLSA? Do they require 1099 or W2 forms?

- Will all employees be on the same compensation plan, or will executives and business partners be on a different compensation plan?

2. Research and analyze the job market

As emphasized earlier, consulting market trends is crucial for offering competitive pay that attracts top professionals. So, you’ll need to scrutinize the market before defining your compensation offers. The best way to do so is to analyze and research salary data and market surveys — this is also known as compensation benchmarking.

If you are operating in the US, you can obtain useful general compensation statistics from the US Bureau of Labor Statistics. For more specific numbers, consult several market surveys, to make comparisons and draw more accurate conclusions.

When looking for the market surveys and salary data to buy and analyze, make sure you pay close attention to the following elements:

- Industries — look for surveys that cater to your company’s industry.

- Location — look for surveys that cater to the country, state, or city your company is operating in.

- Employee size — look for surveys that cater to the size of your company (if you are a company of 20 employees, a survey covering companies with 500+ employees won’t be of much use, as you’ll likely be paying your employees less anyway).

- Revenue size — look for surveys that show data from companies that have a similar business volume as you.

- Job Summaries — look for the job summaries closest to the positions you need.

- Being non-profit — non-profit companies pay less than for-profit companies, so look for the market surveys that cater to your company type based on these parameters.

➕Bonus tip: You may be tempted to go through salary-focused websites (considering that they are free) to find compensation statistics. But, bear in mind that this data is not the true representation of the market as anyone can edit it.

3. Decide whether you want to implement salaries or hourly wages

Both salaried and hourly pay have their pros and cons, depending on what you are looking for.

But, no matter how you choose to compensate for your employee work, you’ll need to think carefully about how best to define the hourly rates, salaries, and salary ranges you want to offer.

The following elements should influence your decision:

- the industry you are operating in

- the size of your company

- the revenue your company makes

- the specific job positions you are looking for

- the importance and worth of these positions for the successful operation of your company

Here’s how you can best define the salaries and hourly rates in your company:

Defining employee salaries

If you’ve decided to compensate your employees through salaries, you’ll need to think about the salary ranges you want to offer. Here’s how you can best define salary ranges:

Step #1: Carry out job analysis

Once you’ve defined your compensation philosophy, you should analyze the job positions you are looking for, to draw conclusions that will help you define salary ranges:

- What level of education and knowledge are you looking for in this job position?

- What level of experience and skills are required to perform the tasks and duties associated with the said job position?

In order to determine how important a job position really is for your company, as well as what level of education, knowledge, experience, and skills you are looking for you can:

- Observe current employees

- Conduct surveys

- Interview employees

- Use a combination of the above-mentioned methods

Once you have this data, use it to write down the specific job descriptions for the job positions you are looking for.

Step #2: Group the jobs into job families

Now that you have clear and specific job descriptions, you’ll need to determine whether and how you want to group the jobs into job families.

When grouping jobs into job families, you’ll need to decide on the parameters you want to use. For example, you can group the jobs by:

- Department and type — i.e. jobs are grouped based on whether they belong to the executive, administrative, technical, or management job family.

- Location — i.e. jobs are grouped based on the geographic location of the customers. Jobs that are in charge of handling customers of the same geographical location are grouped together.

Step #3: Evaluate positions based on their worth and importance for your company

Rather than focusing on the qualities of professionals who are expected to fill these positions, this crucial step in determining salary ranges focuses on the importance and worth of a job position for the successful operations of the company.

To determine the worth and importance of a job position for your company, you can rely on The Point Method:

This method helps you evaluate positions by assigning points to qualities required to carry out the expected job duties and responsibilities.

The qualities in total can build up to 100 points per position. Each separate quality has its own maximum:

- Skills — e.g. you assign up to 50 points for this parameter

- Education — e.g. you assign up to 30 points for this parameter

- The difficulties of the working conditions — e.g. you assign up to 10 points for this parameter

- The final independent judgment — e.g. you assign up to 10 points for this parameter

To illustrate this method, one job may gather 50 such points in the listed qualities:

- Skills — e.g. 20 points

- Education — e.g. 20 points

- The difficulties of the working conditions — e.g. 2 points

- The final independent judgment — e.g. 8 points

Once you’ve evaluated (i.e. given points to) all the defined positions in your company, make sure you rank and order the jobs in comparison to one another and their final scores.

Step #4: Group jobs by job grades

So, you’ve already grouped jobs by job families and ordered them based on importance. Now it’s time to categorize them further and place them in the correct job grades.

The US federal government recognizes 15 job pay grades, each characterized by the General Schedule pay grade, and a pay grade step. These two factors determine the base pay, whose averages in 2020 you can see below:

- Entry-level positions

- GS1 (no high-school diploma) — $19,543-$24,448

- GS2 (a high school diploma or an equivalent) — $21,974-$27,653

- GS3 (a high school diploma or an equivalent) — $23,976-$31,167

- GS4 (an associate’s degree) — $26,915-$34,988

- GS5 (an associate’s degree) — $30,113-$39,149

- GS6 (an associate’s or bachelor’s degree) — $33,567-$43,638

- GS7(a bachelor’s degree) — $37,301-$48,488

- White-collar, mid-level positions

- GS8 (a bachelor’s degree) — $41,310-$53,703

- GS9 (a bachelor’s or master’s degree) — $45,627-$59,316

- GS10 (a master’s degree) — $50,246-$65,321

- GS11 (a master’s degree) — $55,204-$71,764

- GS12 (a master’s degree or Ph.D.) — $66,167-$86,021

- Top-level positions (supervisors, high-level technical specialists)

- GS13 (a master’s degree or Ph.D.) — $78,681-$102,288

- GS14 (Ph.D.) — $92,977-$120,868

- GS15 (Ph.D.) — $109,366-$142,180

It should be noted that one company will hardly need such a wide range of professionals — smaller companies usually implement as few as 3 or 4 pay scales. In any case, always make sure you pay attention to the market trends when defining your pay grades.

➕ Bonus: Other ways to define pay grades

Apart from market-based compensation structures, there are other alternatives to defining pay grades:

Defining pay grades based on job range

Job range compensation structures work on a 1-on-1 basis — each individual job is placed in and corresponds to one salary grade, based on the pay range the job holds at the job market.

This type of compensation structure is best:

- If you have enough employees who hold a particular job position to justify it getting a separate salary range

- If you can match and price the jobs in your company accurately

- If your company has many job positions that are high in demand, triggering a frequent change in market prices

- If your company places great emphasis on market competitiveness

Defining salary bands instead

Broadband compensation structures divide pay grades into wider salary bands.

The salary range in terms of the minimum and maximum amount in each band are larger than they are in pay grades (i.e. each salary band may consist of several pay grades), so the emphasis with this type of compensation structure is on career development rather than job promotion — considering that it takes more time to move up from one salary band to the next.

This type of compensation structure is best:

- If you need a more flexible approach when determining pay

- If you want to reward people for acquiring new skills

Step #5: Calculate the actual salary ranges

Now, the job grades we listed in step #4 are merely the minimum and maximum starting points, not the actual salary ranges. It’s up to the discretion of the company to decide on the midpoint and actual percentile to use to calculate the minimum and maximum salary ranges. You can even use various percentiles for various job grades.

However, most companies will use +/- 15% or 20%, starting from the midpoint.

Say that your salary market surveys and salary data show a certain administrative position pays $30,000 on average (which means this salary falls in the GS4 pay grade). And, say you want to implement a +/-15% percentile in your calculations. Here’s how your salary range may look:

- Medium position: $30,000

- Minimum salary range: $30,000 x 0.85 = $25,000

- Maximum range: $30,000 x 1.15 = $34,500

To conclude, the midpoint for the salary of this particular position is $30,000, with a salary range of $25,000-$34,500.

Step #6: Decide how you want employees to progress within their salary range

Now that you’ve defined your pay grades and salary ranges, you’ll need to decide how employees will be able to progress across the said salary ranges, i.e. move from $25,000 towards $34,500.

For example, you can base this progression on the number and difficulty of skills, duties, and responsibilities — as employees learn new skills and take on new responsibilities, they get career promotions and move up to higher pay grades.

Or, you can base this progression on a preplanned schedule. These progressions are associated with the time an employee stays in a company (i.e. his or her tenure) rather than employee performance. The employee receives fixed pay raises as his or her tenure progresses.

In line with that, an employee with 5 years of experience in a particular industry will earn more than an employee with 3 years of experience in the same industry.

Defining employee hourly wages

Let’s now see how you can define employee hourly wages if this is the type of compensation you opted for instead of giving your employees salaries.

When it comes to determining hourly rates, they will differ based on the industry you are working in, the position you are looking for, as well as the skills and experience you require from the professional who will fill up the said position.

The real constant that you should focus on is making sure you are offering “competitive hourly rates” — once again, this means that you are offering equal or better hourly pay compared to what other companies in the market are offering to their employees.

Here are the 15 federal pay grades and their hourly rates you can use for inspiration when defining your own compensation packages:

- Entry-level positions

- GS1 (no high-school diploma) — $9.36 – $11.71

- GS2 (a high school diploma or an equivalent) — $10.53 – $13.25

- GS3 (a high school diploma or an equivalent) — $11.49 – $14.93

- GS4 (an associate’s degree) — $12.90 – $16.76

- GS5 (an associate’s degree) — $14.43 – $18.76

- GS6 (an associate’s or bachelor’s degree) — $16.08 – $20.91

- GS7(a bachelor’s degree) — $17.87 – $23.23

- White-collar, mid-level positions

- GS8 (a bachelor’s degree) — $19.79 – $25.73

- GS9 (a bachelor’s or master’s degree) — $21.86 – $28.42

- GS10 (a master’s degree) — $24.08 – $31.30

- GS11 (a master’s degree) — $26.45 – $34.39

- GS12 (a master’s degree or Ph.D.) — $31.70 – $41.22

- Top-level positions (supervisors, high-level technical specialists)

- GS13 (a master’s degree or Ph.D.) — $37.70 – $49.01

- GS14 (Ph.D.) — $44.55 – $57.91

- GS15 (Ph.D.) — $52.40 – $68.13

➕ Bonus tips: Calculating commissions

If you’re choosing to include commissions in your compensation plan to any extent (either as the only form of compensation or a supplementary form of compensation), there are several factors you should consider when defining commissions for your employees:

- The commission rate — this is the percentage (e.g. 5%) or fixed compensation ($25) employees will get for each sale they make.

- The commission basis — a commission can be based on:

- the total number of sales

- the gross margin of the product being sold

- the net profit of the product being sold (when you want to inspire your sales team to focus on selling the more profitable products in your offer)

- the cash received from sales (when you want to inspire the sales team to collect all overdue receivables)

- the inventory (when you’re looking to eliminate a product from stock)

- The overrides — One percentage (e.g 5%) of fixed compensation (e.g. $25) may apply before the employees reach a certain goal, after which they can count on a higher percentage (e.g. 8%) or fixed compensation (e.g. $30).

- The splits — in the case when two or more employees are responsible for the sale, they split the commission.

- The payment delay — commissions are usually calculated subsequently, at the end of the month.

➕ Bonus tips: Calculating bonuses

Sometimes, you’ll want to include bonuses in your employee compensation packages, to serve as additional incentives for high-quality performance. Here are only some of the bonuses you can consider offering:

- Sign-on bonuses — bonuses offered to job candidate executives as incentives to inspire them to accept positions.

- Salary-based bonuses — based on the amount of hourly wages or annual salaries the employees are making (the higher the wages or salaries, the higher the bonuses).

- Bonuses based on department goals — once a team or department meets the predefined goal, all members of the team receive bonuses.

- Referral bonuses — the higher the number of customers referred, the higher bonuses for the employees who referred them.

- Holiday bonuses — non-performance-based bonuses typically paid around a beloved national holiday, such as Christmas.

- Quarterly or annual bonuses — if the company reaches a certain net profit goal, the employees receive a flat rate bonus or percentage.

- Retention bonuses — bonuses paid to top performers in order to keep them.

4. Select the benefits you’ll offer

Apart from direct compensation, in order to attract top talent, you’ll also need to offer competitive benefits packages:

Benefits companies are required to provide by law:

- COBRA health insurance — extended medical benefits to former employees in companies that have more than 20 employees for at least 18 months.

- Disability and workers’ compensation — serves to make sure the sick and injured employees get paid at least part of their usual pay while unable to attend work.

- Family and medical leave — includes maternal, paternal, and adoption leave (not required to be paid leave, by law).

- Minimum wage — In accordance with the FLSA, non-exempt employees must receive a minimum hourly wage of $7.25 per hour. Some US states have state laws that mandate a higher hourly wage — these state laws override federal law, and employers must abide by them when defining compensation for their employees.

- Overtime for non-exempt employees — This overtime rate amounts to 1.5 times more than their base hourly rate for each overtime hour. California has additional overtime rules that apply to hourly employees, as mandated by The California Overtime Law. According to it, all non-exempt hourly employees need to be paid 1.5 times their base hourly rate for every hour they spend working past 40 hours per week AND past 8 hours per day. They also get paid 1.5 overtime for the first 8 hours they spend working on the 7th consecutive day of work. Moreover, the same law mandates that non-exempt hourly employees in California be paid 2 times more than their base hourly rate for all hours worked past 12 hours per day during the first 6 workdays and past 8 hours per day on the 7th consecutive day of work.

- Severance pay — employees laid-off because of a layoff (and not because they were fired or resigned) may be entitled to severance pay during a certain period of time.

Benefits provided by most companies, despite not being mandated by law:

- Health insurance — employees get paid at least a portion of their health costs, for specific treatments and procedures.

- A Dental Care plan — employees get paid at least a portion of their dental costs, for specific dental treatments and procedures.

- PTO — employees get paid time off, which is often used as an umbrella term for vacations and sick leave.

- Paid holidays — in order to stay competitive, employers usually provide employees with paid holidays and offer overtime pay for people willing to work during the holidays.

- Pay Rises — usually based on inflation or merit.

- Flexible schedules — company hours may not be fixed, but more accommodating to employees looking to strike a better work/life balance.

- Work breaks — times off during work time provided for lunch breaks and short breaks.

- Hazard pay — provided to employees whose job duties require them to work in unsafe conditions (such as security and military professions).

- College debt assistance — sometimes provided to employees just starting their professional careers.

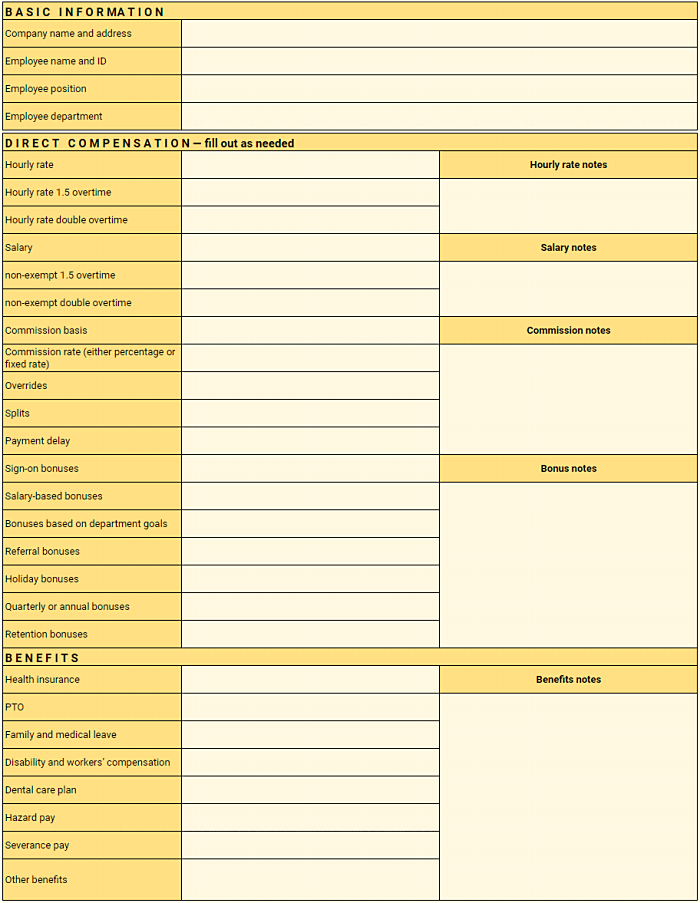

A compensation plan template based on this guide

Now that you know what you need to include in your compensation plan, here is a compensation plan template you can follow when defining compensation packages. It will help you decide what you want to offer to each of your employees, including the type of direct, monetary compensation and benefits.

⏬ Download an employee compensation plan in Google Sheets

⏬ Download an employee compensation plan in Google Docs

⏬ Download an employee compensation plan in PDF

⏬ Download an employee compensation plan in Excel

⏬ Download an employee compensation plan in Word

Wrapping up: Staying up-to-date to market changes and trends

In the end, considering that the market trends in all industries are constantly progressing and changing, you’ll need to update your compensation plan regularly in order to remain current.

Luckily, when it comes to market surveys and salary data, you don’t need to buy new ones each time you want to update employee salaries. The Employee Cost Index from the National Compensation Survey is one great resource you can consult with, and the Cost of Living Adjustment is another one you can use.

You’d also be advised to update your plan in accordance with the current trends on the market regarding employee benefits and monetary compensation itself. To wrap up this guide, here are 10 compensation trends you should watch out for in the upcoming period:

Compensation based on customer satisfaction

Employees who work on commission may no longer be compensated based on their sales volumes, but also based on customer satisfaction. This trend was first introduced by the company Xerox, and it involves the customers defining their satisfaction levels, and salespeople getting paid commissions based on the customer satisfaction levels they reach.

Team-based compensation

This one especially applies to the sales industry. Instead of the standard commission-based compensation, salespeople pay is linked with the performance of the delivery people, the customer service personnel, as well as the managers supervising the teams.

Compensation adjusted based on “hot” jobs

Compensation for some jobs rises much faster than for others, especially in certain areas — it’s important that you identify these jobs in your industry, identify these positions in your company, and then research the market rates for these positions much more frequently, in order to always stay competitive and current.

Looking after employee financial well-being

According to a survey, as much as 35% of working adults in the US are experiencing financial stress. In line with that, companies are now starting to introduce financial wellness initiatives that include counseling and education about:

- Better budgeting

- Reducing debt

- Saving for retirement

Pay-equity

The gender gap problem in pay that usually has women being paid less for the same value of work than men is still a pressing problem the industries are trying to solve. More and more effort is being invested in finally establishing pay-equity that is gender-blind and only recognizes the value of work.

Pay transparency

Oregon, California, and Washington have gone to officiate their pay-equity and transparency laws that ban employers from asking their job interviewees about their past pay. The same laws require the salary ranges of employees in the company to be made transparent.

In line with that, a 2019 Korn Ferry Survey indicates that the majority of HR professionals (75%) believe pay transparency will only gain importance in the upcoming period — in order to help managers better communicate with employees who may feel under-compensated for their work.

Variable pay becoming more important (and more frequent)

Variable pay is expected to become more and more important, considering the high speed and overall agility expected of today’s workforce. To provide suitable incentives to encourage such high performances, bonuses are expected to become more and more present in modern compensation packages.

Moreover, according to experts, performance-based rewards in the form of bonuses are expected to become more frequent, in order to provide instant recognition to deserving employees. In line with that, bonuses are starting to be paid on a monthly and quarterly basis (rather than at the end of the year), and are starting to include various travel vouchers, gift cards, additional PTO, as well as one-time cash awards.

Personalized career development paths

Employees who have more opportunities to advance their careers through personal and professional growth are more likely to be satisfied with their positions at their companies. In line with that, companies are starting to offer development opportunities that are personalized to the job and skills of individual employees.

Benefits for different family types

Netflix started this trend in 2015 when it started offering 52 weeks of paid parental leave to employees — this type of benefit is looking to get another increase in 2020. More specifically, Netflix also offers paid leave during surrogacy, fertility, and adoption processes — these benefits are available to employees no matter their gender, marital status, or sexual orientation.

Caregiving benefits to employees with aging parents

In addition to giving paid time off to new parents, there is an increase in companies giving paid time off to employees who have to care for their aging parents, but also other family members. These caregiving benefits also include financial and professional support to employees who are going back to work after this period, both part and full-time.