What are budgeting templates?

Budgeting templates are easy-to-use customizable spreadsheets that can help you manage and plan your finances and get a clear picture of your day-to-day spending.

They are specifically designed to help you spot exactly where your money goes and nudge you toward setting realistic financial goals.

Why do you need budgeting templates?

Even if you don't have any trouble controlling your spending, keeping a close eye on your budget could help you allocate your finances better and even save more money in the long run.

For that reason, a well-crafted budget template can assist you with keeping track of your:

- Bill payment,

- Savings,

- Debt payoff,

- Travel expenses, and more.

On top of all that, ready-made budgeting templates that you can fit to your spending habits can help you make smart spending choices by giving you the option to visualize your purchases at all times.

8 Free Budgeting Templates

Whether you'd like to monitor your day-to-day spending or you'd prefer to set your financial goals months in advance, free budgeting templates are there to guide you toward wiser financial decisions.

Take a look at the 8 free budgeting templates you can use right away.

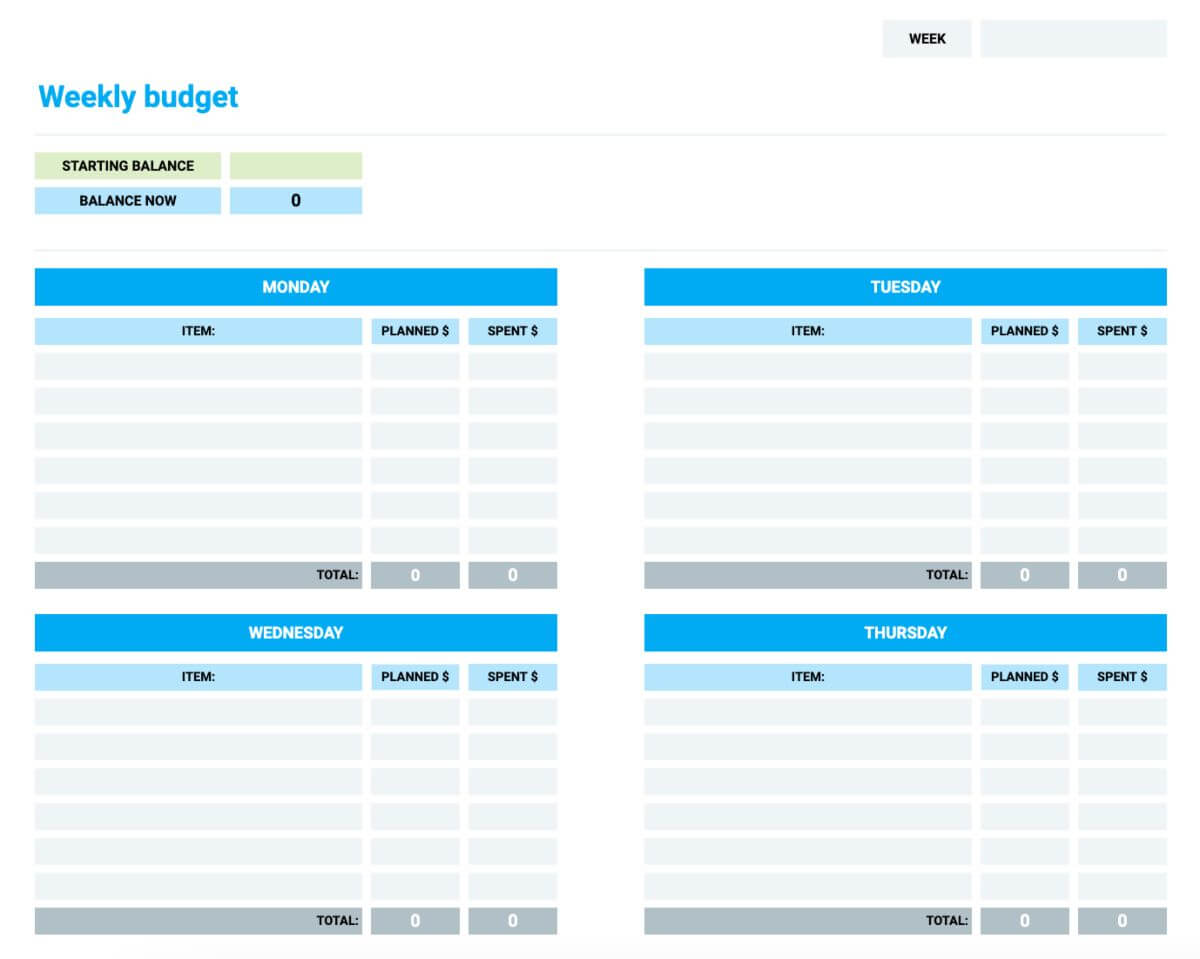

1. Simple Weekly Budget Template

If you'd like to track your day-to-day spending but don't want to invest too much time into logging your expenses, the Simple Weekly Budget Template can help you make a note of your spending even when you're on the move.

⏬ Download: Google Sheets, Excel

What is the Simple Weekly Budget Template?

The Simple Weekly Budget Template is a free customizable spreadsheet you can use to monitor and plan all your weekly expenses, regardless of their type.

Why use the Simple Weekly Budget Template?

Whether you want to keep tabs on your daily expenses or need a quick way to plan your weekly spending, the Simple Weekly Budget Template can provide you with a quick snapshot of your financial patterns.

How best to use the Simple Weekly Budget Template?

To download the Google Sheets version of the Simple Weekly Budget Template, click on the link above that will lead you to this format, and you'll see a new tab popping up with the following question:

Would you like to make a copy of the Simple Weekly Budget Template?

Simply click on the Make a copy button, and this will let you copy and edit the template.

In case you go for the Excel version of the template, clicking on the link will save the document to your device.

After you've downloaded your preferred template format, start by adding the dates and your starting balance for the following week.

Then, you can add your planned expenses and the amount you expect to spend on certain items under Planned $. Immediately after, you'll see the total planned expenses automatically calculated.

In case you'd prefer to use the template to track your expenses without planning them in advance, simply add the description of your purchase under Item, insert the amount you spent under Spent $, and you'll notice the total spent amount automatically calculated.

As you continue adding your expenses, you'll notice the amount under Balance now automatically changes too.

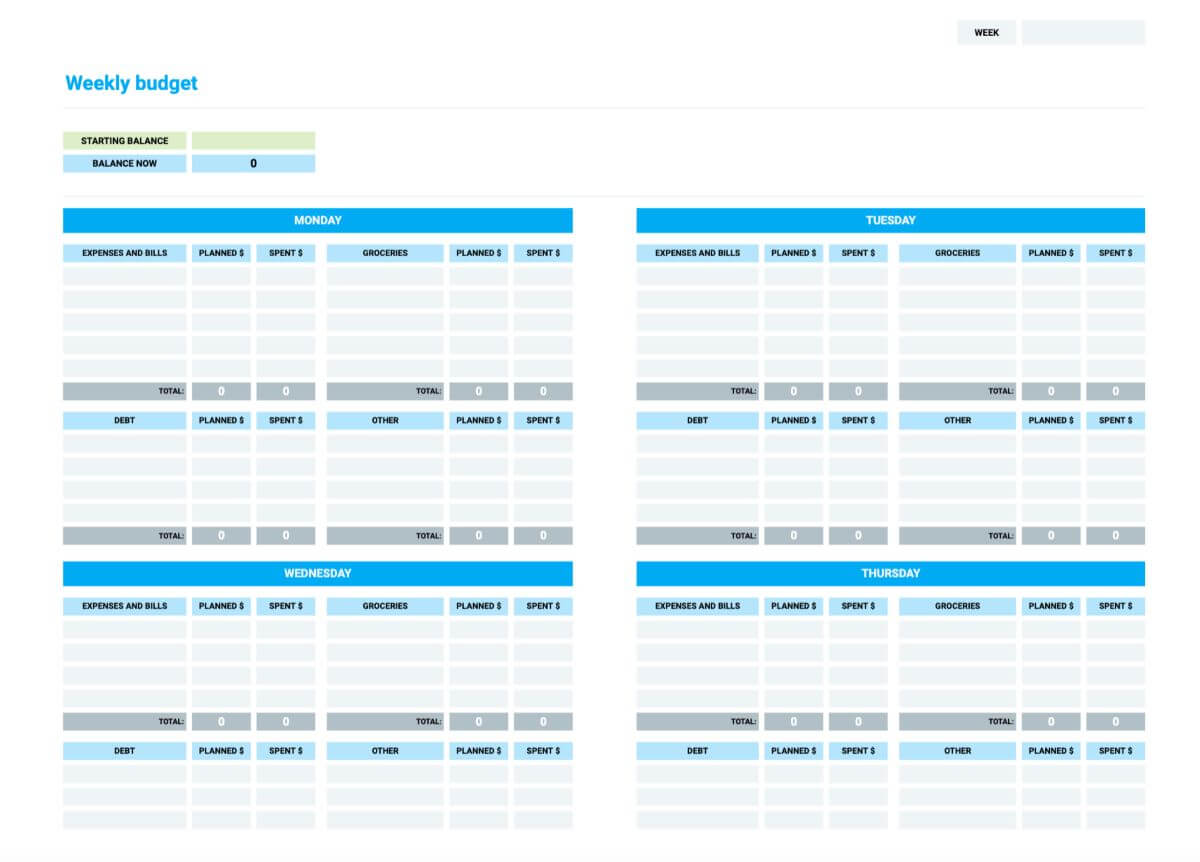

2. Detailed Weekly Budget Template

If you need a visual overview of your weekly spending, or you'd like to plan your purchases in more detail a week in advance, going with the Detailed Weekly Budget Template can help you capture all your expenses in a few clicks.

⏬ Download: Google Sheets, Excel

What is the Detailed Weekly Budget Template?

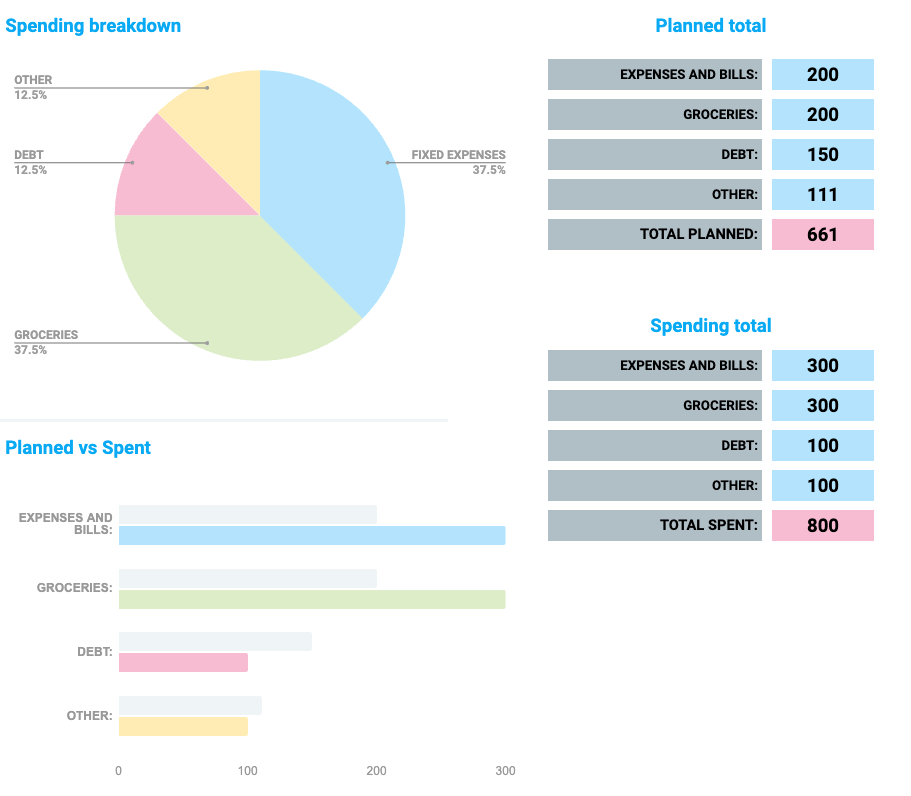

The Detailed Weekly Budget Template is a ready-made budget spreadsheet that lets you log and plan your weekly expenses based on their categories (such as bills, groceries, etc). Moreover, it helps you obtain a detailed visual overview of your weekly budget.

Why use the Detailed Weekly Budget Template?

If you want to plan your weekly purchases in detail and log all your spending as you go, the Detailed Weekly Budget Template could be a great option for you.

This template also comes with two color-coded graphs that show you precisely where your money goes and how/if your planned budget deviates from your actual expenses.

How best to use the Detailed Weekly Budget Template?

To download the Google Sheets version of the Detailed Weekly Budget Template, click on the link leading to this format, and you'll see a new tab popping up with the following question:

Would you like to make a copy of the Detailed Weekly Budget Template?

Simply click on the Make a copy button, and this will let you copy and edit the template.

In case you go for the Excel version of the template, clicking on the Excel link will save the document to your device.

After you've downloaded your preferred template format, start by adding the dates and your starting balance for the following week.

If you'd like to plan your budget in advance, add your planned purchases for each category:

- Expenses and bills,

- Groceries,

- Debt, and

- Other.

Immediately after you've filled in the Planned $ column for each item you've listed, you should see your planned expenses automatically calculated in the Planned total column.

Continue by adding the actual amount in the Spent $ column as you make a purchase, and you'll notice the sum of your expenses automatically calculated in the Spending total column.

As you keep on adding your expenses, you'll notice the amount under Balance now automatically changes.

While you fill out columns with both your planned and actual expenses, you'll see that the Spending breakdown and Planned vs. Spent graphs will start to take shape, mirroring your weekly purchases.

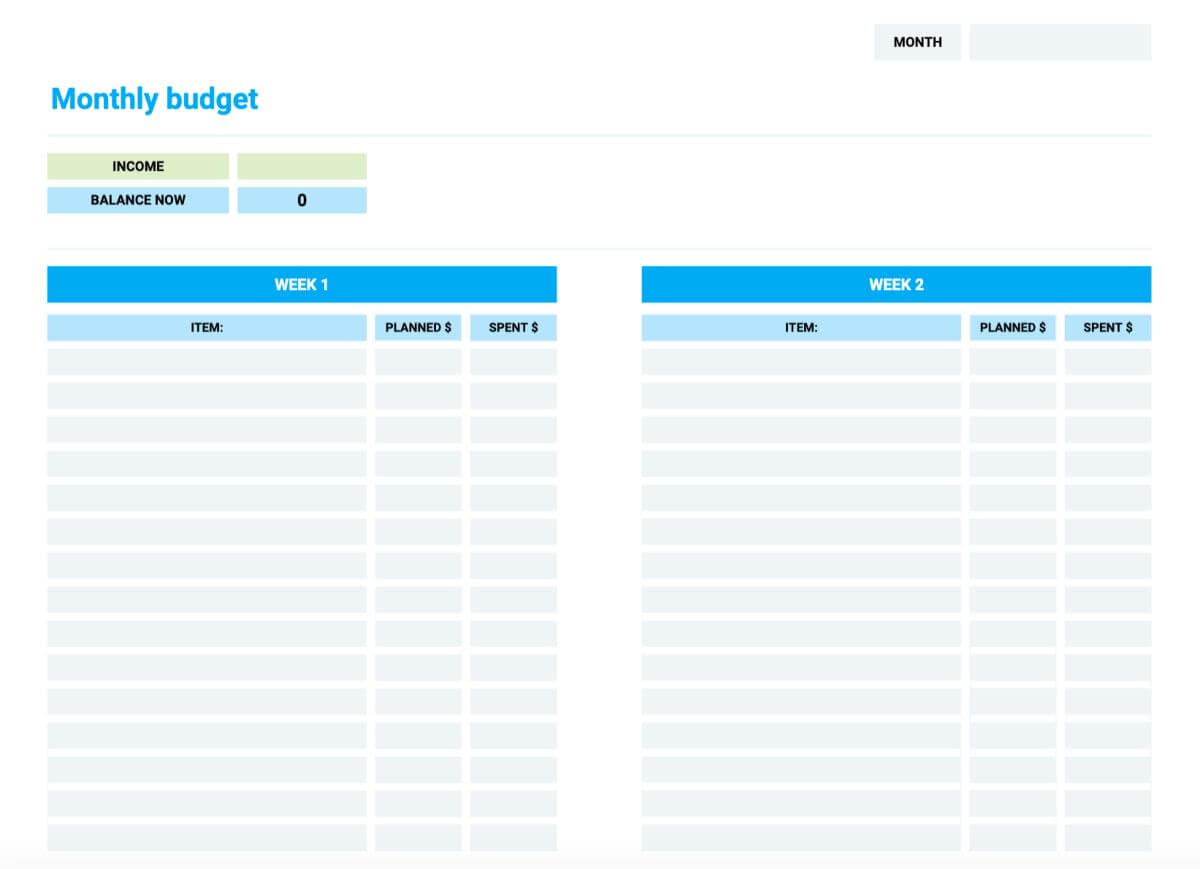

3. Simple Monthly Budget Template

If you'd like to manage your spending without having to work through a detailed budget management strategy, then you could greatly benefit from using the Simple Monthly Budget Template.

⏬ Download: Google Sheets, Excel

What is the Simple Monthly Budget Template?

The Simple Monthly Budget Template is a spreadsheet tailored to help you summarize your monthly purchases and plan your spending one month in advance.

Why use the Simple Monthly Budget Template?

If your purchases vary from month to month — but you still want to stay on your intended spending course — the Simple Monthly Budget Template can steer you in the right direction and help you stay on track with your financial goals.

How best to use the Simple Monthly Budget Template?

In case you want to go for the Google Sheets version of the Simple Monthly Budget Template, start by clicking on the link leading to this format.

Immediately after, you'll notice a new tab popping up with the following question:

Would you like to make a copy of the Simple Monthly Budget Template?

Then, simply click on the Make a copy button you see below, and this will let you copy and edit the template.

In case you want to download the Excel version of the template, clicking on the link will store the document on your device.

After you've downloaded your chosen template format, start by adding the dates and your income for the following month.

Then, you can add your planned expenses and the amount you expect to spend on each item under Planned $. You'll notice the total planned expenses automatically calculated.

To track your purchases, simply add the description of your purchase under Item, insert the amount you spent under Spent $, and you'll notice the total spent amount automatically calculated too.

As you continue adding your expenses, you'll notice the amount under Balance now automatically changes.

4. Detailed Monthly Budget Template

If you want to track your finances in great detail, but you still need an easy-to-read summary of your monthly expenses, then the Detailed Monthly Budget Template could be your answer.

⏬ Download: Google Sheets, Excel

What is the Detailed Monthly Budget Template?

The Detailed Monthly Budget Template is a customizable budget spreadsheet with enough space for you to log your monthly expenses week in and week out.

Why use the Detailed Monthly Budget Template?

If you want a budget template that provides you with a detailed overview of your purchases but also nudges you to plan your budget thoroughly, you'll find everything you need in the Detailed Monthly Budget Template.

This ready-made template stores your spending data at your fingertips and even breaks down your expenses into color-coded graphs for easy budget tracking.

How best to use the Detailed Monthly Budget Template?

To download the Google Sheets version of the Detailed Monthly Budget Template, click on the link leading to this format, and you'll see a new tab popping up with the following question:

Would you like to make a copy of the Detailed Monthly Budget Template?

Then, click on the Make a copy button, and you'll be able to copy and edit the template.

In case you go for the Excel version of the template, clicking on the Excel link will save the document to your device.

After you've downloaded your chosen template format, start by adding the dates and your income for the following month.

In case you'd like to plan your budget in advance, add your planned purchases for each category:

- Fixed expenses,

- Groceries,

- Debt, and

- Other.

After you've filled in the Planned $ column for each item you've listed, you should see your planned expenses automatically calculated in the Planned total column.

Continue by adding the actual amount in the Spent $ column as you make a purchase, and you'll notice the sum of your expenses automatically calculated in the Spending total column.

While you keep on adding your expenses, you'll notice the amount under Balance now automatically changes.

As you fill out columns with both your planned and actual expenses, you'll see that the Spending breakdown and Planned vs. Spent graphs will start to take shape, showing your monthly purchases.

5. Simple Quarterly Budget Template

If you'd wish to make a note of all your quarterly purchases without having to develop a budget management system from scratch, going for the Simple Quarterly Budget Template could help you achieve just that in a few clicks.

⏬ Download: Google Sheets, Excel

What is the Simple Quarterly Budget Template?

Simple Quarterly Budget Template is a budget spreadsheet specifically designed to help you meet your financial goals by planning and keeping a record of your quarterly expenses.

Why use the Simple Quarterly Budget Template?

Use the Simple Quarterly Budget Template if you'd like to plan, monitor, and keep all your quarterly purchases in one place.

How best to use the Simple Quarterly Budget Template?

To download the Google Sheets version of the Simple Quarterly Budget Template, click on the link leading to this format, and a new tab with the following question will appear:

Would you like to make a copy of the Simple Quarterly Budget Template?

After you click the Make a copy button, you'll be able to copy and edit the template.

In case you'd like to use the Excel version of the template, clicking on the Excel link will save the document to your device.

After you've downloaded your chosen template format, start by adding the dates and your income for the following month.

Then, add your planned expenses and the amount you expect to spend on each item under Planned $. Immediately after, you'll notice the total planned expenses automatically calculated.

To track your purchases, simply add the description of your purchase under Item, insert the amount you spent under Spent $, and you'll notice the total spent amount automatically calculated too.

As you continue adding your expenses, you'll see the amount under Balance now automatically changes.

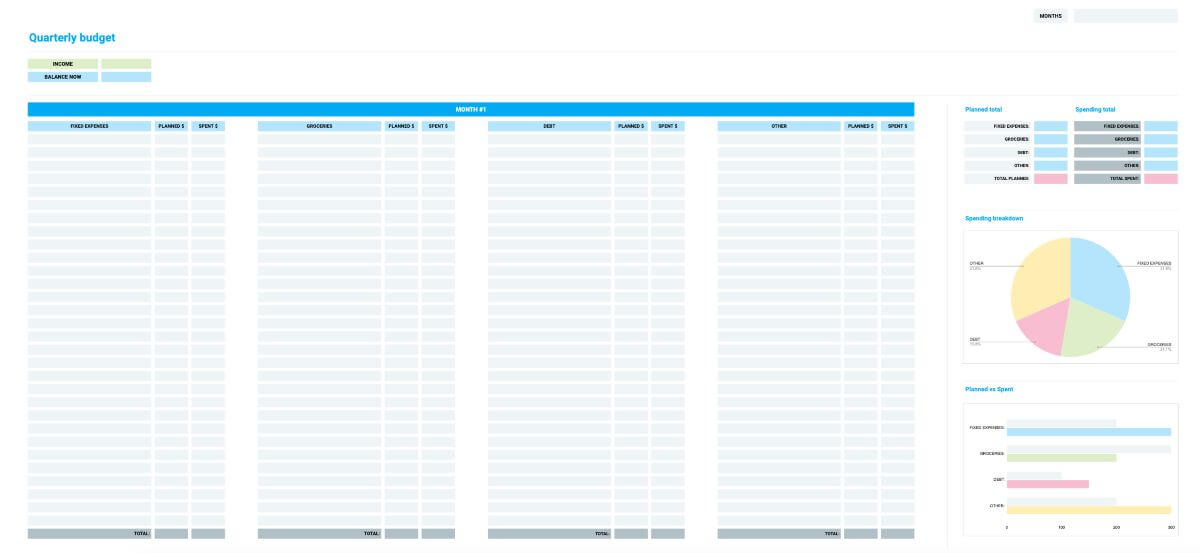

6. Detailed Quarterly Budget Template

If you need a comprehensive version of a budget template that lets you keep up with your quarterly expenses, then the Detailed Quarterly Budget Template could be perfect for you.

⏬ Download: Google Sheets, Excel

What is the Detailed Quarterly Budget Template?

The Detailed Quarterly Budget Template is a ready-made budget spreadsheet that helps you plan, log, and review all your quarterly expenses in a quick glance.

Why use the Detailed Quarterly Budget Template?

Going for the Detailed Quarterly Budget Template could be a great decision if you're looking for an intuitive way to streamline your budgeting process without having to set up an entirely new budget management system.

This free template also lets you visualize your financial habits by providing you with detailed graphs of your quarterly spending broken down by categories.

How best to use the Detailed Quarterly Budget Template?

If you want to use the Google Sheets version of the Detailed Quarterly Budget Template, start by clicking on the link leading to this format.

Immediately after, you'll notice a new tab popping up with the following question:

Would you like to make a copy of the Detailed Quarterly Budget Template?

Then, click on the Make a copy button to be able to copy and edit the template.

In case you go for the Excel version of the template, clicking on the Excel link will save the document to your device.

After you've downloaded your chosen template format, start by adding the dates and your income for the first month.

If you'd like to plan your budget in advance, add your planned purchases for each category:

- Fixed expenses,

- Groceries,

- Debt, and

- Other.

Immediately after you've filled in the Planned $ column for each item you've listed, you should see your planned expenses automatically calculated in the Planned total column.

Continue by adding the actual amount in the Spent $ column as you make a purchase, and you'll notice the sum of your expenses automatically calculated in the Spending total column.

As you keep on adding your expenses, you'll notice the amount under Balance now automatically changes.

While you fill out columns with both your planned and actual expenses, you'll notice that the Spending breakdown and Planned vs. Spent graphs will start to take shape, mirroring your monthly purchases.

After you're done filling out the sheet titled MONTH #1, move on to the next sheet to plan and log your expenses for the next month the same way.

7. Simple Yearly Budget Template

If you need an overview of your all-year-round spending habits, then the Simple Yearly Budget Template could be an essential ingredient to your budget management.

⏬ Download: Google Sheets, Excel

What is the Simple Yearly Budget Template?

The Simple Yearly Budget Template is a budget spreadsheet designed to assist you with logging and planning your monthly expenses all year round.

Why use the Simple Yearly Budget Template?

If you need a quick and easy way to log and plan your purchases month in and month out, then the Simple Yearly Budget Template could be the central hub of all your yearly expenses.

How best to use the Simple Yearly Budget Template?

To download the Google Sheets version of the Simple Yearly Budget Template, click on the link leading to this format, and you'll see a new tab popping up with the following question:

Would you like to make a copy of the Simple Yearly Budget Template?

Then, simply click on the Make a copy button, which will let you copy and edit the template.

Clicking on the Excel link, on the other hand, will store the document on your device.

After opening your preferred template format, start by adding your Starting balance. You can edit the balance each month after you receive your monthly paycheck.

Then, add your planned expenses and the amount you expect to spend on each item under Planned $. Immediately after, you'll notice the total planned expenses automatically calculated.

To track your purchases, simply add the description of your purchase under Item, insert the amount you spent under Spent $, and you'll notice the total spent amount automatically calculated too.

As you continue adding your expenses, you'll notice the amount under Balance now automatically changes.

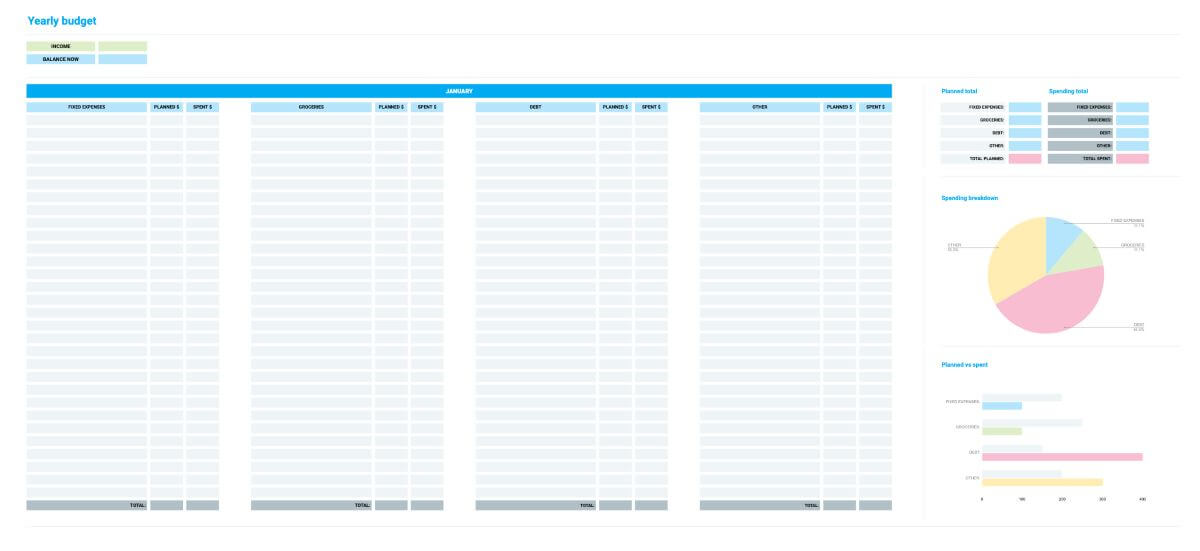

8. Detailed Yearly Budget Template

The Detailed Yearly Budget Template is specifically tailored to help you manage every facet of your finances over the year without having to worry about your year-long purchases falling through the cracks.

⏬ Download: Google Sheets, Excel

What is the Detailed Yearly Budget Template?

The Detailed Yearly Budget Template is a ready-to-use, customizable budget spreadsheet you can use to plan and log your expenses all year long.

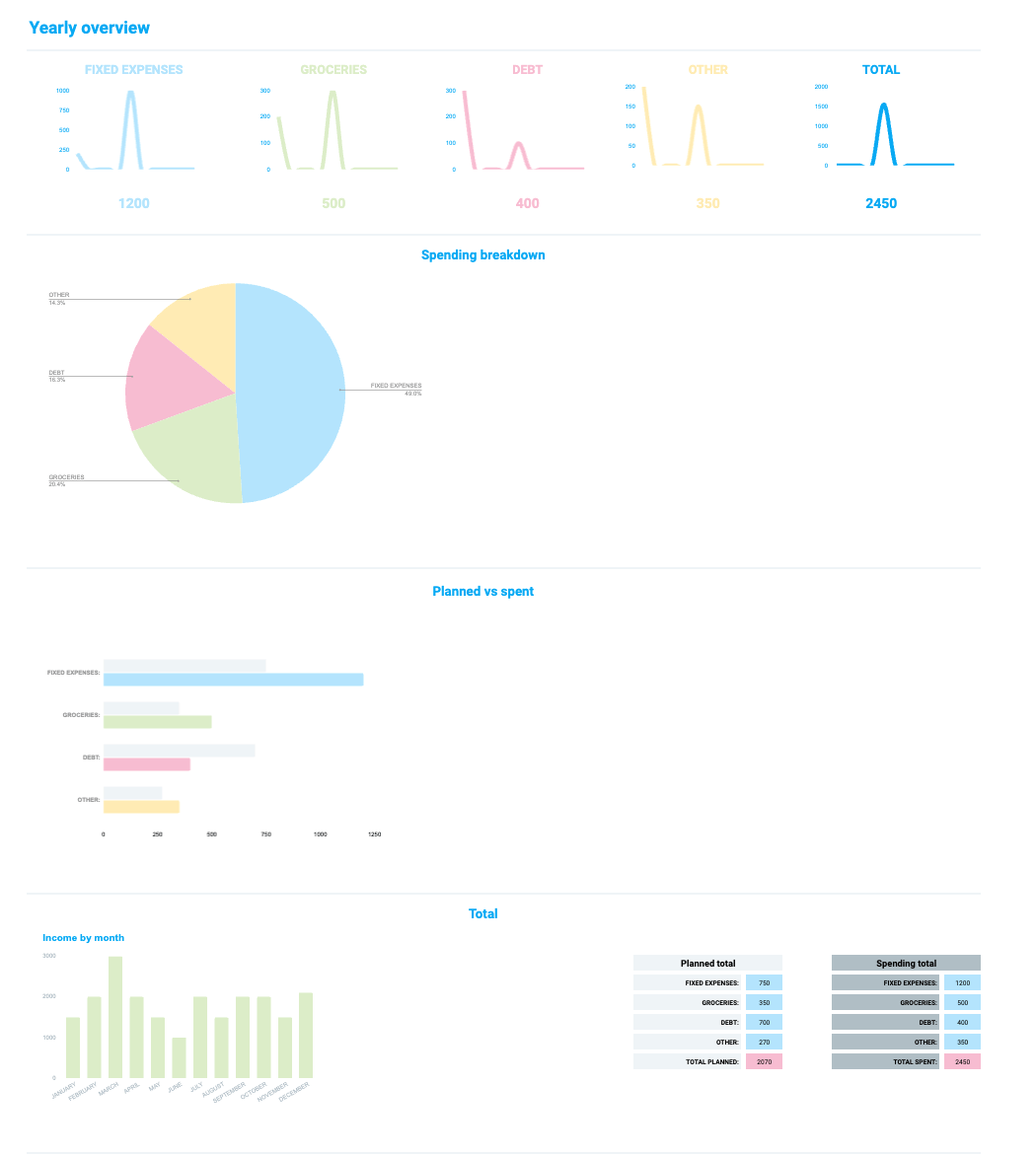

This template also includes visual breakdowns of your monthly purchases, as well as a detailed yearly overview of your total budget and expenses.

Why use the Detailed Yearly Budget Template?

Whether you want to plan your purchases for a whole year in advance, or you'd like to start tracking expenses in great detail — the Detailed Yearly Budget template is built to fit your budgeting needs.

This template also comes with a Yearly Overview sheet that gives you a color-coded visual breakdown of your finances over the year and wraps up your total yearly expenses by categories.

How best to use the Detailed Yearly Budget Template?

If you want to use the Google Sheets version of the Detailed Yearly Budget Template, start by clicking on the link leading to this format.

Then, you'll notice a new tab opening with the following question:

Would you like to make a copy of the Detailed Yearly Budget Template?

Click on the Make a copy button to be able to copy and edit the template.

In case you prefer the Excel format, clicking on the Excel link will download the document to your device.

After you've downloaded your chosen template format, start by adding the dates and your income for the first month.

If you'd like to plan your budget in advance, add your planned purchases for each category:

- Fixed expenses,

- Groceries,

- Debt, and

- Other.

After you've filled in the Planned $ column for each item you've listed, you'll see your planned expenses automatically calculated in the Planned total column.

Continue by adding the actual amount in the Spent $ column as you make a purchase, and you'll notice the sum of your expenses automatically calculated in the Spending total column.

As you continue adding your expenses, you'll notice the amount under Balance now automatically changes.

While you fill out columns with your planned and actual expenses, you'll notice that the Spending breakdown and Planned vs. Spent graphs are starting to take shape, mirroring your monthly purchases.

After you're done filling out the first sheet, move on to the next one to plan and log your expenses for the next month the same way.

As you fill out each column, you'll notice the graphs in the Yearly Overview sheet starting to take shape, demonstrating how your planned expenses stack up against your actual spending, and how much you've spent in each category over the year.

Additional free budgeting templates

Budgeting comes in all shapes and sizes. If you're just starting out, or you'd simply like to improve your spending habits, take a look at the 4 additional budgeting templates we've designed for you.

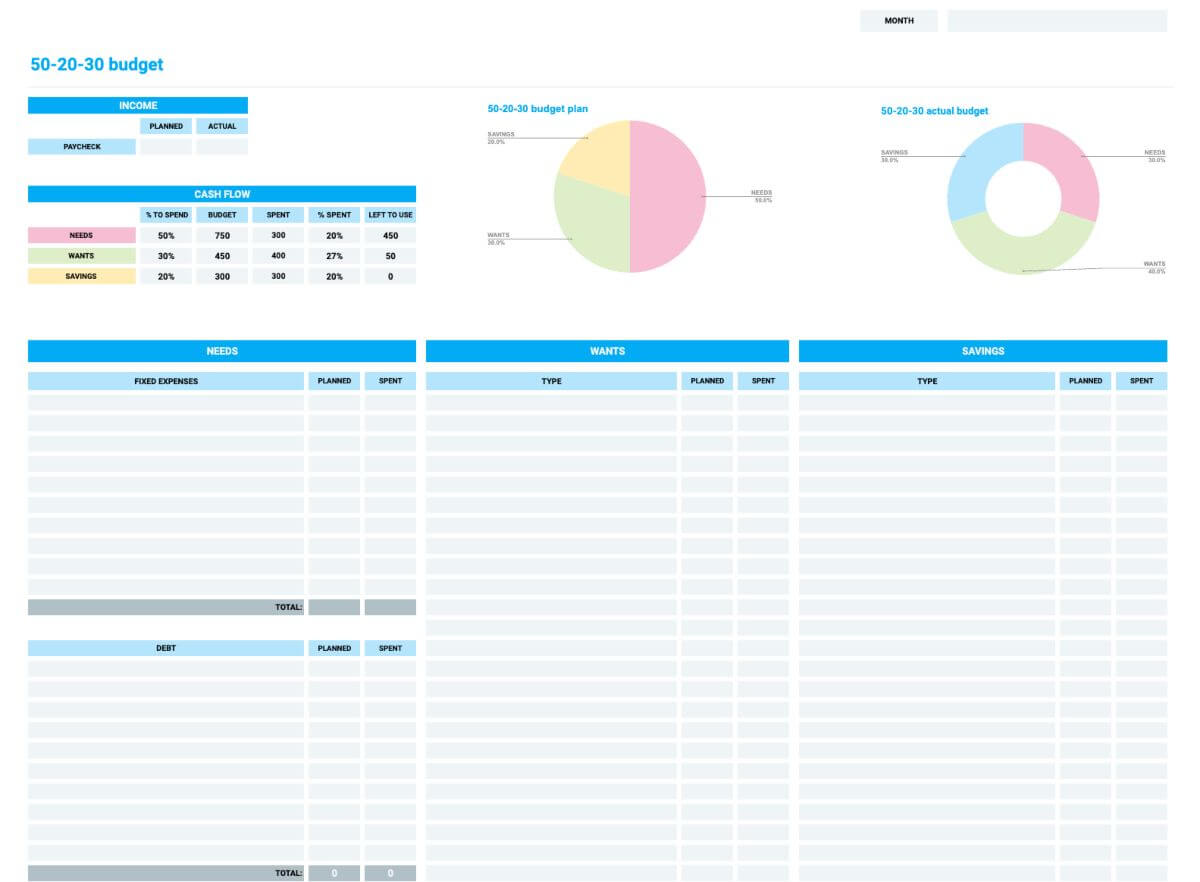

50-30-20 Budget Template

Splitting your budget into categories can help with keeping your finances under control, and the 50-30-20 Budget Template is created with that specific purpose in mind.

⏬ Download: Google Sheets, Excel

What is the 50-30-20 Budget Template?

The 50-30-20 Budget Template is an easy-to-edit spreadsheet based on the 50-30-20 budget plan that proposes splitting your income into 3 separate categories:

- Needs — 50% of your income goes towards essential expenses such as bills, mortgage payments, debt payoff, groceries, etc.,

- Wants — 30% of your payment goes towards your non-essential purchases, which could be anything from treating yourself to investing in hobbies, and

- Savings — 20% of your income goes towards your savings fund.

For easier budgeting, the template also comes with color-coded graphs showing you the exact amount you're allowed to spend in each expense category.

Why use the 50-30-20 Budget Template?

The 50-30-20 Budget Template is a great option for anyone striving towards reaching their financial goals without having to figure out a whole new budgeting system.

This template also comes in handy if you want to ensure that you'll allocate enough funds to savings each month.

How best to use the 50-30-20 Budget Template?

To use the Google Sheets version of the 50-30-20 Budget Template, click on the link leading to this format.

Immediately after, you'll notice a new tab opening with the following question:

Would you like to make a copy of the 50-30-20 Budget Template?

Click on the Make a copy button to be able to copy and edit the template.

In case you prefer the Excel format, clicking on the Excel link will store the document on your device.

Then, start by adding the month and your planned and actual income. After you add your actual income, you'll notice the total amount automatically allocated towards 3 separate categories under Budget.

As you fill in the Needs, Wants, and Savings columns, the percentage and amount in the %Spent and Left to Use columns change too.

Simultaneously, while you're adding your purchases, the Actual 50-30-20 graph should start to reflect your spending and show you the exact percentage of the income you've allocated to each category.

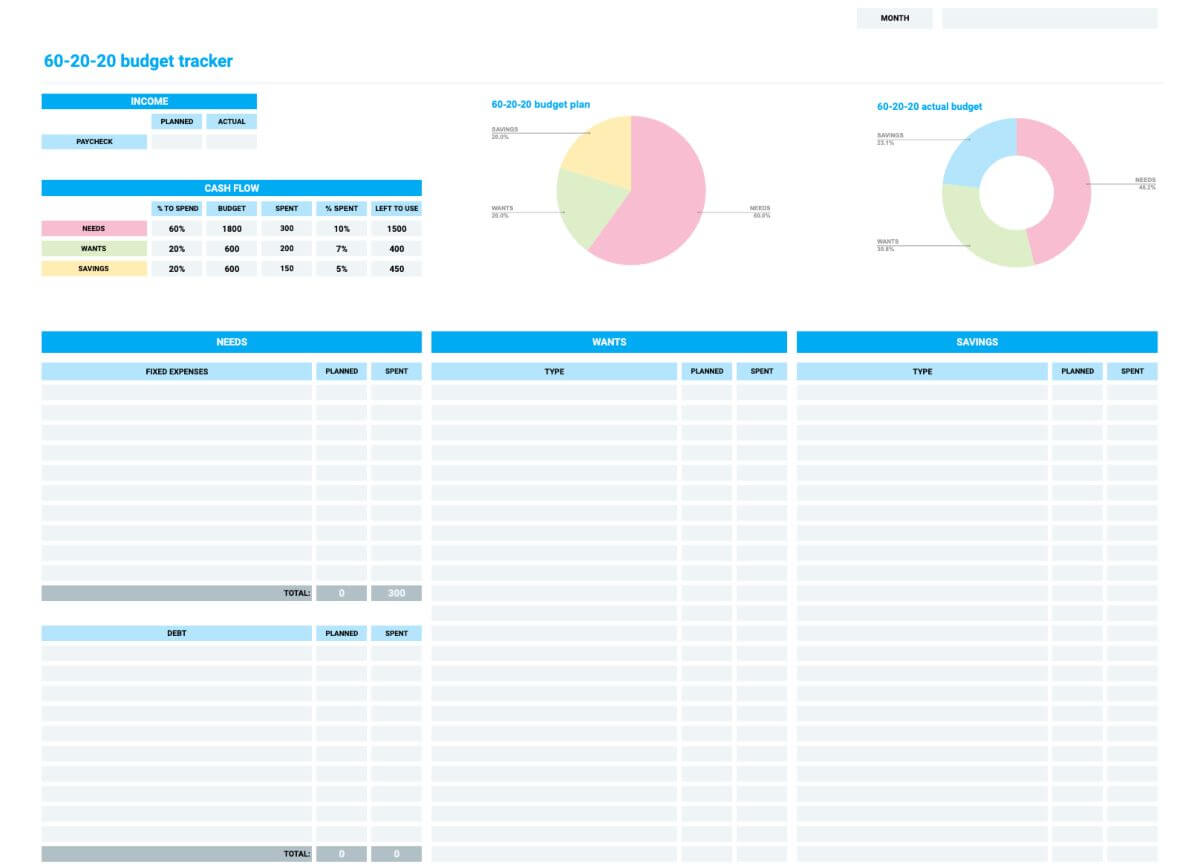

60-20-20 Budget Template

If you like the idea behind the 50-30-20 budget plan, but you wish to prioritize your essential expenses first, then the 60-20-20 Budget Template could be perfect for you.

⏬ Download: Google Sheets, Excel

What is the 60-20-20 Budget Template?

The 60-20-20 Budget Template is a straightforward budgeting spreadsheet that lets you allocate your income based on the 60-20-20 spending plan. The idea behind the 60-20-20 budgeting method lies in allocating your income into three categories:

- Needs — 60% of your income goes towards your essential expenses such as bills, mortgage payments, debt payoff, groceries, etc.,

- Wants — 20% of your payment goes towards your non-essential purchases, which could be anything from treating yourself to investing in hobbies, and

- Savings — 20% of your income goes towards your savings fund.

This template also comes with color-coded graphs that help you get a clear picture of your budget allocation as soon as you log your purchases.

Why use the 60-20-20 Budget Template?

You can use the 60-20-20 Budget Template regardless of whether you'd like to set aside enough savings month in and month out to secure financial stability, or you just need a jumping-off point for managing your finances.

How best to use the 60-20-20 Budget Template?

To download the Google Sheets version of the 60-20-20 Budget Template, click on the link leading to this format, and you'll see a new tab popping up with the following question:

Would you like to make a copy of the 60-20-20 Budget Template?

Then, simply click on the Make a copy button, and this will let you copy and edit the template.

In case you go for the Excel version of the template, clicking on the link will save the document to your device.

After you've downloaded your preferred template format, start by adding the month and your planned and actual income.

Immediately after, you'll notice the total amount automatically allocated towards 3 separate categories under Budget.

As you fill in the Needs, Wants, and Savings columns, you'll notice the percentage and amount changing in the %Spent and Left to Use columns too.

While you're adding your purchases, you'll see how the Actual 60-20-20 graph reflects your spending and shows you the exact percentage of the income you've allocated to each expense category.

Savings Tracker Template

Whether you'd like to make saving a habit, or you're just focused on reaching a specific goal, the Savings Tracker Template can be a nifty tool to nudge you toward building long-term financial stability.

⏬ Download: Google Sheets, Excel

What is the Savings Tracker Template?

The Savings Tracker Template is an editable spreadsheet you can use to stay focused on your savings goals and keep track of the amount you set aside each month throughout the year.

To help you steer a course toward your savings goal, the template also comes with a visual representation of your saving process, showing exactly how much you've already saved, and how much you're left to set aside to reach your goal.

Why use the Savings Tracker Template?

Use the Savings Tracker Template if you're starting out saving up and need a motivational boost to help you keep going, or you'd just like to track your progress while working on a specific savings goal.

How best to use the Savings Tracker Template?

If you want to use the Google Sheets version of the Savings Tracker Template, start by clicking on the link leading to this format.

Immediately after, you'll notice a new tab opening with the following question:

Would you like to make a copy of the Savings Tracker Template?

Click on the Make a copy button to be able to copy and edit the template.

In case you prefer the Excel format, clicking on the Excel link will download the document to your device.

Then, start by adding your savings goal and the amount you'd like to save.

Immediately after you add your first monthly savings amount, you'll see the amount you're left to save automatically calculated in the Left to save column.

As you continue logging the amount you set aside each month, you'll also notice the graph starting to take shape to show your progress.

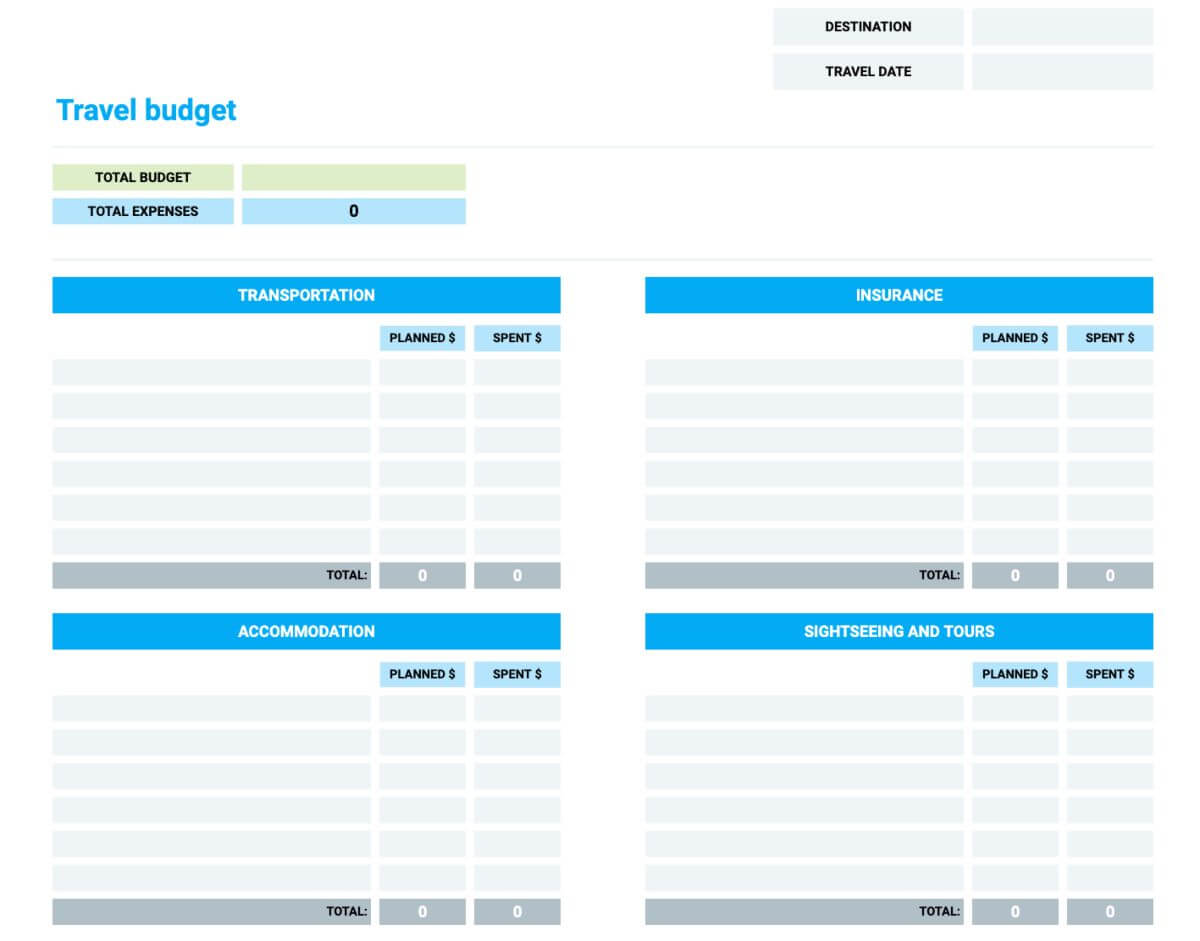

Travel Budget Template

If you're getting ready for a trip, and you want to make sure your travel costs stay within the budget, the Travel Budget Template could help you plan your vacation from the day you request PTO to the moment you unpack your suitcases after the trip.

⏬ Download: Google Sheets, Excel

What is the Travel Budget Template?

The Travel Budget Template is a simple, customizable spreadsheet you can use to plan and log your travel expenses, from transportation and insurance to sightseeing, souvenirs, and more.

Why use the Travel Budget Template?

Whether you're just starting to make vacation plans, or you've already booked your trip, the Travel Budget Template can help you follow through with your travel budget plan.

How best to use the Travel Budget Template?

To download the Google Sheets version of the Travel Budget Template, click on the link leading to this format, and you'll see a new tab popping up with the following question:

Would you like to make a copy of the Travel Budget Template?

Simply click on the Make a copy button, and this will let you copy and edit the template.

In case you go for the Excel version of the template, clicking on the Excel link will save the document to your device.

After you've downloaded your preferred template format, start by adding your destination, travel date, and your total budget for the trip.

If you'd like to plan your travel budget in advance, add your expected costs for each category:

- Transportation,

- Insurance,

- Accommodation,

- Sightseeing and tours,

- Food,

- Entertainment,

- Souvenirs and gifts, and

- Other.

Immediately after you fill in each Planned $ column, you'll see your expected costs automatically calculated in the Planned total column.

Continue by adding the actual amount in the Spent $ column as you make a purchase, and you'll see the sum of your expenses automatically calculated in the Spending total column.

As you continue adding your expenses, you'll notice the amount under Total expenses automatically changes.

Stay on top of your income for accurate budgeting

Budgeting templates are a perfect all-in-one tool for:

- Making spending estimates,

- Setting attainable financial goals, and

- Obtaining a clear rundown of all your expenses over time.

However, making accurate income estimates and crafting an error-free financial plan might not always be doable — especially if your salary varies month in and month out.

On top of that, if you're just now dipping your toes into budgeting, you might also frequently need to review and change your plan along the way. Apart from being a massive time waster, this could also potentially decrease your motivation to continue keeping a close eye on your budget.

To make sure you have the most accurate numbers at hand, even before plotting a financial plan, you'll need to know the exact number of hours you've worked. This is where a work hours tracker can help you get going.

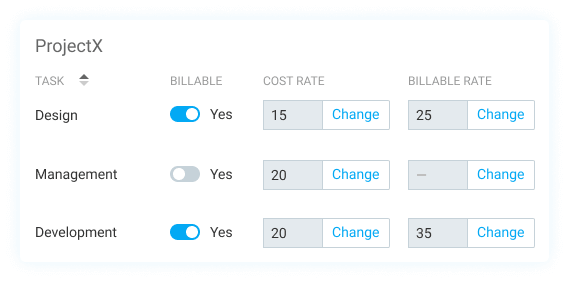

If you use Clockify to track your work hours, you'll be able to see exactly how much you've earned by activating billable rates and tracking your project progress in real-time.

Setting billable hours in Clockify is a matter of seconds

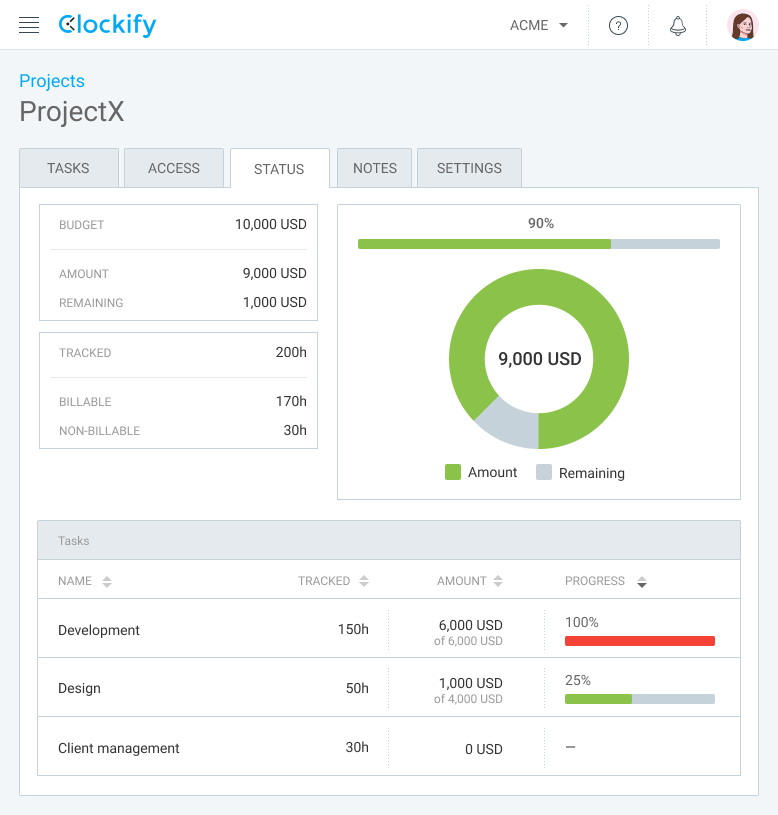

Also, if you are a freelancer who bills by project, you could greatly benefit from Clockify's budget and estimates feature, which gives you the option to:

- Estimate your project budget,

- Track project status, and

- Even invoice your clients based on your summary reports.

Tracking your project budget and progress helps with making better financial estimates

This way, you'll always be up-to-date with all the upcoming payments, which further helps you plot a feasible financial plan.