District of Columbia Labor Laws Guide

Ultimate District of Columbia labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| District of Columbia Labor Laws FAQ | |

| District of Columbia minimum wage | $15.20 |

| District of Columbia overtime | 1.5 times the minimum wage for any time worked over 40 hours/week ($22.8 for minimum wage workers) |

| District of Columbia breaks | Breaks not required by law |

Table of contents

- District of Columbia Wage Laws

- District of Columbia Payment Laws

- District of Columbia Overtime Laws

- District of Columbia Break Laws

- District of Columbia Leave Requirements

- Child Labor Laws In District of Columbia

- District of Columbia Hiring Laws

- District of Columbia Termination Laws

- Occupational Safety In District of Columbia

- Miscellaneous District of Columbia Labor Laws

District of Columbia wage laws

We'll first deal with the most important laws and regulations regarding minimum, tipped, and subminimum wages.

| DISTRICT OF COLUMBIA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $15.20 | $5.05 | $4.25 |

District of Columbia minimum wage

The act that states the minimum wage requirement in the District of Columbia points out to $15.20 per hour worked.

There are some exemptions and exceptions to this requirement — for example, for tipped occupations and minors.

Tipped minimum wage in the District of Columbia

According to the federal law, tips are certain amounts of moneythat are freely provided by the customers to employees. Tips are closely tied with certain professions, especially in the hospitality industry. To provide a couple of examples — you will leave tips to servers and bartenders, as a recognition for their service.

Tipped employees in the District of Columbia are employees who regularly receive such gratuities. Currently, the tipped employees' minimum wage is $5.05.

However, the tipped minimum wage rate is applicable only if the sum of the basis ($5.05) and the earned tips amounts to at least $15.20 (regular minimum wage.) If the sum is lower, DC employees must pay the difference.

Exceptions to the minimum wage in the District of Columbia

Certain employment or personal statuses are exempt from the law regarding minimum wage in the District of Columbia. For example, tipped employees, as we've just explained above.

Another example is the possibility of providing subminimum wage to the employed youth under 20 years of age.

Let us share the rest of instances where minimum wage requirements don't apply, so you can check out who are the exemptions:

- Student-employees (who can be paid at a federal minimum wage rate of $7.25 per hour)

- US government employees

- Security Officers (working in an office building)

- Disabled workers (provided they've submitted a DOL certificate, issued by the US Department of Labor)

- Laundry and dry cleaning occupations

- White Collar employees (bona fide executives, administratives, and professionals)

- Outside salespeople

- Lay members of religious organizations

- Newspaper delivery employees

- Employees under the Job Training Partnership Act

- Employees under the Older Americans Act

- Volunteers

- Babysitters

Subminimum wage in District of Columbia

Minimum wage for employees under the age of 18 in the District of Columbia, also called the subminimum wage, is regulated by the rule of law.

The main purpose is avoiding the possibility of child labor exploatation.

Subminimum wage applies to minors (under 18 years of age) but also the rest of the youth under 20 years of age. It is set at $4.25.

A subminimum wage can only be applicable for the compensation during the first 90 days of employment and for employees younger than 20. After that period, which is often considered to be a training period, all employers must switch to paying the regular minimum wage of $15.20.

The District of Columbia payment laws

When it comes to pay frequency for DC, employers are required by the law to provide regular compensation for their employees on a semi-monthly basis. Which means, every 2 weeks are considered a payroll period.

The regulations also state that, if an employee is working a split shift, employers must compensate the employee for 1 additional hour for each day of such shifts occurring.

Deductions are another relevant category of payment laws, so let's check out what employers have the right to deduct from the payroll total.

Anything other than income taxes and court-ordered payments is illegal for the employer to deduct from the total salary of any employee.

Court-ordered payments include:

- Alimony

- Child support

- Debts to a third party

For any other types of deductions, employees must voluntarily authorize it.

Employees who are not adequately compensated for their work can and should submit a formal complaint. Their employers may be liable to compensate up to 4 times the amount of unpaid wages. Additionally, if the complaint was true, employers will also have to pay the costs of an attorney and any other costs, if relevant to the case.

District of Columbia overtime laws

Regulations established by the Fair Labor Standards Act define a working week as any seven consecutive working days. During this period, employees who work up to 40 hours are compensated for their work at an hourly rate of a minimum wage, defined by the District of Columbia regulations.

Any number of hours exceeding 40 counts as overtime and must be compensated at a higher hourly rate.

Non-exempt employees who do exceed that number are entitled to 1.5 times the regular rate.

Meaning, the number currently translates to $22.8 per hour, for minimum wage workers.

Some occupations and conditions can overrule this 1.5 rate requirement — so that's why we said “non-exempt employees” earlier.

We'll explain everything in the following sections, so read on and check out who is eligible for overtime compensation in the District of Columbia, and who is not.

Track District of Columbia overtime with ClockifyOvertime exceptions and exemptions in the District of Columbia

Following the federal requirements on the overtime exemptions, 4 main categories of employees are not protected by the law, as they fit into the larger category of White Collar occupations. We've mentioned them as exceptions to the minimum wage rule as well.

When it comes to overtime, provided they earn at least $684 per week, White Collar employees do not have to be paid at a 1.5 rate for working over 40 hours.

White Collar employees are the ones working in any of the following categories:

- Administration — if they spend up to 20% of time on unrelated activities, every type of non-manual work related to business operations, management policies, or administrative training.

- Executives — if they are directly managing at least 2 employees.

- Professionals — if the position in question implies advanced knowledge and extensive education (e.g. artists, certified teachers, and skilled computer professionals).

- Outside sales — if the position of making sales or taking orders happens outside of the employer's main workplace.

Besides the federal government exemptions, the state enforces overtime restrictions tosome other, more specific occupations.

So, here's the full list:

- US government employees

- Airline employees

- Commissioned employees

- Railroad employees

- Automobile dealership employees

- Newspaper delivery employees

- Babysitters

- Volunteers

- Companions for the aged or infirm

- Lay members of religious organizations

- Domestic workers

- Seamen

District of Columbia break laws

Employers in the District of Columbia are not legally required to provide any type of breaks to their employees. It's because there is no specific statute in DC that regulates meal periods and breaks — so the federal rules apply.

However, even though breaks are not required by law, many employers choose to offer rest or meal breaks.

For employers who do offer breaks, there is a regulation that short breaks (up to 20 minutes) must be compensated for.

Employers who offer meal breaks that last at least 30 minutes don't have to compensate their employees for this time.

There is an exception to the rule — a lactating break for still breastfeeding mothers.

District of Columbia breastfeeding laws

This is something that applies to all working mothers who gave birth recently and are still lactating and breastfeeding.

In the District of Columbia, the same as on a federal level, employers are obligated to provide adequate conditions for such female employees.

This type of break can be either paid or unpaid, as predetermined by the company regulations and policy.

By “adequate conditions”, the law refers to employers providing a room or location with a door that can't be a bathroom stall.

Employers must provide such a location in the nearest possible proximity to the working environment.

District of Columbia leave requirements

What are employers in the District of Columbia entitled to do if an employee asks for a leave of absence from work in the District of Columbia? If they allow leave time, will an employee be compensated for it?

Well, it depends on the reason — why is the employee asking for a leave of absence?

The law clearly regulates which types of leave employers are required to offer and provide, without any negative consequences for an employee, upon their return to work.

There are 2 broad categories of leave of absence — required and non-required, according to the US Department of Labor.

However, the types of leave included in the 2 categories are not predetermined, as each state regulates them differently.

The District of Columbia required leave

There are instances where an employee is entitled to take a leave of absence, without being punished in any way upon their return to work. While employers do have to offer and provide some types of required leave to all their employees, they don't have to compensate them for that period. But, some company policies will offer paid required leave.

Here's the list of types of leave that employers in the District of Columbia are required to offer by law:

- Sick leave

- Holiday leave

- Jury duty leave

- Military leave

- School leave

- Universal Paid Leave Emergency Amendment Act

Sick leave

Paid sick leave is a type of required leave for all employers in the District of Columbia. The size of their company will dictate the other terms and conditions:

- For any number of employees, up to 24 — employers are required to offer at least 1 hour of paid sick leave for every 87 hours worked.

- For 25–99 employees — employers are required to offer at least 1 hour of paid sick leave for every 43 hours worked.

- For 100+ employees — employers are required to offer at least 1 hour of paid sick leave for every 37 hours worked.

Holiday leave

In the District of Columbia, April 16 is the official holiday — Emancipation Day.

Employers are required to offer an unpaid leave of absence for the day (or the nearest workday), provided they submit a request at least 10 days in advance.

The only exception is if an employer proves that the leave would disrupt company operations.

Jury duty leave

If an employee in the District of Columbia is summoned to perform jury duty, employers must allow them to be absent from work during that time.

Moreover, the law states they can't penalize or discipline their employees in any way for the acceptance of jury duty.

Military leave

Even though the District of Columbia doesn't have its own, specific regulations regarding military leave, there is a federal act that regulates such situations. It's applicable everywhere in the US, so DC employees are entitled to that as well.

The law in question is the Uniformed Services Employment and Reemployment Rights Act — or USERRA.

Uniformed service members can perform their duty on a voluntary or involuntary basis without their job being terminated or endangered in any way upon their return.

Active duty (in the Army, Navy, Coast Guard, Air Force, Reserves, etc.), but also, inactive duty and training, are all included.

The law applies to both public and private sectors.

School leave

When it comes to employees who are parents or guardians, but also grandparents, aunts and uncles, there's another type of required leave in the District of Columbia.

It concerns the attendance of any school-related activities and is limited to 24 hours in a 12-month period.

For leave to be approved, the procedure requires that employees submit a request at least 10 days in advance.

The employer can choose whether school leave time will be paid or unpaid.

Universal Paid Leave Emergency Amendment Act

This amendment regulates the prenatal period and responsibilities related to it.

It states that eligible employees in the District of Columbia can take 2 weeksof paid leave for any of the following reasons:

- Required bedrest

- Pregnancy complication treatment

- Medical care after a miscarriage

- Appointments, exams, and treatments

- Prenatal physical therapy

Moreover, the initial period has been extended, and all approved claims starting from September 26, 2021 result in up to 6 weeks of job-protected prenatal leave.

District of Columbia non-required leave

There are 3 categories of leave that, by state law, employers are not required to offer to their employees.

Said categories are:

- Bereavement leave

- Vacation leave

- Voting time leave

It is important to mention that the law also doesn't prohibit or restrict these types of leave.

If an employer chooses to offer any or all, the exact terms need to be stated in the signed contract of employment.

Bereavement leave

Employers are not required to offer bereavement leave to any of their employees.

Vacation leave

The same applies to vacation leave — employers are not required to offer it. Employers who choose to offer this type of leave can include certain benefits, but all the details of the agreement between the two parties must be stated in the signed contract.

Voting time leave

Regarding voting time leave — employers are not required to offer this type either. If they do offer it, they can decide whether the leave is paid or unpaid, and how long it can last.

Child labor laws in the District of Columbia

The term “minors'' refers to young people, aged under 18. The main purpose of both federal and the District of Columbia child labor laws is to prevent the exploitation of minors. Additionally, to help minors put education first — their employment is only meant to enhance their academic and life experience.

Some of the most relevant limitations regarding the employment of minors can be seen in the following categories:

- Maximum number of work hours

- Nightwork

- Restrictions on specific industries

Different rules and regulations apply to different age groups of minors but there is one thing applicable to all minors — they are forbidden to work in any hazardous positions.

Next, let's take a look at some rules stated in the District of Columbia Child Labor Law.

Specific labor laws for minors

In the District of Columbia, child labor laws enforce specific rules for different age groups. The 2 categories put restrictions on the maximum hours of work and nightwork of minors.

There's another relevant thing to mention — employers are not required to obtain an age certification document for the employment of minors.

For the employment of minors, the following rules apply.

The maximum number of work for all minors is 8 hours per day, 48 hours per week.

Nightwork restrictions go as follows:

- Under 16 years of age, minors are prohibited to work between 7 p.m. and 7 a.m.

- For ages 16 and 17, minors are prohibited to work between 10 p.m. and 6 a.m.

Prohibited occupations for minors in District of Columbia

There are also some restrictions on child labor in specific industries.

To provide an example, minors under the age of 16 are prohibited from working with any and all power-driven machinery.

For more detailed information about specifically prohibited occupations for different age groups of minors in the District of Columbia, check out their official government website.

Termination laws in the District of Columbia

Like the majority of other states in the US, the District of Columbia also implements an “employment-at-will” doctrine and policy.

What does that mean for both employers and employees?

- Employers — they can terminate their employees' work engagement anytime, for any reason, or perhaps for no reason at all.

- Employees — they are free to leave a job for any or no reason with no legal consequences.

Final paycheck in the District of Columbia

Employers in the District of Columbia are legally required to provide a final paycheck, including all the wages and benefits to everyone whose employment was terminated.

A final paycheck is due not later than the following workday of the termination date, if the employer in question terminates the employment.

The only exception to the rule is if the former employee was in charge of accounting, or handling money in any way.

In that case, employers have 4 working days to issue and deliver the final paycheck.

Discrimination laws in the District of Columbia

Discrimination in the workplace is not only unethical but also illegal. The DC Human Rights Act enforces the law, which prohibits such behavior not only in employment, but also housing, educational institutions, and public accommodations.

Here's the list of reasons employers are not allowed to take into account while looking for new employees and while treating their employees in general:

- Race

- Color

- Religion

- Gender

- National origin

- Age

- Marital status

- Personal appearance

- Sexual orientation

- Gender identity/expression

- Family responsibilities

- Political affiliation

- Physical/mental disability

- Matriculation

- Genetic information

- Status as a victim of any type of domestic violence, sexual offense, or stalking

- Credit information

Occupational safety in the District of Columbia

All employees must have a safe and healthy working environment and the state of specific conditions is regulated by the law. The first thing to mention is the federal Occupational Safety and Health Act (OSHA), passed by the Congress in 1970 — but there are some additional requirements for the employers in DC.

OSHA states that employers are required to provide safe and healthy working conditions, continually inspect for flaws and irregularities, and strive to improve them, if possible.

Let's start with what employers are required to provide in order to ensure workplace safety — proper training, education, and continuous assistance to their employees. The main goal is, of course, to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

Besides providing necessary education for employees, employers must create optimal working conditions — free from any recognized hazards that may cause harm. Moreover, it is obligatory to conduct research regularly, as well as undertake safety demonstrations concerning health matters.

Inspections can occur due to various factors, and be both scheduled and unscheduled. This is regulated and determined by the District of Columbia Occupational Safety and Health Board, whose 7 members are appointed by the Mayor.

Unscheduled inspections may come as a consequence of many issues, including employee complaints.

Miscellaneous District of Columbia labor laws

Those were the most important and common categories of labor laws relevant in the District of Columbia. Now let's see what else is enforced and mention several additional laws that may be applicable to your situation.

Here's what else is regulated by the rule of law in the District of Columbia:

- Whistleblower protection laws

- Background check laws

- Employer use of social media regulations

- The Employee monitoring law

- Drug and alcohol testing laws

- Sexual harassment training laws

- Cal-COBRA laws

- Record-keeping laws

Whistleblower protection laws

The main purpose of this set of laws is to ensure that employees can exercise all of their legal rights without negative repercussions as a result. The term “whistleblower” refers to employees who have inside knowledge of an illegal practice or a safety hazard in the workplace. They must be able to report it and continue being employed.

Some of the reasons why employees can't be discriminated against, or treated differently in any way include:

- Exercising their First Amendment rights

- Reporting an alleged violation of law

- Opposing or complaining about discrimination in the workplace

- Exercising their OSHA (Occupational Safety and Health) rights

- Opposing or participating in investigation of discrimination

Background check laws

Background checks are allowed by all the employers (but not required) and are subject to the Federal Fair Credit Reporting Act. This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau.

Only certain positions do require background checks in DC, so let's see which ones.

- Firefighters

- Public school employees

- Any institution working with minors

- Healthcare, community residence, hospice, and home care facility employees

- Mortgage bankers and brokers

- Department of Corrections employees

Credit and investigative check laws

Credit and investigative checks are neither required nor prohibited, so DC employers can rely on the federal law regarding this matter.

If they opt to do so, they must carefully follow the procedures stated by the Fair Credit Reporting Act.

Arrest and conviction check laws

When it comes to arrest and conviction checks during the interview process, DC employers are forbidden to ask about the following:

- Arrests

- Criminal accusations

- Criminal convictions

Only once the official job offer is made by the employer, may the said employer look into just one of the 3 items we've just listed — criminal convictions.

If there is a legitimate business reason, employers who believe the person offered the job would endanger the employer's reputation or similar are allowed to withdraw the offer of employment.

Non-compete agreements laws

Non-compete agreements law is something that should've already been in effect, but was delayed due to the global pandemic.

It refers to the law forbidding employers from requesting a non-compete clause in an employee contract.

Another important aspect of this law is that the workplace policies won't be able to restrict employees from:

- Having another job

- Provide services to another employer

- Operate their own business

This law will go into effect on April 1, 2022.

Discussing wages laws

It's important to mention several aspects of freedom of speech in the workplace (regarding wages) that are regulated in the District of Columbia.

Employers are prohibited from doing the following 3 things:

- Forbid their employees to ask about, disclose information about, and discuss their own or another's wages.

- Discriminate against, interfere with, or discharge an employee because they did anything from the previous point.

- Try to prohibit an employee from asserting the right to wage transparency.

Sexual harassment training laws

Employers whose business is located in the District of Columbia are required to provide training on sexual harassment prevention to all of their employees.

There are no exceptions to this rule, and moreover, training must be provided within the first 90 days of employment.

COBRA laws

COBRA is a law that operates on a federal level, so let's start this section by explaining what the acronym means. The Consolidated Omnibus Budget Reconciliation Act allows employees to retain health care insurance and benefits after the termination of employment.

Federal regulations also state the law can be applied to employers with over 20 employees. In the District of Columbia, their mini-COBRA ensures 3 months of continuation coverage.

The only exception to this rule is if the termination happened due to gross negligence or misconduct of an employee.

Expense reimbursement laws

This is the group of laws related to the costs of employees' travel expenses, uniforms, tools, and other pieces of equipment they need for work.

The law clearly states that employers must either provide the employees with all of the abovementioned or fully reimburse them for it. The total should be added to the first following paycheck, in addition to the base salary earned.

Record-keeping laws

Keeping the records of all their employees is an obligation for all DC employers. They must do so for the length of 3 years.

So, what types and categories of information should such records consist of?

Here's the full list:

- Employee name

- Social security number

- Occupation of the employee

- Date of birth

- Address including ZIP code

- Regular hourly rate of pay

- Basis on which wages are paid

- A daily record of beginning and ending work, if a split shift is in question

- Total daily or weekly net wages and deductions

- Total gross daily or weekly wages

- Date of each payment

Conclusion/Disclaimer

We hope this District of Columbia labor law guide has been helpful. We advise you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q1 2022, so any changes in the labor laws that were included later than that may not be included in this District of Columbia labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

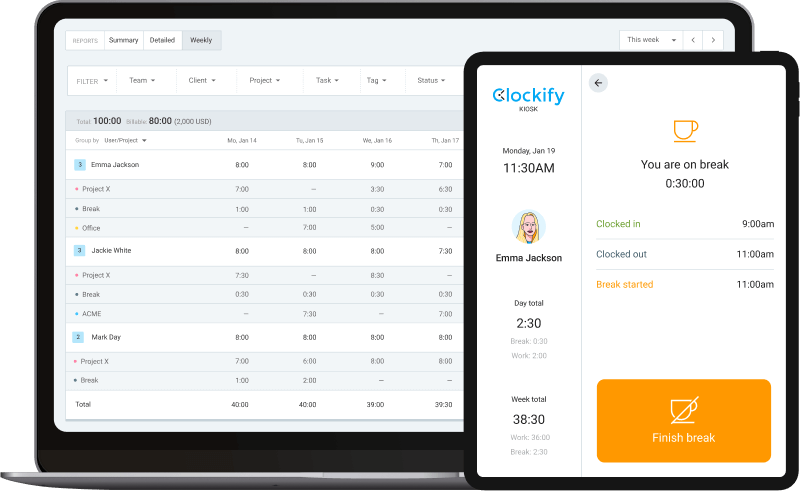

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).