Florida Labor Laws Guide

Ultimate Florida labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Florida Labor Laws FAQ | |

| Florida minimum wage | $10 |

| Florida overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($15 for minimum wage workers) |

| Florida breaks | Breaks not required by law |

Table of contents

Florida wage laws

Unlike certain states, Florida has state laws regarding employees' wages.

The following are the regulations concerning the state minimum, tipped hourly wage, and the youth minimum wage in Florida.

| FLORIDA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $10 | $6.98 | $4.25 |

Florida minimum wage

What is Florida's minimum wage 2022?

All employees in Florida are entitled to the state minimum wage of $10 per hour.

Exceptions to the minimum wage in Florida

The Fair Labor Standards Act proposes that certain employees are exempt from the minimum wage.

The following is the list of employees who are exempt from the minimum wage (together with certain requirements):

- Executive workers who are paid on a salary basis and earn not less than $684 per week.

- Administrative workers who are paid on a salary basis and earn not less than $684 per week.

- Learned and creative professionals paid on a salary basis who earn not less than $684 per week.

- Computer employees who earn $684 per week or at least $27.63 per hour.

- Highly compensated employees who earn $107,432 or more a year.

- Outside sales employees — There is no minimum salary requirement for such employees.

- Tipped employees

- Minors

Tipped minimum wage in Florida

What is Florida's minimum wage for tipped employees 2022?

Under Florida law, tipped employees are entitled to the state minimum cash wage of $6.98 per hour — provided that the employee's hourly earnings (with tips) are equal to or exceed the state minimum wage of $10.

Furthermore, the FLSA imposes that an employer must pay the difference if an employee's earnings don't equal the state minimum wage of $10 per hour.

To conclude, an employer is allowed to take a tip credit from an employee of no more than $3.02 per hour.

Florida subminimum wage

What is Florida's youth minimum wage 2022?

Under federal law, employers are allowed to pay employees under 20 years of age a minimum wage of $4.25 per hour for the first 90 calendar days after employment.

However, full-time students who work in retail, agriculture, or colleges and universities are entitled to 85% of the minimum wage.

The employer must obtain a certificate to be able to employ a full-time student. Also, full-time students can work no more than 20 hours a week (8 hours a day) during school time, and 40 hours per week when school is not in session.

Florida payment laws

The state of Florida doesn't have any laws regulating how often an employer must pay employees their wages.

Thus, employers have the freedom to set their own payment schemes.

Here are the most common pay frequency schemes in the USA:

- Weekly — Employees are paid once a week (52 paychecks per year).

- Biweekly — Employees are paid every other week (26 paychecks per year).

- Semi-monthly — Employees are paid twice a month (24 paychecks per year).

- Monthly — Employees are paid once a month (12 paychecks per year).

Florida overtime laws

Florida doesn't have any state laws that regulate overtime working. Therefore, all nonexempt Florida employees must be paid a federal overtime rate of time and a half (1.5) the regular hourly pay for any hours exceeding 40 a week.

The FLSA doesn't require overtime pay for work on the weekend, holidays, or any other regular days of rest.

Track Florida overtime with ClockifyOvertime exceptions and exemptions in Florida

Certain occupations are exempt from both minimum wage and overtime pay — they include:

- Executives who are compensated on a salary basis and earn not less than $684 weekly,

- Administrative employees who receive a salary and earn not less than $684 per week,

- Learned and creative professionals who receive a salary and earn not less than $684 per week,

- Highly compensated employees who are paid on a salary basis and receive $107,432 (at least $684 weekly),

- Outside sales employees,

- Employees who work varying schedules, i.e., use the Fluctuating Workweek Method (FWW), and

- Computer employees who work on a salary basis and earn no less than $684 weekly.

The exemptions don't apply to “blue-collar” workers, police officers, firefighters, paramedics, rescue workers, and similar employees.

Fluctuating Workweek Method (FWW) in Florida

Fluctuating Workweek Method, also known as the “Chinese overtime”, entitles salaried employees to an overtime premium of one-half (0.5) times their regular hourly rate.

So, if employees have a fixed salary and their workweek is “fluctuating” — sometimes they work 40 hours a week, sometimes more, or less — they are entitled to this overtime rate.

For instance, if employees work 40 hours or less per week, they receive their regular weekly pay. But if one week they work, let's say, 45 hours — they are entitled to an additional 0.5 times their regular rate for those extra 5 hours of overtime.

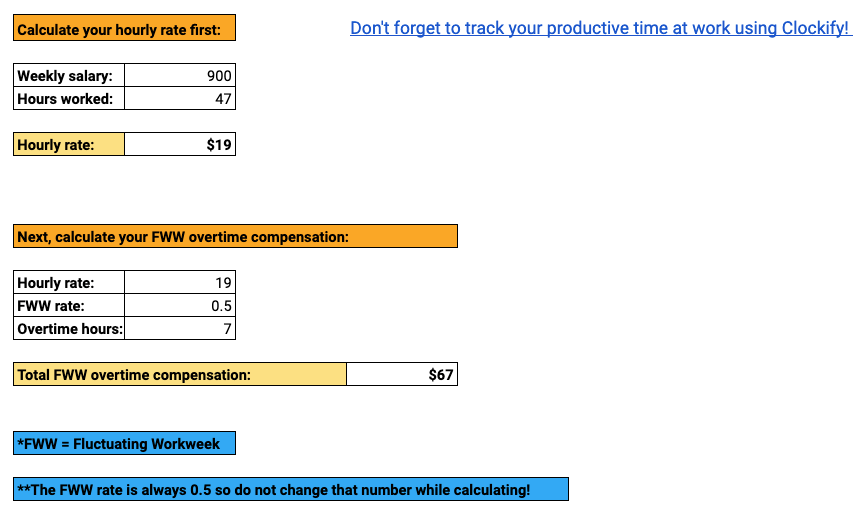

Take a look at the example:

Let's say an employee's weekly income is $900 and in the preceding week the employee worked 45 hours.

To be able to calculate overtime hours, calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week.

$900 / 45 = $20 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week.

$20 per hour x 0.5 = $10 for each overtime hour worked

Total overtime compensation goes as follows:

$10 x 5 overtime hours = $50

Fluctuating Workweek Calculator

Florida break laws

What is the legal break for an 8-hour shift in Florida?

Florida doesn't have any labor regulations specifying meal breaks for adult employees.

Therefore, under federal law, employers in Florida are not required to offer rest breaks to their employees during the workday.

Exceptions to break laws in Florida

Of course, everything is a matter of mutual understanding between an employer and an employee. So, if an employee is provided a rest period of 5 to 20 minutes, it is considered as compensatory time.

Meal periods, also called bona fide meal periods, lasting at least 30 minutes, are not considered work hours — hence, are not compensable.

On the other hand, if an employee eats during work — hotline workers for instance — such time is considered compensable time.

Florida breastfeeding laws

Under Florida law, a mother has the right to breastfeed her baby in any location — whether public or private.

However, Florida doesn't have any state laws that support breastfeeding in the workplace. In that situation, FLSA proposes that employees who breastfeed are entitled to a reasonable break time and a separate room (other than an office's bathroom) to express breast milk at work.

In addition, nursing mothers in Florida are exempt from public indecency laws.

Florida leave requirements

Florida offers the following types of leave:

- Required leave

- Non-required leave

Florida required leave

All states have different regulations concerning leave days, including Florida.

Take a look at the required leave regulations regarding Florida employees below.

Holiday leave (public employers)

All Florida state branches and agencies shall not work on certain state and religious holidays and they are entitled to a paid day off.

If any of the said holidays fall on Saturday, the preceding Friday will be a day off. If a holiday falls on Sunday, the following Monday will be a day off.

Parental and family medical leave

Florida state offices offer their employees:

- Family medical leave

- Parental leave

The family medical leave can be used in the case of a serious disease or illness of an employee or his/her family member, any mental or physical condition that requires in-home care, a condition that poses an imminent danger of death, etc.

Parental leave is used for the birth and care of a newborn baby, whether that means leave for the father or mother.

State employers are required to grant employees up to 6 months of unpaid leave. The employee must obtain a written statement from a physician for such leave to commence.

An employer cannot terminate the employment of any employee because of pregnancy or refuse to grant family medical leave.

Jury duty

Florida employers must grant their employees time off if they're called up to serve on a jury.

However, full-time employees are not entitled to receive compensation for the first 3 days of juror service.

In contrast, jurors who are not regular (full-time) employees receive $15 a day for the first 3 days of juror service.

Finally, each juror who serves more than 3 days gets paid for the fourth day of service and each day thereafter — $30 per day of service.

Military leave

All Florida employees are entitled to military leave without loss of pay, vacation, or sick leave.

Leave of paid absence may not exceed 240 working hours during one year.

Emergency response leave

Employees of a state agency may be granted a paid leave of up to 120 working hours in a 12-month period to serve as volunteers.

Florida non-required leave

The following are occasions when employers are not required to give their employees days off:

Vacation leave

Employers in the USA are not required to pay for time not worked — whether that is vacation leave, sick leave, and similar.

Florida has no state laws requiring employers to provide employees with vacation days. Thus, under federal law, employers don't need to give their employees vacation leave — paid or unpaid.

However, that doesn't mean employers don't offer vacation or similar benefits to their employees. If granted — such leave is usually a mutual agreement between an employer and an employee.

Sick leave

The same rule applies to sick leave. Under federal law, employers don't need to provide employees with sick leave benefits — paid or unpaid.

If granted, it's a matter of mutual understanding between the employer and employee.

Holiday leave (private employers)

Unlike public employers, private employers in Florida are not required to provide their employees with holiday leave — paid or unpaid.

In addition, employers don't need to pay any premium wage rates if employees work during holidays.

Voting leave

Florida doesn't require employers to give their employees time off to vote — whether paid or unpaid. Yet, it's considered a third-degree felony for those who discharge or threaten to discharge an employee who wants to vote or not vote in any election.

Bereavement leave

Florida employers are not required to provide employees with bereavement leave.

Therefore, it's up to the employers to decide how they want to handle bereavement leave benefits.

Child labor laws in Florida

The regulations regarding child labor in Florida ensure that minors work in an environment that doesn't pose any physical, emotional, or moral danger to them.

But, unlike other states — such as Alabama — Florida doesn't require minors to obtain work permits or working papers from either schools or government agencies to be able to work.

However, Florida does regulate things like working hours, breaks, and similar, when it comes to child labor.

Work time restrictions for Florida minors

How many hours can a minor work in the state of Florida?

Florida has both state and federal labor laws regulating the working hours of minors.

For minors aged 14 and 15 when public schools are in session:

- Up to 3 hours of work on a school day.

- Up to 8 hours of work on a non-school day.

- Up to 15 hours of work weekly.

- Up to 6 consecutive days of work weekly.

- No work before 7 a.m. or after 7 p.m. but may not work during public school hours.

For minors aged 14 and 15 when public schools are NOT in session (June 1st through Labor Day):

- Up to 8 hours of work a day.

- Up to 40 hours of work weekly.

- Up to 6 consecutive days of work weekly.

- No work before 7 a.m. or after 9 p.m. each day.

For minors aged 16, 17 when public or private schools are in session:

- No work before 6:30 a.m. or after 11 p.m. on a school day.

- Up to 8 hours of work a day when school is scheduled the following day (no work during school hours).

- Up to 6 consecutive days of work weekly.

- Up to 30 hours of work weekly.

For minors aged 16, 17 when public or private schools are NOT in session:

- Minors may work until their shift is completed during non-school weeks, when a school day doesn't follow, or during summer vacation.

- Up to 6 consecutive days of work weekly.

- No hour restrictions during this time.

Exemptions from time restrictions for Florida minors

The following are situations when minors are exempt from the said hour limitations:

- If they are enrolled in a school-to-work experience program, career education, and similar.

- If they've received a partial waiver by the public school or the Child Labor Program.

- If they've been married.

- If they graduated from an accredited high school or hold a high school equivalency diploma.

- If they've served in the military.

- If they've been authorized by a court order.

Breaks for Florida minors

All minors who work more than four hours continuously are entitled to a 30-minute meal break whether the school is in session or not.

Prohibited occupations for Florida minors

Together with the Fair Labor Standards Act (FLSA), the Florida Child Labor Law, and the Florida Rule, certain professions qualify as harmful to the health and safety of minors under 18 years of age.

The hazardous occupations are grouped into two categories:

- Occupations prohibited for all minors such as building construction, working around toxic substances, operating different power-driven machines, etc.

- Occupations prohibited for minors aged 14 and 15 such as heavy work in the building trades, working in freezers or meat coolers, working in connection with snake pits, etc.

Note: Minors who live on farms and whose parents or guardians manage a ranch or a farm with livestock are exempt from the hazardous occupations regulations, provided that they don't work during school hours.

Working near alcoholic beverages

Florida Child Labor Law prohibits minors aged 18 or younger from working in establishments where alcoholic beverages are sold and served on-premises.

However, these regulations don't apply to:

- Minors who work in drugstores, grocery stores, and similar, where alcoholic beverages are sold but not consumed on-premises.

- Professional entertainers 17 years of age who are not in school.

- Minors who have been granted a waiver.

- Minors 17 years of age or over with written permission from the principal employed by a bona fide foodservice establishment.

- Minors 18 years of age and under employed as bellhops, elevator operators, and similar.

- Minors under the age of 18 employed in bowling alleys provided that they don't serve, prepare, or sell such beverages.

- Minors under the age of 18 employed by a bona fide dinner theater provided that they work as actors, actresses, or musicians only.

Record keeping and posting requirements

Each establishment that employs minors must keep or display Florida Child Labor Law Posters in a conspicuous place on the property notifying them of the Child Labor Law, including:

- Weekly and daily hour restrictions when school is in session and out of session.

- Prohibited occupations for minors.

- Fines for employers who don't comply with the law.

- Required breaks for all minors.

Furthermore, employers must keep waiver authorizations, proof of age documentation (copy of driver's license, birth certificate, passport, or visa), and proof of exemption from minor status during the minor's employment or until the minor turns 19.

Florida Waivers of the Law

The Florida Child Labor Law allows minors who live in difficult life circumstances to be exempt from certain regulations to be able to work. They may apply for waivers and receive a working license from the Child Labor Office. However, this doesn't apply to minors working in the entertainment industry.

Each waivers application is carefully examined and granted on a case-by-case basis.

The Florida Department of Business & Professional RegulationPenalties for employers

All employers must:

- Comply with child labor laws,

- Make sure children work in a safe environment, and

- Make sure the children are properly supervised.

If there is a violation of any of the provisions of the child labor law, an employer, not the insurance carrier, must compensate the injured employee. However, the total compensation can't exceed double the amount payable under this statute.

Florida hiring laws

Florida protects job applicants from potential conspiracies to provide equal chances throughout the onboarding process — but also carefully selects future employees.

Consequently, it's considered a misdemeanor of the first degree if two or more persons conspire against a job applicant to obtain employment in any firm or corporation. The penalty for such conspiracy is a fine of up to $1,000 or even imprisonment up to one year.

Background screening in Florida

To increase the odds of hiring a competent applicant, employers may request background checks. This is also known as a background screening.

Background screenings in Florida can be:

- Level 1 screening — This level of background screening requires checking certain applicants such as law enforcement officers, people who work with children, the elderly, and similar. Said applicants may undergo employment history checks, statewide criminal correspondence checks through the Department of Law Enforcement, a check of the Dru Sjodin National Sex Offender Public Website, or local criminal records checks.

- Level 2 screening — The applicants that usually undergo level 2 screening are persons who provide care to children, the developmentally disabled, or vulnerable adults (adults with mental, physical, or functional disabilities), persons who work on helplines, or those who have access to abuse records. Level 2 screening includes employment history checks, fingerprinting, national criminal history records checks, or local criminal records checks.

If an employer who conducted the screening finds out that an applicant has committed prohibited offenses — he or she is allowed by law to reject a candidate.

Employment practices

The state of Florida protects employees and job applicants from any type of discrimination at work or during the onboarding process. For that reason, it is considered unlawful to refuse to hire, limit, segregate, or classify someone because of their age, sex, race, national origin, pregnancy, handicap, or marital status.

However, under the same statute, Florida allows “giving preferences” while employing applicants who are members of certain religious associations or educational institutions to perform work connected with said institutions.

Moreover, an employer does not have the right to require an applicant to take an HIV-related test while hiring unless the job in question carries the risk of transmitting the infection while performing work-related activities.

Likewise, if the results of the HIV-related tests turn out to be affirmative — an employer must not discriminate against such applicants while hiring (unless that job carries a significant risk of transmitting the infection).

Florida employers have no legal duties to test their employees or job applicants for drugs or alcohol.

However, an employer may conduct drug testing to make sure the work environment is drug and alcohol-free. The employer must notify the job applicant via written form 60 days prior to the testing. If a candidate refuses to undergo testing, or if he or she turns out to be positive, an employer may reject that candidate.

Right to work law in Florida

A “right-to-work” state is a state where employees have the freedom to make their own decisions whether or not to join a labor union. No one can require an employee to join a labor union to get or keep a job. Florida adopted a right-to-work statute in 1943.

Any labor organization, labor union, employer, corporation, or association in Florida is not allowed to:

- Deny employees the right to form, join, or assist labor unions and organizations or to refrain from such activity.

- Deny employment or discriminate against an employee on the basis of membership or nonmembership in any labor union or organization.

- Forbid public employees to form, join, or participate in any employee organization of their choice, or to refrain from such activities.

- Discriminate against a public employee because of the employee membership or nonmembership in any labor union or organization.

However, unlike some other states, public employees shall not have the right to strike in the state of Florida.

If any person or labor organization violates any of the provisions stated above — a conviction of second-degree misdemeanor will be obtained.

Florida termination laws

Florida is another “at-will” employment state — which means that an employee or employer can terminate the employment relationship at any time without providing any specific reason.

However, no employer can discharge an employee based on the employee's age, gender, race, national origin, disability, or marital status. This is referred to as wrongful termination and an employee can file a lawsuit against the employer in such a case.

Florida final paycheck

There is no state regulation concerning the timing of the final paycheck in Florida. Therefore, the Department of Labor suggests that employers are not required to give former employees their final check immediately after the termination of their employment but on the next scheduled payroll day.

Employees who haven't been paid on the next scheduled payday for the last pay period can contact the Department of Labor's Wage and Hour Division or the Florida Department of Economic Opportunity (DEO) for further information and assistance.

Health insurance continuation in Florida (COBRA)

Are employers obligated to provide health insurance after the employment termination?

Full-time employees (or their beneficiaries) who have terminated their employment due to job loss (voluntary or involuntary), death, divorce, and similar “qualifying events”, are entitled to continue using their health benefits under federal law from 18 to 36 months after. This act is also known as the Consolidated Omnibus Budget Reconciliation Act (COBRA) and it only applies to businesses with more than 20 employees.

Luckily, Florida Health Insurance Coverage Continuation Act protects employees who work in companies with fewer than 20 employees and this is also known as the “mini-COBRA” law. Said employees are required to notify their insurer within 30 days and they can extend their health insurance for another 18 months after the termination of employment.

Terminal payment for accumulated sick leave in Florida

When it comes to terminal payment for accumulated sick leave, the regulations are more inclined towards state employees. That being said, all state employees are entitled to terminal incentive pay for accumulated sick leave upon normal or regular retirement.

In the event of death or disability, but only after 10 years of state employment, the employee or employee's beneficiary is also entitled to terminal incentive pay for accumulated sick leave upon termination. The rate of the terminal pay must be equal to the rate of pay received by the employee at the time of retirement, termination, or death.

The statute permits terminal payout for sick leave equal to one-eights of all unused sick leave credit accumulated prior to October 1st, 1973, plus one-fourth of all unused sick leave accumulated after October 1st, 1973. However, sick leave cannot exceed a maximum of 480 hours.

This statute does not apply to employees who have been found guilty in a court or have been involved in any embezzlement, theft, and similar.

Occupational safety in Florida

Florida is another state where private sector employers and workers are under federal Occupational Safety and Health Administration (OSHA) jurisdiction. That being said, each private-sector employer must provide the employees with a hazard-free work environment.

According to OSHA, the hazards are grouped as follows:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Things that cause stress.

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

The authorities are allowed to enter premises during working hours to make sure all the regulations are followed as stated in the act. Also, if an employee notices any violation of safety in the workplace, he or she may send a written notice to inform the authorities.

Under OSHA, any employer who fails to provide the employees with a safe work environment as stated in this act can receive a penalty of up to $70,000 but not less than $5,000 for each violation.

OSHA penalties for employersIn addition, Florida has profound state-level guidelines regarding occupational safety for employees.

With the intent to improve the health and safety of Florida's workforce, the Florida Department of Health offers different educational programs and research that include:

- Surveillance of work-related injuries and illnesses.

- Educating the workers, employers, and health care providers about the risks.

- Compensations for injured employers, employees, and insurers through Florida's Workers' Compensation division.

- Training and research related to occupational health and safety through the Sunshine Education & Research Center.

Miscellaneous Florida labor laws

Certain labor laws don't belong to any specific group above, so we've decided to place them in the miscellaneous section.

The most significant such laws in Florida include:

- Whistleblower laws

- Record keeping laws

Florida whistleblower laws

Florida's Whistleblower Act prevents any state, regional, local, or municipal government entity or independent contractor from any adverse action taken against an employee who reports unlawful behavior inside an institution.

Adverse actions prohibited by this act include dismissing, disciplining, suspending, or demotion of the employee, reduction in benefits, and similar.

Who is protected under the Whistleblower Act?

The act protects anyone who “blows the whistle”, i.e., discloses information:

- In a written form to their supervisory officials or the Florida Commission on Human Relations, or

- Through the whistle-blower's hotline of the Medicaid Fraud Control Unit of the Department of Legal Affairs.

If an employee suffers from said adverse actions, he or she may file a complaint within 180 days after the said adverse action to conduct a hearing, receive compensation for any lost benefits, attorney's fees, and similar.

Florida recordkeeping laws

Florida has state recordkeeping requirements for employers in addition to federal ones, as well.

Recordkeeping requirements for employers include:

- General information — Employers should keep copies of employees' documents that establish their identity and employment eligibility (I-9 form) for three years from the date of hire or one year after the termination.

- Payroll records — Name, address, rate of pay, date of birth should be retained for three years.

- Wage computation records — Wage rate tables, work and time schedules, records of additions or deductions from the employee's wages should be kept for two years.

- W-4 form — Should be kept for four years.

- Dispute records — In the case of a dispute between the employer and employee, a record of the dispute should be kept for three years.

- Confidential documents — These include documents relating to the Family and Medical Leave Act (FMLA) and should be kept for three years.

- Onboarding records of current and former employees — These include application forms, resumes, tests, and background checks and should be kept for one year.

Conclusion/Disclaimer

We hope this Florida labor law guide has been helpful. We advise you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q1 2022, so any changes in the labor laws that were included later than that may not be included in this Florida labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

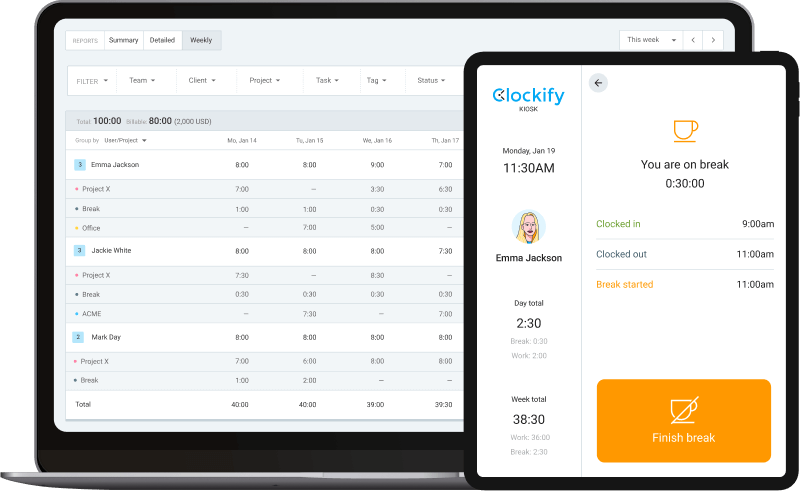

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).