Idaho Labor Laws Guide

The ultimate Idaho labor laws guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Idaho Labor Laws Guide FAQ | |

| Idaho minimum wage | $7.25 |

| Idaho overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| Idaho breaks | Breaks not required by law |

Table of contents

Idaho wage laws

To begin with, we'll take a look into several subcategories of Idaho wage laws, including:

- Idaho minimum wage

- Tipped minimum wage in Idaho

- Minimum wage for minors in Idaho

- Exceptions to minimum wage in Idaho

- Idaho payment laws

| IDAHO MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Training minimum wage |

| $7.25 | $3.35 | $4.25 |

Idaho minimum wage

The state of Idaho uses the same minimum wage rate as the federal minimum wage.

This means that the current Idaho minimum wage is $7.25.

Tipped minimum wage in Idaho

As per federal standards, an employee regularly earning more than $30 in wages is considered a “tipped employee”.

In Idaho, these employees receive a tipped minimum wage of $3.35 per hour.

If this direct wage, combined with the tips the employee receives, does not amount at least to the federal minimum wage — the employer is required to cover the difference.

Subminimum wage in Idaho (Training minimum wage)

In cases where a minor under the age of 20 starts working at a new job, the employer can pay them at the rate of $4.25 per hour.

This is the so-called training minimum wage, and this rate can be applied only during the first 90 calendar days of work.

Exceptions to minimum wage in Idaho

There are exceptions to the minimum wage requirements in Idaho, meaning that some occupations exempt the employee from any minimum wage regulations.

These occupations include:

- Executives

- Professionals

- Administrative staff

- Outside salespersons

- Domestic service providers

Idaho payment laws

When it comes to pay frequency requirements, Idaho employers are required to pay their employees at least once during each calendar month.

The payday should be previously established, and no longer than 15 days after the end of a pay period. In cases when the payday falls on a non-work day, wages can be paid out on the following working day.

Idaho overtime laws

Idaho relies on provisions inside the Fair Labor Standards Act (FLSA) to regulate overtime requirements.

This act states that any employee — unless exempt — having worked in excess of 40 hours in a workweek, is entitled to overtime pay at the rate of 1.5 times their regular wage rate.

The workweek in this case is defined as any 168-hour regularly recurring period, not necessarily coinciding with the calendar week.

Overtime exceptions and exemptions in Idaho

Also referring to federal FLSA regulations, the state of Idaho recognizes certain exceptions and exemptions from overtime requirements.

Here we see that, provided that they earn at least $684 per week, certain categories of workers are not entitled to overtime pay. These include:

- Executives, professionals, administrative staff — including educators and computer workers

- Outside salespersons

- Staff at seasonal amusement and recreation establishments

- Casual babysitters

- Certain commissioned employees (auto, truck, farm equipment and similar)

- Taxi drivers

- Farm workers

Additionally, some categories of workers are subject to partial exemptions, including:

- Employees engaged in certain agricultural operations

- Employees of certain bulk petroleum distributors

- Employees without a high school diploma, who can be required to spend up to 10 hours in a workweek on remedial training (paid at their regular hourly rate)

- Hospital and residential care staff, who can work on a 14 day workweek

Idaho break laws

Idaho law does not require that employers provide breaks or rest periods.

If the contract between the employer and employee does include rest periods or meal breaks as terms of employment — federal regulations apply.

This means that rest periods up to 20 minutes long are to be paid, as they count inside the total hours worked.

Additionally, the meal breaks — longer than 30 minutes — do not need to be paid, unless the employee is not relieved of their work duties for the duration of the break.

Idaho breastfeeding laws

Federal law requires that nursing mothers be provided with breaks to express their breast milk for up to a year after childbirth.

Employers need to provide a private place (which is not a bathroom) where the employee will have reasonable time to express the milk.

These breaks do not have to be paid.

Idaho leave requirements

Each US state has its own regulations around leave requirements — which types of time off employers are or are not required to provide. Upcoming is a list of both kinds of leave requirements in Idaho.

Idaho required leave

We can begin with addressing the types of leaves required in Idaho.

Family and medical leave

In accordance with the Family and Medical Leave Act of 1993, eligible employees are allowed to take extended, unpaid, but job-protected time off.

Employees are considered eligible for this leave once they've worked for a covered employer for at least 12 months, provided that they have amassed at least 1,250 hours during this time.

These employees can take up to 12 weeks (or 480 hours) of unpaid time off in case of:

- Giving birth and caring for a newborn

- A foster child or adopted child being placed in the employee's home

- Caring for a family member with a serious illness

- The employee themself being incapacitated due to a serious ilness

Military leave

As an extension of the family and medical leave, there are also specific provisions for military members and their families.

There are two types of military family medical leaves:

- Standard FML — up to 12 weeks for family members of military personnel in active duty or with notification of impending active duty.

- Service member FML — up to 26 weeks of leave for employees caring for a family member recovering from serious injury incurred during active military duty.

Jury duty leave

According to Idaho law, an employer cannot take any negative action against an employee serving jury duty.

However, the employer is not required to pay for this time off, and may ask the employee to use their accrued time off to attend court.

Idaho non-required leave

On the other hand, here are the types of leave not required by any Idaho law.

Sick leave

Private employers in Idaho are not required to provide sick leave to employees.

Employees working for the State may be eligible for sick leave accrued at the rate of 0.04615 hours per hours worked. You can find more information in this Sick leave policy guide.

Bereavement leave

Unless specifically stated in their mutual contract, Idaho employers do not need to provide bereavement leave.

Vacation and holiday leave

Neither vacation, nor holiday leave are required from employers by Idaho law.

Voting time leave

As of Q1 2022, Idaho has no statutes concerned with voting time leave.

Child labor laws in Idaho

Idaho uses the federal FLSA laws to regulate child labor in this state.

Federal laws make a distinction between two categories of minors — those aged under 16, and those aged 16 and 17.

Let's look at the different work hour restrictions for these categories, as well as prohibited occupations for minors.

Labor laws for minors under the age of 16

Minors aged 14 and 15 can work 3 hours a day, or 18 hours in total during a week when school is in session.

When school is out, minors can work a total of 8 hours a day or 40 hours a week.

In addition, during the school year, minors can work from 7 a.m. to 7 p. m.

These hours can be extended to 9 p.m. from June 1st to Labor Day.

Labor laws for minors aged 16 and 17

FLSA has no restrictions when it comes to work hours for minors aged 16 and 17.

Prohibited occupations for minors

FLSA regulations also include laws concerned with banning minors from working in occupations deemed too hazardous.

These occupations include:

- Handling or being near any type of explosives

- Operating a motor vehicle or working as an outside helper

- Mining or quarrying

- Logging

- Operating power-driven machinery

Hiring laws in Idaho

Relevant to the issue of hiring in Idaho is the Idaho Human Rights Act, which makes it illegal for anyone (including employers) to discriminate on the basis of:

- Race or color

- Sex

- National origin

- Age

- Disability

Furthemore, employers are prohibited from refusing to hire, or in any other way limiting employment opportunities on the grounds of any of the mentioned categories.

Idaho Right-to-work law

In 28 of the US States, including Idaho, there are laws aimed at limiting the reach of union organizations.

These are the so-called “Right-to-Work” laws, and their primary purpose is prohibiting union membership being used as a condition of employment.

Additionally, Idaho laws require that unions get written permission from the employees before charging any representation fees.

Termination laws in Idaho

Idaho is one of the US states that uses the doctrine of “employment-at-will”.

This means the employment relationship can be ended at any time, without particular reason.

Either party may terminate the employment, without prior notice or argumentation.

Final paycheck in Idaho

Once the employment relationship has been terminated, the employer has 10 days time (weekends and holidays excluded) to pay out to the employee their final paycheck.

This process can be sped up if the employee submits a written request, in which case their earnings should be paid out within 48 hours of receiving the request. Weekends and holidays also do not count inside the mentioned 48 hours.

If the employee is not being paid on an hourly or salaried basis, the employer has to pay out their due wages on the next regularly scheduled payday.

COBRA laws

Upon termination, the employee may be eligible for an extended health insurance under the Consolidated Omnibus Budget Reconciliation Act (COBRA).

Major life events that can qualify employees or their dependents to receive the COBRA insurance include:

- Termination or significant reduction of work hours

- Employee death

- Divorce or legal separation

- Loss of dependent child status

Once proven eligible, the employees or their dependents can have their health insurance (which they still have to pay in full) extended by 18 to 36 months.

To get more information, visit the Leave and COBRA Options page published by the Idaho Office of Group Insurance.

Occupational safety in Idaho

Idaho has no federally approved state plan for occupational safety, so it relies on the federal OSH Act.

The agency that makes sure of compliance with it is the Occupational Safety and Health Administration (OSHA).

The OSH Act regulates how hazardous substances are to be handled in the workplace, as well as the standards for training and behaving in dangerous work environments.

If you believe that your employer may be compromising the employee's health or safety, you can file a complaint with the local OSHA outpost in Boise.

Their staff can conduct an on-site safety inspection, if there are valid concerns.

Miscellaneous Idaho labor laws

In this segment, we can review some of the miscellaneous Idaho labor laws that do not fit into the previously mentioned categories.

We will consider the following laws:

- Whistleblower protection laws

- Background check laws

- Laws concerned with employer use of social media

- Drug and alcohol testing laws

- The Davis-Bacon Act

- Record keeping laws

Whistleblower protection laws

The state of Idaho provides protection for public employees acting as whistleblowers and reporting the waste of government resources or violations to the law.

In these cases, the employer is prohibited from retaliating against the employee in any way, or from posing restrictions on their ability to report said violations.

Private employees do not have these benefits in Idaho.

Background check laws

Some types of businesses in Idaho are required to conduct background checks prior to employment.

Occupations where background checks are necessary include:

- School personnel

- Childcare facilities staff

- Employees working in residential homes for the elderly

- Employees working with people with mental or physical disabilities

- Bank employees

- Alcohol permit holders

- Truck drivers

Other than past employment, a background check can include credit information or criminal records.

The employer needs written consent to conduct a background check.

However, medical records are private and employers cannot request access to them.

Employer use of social media regulations

In Idaho, it is legal for employers to check on their employee's use of social media.

Problematic behavior seen on social media can even be considered fair cause for the termination of employment.

Drug and alcohol testing laws

Private employers in Idaho can test their employees for drug and alcohol as a condition of hiring or continuing their employment.

This is true in cases when the testing procedures comply with the Americans With Disabilities Act.

Employers can use the results of drug and alcohol tests conducted by third parties, including law enforcement agencies and hospitals.

A positive result is considered misconduct under state unemployment benefit laws.

Davis-Bacon Act

In Idaho, the wages of contractors working on federal contracts concerned with building, altering, or repairing public buildings are regulated by the Davis-Bacon Act.

This act states that the mentioned contractors (and subcontractors) are to be paid at least the minimum wage — the prevailing wage — as well as any fringe benefits.

These wages are determined by the US Secretary of Labor, and are based on the wages and fringe benefits of employees working on similar projects in the same area.

Record-keeping laws

Idaho law requires that employee records be kept for a minimum of 3 years.

There are no specific requirements for the format or form these records are kept in.

Employee information kept in the records should include:

- Employee's name

- Occupation

- Home address

- Sex

- Date of birth (if under 19)

- Hour and day of the beginning of the workweek

- Total hours worked each workday and workweek

- Total daily or weekly straight time earnings

- Regular hourly pay rate

- Total amount of overtime pay per workweek

- Any wage deductions

- Total wages for each pay period

- Date of wage payment along with pay period covered

Conclusion/Disclaimer

We hope this Idaho labor laws guide has been helpful. We once again remind you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official websites and other relevant information.

Please note that this guide was written in Q1 2022, so any changes in the labor laws that were included later than that may not be included in this Idaho labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

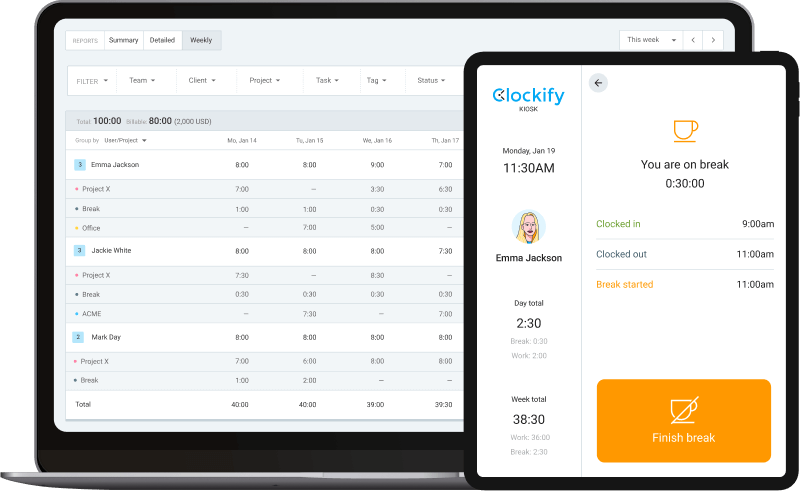

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).