Illinois Labor Laws Guide

Ultimate Illinois labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Illinois Labor Laws FAQ | |

| Illinois minimum wage | $12 |

| Illinois overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($18 for minimum wage workers) |

| Illinois breaks | Meal break for employees working at least 7.5 hours per shift (at least a 20-minute break, after 5 hours of work) |

Table of contents

Illinois wage laws

The very first segment we ought to cover is the minimum wage requirement per hour worked.

The minimum wage differs for non-tipped and tipped employees, as well as for minors who are employed.

Regulations in Illinois state that any number of hours up to 40 per week must be compensated to employees at a rate of minimum wage, at least.

On a federal level, wages are regulated by the Fair Labor Standards Act (FLSA) — but each state has the right for the minimum wage to be higher than the federal minimum wage of $7.25, which is the case for Illinois.

| ILLINOIS MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $12 | $7.20 | $9.25 |

Illinois minimum wage

In the state of Illinois, the minimum wage requirement is $12 per one hour worked.

The increase to the minimum wage in Illinois is already announced for the next few years and will go into effect as follows:

- January 1, 2023 — $13

- January 1, 2024 — $14

- January 1, 2025 — $15

It is illegal for employers to offer a lower hourly rate than the minimum wage to non-exempt employees.

Read the following segments to make sure you're fully aware of which situations and positions are exempt from the minimum wage rule.

Tipped minimum wage in Illinois

Certain professions, especially the ones in the hospitality industry, are commonly and closely tied with tips. The very term refers to sums of money that customers freely provide to tipped employees, as a recognition for their service and attitude.

Only employees who regularly receive such forms of gratuities (cash) count as tipped employees — e.g. servers, bartenders, waiters, delivery people, etc.

Tipped employees' minimum wage in Illinois is currently set to $7.20.

But, there is something else that tipped employees must be aware of — if the total of the wage base ($7.20) and the tips doesn't amount to the amount of regular minimum wage in Illinois ($12,) the employers are required to make up the difference.

The increase to the tipped minimum wage in Illinois is also announced and will go into effect as follows:

- January 1, 2023 — $7.80

- January 1, 2024 — $8.40

- January 1, 2025 — $9

Exceptions to the minimum wage in Illinois

Just as tipped employees are exempt from the minimum wage requirement, there are other instances of exempt positions. Let's see what else is not regulated by the rule of law, so employers can offer lower than standard hourly minimum wage.

Here's a full list of instances when that is allowed:

- White Collar employees (bona fide executives, administrative workers, and professionals)

- Employers with less than 4 employees (not including the employer's parents, children, spouse, or other members of the immediate family who serve as employees)

- Agriculture and aquaculture employees

- Student learners

- Student employees

- Learners

- Apprentices

- Trainees of any kind

- Employees with disabilities

- Minors (if working less than 650 hours per calendar year)

Subminimum wage in Illinois

The minimum wage for the employed minors is also called the subminimum wage. The term “minors” refers to the youth under the age of 18. The rule of law regulates employed minors, in order to avoid the possibility of child labor exploitation.

The subminimum wage is currently set at $9.25.

The increase to the subminimum wage in Illinois is announced and will go into effect as follows:

- January 1, 2023 — $10.50

- January 1, 2024 — $12

- January 1, 2025 — $13

This rate of compensation is applicable only if an employee (who is a minor) works less than 650 hours per calendar year.

This regulation was added as of January 2020, stating that if a minor employee's number of hours worked exceeds 650 hours per year, their employers must compensate them at a regular minimum hourly rate, or $12.

Illinois payment laws

Now, let's see what are the requirements for Illinois employers in relation to employee wages.

The first thing to mention is that all employers must establish at least semi-monthly pay periods. In other words, they must offer compensation for their employees no later than 13 days after the end day in a certain pay period.

Employers are also required to provide an itemized statement of deductions for each pay period.

The regulations also state that there are some exceptions to the rule, when employers can provide compensation on a monthly basis.

Here is the list of exempt positions:

- Executive personnel

- Administrative personnel

- Professional employees

- Employees receiving commissions

Now, if you are an employee, you may be wondering: “What should I do if my employer hasn't properly compensated me?”

Well, all employees must be regularly and fairly compensated for their work. If you are an employee who believes this wasn't the case for you, you should submit a formal complaint. This is regulated by the Illinois Workers' Compensation Commission — if you don't want to wait in line in their institution, you can also file a complaint online.

Illinois overtime laws

According to both federal and state law, any number of hours exceeding 40 per week counts as overtime. Why 40? Well, 40 hours per week is a regular requirement for full-time employees, e.g. working Monday to Friday, from 9 to 5.

For example, non-exempt minimum wage employees who do exceed that number are entitled to 1.5 times the regular rate of $12. That's currently $18 per hour.

But, even though employees can work overtime hours, there's another specific regulation stating employees must have at least 24 hours of rest during each calendar week.

As was the case with the minimum wage requirement, some exceptions exist, when employers aren't required to offer compensation at a 1.5 rate.

The following section will deal with exceptions from overtime, so employees can check out if they are eligible for overtime compensation in Illinois.

Overtime trackerOvertime exceptions and exemptions in Illinois

Following the federal requirements on the overtime exemptions, 4 main categories of employees are not protected by the law, as they fit into the larger category of White Collar occupations. We've mentioned them as exceptions to the minimum wage rule as well.

When it comes to overtime, provided they earn at least $684 per week, White Collar employees do not have to be paid at a 1.5 rate for working over 40 hours.

White Collar employees are the ones working in any of the following categories:

- Administration — every type of non-manual work related to business operations, management policies, or administrative training, such as accountants, HR team members, market research analysts, etc.

- Executives — business, general, and executive managers directly managing at least 2 employees.

- Professionals — if the position in question implies advanced knowledge and extensive education (e.g. software analysts and engineers).

- Outside sales — if the position of making sales or taking orders happens outside of the employer's main workplace — i.e. outside sales representatives who visit potential and existing customers at their premises.

Besides the federal government exemptions, the state enforces overtime restrictions on some other, more specific occupations.

Here's the full list:

- Employers with less than 4 employees (not including the employer's parents, children, spouse, or other members of the immediate family)

- Agriculture and aquaculture employees

- Student learners

- Student employees

- Learners

- Apprentices

- Trainees of any kind

- Employees with disabilities

- Minors (if working less than 650 hours per calendar year)

- Salesmen and mechanics who sell or service vehicles (automobiles, trucks, farm implements, trailers, boats, aircraft), provided they work in non-manufacturing establishments

- Commissioned employees

- Employees of non-profit educational and residential child care centers

- Crew members of uninspected towing vessels

- Members of bargaining units, provided that said unit is recognized by the Illinois Labor Relations Board

Illinois break laws

Employers in the state of Illinois are legally required to provide a meal break of at least 20 minutes to their employees whose shift is at least 7.5 hours.

This break must be provided when an employee is no later than 5 hours into the workday.

When the number of hours doubles, so does the number of breaks — i.e. if your shift lasts 15 hours, you're entitled to 2 meal breaks.

The length of the shift is different for minors — instead of 7.5 hours, they are entitled to meal breaks for each 5-hour shift.

Illinois breastfeeding laws

This law is applicable to all working mothers who gave birth recently and are still breastfeeding. It is observed on a federal level, and employers whose businesses are based in Illinois are required to provide adequate conditions for such employees.

This type of break can be either paid or unpaid, as predetermined by the company regulations and policy.

By “adequate conditions”, the law refers to employers providing a private room or location with a door that can't be a bathroom stall.

Employers' obligation is to provide such a location in the nearest possible proximity to the working environment.

Illinois leave requirements

Now, let's take a look into what happens if an employee asks for a leave of absence from work in the state of Illinois.

The law regulates which types of leave Illinois employers are required to offer and provide, without regulating whether these types of leave are to be paid or unpaid.

The main factor is the reason for the leave request — why is an employee asking for a leave of absence?

The law also clearly states that employees shouldn't suffer any negative consequences upon their return to work after taking a type of leave marked as required.

In line with that, let's first observe the required types of leave in the state of Illinois, before moving on to the non-required types of leave.

Illinois required leave

There are several situations when an employee is entitled to take a leave of absence, without being treated differently in any way upon their return to work.

What the state law doesn't regulate is the compensation during the leave period. Employers can choose whether the leave will be paid or unpaid.

So, here's the full list of leave requirements that employers must allow:

- Medical and family leave

- Blood donation leave

- Bereavement leave

- School leave

- Jury duty leave

- Voting time leave

- Military leave

- Family military leave

- Emergency response leave

- Witness leave

- Crime victim leave

- Domestic violence or sexual assault leave

Medical and family leave

Medical and family leave is a type of a required leave that all employers in the state of Illinois have to offer. When it comes to the terms and conditions, there are several.

The first condition determines which employees are eligible for this type of leave. An employee must have worked for a company for at least 12 months and 1,250 hours to request medical and family leave. Moreover, this type of leave is applicable only to companies with at least 50 employees.

The second condition determines how long employees can be absent for this reason — up to 12 weeks per every 12-month period.

When it comes to reasons for determining eligibility, here's a full list explaining when employees can request this type of leave:

- Bonding with a new child

- Recuperating from a serious health condition

- Caring for a family member in a serious health condition

- Handling exigencies arising from a family member's military service

- Caring for a family member who suffered a serious injury during active duty in the military

Blood donation leave

Employers in Illinois are required to offer up to an hour of leave every 56 days to all employees who want to donate blood.

In order to be eligible for this type of required leave, an employee must have worked for the employer for at least half a year.

The law applies only to employers with more than 50 employees.

Bereavement leave

According to the law, in the state of Illinois, employers are required to offer bereavement leave to all of their employees who have lost a child.

Employees are entitled to up to 2 weeks of unpaid leave to take care of the necessary arrangements regarding the funeral, or simply to grieve.

The law applies only to employers with more than 50 employees.

School leave

All employees who are parents are entitled to another type of required leave in Illinois. It concerns the attendance of any school-related activities if they can't be scheduled outside of working hours.

The leave can last up to 8 hours.

The law applies only to employers with more than 50 employees.

Jury duty leave

If an employee in the state of Illinois is summoned to perform jury duty, employers must allow them to be absent from work during that time.

Moreover, the law states employers can't terminate an employee for the acceptance of jury duty.

If an employee participates in jury duty during the day and is scheduled to work the night shift, they mustn't be required to come to work.

Voting time leave

Employers must offer 2 hours of voting time leave to all their employees whose shift:

- Starts less than 2 hours before the polls open

- Ends less than 2 hours before the polls close

Employees who are eligible to take this type of leave must give notice in advance.

Military leave

This type of leave is regulated on a federal level, by the Uniformed Services Employment and Reemployment Act. The act states that all employees in the US must be granted a leave of absence in order to serve or train in:

- The US Armed Forces,

- The National Guard, or

- The state militia.

Upon the employee's return to work, they must be entitled to the same pay increases and other benefits as if they were present at work the whole time.

In case the employee sustains a serious injury preventing them from performing their previous duties, they must be offered another position that they are qualified for.

Family military leave

Employees whose spouse, parent, child, or grandchild is called to military service lasting longer than 30 days are eligible for this type of leave.

Family military leave is unpaid and applies only to employers with at least 15 employees. It can last up to 15 days.

For employers with over 50 employees, that period is extended to up to 30 days.

Emergency response leave

The state of Illinois protects all employees who want to take time off to respond to an emergency.

Volunteer emergency workers mustn't be punished or disciplined in any way.

Witness leave

The law requires employers to provide either paid or unpaid leave for all their employees who are summoned to be a witness in any court.

Crime victim leave

For employees who are victims of a crime, employers are required to offer paid or unpaid leave for participating in, preparing for, and attending proceedings related to the crime.

The same is applicable if their family or household member is a victim.

Domestic violence or sexual assault leave

Employees who are victims of domestic or sexual violence must be provided this type of leave in order to address various issues related to it, such as — seeking medical treatment, relocating, seeking legal advice, etc.

The length of leave is determined by the size of a company and is categorized as follows:

- Employers with up to 14 employees — up to 4 weeks in a 12-month period

- Employers with 15–49 employees — up to 8 weeks in a 12-month period

- Employers with more than 50 employees — up to 12 weeks in a 12-month period

Illinois non-required leave

In the state of Illinois, there are 3 categories of leave that employers are not required to offer to their employees.

Said categories are:

- Sick leave

- Vacation leave

- Holiday leave

It is important to mention that the law also doesn't prohibit or restrict these types of leave.

If an employer chooses to offer any or all, the exact terms need to be stated in the signed contract of employment.

Sick leave

In the state of Illinois, employers are not required to offer any paid or unpaid sick days.

Vacation leave

The same applies to vacation leave — employers are not required to offer it.

Employers who choose to offer this type of leave can include certain benefits — but all the details of the agreement between the two parties must be stated in the signed contract.

If the employer offers vacation leave, they are allowed to implement a “use it or lose it” policy — a rule where an employee can use their vacation days only if they use them by a certain date.

Holiday leave

In the state of Illinois, employers are not required to offer any paid or unpaid holiday leave.

Child labor laws in Illinois

Child labor laws are applicable for the employment of people aged under 18. We will use the term “minors'' to refer to this age category of employees in the state of Illinois.

The main purpose of both federal and Illinois child labor laws is to prevent the exploitation of minors. Additionally, these laws help students put education as a priority, while highlighting that student employment only enhances their academic and life experience.

In order to be legally employed, all minors must obtain a Work Permit, also known as an Employment Certificate. In general, this document is issued by the school that the minors attend.

Employers are not required but are allowed to also ask for the acquisition of an age certification process. Age certification can be requested not only for minors but rather all youth under 20 years of age.

Some of the most relevant limitations regarding the employment of minors can be seen in the following categories:

- Maximum number of work hours

- Nightwork

- Restrictions on specific industries

While different rules and regulations are applicable to different age groups of minors, there is still one thing applicable to all age groups — they are forbidden to work in hazardous positions.

Next, let's take a look at some rules stated in the state of Illinois Child Labor Laws.

Specific labor laws for minors

The state of Illinois enforces specific rules for different age groups. Let's mention some restrictions on the maximum hours of work and night work for minors' employment.

For the employment of minors, the following rules apply.

The maximum number of work hours is only regulated for minors under 16 and is 8 hours per day, 48 hours per week, when school is not in session. When school is in session, it's 3 hours per day and up to 24 hours per week.

Night work restrictions go as follows:

- Under 16 years of age, minors are prohibited from working between 7 p.m. and 7 a.m. (unless they are employed in recreational or educational activities by a park district)

- For ages 16 and 17, there are no night work restrictions

There are also some restrictions on child labor in specific industries.

To provide an example, minors under the age of 16 are prohibited from working with any and all power-driven machinery. Let's see what else is prohibited for minors in the state of Illinois.

Prohibited occupations for minors

We've previously mentioned that minors are prohibited from working in hazardous positions — now let's see what is considered hazardous in the state of Illinois.

Here's the list of examples, including some that are considered so on a federal level but the state level as well:

- Working in oil refineries, gasoline blending plants, or pumping stations on oil transmission lines

- Working in occupations involving exposure to radioactive substances

- Working in construction, including demolition and reconstruction

- Working in or about mine or a quarry

- Working in or about any plant manufacturing explosives

- Working in or about sawmills or laths

- Working in any establishment serving intoxicating alcoholic beverages

- Working with weapons

- Working in any occupations involving the handling or storage of blood, blood products, body fluids or body tissue

Hiring laws in Illinois

When it comes to the hiring process in the state of Illinois, employers are prohibited from making selection decisions based on certain factors.

Under the Illinois Human Rights Act, employers aren't allowed to take adverse employment action against their applicants and potential employees based on reasons such as gender, age, or race.

Other relevant factors that employers aren't allowed to take into account during the selection and hiring process include the following:

- Race

- Ancestry

- Religion

- National origin

- Marital status

- Citizenship status

- Sexual orientation

- Gender-related identity

- Pregnancy

- Military status

- Physical/mental disability

Termination laws in Illinois

Starting from January 1st, 2022, Illinois is no longer following the “employment-at-will” regulation, which enables employers and employees to terminate their contracts without any given cause.

Currently, the “Just Cause” regulation is implemented.

Employers are now allowed to terminate someone's employment for a just cause and are required to provide mandatory severance pay upon termination.

What counts as a just cause? The termination under the following circumstances:

- The employee in question failed to satisfactorily complete their duties and perform their job,

- The employee in question conducted egregious misconduct, and

- The employer had a “bona fide economic reason” which can't be staff redundancy as a result of a merger or an acquisition.

Final paycheck in Illinois

Employers in the state of Illinois are legally required to provide a final paycheck to everyone whose employment was terminated. The paycheck must include all the wages and benefits.

A final paycheck is due at the time of separation, if possible. In case this isn't possible, in no event should an employee receive the final paycheck later than the next regularly scheduled payday.

Discrimination laws in Illinois

Discrimination in the workplace is not only unethical but also illegal in the state of Illinois. The anti-discrimination law is currently applicable to all employers who employ 1 or more employees.

Here's the list of reasons employers are not allowed to take into account while managing their current employees in the workplace, nor decide to terminate their employment for the following:

- Race

- Color

- Ancestry

- Religion

- Gender

- National origin

- Age

- Marital status

- Citizenship status

- Sexual orientation

- Gender-related identity

- Pregnancy

- Military status

- Physical/mental disability

It's important to mention that the prohibited actions aren't limited to termination only but rather include the following actions as well:

- Unequal pay

- Demotions

- Failure to promote

- Unequal benefits

- Workplace harassment

- Retaliation

- Pay cuts

- Unequal terms and conditions of employment

Occupational safety in Illinois

A safe and healthy working environment is a must — and both the federal and the Illinois state law require employers to provide optimal conditions.

On a federal level, this is regulated by the Occupational Safety and Health Act (OSHA), passed by Congress in 1970.

OSHA states that employers are required to continually inspect for flaws and irregularities in the safety conditions, as well as continually work on improving them.

Every employer's obligation is to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

So, what are employers required to provide to ensure adequate workplace health and safety conditions?

For starters, proper training and education for all their employees immediately upon their employment.

Then, to comply with all the regulations, employers must conduct educational and advisory activities to assure safe and healthy working conditions.

There is another thing employers are required to do — create optimal working conditions.

The premises must be free from any recognized hazards that may cause harm. Employers should regularly undertake safety demonstrations concerning health matters.

Inspections can happen with or without probable cause.

They may be a result of regular scheduling. But they may also happen due to reports of imminent danger, worker complaints, referrals, or the worst-case scenario — fatalities.

Miscellaneous Illinois labor laws

Now that we've covered the most important labor laws that apply to Illinois employees, let's see what else is enforced. Read on, as some of the following may apply to your situation.

Here's what else is regulated by the rule of law in the state of Illinois:

- Whistleblower protection laws

- Background check laws

- Credit and investigative check laws

- Arrest and conviction check laws

- Non-compete agreement laws

- Drug and alcohol testing laws

- Sexual harassment training laws

- COBRA laws

- Pregnancy accommodation laws

- Social media laws

- Telephone monitoring laws

- Collecting biometric data laws

- Record-keeping laws

Whistleblower protection laws

The main purpose of this set of laws is to ensure that employees can exercise all of their legal rights without negative repercussions as a result.

The term “whistleblower” refers to employees who have inside knowledge of illegal practices or a safety hazard in the workplace. They must be able to report it and continue being employed.

Some of the reasons why employees can't be discriminated against, or treated in any way differently after are:

- Exercising their First Amendment rights

- Reporting an alleged violation of law

- Opposing or complaining about discrimination in the workplace

- Exercising their OSHA (Occupational Safety and Health Act) rights

- Opposing or participating in an investigation of discrimination

Background check laws

Background checks are allowed by all employers (but not required) and are subject to the Federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau.

Only certain positions do require background checks in the state of Illinois, so let's see which ones.

- Healthcare personnel

- Park district personnel

- Armed security guards

- Private detectives

- Private security contractors

- Private alarm contractors

- Locksmiths

- Firefighters

- Peace officers

- School bus drivers

- Public and state-recognized private school personnel

- Mental health facilities personnel

- Anyone providing intervention services to children

- Youth care facility personnel

- Carnival personnel

Credit and investigative check laws

In the state of Illinois, employers are not allowed to use or ask for a credit check on their employees or applicants, unless they are exempt from the law.

Here's the list of employers who are exempt from the law and thus allowed to ask for credit and investigative checks:

- Working in a financial institution

- Working in an insurance business

- Working in law enforcement

- Working as a debt collector

Arrest and conviction check laws

When it comes to the arrest and conviction checks, employers (with at least 15 employees) are forbidden from inquiring about criminal records during the interview.

If an official job offer has been made, employers may ask potential employees to disclose that information.

Non-compete agreements laws

This is the law forbidding employers from requesting a non-compete clause in an employment contract, provided that the employee earns up to $75,000 per year.

The law indicates the workplace policy for those employees can't restrict them from having another job, providing services to other employers, or operating their own business.

Drug and alcohol testing laws

Since marijuana is legal in the state of Illinois, employers must accommodate off-duty usage for their employees — but only for medical reasons. So, if an employee is a qualified medical marijuana user, employers are not allowed to discipline them in any way for that reason.

As for recreational use permissions, they will depend on a specific company policy, as employers are allowed to prohibit such usage.

Any drug and alcohol tests can be requested by employers who have reasonable suspicion that the usage is affecting the quality of job performance.

Sexual harassment training laws

Employers whose business is located in the state of Illinois are required to provide training on sexual harassment prevention to all of their employees.

There are no exceptions to this rule and training must be provided within the first 90 days of employment.

COBRA laws

COBRA is a law that operates on a federal level, so let's start this section by explaining what the acronym means. The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees to retain health care insurance and benefits after the termination of employment.

Federal regulations also state the law can be applied to employers with over 20 employees.

In the state of Illinois, their mini-COBRA ensures 12 months of continuation coverage.

The only exception to this rule is if the termination happened due to gross negligence or misconduct of an employee.

Pregnancy accommodation laws

Employers must provide adequate and reasonable conditions for their pregnant employees. This regulation refers to:

- Assistance with manual labor

- Modifications to work schedule

- Frequent bathroom breaks

Social media laws

Illinois employers are prohibited from asking their employees or applicants to disclose information about their personal social media accounts.

Regulations also state that it's illegal for an employer to ask their employees to access their personal accounts in their presence, as well as to compel them to add certain contacts associated with their business.

Telephone monitoring laws

Phone calls between employers and employees can be monitored under one condition — all present parties must be aware of the fact.

The company policy can clearly state that phone calls between employees can also be monitored and recorded, provided that:

- Calls were made on company-provided devices

- Employees are aware of the fact and have given their consent

If an employer violates this law, they will suffer both criminal and civil penalties.

Collecting biometric data laws

The state of Illinois legislature passed the Biometric Information Privacy Act or BIPA back in 2008.

This act ensures that employees are in control of their biometric information and prohibits companies from collecting such information.

If any kind of biometric information is needed for work purposes, such as a fingerprint ID for logging into a company-related app, employers must have written consent.

Biometric data includes the following information:

- Fingerprints

- DNA

- Hand scans

- Retina or iris scans

- Voiceprints

- Facial geometry

Record-keeping laws

Employers whose businesses operate in the state of Illinois follow the FLSA rules and are therefore required to keep the records of all their employees for at least 3 years.

So, what types and categories of information should such records consist of?

Here's the full list:

- Full name

- Social security number

- Occupation of the employee

- Date of birth

- Home address

- Gender

- Regular hourly rate of pay

- Basis on which wages are paid

- Total daily or weekly net wages and deductions

- Total gross daily or weekly wages

- Date of each payment

Conclusion/Disclaimer

We hope this Illinois labor law guide has been helpful. We once again remind you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official websites and other relevant information.

Please note that this guide was written in Q1 2022, so any changes in the labor laws that were included later than that may not be included in this Illinois labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

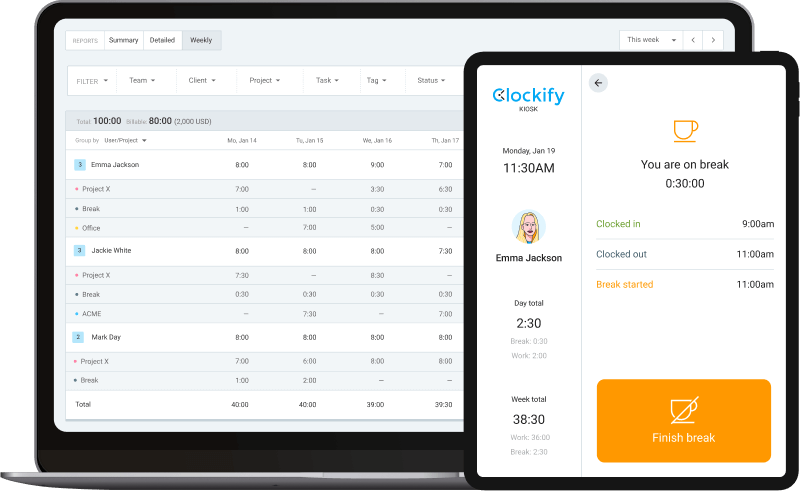

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).