Is overtime taxed more? Here’s what you need to know

Last updated on: January 19, 2023

When you decide you want to work some additional hours, a few thoughts may pop into your head:

Is overtime taxed more?

And, essentially:

Is working overtime actually worth it in the end?

Many people believe that if they work more hours and earn more money, they will have to pay more taxes. Although this seems like a logical sequence of events, it is not always so. In other words — it doesn’t necessarily mean you’ll end up making less money because of taxes that you’ll have to pay when working overtime.

However, if you don’t want to be unpleasantly surprised when you see that the increase in your paycheck isn’t as high as you expected, stick around and keep on reading.

We’ll include everything you need to know about overtime taxation — that is, we’ll answer some questions on this subject, use examples, and hopefully, clear up the confusion.

In this blog post, we’ll cover the following topics:

- Regular pay vs. overtime pay,

- Whether overtime is taxed more than regular pay,

- How is overtime taxed,

- How is overtime tax calculated,

- Why is overtime taxed more (if it actually is), and

- Frequently asked questions about overtime and taxation.

So, let’s begin.

Table of Contents

Regular pay vs. overtime pay

First, we have to highlight that there are two types of pay:

- Regular pay, and

- Overtime pay.

Both are subject to taxes.

Regular pay refers to the regular rate of pay that the employer compensates employees for working a standard workweek, that is, for working 40 hours a week. Regular pay doesn’t include overtime pay, any benefits, payments for leave, reimbursement for business expenses, bonuses, or similar.

The regular rate of pay is calculated this way:

The total money that is owed to the employee by the employer (except for statutory exclusions) / the total number of hours the employee worked in the workweek = the regular rate of pay for the workweek

Like regular pay, overtime pay is considered a type of income, so it’s taxable.

Overtime pay is a compensation that a non-exempt employee gets for working more than 40 hours per week. As regulated by the Fair Labor Standards Act (FLSA), a non-exempt employee is an employee who’s entitled to receive at least the minimum wage and overtime pay at a rate of one and a half (1.5) times their regular pay rate.

💡 Clockify Pro Tip

Even though working overtime has financial benefits, try to limit working long hours because it can affect your productivity and mental health, in the long run. Check out the following blog post to find out more on this topic:

Is overtime taxed more than regular pay?

Simply put — no.

But we can’t just leave it at that, can we?

As an employee, you have your regular pay, and you pay your taxes according to your taxable income and your tax bracket. A tax bracket refers to a range of incomes that are taxed at different tax rates and which are largely based on your filing status.

In certain circumstances, the tax bracket you belong to can change. For example, if you work overtime (in addition to your regular hours) and increase your gross income in a certain pay period — you may be moved to a higher marginal tax bracket but only for that pay period.

The marginal tax rate is the extra tax you pay on every extra dollar you earn as part of your income. The marginal tax rate is also the main reason why some of your hard-earned money seems to have slipped through your fingers in that pay period.

However, the taxes you owe are based on your annual earnings. So, if you earn more money by working overtime during a certain pay period, you may be moved to a higher wage bracket, for sure, but only for that specific period of time.

To give you a clear picture of how overtime is taxed in general, we’ll explain it in the following paragraph.

How is overtime taxed?

Determining how overtime is taxed isn’t that different from determining how regular income is taxed.

First, you must identify your tax bracket. These federal tax brackets are separated based on the marginal tax rates — tax on every extra dollar you earn, as we mentioned earlier.

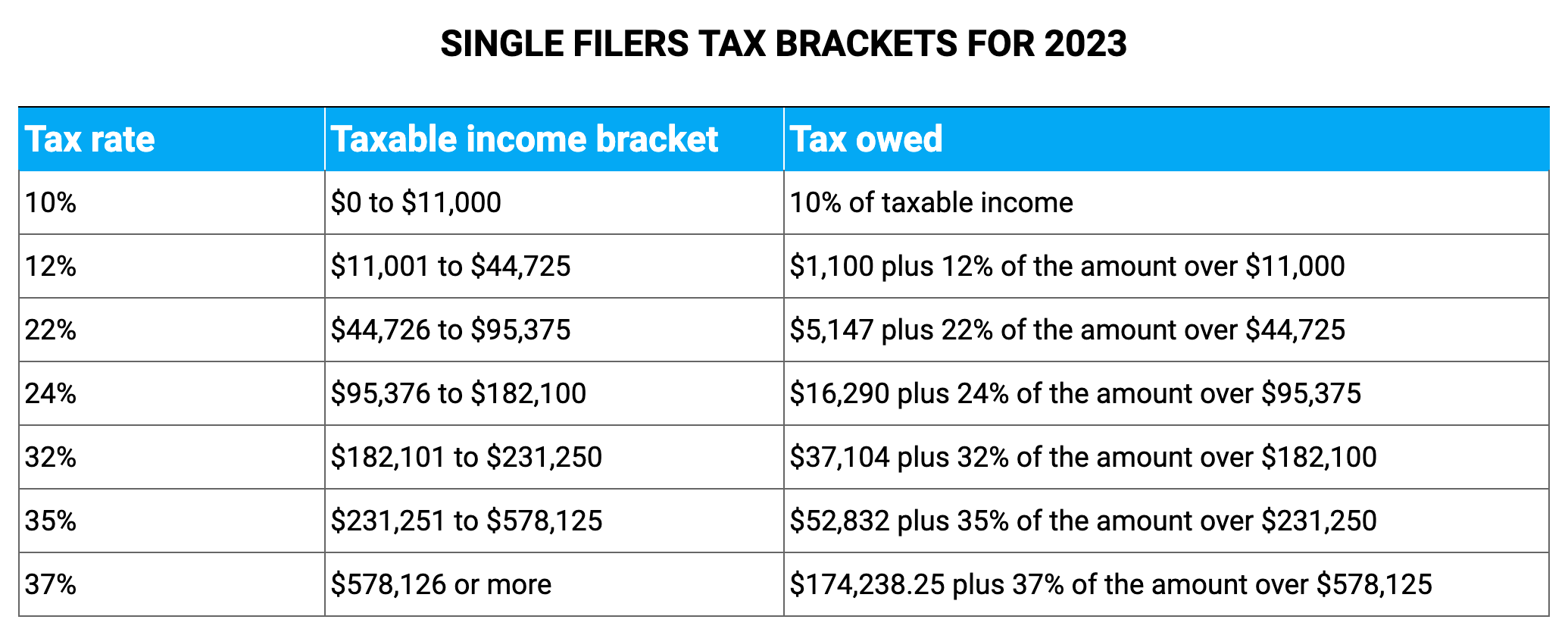

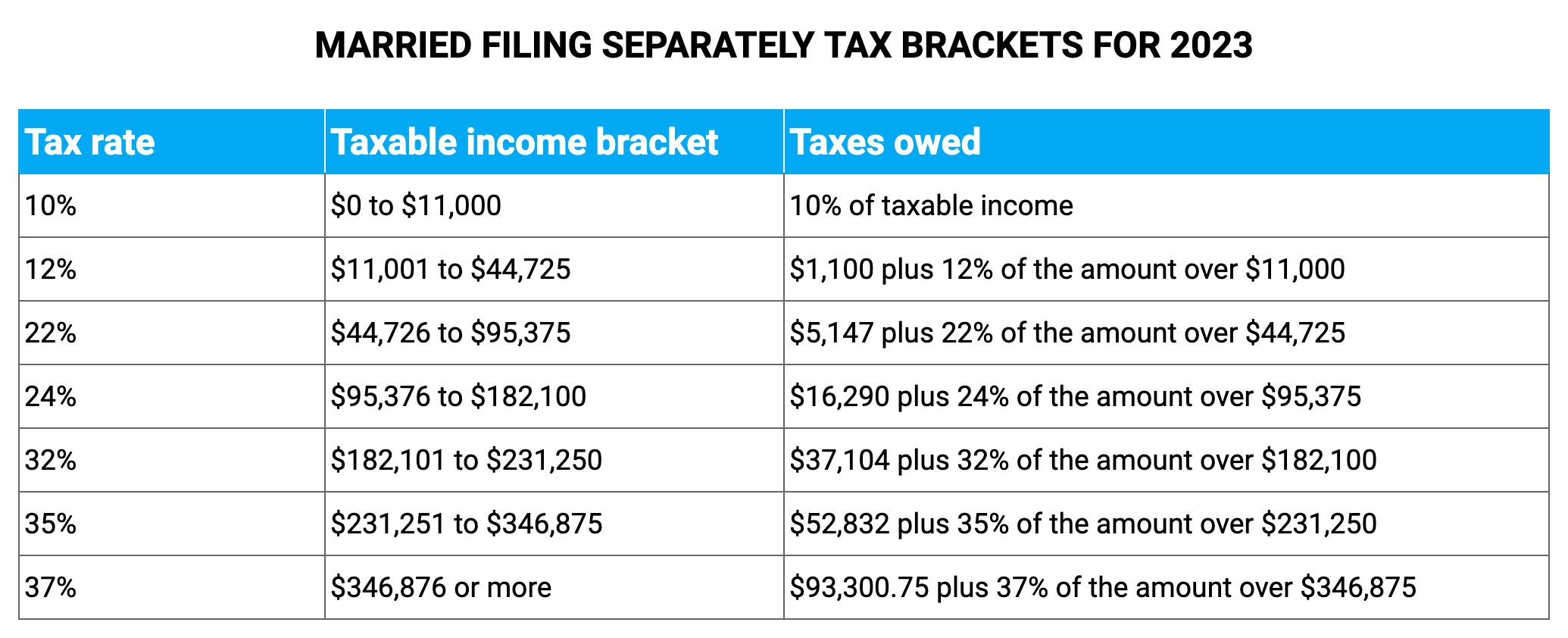

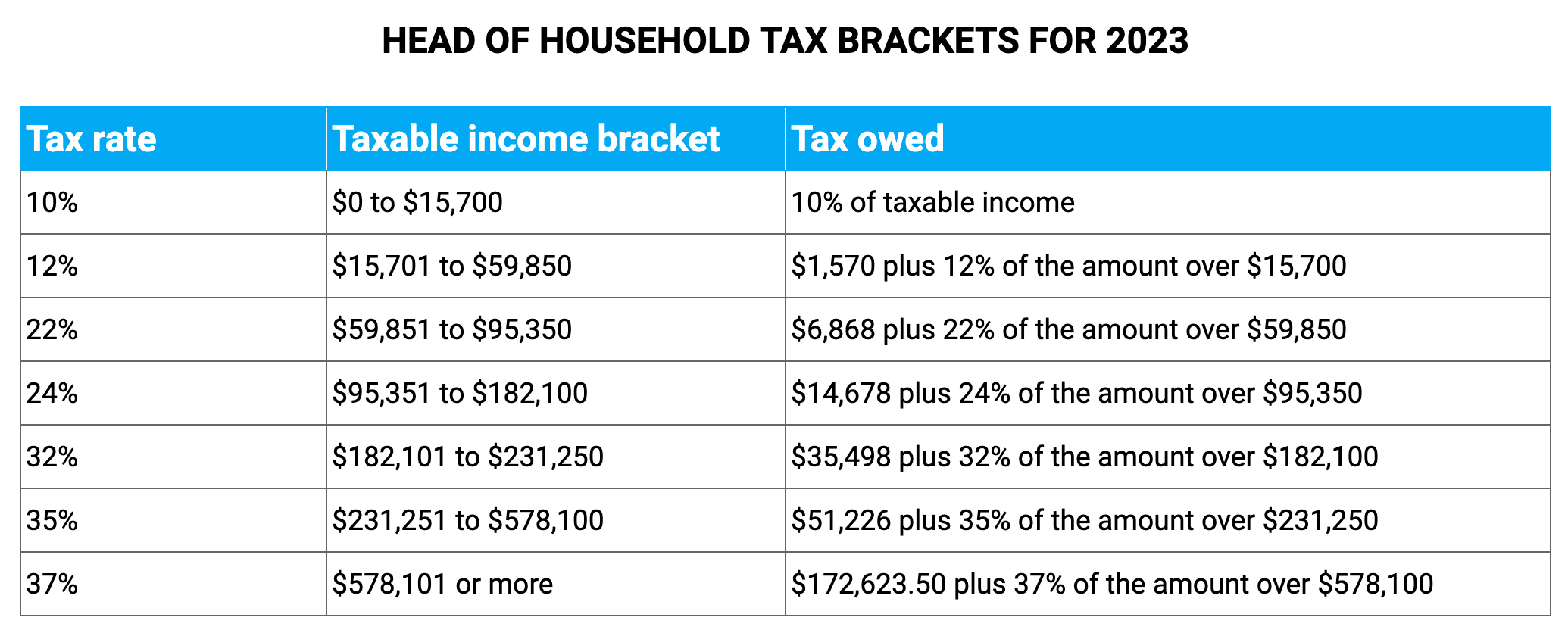

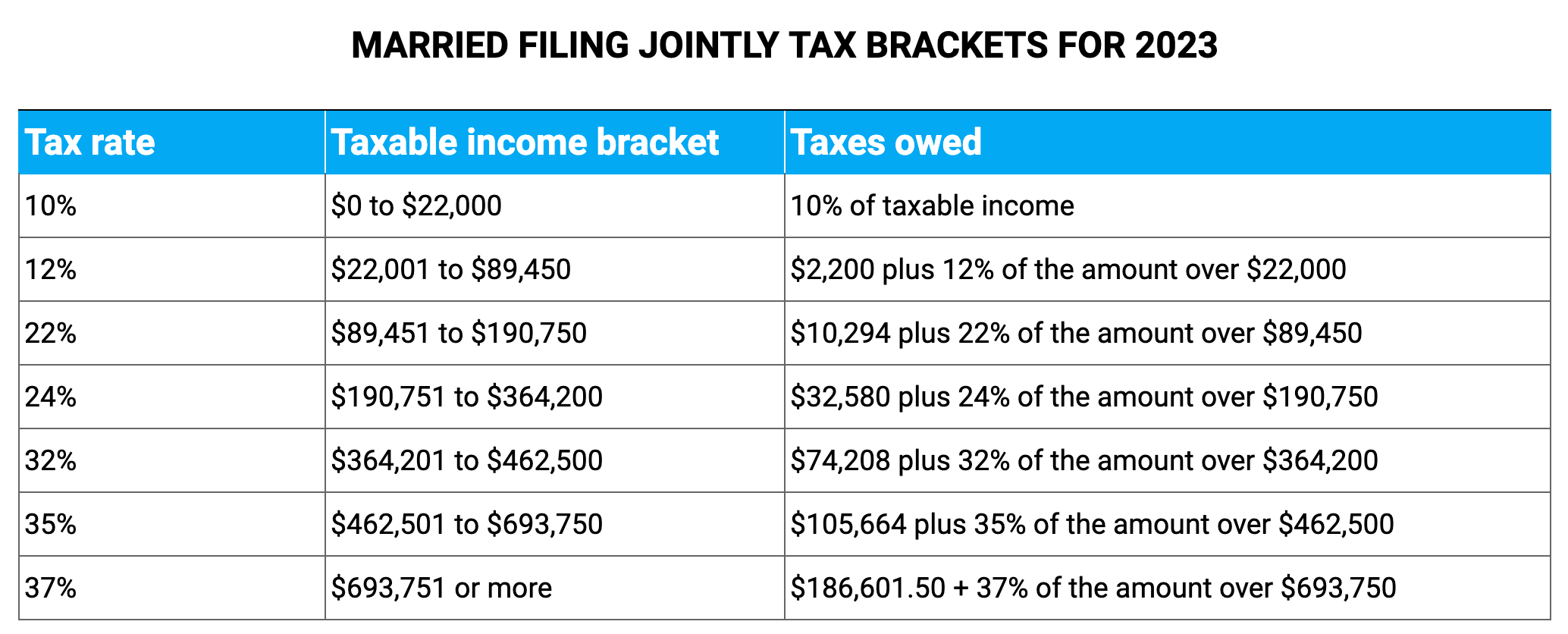

As confirmed by the IRS, the US has 7 federal tax brackets — 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The tax bracket you belong to depends on your taxable income and filing status:

- Single filers,

- Married filing separately,

- Head of household, and

- Married filing jointly.

For more information, let’s take a closer look at the tax brackets for each filing status presented in the tables below.

Apart from the categories listed above, marginal tax rates also apply to widows and widowers in certain cases. If qualified, a widow or widower can use the married filing jointly tax rates when paying taxes. See the qualification requirements here.

For example, if you’re a single taxpayer with an income of $11,000, you’ll pay a 10-percent rate on the first $11,000 you earn.

When working overtime, you may move up a tax bracket — on your $11,001st dollar, you’ll move to the next tax bracket and start paying a 12-percent rate on each dollar you earn.

However, your gross income will be taxed more — not your overtime.

💡 Clockify Pro Tip

If you’re looking for a quick and easy way to track your employees’ working hours and calculate their payroll, take a look at the blog post below:

How is overtime tax calculated?

As stated above, an employee’s overtime rate cannot be less than 1.5 times their regular pay rate. In other words, for each additional hour, that is, for each hour over 40 hours weekly, employees are entitled to a time and a half (1.5) their regular rate of pay.

To give an example, let’s say you’re an employee and you want to calculate your overtime pay so that you could calculate the overtime taxes you owe.

For instance, if you’re an hourly employee with an hourly rate of $18, your overtime rate of pay per hour would be calculated this way:

Regular hourly rate x 1.5 = overtime rate of pay/hour

The equation goes as follows:

$18 x 1.5 = $27 overtime rate of pay/hour

Now, let’s say you worked 5 additional hours that week, your overtime pay would be calculated this way:

$27 overtime rate/hour x 5 overtime hours = $135 total overtime pay for that week

Now that you know how much money you earned from working overtime, you can determine what tax bracket you fall into.

For example, if you are in the 22% tax bracket as a single filer, and you made an additional $135 while working overtime, you would calculate your overtime tax like this:

Overtime pay x the income tax rate of 22% = overtime tax you owe

The equation goes as follows:

$135 x 22% (0.22) = $29.7 of overtime tax you owe

You owe $29.7 of overtime tax for that specific period of time.

Aside from employees, determining overtime pay and overtime tax is important for employers too. When doing taxes, employers have to calculate how much money they should withhold from their employee’s paycheck.

💡 Clockify Pro Tip

If you’re self-employed and need to learn more about how you can calculate and pay your taxes, check out our guide for independent contractors:

Why is overtime taxed more? (If it actually is)

Although overtime is not taxed any differently than regular pay, this matter can be confusing — it can make you think about whether working additional hours is actually worth it due to taxes.

If you earn more money and increase your gross income — you may be moved into a higher tax bracket, for sure.

Overtime is always taxed, but it’s taxed at the same rate as your regular wage bracket (10% for the lowest and 37% for the highest income) hence overtime isn’t actually taxed more.

Only your gross income as a whole will be taxed more (and only in that pay period) thus working overtime is still worth it.

💡 Clockify Pro Tip

If you’re wondering if working overtime actually hurts more than it helps in terms of your taxes, track your overtime hours, do a calculation, and see for yourself:

Frequently asked questions about overtime and taxation

Now that we’ve learned the basics, let’s answer some frequently asked questions about overtime and taxation.

#1 Are there any exemptions from the overtime tax law?

According to the FLSA, employees are exempt from (not covered by) overtime tax law under the following circumstances:

- If they are considered administrative, professional, executive, or computer employees — since these employees usually earn twice the minimum wage,

- If they are paid a salary instead of an hourly rate (salaried employees), and

- If they are considered “highly compensated” — according to the US Department of Labor, employees are considered “highly compensated” if they earn a total annual compensation of $107,432 or more, which includes at least $684 per week. Also, they have to regularly perform at least one of the exempt duties (office or non-manual work).

#2 What are the pros and cons of the progressive tax system?

According to the IRS, “a progressive tax takes a larger percentage of income from high-income groups than from low-income groups and is based on the concept of ability to pay.”

For example, depending on whether you’re a taxpayer with a lower or higher income, a progressive tax system might tax you at lower or higher rates. A progressive tax system includes tax brackets that separate taxpayers according to their income ranges.

Compared to a flat percentage tax where all taxpayers are taxed at the same rate regardless of income, a progressive tax system ensures certain fairness for all taxpayers.

However, like any other tax system, progressive tax system also has its advantages and disadvantages, so let’s see them.

Pros of the progressive tax system

These are some of the good sides of the progressive tax system:

- It reduces the tax burden on those who earn less money and simply can’t afford to pay a lot of taxes — these people have lower wages and usually a lower living standard,

- It stimulates the economy because people with lower wages spend their money mostly on essential items — the progressive tax system actually increases economic demand, and

- It provides governments with more revenue — the progressive tax system allows governments to collect more money from those with higher incomes, which eventually results in more money being collected than with any other tax system.

Cons of the progressive tax system

Although the progressive tax system brings certain benefits, it also has some drawbacks:

- It can discourage those on the wealthier side — as a larger portion of the money is being taken away from them, this can reduce the desire of people with higher incomes to work hard and be competitive,

- It can seem unfair to people from the upper and middle classes — they end up paying a disproportionate amount of taxes. The progressive tax system also can encourage those with higher incomes to find ways to underpay their taxes, and

- It encourages capital flight and reduces the overall size of the economy — money flows out of the country quickly as certain individuals decide that investing abroad is a better financial option for them.

#3 What is the difference between time-and-a-half pay and double-time pay?

When calculating the total compensation for an employee, an employer must also take into account two forms of overtime work:

- Time-and-a-half pay — Refers to the amount of additional payment that an employer has to provide for an employee who worked overtime. Time-and-a-half (1.5) means literally that an employee gets paid according to their regular hourly rate plus 50% (that is, half) of their regular pay/hour. And this applies to every hour that is overtime.

- Double-time pay — According to the FLSA, employers are not required to cover the double-time pay. Double-time pay is generally used as a way of thanking employees for putting in extra effort, and it depends on the state you live in or the company you work for. For example, California has its own overtime law that states that employers need to pay their employees two times their regular pay rates if they work beyond 12 hours in a work day.

💡 Clockify Pro Tip

Do you have a business and want to find an easy way to manage and calculate your employee payroll? Make sure you read our blog post on this subject:

#4 What are some of the reasons why people end up doing overtime?

Working overtime hours can be enticing to many people because it enables them to reach some of their financial goals.

If you’ve ever wondered what actually motivates people to put in that extra effort — take a look at some of the top reasons why people work overtime.

💡 Clockify Pro Tip

If you’re ever in a situation where you don’t really have any other option but to work long hours, here are some tips on how to pull it off successfully.

Reason #1: To earn extra money

This is perhaps the most obvious reason why people work additional hours. By working overtime, they get the extra money that they can later use for vacations, savings, or whatever the reason is.

Reason #2: To pay off debts

Earning overtime is a big relief for people who have debts to pay off.

According to a 2021 CNBC report, the average American has about $90,000 in debt. Therefore, to help relieve some of their debts, most Americans usually choose to work overtime.

Reason #3: To invest in a business venture

If you want to start investing in a business venture — but don’t want to spend money from your regular earnings — working overtime may help you in achieving such a goal.

Reason #4: To improve skills and achieve career advancement

Although working overtime doesn’t necessarily help in advancing your career, it can be a good enough reason for some people to start working additional hours.

Employees can use this time to improve their skills and show their employer their full potential.

Conclusion: Working overtime (but in moderation) pays off after all

If you want to increase your earnings through working overtime, don’t let misconceptions about paying overtime taxes hold you back.

Overtime pay is not taxed differently than regular pay — there’s only the possibility that you’ll have to pay more taxes in that pay period when your gross income increases.

Working overtime will surely put extra dollars in your pocket, whether you get pushed into a higher tax bracket or not. Although working overtime has its benefits, it’s better to do it in moderation and not overwork yourself, considering it can have a negative impact on your health.

And if you weren’t sure whether working additional hours is actually beneficial considering the taxes you need to pay, we hope we’ve made it easier for you to understand how overtime taxation works and make a final decision.

✉️ Have you ever wondered how overtime taxation works? Maybe you have already found the right method and tool that helped you calculate your employees’ or your own total income taxes. Let us know at blogfeedback@clockify.me so we can try out your technique next. And, if you liked this blog post, share it with someone you think would be interested in reading it.