Kentucky Labor Laws Guide

Ultimate Kentucky labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Kentucky Labor Laws Guide FAQ | |

| Kentucky minimum wage | $7.25 |

| Kentucky overtime laws | 1.5 times rate for over 40 hours/week ($10.875 for minimum wage workers) |

| Kentucky break laws | Meal breaks (at least 20 minutes between the 3rd and 5th hour of the shift) and rest breaks (10 minutes after 4 hours of work) Lunch break for minors (30 minutes per 5 hours of work) |

Table of contents

Kentucky wage laws

| Kentucky Minimum Wage Laws (hourly) | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | $7.25 |

Both federal and Kentucky state regulations mandate that any number of hours up to 40 per week be compensated to employees at a rate of at least the minimum wage.

The state of Kentucky follows the federal minimum wage regulation.

If an employee works over 40 hours a week, they are entitled to a higher hourly rate. Overtime pay is regulated by the Fair Labor Standards Act.

The minimum wage requirement is different for non-tipped and tipped employees. Moreover, certain occupations are exempt from this requirement, and we'll cover all instances in the following segments.

Let's see what Kentucky employees are entitled to, in terms of fair and adequate compensation for their work.

Kentucky minimum wage

The state of Kentucky abides by the minimum wage requirement set by the federal law — $7.25 per one hour worked.

The minimum wage in Kentucky is announced to stay in compliance with the federal minimum wage rate. If the federal minimum wage requirement increases, the same will go into effect for Kentucky employees.

It is important to mention that it is illegal for employers to offer a lower hourly rate to non-exempt employees. However, there are some exemptions and exceptions to this requirement — for example, for tipped occupations.

Read the following segments to make sure you're fully aware of which employees are exempt from the minimum wage rule.

Tipped minimum wage in Kentucky

Certain professions, especially the ones in the hospitality industry, are commonly and closely associated with tipping.

The term, according to the Internal Revenue Service (IRS), refers to sums of money customers freely provide to tipped employees, as a recognition for their service.

Employees must regularly receive such form of gratuity (mostly in cash) in order to count as tipped employees — e.g. servers, bartenders, waiters, delivery people, etc.

Tipped employees' minimum wage in Kentucky is currently set to $2.13.

If the total of the base pay ($2.13) plus tips doesn't equal at least the amount of regular minimum wage ($7.25), the law states it's up to the employers to make up the difference.

Another practice commonly found among tipped employees is tip pooling.

The state of Kentucky is one of a few states that legally restrict employers from requiring that practice.

Tip pooling, or tip sharing, refers to all employees being obligated to share a portion of their tips in order for a part to be distributed to employees who usually don't receive tips, such as cooks, prep-cooks, and dishwashers.

The practice is not illegal in Kentucky, but employees must agree to tip sharing voluntarily.

Exceptions to the minimum wage in Kentucky

Employers can offer lower than standard hourly minimum wage to the following employees:

- White Collar employees (bona fide executives, administratives, and professionals, provided they earn at least $684 per week)

- Outside salespeople (provided they earn at least $684 per week)

- Computer employees

- Employees working in agriculture

- Employees of the US government services

- Employees working in domestic service, in or about a private homes

- Employees working as babysitters in the employer's home

- Employees working as companions to an elderly, sick, or convalescing person

- Employees working in newspaper delivery

- Employees working in organized non-profit camps, religious, or educational centers (provided they are not open for work more than 7 months in a calendar year)

- Employees working in a 24-hour residential care facility for children who are dependant, abused, or neglected

- Employees working in non-profit child-caring facilities (provided the facility is licensed by the Cabinet for Health and Family Services)

- Employees working in residential care as a family caregiver to an adult with mental health or intellectual disability (provided they are certified to provide adult foster care, by the Cabinet for Health and Family Services)

- Employees working in retail stores, hotels, motels, restaurants, and service industries — provided that either of the following applies:

- The business earned less than $95,000 for the 5 preceding years exclusive of excise taxes

- The employees are members of the employer's immediate family

Subminimum wage in Kentucky

The minimum wage for employed minors (i.e. youth under the age of 18), as well as several other categories of employees, is also called the subminimum wage.

Besides minors, other categories eligible for subminimum hourly wage are:

- Employees with disabilities

- Apprentices

- Trainees

- Learners

- Student learners

- Student workers

However, subminimum and minimum wages are the same in Kentucky, both based on the federal minimum wage at $7.25.

Kentucky payment laws

Employers must establish at least semi-monthly pay periods. In other words, employers need to provide compensation for their employees no later than 13 days after the end of the pay period.

As for the way in which employers can compensate employees, there are 4 options to choose from:

- Cash

- Direct deposit

- Payable checks

- Payroll card account.

Deductions from wages in Kentucky

Employers are also required to provide an itemized statement of deductions for each pay period. It's important to mention that employers can make deductions only in certain cases.

Let's first mention the cases when employers are not allowed to withhold or deduct any wages from employees' paychecks.

Here's the full list of instances in which employers aren't legally allowed to deduct any amount from an employee's paycheck:

- Lost or stolen property

- Damage to property

- Personal fines

- Cash shortages (provided at least 2 persons used the cash box or register)

- Losses due to acceptance of a bad check

- Losses due to defective or faulty workmanship

- Default or customer credit, or nonpayment for goods or services by the customer (provided losses can't be attributed to the employee in question's intentional or willful disregard of employer's interest)

An employer is allowed to withhold and deduct pay if they are authorized to do so by local, state, or federal law.

Additionally, an employer can deduct an employee's pay if they have written consent from a specific employee who wants to cover insurance, hospital, or other bills of their choice by deductions.

The law clearly states that all employees must be regularly and fairly compensated for their work. If you are an employee who believes an employer hasn't compensated you adequately, you should submit a formal complaint to the Kentucky Department of Workers' Claims.

Kentucky overtime laws

According to both federal and Kentucky state law, any number of hours exceeding 40 per week counts as overtime.

Forty hours per week is a regular requirement for full-time employees, e.g. those working Monday to Friday, from 9 to 5.

Non-exempt minimum wage employees who exceed that number of work hours are entitled to a wage of 1.5 times the regular minimum wage of $7.25. That amounts to $10.875 per hour and is applicable to all non-exempt employees who receive the minimum wage.

Kentucky state law also stipulates that, if an employee works for 7 consecutive days, the rate of all hours worked on the 7th day will be treated as overtime.

As is the case with the minimum wage requirement, there are also some exceptions to the overtime compensation of 1.5 times the minimum wage.

The following section will deal with exceptions from overtime in Kentucky.

Track Kentucky overtime with ClockifyOvertime exceptions and exemptions for White Collar employees in Kentucky

According to the federal overtime rules, which the state of Kentucky abides by, white collar employees are exempt from overtime pay. We've mentioned them as exceptions to the minimum wage rule as well.

Provided they earn at least $684 per week, white collar employees do not have to be paid at a 1.5 rate for working over 40 hours.

White collar employees are the ones working in any of the following categories:

- Administration — people who perform non-manual work related to business operations, management policies, or administrative training (provided that no more than 20% of the time is spent on activities unrelated to the position) — this category includes accountants, HR team members, market research analysts, etc.

- Executives — business, general, and executive managers who directly manage at least 2 employees.

- Professionals — people whose position calls for advanced knowledge and extensive education, such as software analysts or software engineers (The category also includes artists, certified teachers, and other creative work requiring talent, invention, or imagination.).

- Outside sales — outside sales representatives who visit potential and existing customers at their premises.

Kentucky overtime restrictions for specific occupations

Besides the federal government exemptions, the state enforces overtime restrictions on some other, more specific occupations.

The entire list of exceptions to the minimum wage applies to overtime exemptions as well.

The following occupations are exempt from overtime pay in Kentucky:

- Agriculturists

- US government employees

- People employed in domestic service in a private home

- Babysitters in the employer's home

- Companions of an elderly, sick, or convalescing person

- Newspaper delivery people

- People working in organized non-profit camps, religious, or educational centers (provided they are not open for work more than 7 months in a calendar year)

- Employees in a 24-hour residential care facility for children who are dependant, abused, or neglected

- Employees in non-profit child-caring facilities (provided the facility is licensed by the Cabinet for Health and Family Services)

- Employees in residential care working as family caregivers to an adult with mental health or intellectual disability (provided they are certified to provide adult foster care, by the Cabinet for Health and Family Services)

- Employees in retail stores, hotels, motels, restaurants, and service industries — provided that either of the following applies:

- The business earned less than $95,000 for the 5 preceding years exclusive of excise taxes

- The employees are members of the employer's immediate family

Kentucky break laws

Employers in the state of Kentucky are legally required to provide a meal break of at least 20 minutes to their employees whose shift is at least 7.5 hours.

This break must be provided to an employee between the 3rd and 5th hour of the workday, provided there's no mutual agreement stating otherwise.

Employers can choose not to compensate employees for meal breaks.

The state of Kentucky imposes another type of required break for employees. It's called the rest break. According to Kentucky law, employees must have a rest period of at least 10 minutes per every 4 hours of work.

Breastfeeding laws in Kentucky

This law is applicable to all working mothers who gave birth recently and are still breastfeeding. Employers whose businesses are based in Kentucky are required to provide adequate conditions for breastfeeding employees, as per federal law.

This type of break can be either paid or unpaid, as predetermined by the employer.

The “adequate conditions” part of the law refers to a room or location with a door that can't be a bathroom stall. That's in order to ensure privacy during the activity.

Employers' obligation is to provide such a location in the nearest possible proximity to the working environment.

In Kentucky, each District or Health Department has a dedicated Breastfeeding Promotion Coordinator who can help employers abide by all regulations concerning this topic, as well as provide additional information and resources.

Kentucky leave requirements

Kentucky state law regulates which types of leave employers are required to offer, as well as what happens in terms of compensation during an employee's leave.

The law also clearly regulates the following — for the required types of leave, employees shouldn't suffer any negative consequences upon their return to work.

Let's check out the rules and regulations regarding required and non-required leave in Kentucky.

Kentucky required leave

There are several types of required leave employers must provide their employees in Kentucky.

What the state law doesn't regulate is the compensation during the leave period. Employers can choose whether the leave will be paid or unpaid.

So here's the full list of the types of required leave in Kentucky:

- Family and medical leave

- Jury duty leave

- Voting time leave

- Military leave

- Emergency response leave

- Witness leave

- Adoption leave

Family and medical leave

This is a type of required leave that all employers in the state of Kentucky must provide their employees with. Eligibility for this type of leave is regulated by the Family and Medical Leave Act or FMLA.

The FMLA states that all employees are eligible to use 12 weeks of unpaid, job-protected work absence in a one-year period, for many household and medicinal-related reasons.

The reasons are:

- Care of the employee's own serious health condition

- Care of an immediate family member with a serious health condition

- Care of the employee's own newly-born child

- Placement for adoption/foster care of a child with the employee

- Any difficulty due to the employee's immediate family member is a covered military member on active duty

To be eligible, an employee must have worked for the employer for at least a year and at least 1,250 work hours. Note that this is applicable for employers with over 50 employees only.

Additionally, in an effort to protect the families of the Armed Services, Congress amended the FMLA in 2008.

Since then, employers have also been required to provide up to 26 weeks of unpaid leave if an employee needs to take care of a member of the Armed Forces with a serious health condition, injury, or undergoing medical treatment or therapy. This is applicable only if said member is an employee's spouse, parent, child, or next of kin.

Jury duty leave

Under Kentucky law, if an employee is summoned to perform jury duty, the employer must allow them to be absent from work during that time.

Moreover, the law states employers can't terminate or penalize an employee in any way for absence due to the acceptance of jury duty.

Voting time leave

Kentucky employers must offer at least 4 hours of voting time leave to all their employees. Employees who take a leave of absence to vote mustn't be penalized in any way upon their return to work.

The only exception is when an employer is able to prove that an employee didn't vote during this leave of absence, for reasons that were within the said employee's control. In other words, it is illegal to postpone going off to vote just to receive these 4 hours off.

If an employer proves that is the case, they can penalize the employee in question.

Military leave

This type of leave is regulated on a federal level, by the Uniformed Services Employment and Reemployment Act. The act states that all employees in the US must be granted a leave of absence to serve in one of the following:

- The US Armed Forces

- The National Guard

- The state militia

Upon the employee's return to work, they must be entitled to the same pay increases and other benefits as if they were present at work the whole time.

Kentucky also has a state-specific regulation, referring to members of the Kentucky National Guard. The reason for this leave of absence doesn't have to be leave for active duty but may also include relevant training of any kind.

Emergency response leave

Kentucky state law protects all employees who want to take time off to respond to an emergency.

Employers must offer this type of leave to employees who act as one of the following:

- Volunteer firefighters

- Rescue-squad members

- Ambulance drivers

- Peace officers

- Any other emergency response position

Proof can be required, in the form of a letter from the supervisor or an institution where the employee performed the emergency work. Volunteer emergency workers mustn't be punished or disciplined in any way. Employers decide whether the leave is paid or unpaid.

If an employee suffers an injury while responding to an emergency, the leave can last up to 12 months. It is illegal for employers to discharge any employee during the recovery period.

Witness leave

The law requires employers to provide either paid or unpaid leave for all their employees who are summoned to be a witness in any court. Employers are not allowed to take any adverse action against such employees.

However, employers are allowed to ask for proof that the employee was a witness in court — in the form of a court or administrative certificate.

Adoption leave

When it comes to employees who are in the process of adoption, employers are required to offer up to 6 weeks of leave.

That period should serve the purpose of receiving custody and any and all related activities.

Kentucky non-required leave

In Kentucky, there are 4 categories of leave that, by state law, employers are not required to offer to their employees.

Said categories are:

- Sick leave

- Vacation leave

- Holiday leave

- Bereavement leave

It is important to mention that the law also doesn't prohibit or restrict these types of leave.

Many company policies do offer some or all of the mentioned types of leave. If that is the case, the exact terms must be clearly stated in the signed contract of employment.

Sick leave

Under Kentucky state law, employers are not required to offer any paid or unpaid sick days.

Vacation leave

Employers in Kentucky are not required to offer vacation leave. However, employers who choose to offer this type of leave can do so — but all the details regarding vacation leave benefits must be stated in the employment contract.

Holiday leave

Employers in Kentucky are not legally required to offer either paid or unpaid leave for the period of any holiday and celebrations related to it.

Bereavement leave

Kentucky employers are not legally required to offer any paid or unpaid bereavement leave.

Child labor laws in Kentucky

Child labor laws apply to the employment of people aged under 18. We will use the term “minors'' to refer to this age category of employees in the state of Kentucky.

The main purpose of both federal and Kentucky child labor laws is to prevent the exploitation of minors. Additionally, these laws help highlight education as a priority, with employment only serving to enhance a minor's academic and life experience.

To be legally employed, all minors must obtain proof of age documentation and submit it to their employer. A driver's license and birth certificate can be said proof, as well as any other government-issued document that includes the date of birth.

Some of the most relevant limitations regarding the employment of minors can be seen in the following categories:

- Maximum number of work hours

- Beginning of their shift

- Restrictions on specific occupations

While different rules and regulations are applicable to different age groups, there is still one thing applicable to all age groups — minors are forbidden to work in any hazardous positions, according to the federal law.

Next, let's take a look at some more specific rules stated in the state of Kentucky Child Labor Laws.

Specific labor laws for minors in Kentucky

The state of Kentucky enforces specific rules for different age groups — 14 & 15 years of age and 16 & 17 years of age. Let's mention some restrictions on the maximum hours of work and night work for minors' employment.

The maximum number of work hours is regulated for all minors and differs when school is in session and when it's not.

Let's first cover the regulations that are applicable when school is in session:

- Minors aged 14 and 15 can work under the following conditions:

- Up to 3 hours per school day

- Up to 8 hours per non-school day

- Up to 18 hours per week

- Minors aged 16 and 17 can work under the following conditions:

- Up to 6 hours per school day

- Up to 8 hours per non-school day

- Up to 30 hours per week

When school is not in session, minors aged 14 and 15 are allowed to work up to 8 hours per day and up to 40 hours per week. There are no restrictions for minors aged 16 and 17 in this case.

Night work restrictions go as follows:

- Minors aged 14 and 15 are prohibited from working between 7 p.m. and 7 a.m.

- If the shift is scheduled before a school day, minors aged 16 and 17 are prohibited from working between 10:30 p.m. and 6 a.m.

- If the shift happens before a non-school day, minors aged 16 and 17 are prohibited from working between 1 a.m. and 6 a.m.

Employers are required to provide longer meal breaks for minors — at least 30 minutes per every 5 hours of work.

There are also some restrictions on child labor in specific industries.

Prohibited occupations for minors

We've previously mentioned that minors are prohibited from working in hazardous positions — now let's see what occupations and tasks are considered dangerous and hazardous in the state of Kentucky.

Here's the list of examples:

- Occupations in or about plants or other establishments manufacturing or storing explosives

- Any and all coal mine occupations

- Any and all logging or sawmill operations

- Handling power-driven hoisting apparatus, including forklifts

- Any and all excavating operations

- Any and all wrecking, demolition, and shipbreaking operations

- Occupations about and in connection with any establishment distilling, compounding, manufacturing, brewing, or bottling alcoholic beverages

- Any and all work on or about a roof

Hiring laws in Kentucky

When it comes to the hiring and selection processes, the first thing to mention is that Kentucky employers are prohibited from making hiring decisions based on several factors.

The main anti-discrimination aspects include the following categories:

- Race

- Color

- Age

- Gender

- Gender-related identity

- Religion

- National origin

- Pregnancy

- Genetic information (including family medical history)

- Physical/mental disability

- Child/spousal support withholding

- Military or veteran status

If you are an employee and you believe you were discriminated against, you should file a formal complaint, as the Kentucky Civil Rights Act strictly prohibits such behavior. There's also an online inquiry form you can fill out and check if your complaint fits into the category of discrimination.

Termination laws in Kentucky

Like the majority of other states in the US, Kentucky also implements an “employment-at-will” regulation and policy.

Let us explain what that means for both employers and employees.

- Employers — they can terminate their employees' work engagement anytime, for any reason.

- Employees — they are free to leave a job for any or no reason with no legal consequences.

Final paycheck in Kentucky

Employers in the state of Kentucky are legally required to provide a final paycheck to everyone whose employment was terminated for any reason. The paycheck must include all the leftover wages and benefits.

The final paycheck is due at the next regularly scheduled payday, or within 14 days of the separation.

Discrimination laws in Kentucky

Discrimination in the workplace is not only unethical but also illegal — these laws are applicable on a federal level, and apply to employee termination.

It is considered illegal if employers terminate employees on the basis of:

- Race

- Color

- Age

- Gender

- Gender-related identity

- Religion

- National origin

- Pregnancy

- Genetic information (including family medical history)

- Physical/mental disability

- Child/spousal support withholding

- Military or veteran status

Additional, state-based anti-discrimination regulations apply in Kentucky, making it illegal to terminate an employee on the basis of their:

- HIV/AIDS status

- Off-duty tobacco use

- Occupational pneumoconiosis without respiratory impairment

Occupational safety in Kentucky

A safe working environment is required by both the federal and the Kentucky state laws. On a federal level, occupational safety is regulated by the Occupational Safety and Health Act (OSHA), passed by Congress in 1970.

OSHA clearly states that employers are required to continually inspect for flaws and irregularities in the safety conditions, as well as continually work on improving them.

Every employer's obligation is to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

So, what are employers required to provide in order to ensure adequate workplace health and safety conditions?

For starters, proper training and education to all their employees immediately upon their employment.

Then, in order to comply with all the regulations, employers must conduct educational and advisory activities to assure safe and healthy working conditions.

There is another thing employers are required to do, to create optimal working conditions — the premises must be free from any recognized hazards that may cause harm.

Employers should regularly undertake safety demonstrations concerning health matters.

Effective enforcement of safety and health requirements is under the jurisdiction of OSHA inspectors, a.k.a. compliance safety and health officers.

Inspections can happen with or without probable cause, for the following reasons:

- Regular scheduling

- Reports of imminent danger

- Worker complaints

- Referrals from other agencies

- Targeted inspections (aimed at specific high-hazard industries)

- Reports of fatalities

In Kentucky, the Division of Compliance is responsible for the enforcement of Occupational Safety and Health Standards, both in the public and private sector workplaces.

If you are an employee and you notice any safety or health hazard at your workplace, you should file a complaint to the Division.

Miscellaneous Kentucky labor laws

The above were the most important and most common categories of labor laws that apply to all or some Kentucky employees — but, there are other labor laws. Read on, as some of the following may be applicable to your situation.

Here's what else is specifically regulated by the rule of law in Kentucky:

- Whistleblower protection laws

- Background check laws

- COBRA laws

- Pregnancy accommodation laws

- Employee monitoring laws

Whistleblower protection laws

The main purpose of this set of laws is to ensure that employees can exercise all of their legal rights without negative repercussions as a result.

The term “whistleblower” refers to employees who have inside knowledge of illegal practices or a safety hazard in the workplace. They must be able to report it and continue being employed.

Some of the reasons why employees can't be discriminated against, or treated in any way differently after are:

- Exercising their First Amendment rights

- Reporting an alleged violation of law

- Opposing or complaining about discrimination in the workplace

- Exercising their OSHA (Occupational Safety and Health Administration) rights

- Opposing or participating in an investigation of discrimination

Background check laws

Background checks are allowed for all the employers to conduct (but not required) and are subject to the Federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau. All employers must ensure they are following these requirements.

Only certain positions do require background checks for Kentucky employees and applicants — so let's see which ones:

- School personnel (including new certified hires, student teachers, and coaches)

- Public college and university personnel

- Personal services agency personnel

- Long-term care facilities personnel (provided the facility is owned, managed, or operated by the Department of Behavioral Health, Developmental, and Intellectual Disabilities)

- Childcare center personnel (provided the employee has direct contact with minors)

COBRA laws

COBRA is a law that operates on a federal level — so let's start this section by explaining what the acronym means. The Consolidated Omnibus Budget Reconciliation Act, or COBRA, allows employees to retain health care insurance and benefits after the termination of employment.

Federal regulations also state this law can be applied to employers with over 20 employees.

For that reason, there's an extension to this law that each state can enforce to include small businesses with fewer than 20 employees. Said extension is referred to as the “mini-COBRA” laws.

In the state of Kentucky, mini-COBRA laws exist and ensure 18 months of continuation coverage, in case an employer has fewer than 20 employees.

The only exception to this rule is if the termination happened due to gross negligence or misconduct of an employee. Such employees don't have the right to continuation of health insurance and benefits.

Pregnancy accommodation laws

Employers must provide adequate and reasonable conditions for their pregnant employees, in order to provide equal employment opportunities.

This is regulated by the Kentucky Pregnant Workers Act and is applicable to employers with 15 or more employees.

This regulation refers to the following:

- Assistance with manual labor

- Modifications to work schedule

- Frequent bathroom breaks

- Time off to recover from childbirth

- Modified work schedule

- Appropriate seating arrangements

- Acquisition or modification of equipment

Also, it is related to breastfeeding at work — which we've already covered in one of the previous sections, — requiring that employers provide adequate conditions for breastfeeding employees.

Employee monitoring laws

Employers are forbidden to monitor their employees via any and all electronic surveillance devices in the personal areas of the workplace, such as restrooms or changing rooms.

Kentucky state law also regulates all listening devices, which may not be used to listen to, amplify, record, or transmit communications.

The only exception involves the employer having the signed consent for monitoring or recording of at least one of the parties involved.

Record-keeping laws

Employers whose businesses operate in Kentucky follow the FLSA rules and are therefore required to keep the records of all their employees for at least 3 years.

So, if you're wondering what types and categories of information such records should consist of, read on — here's the full list:

- Full name

- Social security number

- Occupation of the employee

- Date of birth

- Home address

- Gender

- Regular hourly rate of pay

- Basis on which wages are paid

- Total daily or weekly net wages and deductions

- Total gross daily or weekly wages

- Date of each payment

- Completed copies of I-9

- Collective bargaining agreements

- Sales and purchases

- All certificates

- Records of leaves, notices, policies, etc. under FMLA

There are some other record-keeping laws that are applicable to specific situations. So, here's what else employers ought to keep on record, and for how long.

- Records of all job-related injuries and illnesses under OSHA — for 5 years

- Specifically dangerous instances under OSHA (e.g. covering toxic substance exposure) — for 30 years

Conclusion/Disclaimer

We hope this Kentucky labor law guide has been helpful. We once again remind you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this Kentucky labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

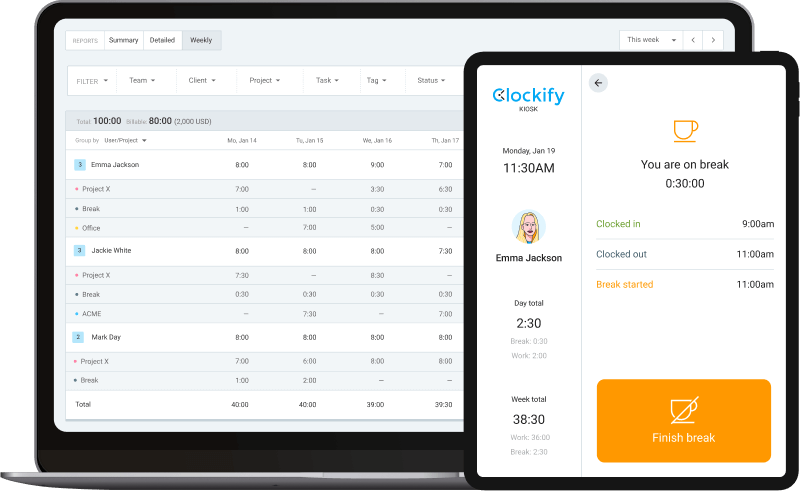

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).