Minnesota Labor Laws Guide

Ultimate Minnesota labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Minnesota Labor Laws FAQ | |

| Minnesota minimum wage | $10.33 for large employers $8.42 — small employer, training, and youth wages |

| Minnesota overtime | 1.5 times the rate of the standard wage if the employee has worked over 48 hours ($12.63 for minimum wage workers) *exempt employees earn the standard overtime rate if they have worked over 40 hours |

| Minnesota break laws | 20-minute meal breaks (must be provided during 8-hour shifts) 30-minute meal breaks for minors 4-hour gap between restroom breaks |

Table of contents

Minnesota wage laws

Unlike many other US states, Minnesota does not comply with the federal standards for minimum wages and has its own laws regarding wages that are adjusted for inflation rates each year by Aug. 31.

The following are the regulations concerning the state minimum, tipped hourly wage, and the subminimum wage in Minnesota

| MINNESOTA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $10.33/8.42 | $8.42 | $8.42 |

Minnesota minimum wage

What is Minnesota’s minimum wage as of Jan. 1, 2022?

Under state law, an annual review is required in order to adjust the minimum wage rate by increasing it by 2.5% or adjusting it for inflation.

The commissioner of the Department of Labor and Industry is obligated to perform the review each year by the end of August and to implement the changes from the beginning of the following calendar year.

The current year — 2022 — saw an increase of 2.5% in minimum wages, which amounts to $10.33 for employers that make more than $500,000 annually and $8.42 for those that make less than $500,000.

Since the minimum wage determined by state laws is higher than the federal minimum wage, all employees are entitled to the higher sum.

However, the localities of Minneapolis and Saint Paul have established their own minimum wages, which are slightly higher than those in the other cities in the state.

As of 2022, the city of Minneapolis legislature states that the minimum wage of $15.00 will be given to large employers and $13.50 to small businesses — less than 101 employees.

The same goes for Saint Paul, but they have specific laws for micro employers — businesses with five or fewer employees that are eligible for a $10.75 minimum wage rate.

The Minnesota Minimum Wage websiteTipped minimum wage in Minnesota

According to the Minnesota law, all tipped employees are entitled to the state minimum wage, which amounts to $8.42 by the hour as of Jan. 1, 2022, + tips.

Under no circumstances can the employer credit the tips toward the minimum wage.

Regarding the tips, all employees are free to choose whether they’ll share the tip pool with their coworkers or if they’ll be tipped individually.

Track work hours and hourly pay with ClockifyMinnesota subminimum wage

As of 2021, Minnesota has become one of the many US states with task forces that strive to abolish subminimum wages, regardless of whether an employee is working part-time or full-time.

Moreover, the plan on dissolving subminimum wages will also protect full-time students, minors, and employees on 90-day training wages.

Currently, in 2022, all employees are entitled to the state minimum wage — $8.42. But, as previously stated, some localities can set their own wages, which is one of the issues that the Task Force on Subminimum Wages will try to solve.

The deadline for the Task Force to develop an official plan is Aug. 1, 2025.

But, the first draft of recommendations will be submitted as early as February 2023.

Track employee payroll with ClockifyExceptions to the minimum wage in Minnesota

Minnesota is one of the US states that have exceptions to the minimum wage covered by the federal and state laws.

In federal terms, the exceptions to the minimum wage include:

- Executive employees who are paid not less than the state minimum wage,

- Administrative employees who are paid not less than the state minimum wage,

- Professional employees who are paid not less than the state minimum wage, and

- Highly compensated employees who earn more than $500,000 in gross annual incomes.

However, there are specific state laws on certain professions exempt from the minimum wage standard, such as:

- Employees who make evergreen wreaths,

- Babysitters,

- Taxi drivers,

- Volunteers of nonprofit organizations,

- US Department of Transportation employees (drivers, mechanics, loaders), and

- Employees that provide police or fire protection.

Minnesota payment laws

The general consensus is that employers in the state of Minnesota are obligated to pay their employees at least once in a 31-day work period.

For new employees — all wages earned in the first period of a calendar month must be paid on the first regular payday.

However, the frequency of payments may vary based on the industry and the type of work.

For example, school workers can agree with their employers in writing for different payment arrangements.

On the other hand, first responders and firefighters can agree on longer payment intervals.

An important thing to note is that migrant workers in the state of Minnesota are entitled to a paycheck once in a 15-day period.

When it comes to public service corporations (public utility companies), the state of Minnesota requires them to pay their employees on a semi-monthly basis.

Minnesota overtime laws

To become eligible for overtime pay, a non-exempt employee must work at least 48 hours in a seven-day workweek.

According to the state law, all excess hours will be paid 1.5 times the regular rate of an hourly wage.

On the other hand, according to the federal law, some employers are required to pay overtime for each hour worked over 40 hours per week.

The employees who are eligible for this type of overtime:

- Produce or handle goods for interstate commerce,

- Work in businesses that make at least $500,000 in gross annual incomes,

- Work in hospitals and nursing facilities,

- Teach in public and private schools, and

- Work at higher positions in federal and state agencies.

Overtime exceptions and exemptions in Minnesota

According to the federal law, most US states are obliged to exempt certain employees and professions from overtime pay, such as:

- Highly compensated employees that make more than $107,432 a year,

- Executive and administrative employees that make at least $684 per week,

- Professional employees — artists, researchers, scientists, skilled computer professionals, etc., and

- Outside salespeople.

Moreover, the state of Minnesota also lists a variety of professions that are completely exempt from overtime pay, such as:

- Mechanics,

- Taxi drivers,

- Seasonal employees,

- Sugar beet hand laborers,

- Babysitters, and

- Agricultural technicians.

Minnesota break laws

In accordance with the Minnesota Department of Labor and Industry, all employers are required to provide enough time for their employees to use the restroom and eat.

The employer is free to set the length of each break. But, the break must last at least 20 minutes to be unpaid — anything below 20 minutes is considered a paid break.

Furthermore, the time to use the restroom must be available to all employees within the time period of 4 consecutive hours worked.

When it comes to the meal break, it must be provided to employees that work 8 hours or more.

Exceptions to break laws in Minnesota

Even though employers must offer meal breaks in Minnesota, it is not strictly stipulated that the break should last for 20 minutes.

In fact, the MFLSA — Minnesota Fair Labor Standards Act — states that “a sufficient time to eat a meal” must be provided to all employees, but the 20-minute break is a general consensus among employers.

On the other hand, there are professions exempt from break laws, the same as overtime laws.

Some of these professions are exempt because the nature of their job enables the employees to take rests on multiple occasions during the day.

The list includes:

- Taxi drivers,

- Babysitters,

- Seafarers,

- Religious employees, and

- Certain agricultural workers.

Minnesota breastfeeding laws

As of 2020/2021, most US states have adapted and transformed their laws to fit the growing needs of breastfeeding parents.

According to the Minnesota Department of Health, all breastfeeding parents are entitled to “a reasonable amount of time” to express breast milk.

In most cases, employers will strike either a verbal or formal understanding with their employees regarding the exact duration of the breastfeeding breaks.

Furthermore, the employer has to provide a private area that is not a restroom or a toilet stall for breastfeeding purposes. The provided area needs to be relatively close to the working space and contain a functional electrical outlet.

In case some of these conditions are not met, the employer can be charged with violations and a fine determined by the court.

Minnesota leave requirements

The state of Minnesota has an amalgamated system of state and federal laws, which often get mashed with the laws of larger cities.

When it comes to leave laws and requirements, we can group them into required and non-required leaves, regardless if they’re paid or unpaid.

Minnesota required leave

The following is the leave time that Minnesota employers are required to assign to their employees:

- Family and Medical Leave (FMLA)

- Military leave

- Bone marrow and organ donation leave

- School activity and conference leave

- Jury duty leave

- Witness leave

- Voting leave

Family and Medical Leave (FMLA)

Minnesota employees are covered by both federal FMLA and state laws that require employers to grant a leave of absence to employees in certain family and medical emergencies and instances.

In situations where both federal and state laws apply, the law that grants employees more protection will be the one taken into consideration.

Under the federal law, all employees are allowed to take 12 weeks of unpaid leave for specified family and medicinal reasons, such as:

- Taking care of an injured or sick family member,

- Treating a serious health condition,

- Bonding with a newborn, or

- Providing care for a family member that was injured on active military duty.

Also, under the Minnesota law, employers that have at least 21 employees must provide 12 weeks of absence for prenatal care, regardless of whether the parents are biological or adoptive.

A 12-week period must be taken within a year of the child’s adoption or birth, which can be used for bonding time and general care.

To receive FMLA benefits, an employee had to have:

- Worked for the employer for at least a year,

- Worked at least 1,250 hours, and

- Worked at the location with at least 50 employed workers within 75 miles.

Military leave

An employee can be granted additional 14 weeks of absence for military caregiver leave — a special type of military leave that’s related to giving care to an injured family member. If the family member were to be injured again on active duty, the employee would not be able to take additional leave of absence.

In addition to the previous FMLA benefits, it is also important to note that Minnesota employees are greatly protected when it comes to military leave.

All employers are obligated to provide a reasonable leave of absence to employees whose spouse, partner, child, or family member is on active duty, especially in circumstances of:

- Welcoming or sending off a family member,

- Taking care of an injured family member, and

- Grieving and organizing a funeral for a killed family member.

Bone marrow and organ donation leave

If an employer has at least 20 employees working on at least one site or virtual space, they have to provide a 40-work hour period for bone marrow and organ donation.

The leave can be prolonged, if necessary due to complications, but the state minimum is 40 unpaid work hours.

To request the leave, an employee has to provide verification by a physician that they are eligible for a donation.

Moreover, if the employer does not qualify for a donation, his leave of absence will not be forfeited.

School activity and conference leave

In order to qualify for this type of leave, an employee must have a biological or adopted child or be a legal guardian of one. Another precondition is that they have to work at least half of a full-time schedule for the employer.

If the criteria are met, an employee will be given a time span of 16 unpaid work hours to attend conferences and school activities in a 1-year span.

The leave is renewed each year, and it’s applicable for each child that the employee has.

Jury duty leave

Under Minnesota law, no employer can penalize or terminate an employee for reporting to jury duty or jury selection.

All employers must provide an unpaid leave of absence for jury duty, but employees might have to justify the leave by providing the jury summons.

Employers are not required to pay for jury duty leave, but certain labor union members might get compensation if it’s clearly stated in the contract.

However, all jurors in the state of Minnesota receive a token reimbursement for their duty.

Witness leave

Witness and Victims of Crime Leave Policy states that all employees who were either victimized or witnessed a crime are eligible to take a leave of absence to respond to the court.

This leave can include:

- Giving a testimony,

- Getting questioned by the police or the authority in charge, and

- Attending criminal proceedings.

The employee is obligated to give a 48-hour notice to their employer, but if the situation calls for immediate action, exceptions can be made.

The employer is strictly prohibited from penalizing, threatening, disciplining, or terminating an employee who took the Witness and Victims of Crime leave.

Voting leave

The state of Minnesota allows all employees to take paid time off of work during an election day if the employee is old enough and eligible to vote.

The duration of the leave is dependent on the time it takes an employee to reach the polling place, vote, and return to work.

Employees cannot be subjected to losing their wages and receiving penalties from their employers for taking time off to vote.

Minnesota non-required leave

Even though most employers are not required to offer leaves of absence in some cases, they will provide some form of leave in order to improve efficiency and keep employees satisfied.

Non-required leaves include:

- Sick days leave

- Vacation leave

- Holiday and bereavement leave

Sick days leave

Even though the employer is not obligated by the federal or state law to give sick days to their employees, if they choose to do so, they must also offer time off for:

- Treating or taking care of children, spouses, family members, and in-laws,

- Receiving assistance due to sexual assault or any form of harassment, and

- Providing assistance to family members that have suffered abuse or any form of harassment.

Sick days leave and FMLA in the state of Minnesota often overlap, so there are instances where the employer is obligated to provide sick leave — e.g., for an employee taking care of a child.

To be eligible for sick days leave, an employee must have worked for the employer in the last year at least half-time.

Furthermore, the state of Minnesota has specific laws in certain localities centered around large cities.

The city of Minneapolis’ employers are required to provide sick leave to their employees if they do 80 or more hours of work in the city during one year. If the business in question has six or more employees, the leave must be paid.

The same goes for the city of St. Paul’s employers — but there are no restrictions based on the number of employees.

Employers in the city of Duluth are obligated to provide a sick leave of absence based on the number of hours that employees have worked in the city — every 50 hours worked in the city amount to 1 hour of paid sick leave.

Vacation leave

No state law issued by the Minnesota Legislature requires employers to provide vacation leave for their employees.

However, if they choose to implement a vacation leave, they must establish a legal policy and follow the conditions set in the employment contract.

The employer is free to create a policy that denies payment of accrued vacation days upon termination of the contract if the employee has not used them beforehand.

Also, the employer is free to:

- Cap (limit) the amount of vacation leave,

- Not pay for vacation leave if the employee has not given a 2-week notice, and

- Not pay for vacation leave if there are no specified regulations on the matter in the contract.

Holiday and bereavement leave

The state of Minnesota has no laws that require employers to provide either paid or unpaid leave for holidays and bereavement.

Child labor laws in Minnesota

Child labor laws in Minnesota are designed to prevent the exploitation of minors in working conditions from any physical, moral, or emotional hazards.

In addition to numerous laws and statutes, all employers in the state of Minnesota are obligated to have:

- Employment Certificates issued by the state’s Labor Department, and/or

- Age Certificates that verify a minor’s age for working purposes.

Work Permits (Employment Certificates) are mandatory for all minors under the age of 16 as verification from their school that they are fit to work after school hours.

Age Certificates are not necessary but can be provided as means of keeping a record of the employee’s age.

Work time restrictions for Minnesota minors

The state of Minnesota law, combined with the federal law, prohibits any type of work for minors under the age of 14, with certain exceptions — e.g., newspaper delivery.

Depending on the type of work, the Commissioner of Labor and Industry can issue a permit for a minor to work.

When it comes to minors under the age of 16 (ages 14 and 15) — both federal and state laws prohibit working more than 40 hours a week/8 hours a day on a non-school week. If it’s a school week, a minor employee can work up to 18 hours a week/3 hours a day.

Furthermore, the amalgamation of federal and state law states that a minor employee can work between the hours of 07:00 a.m. and 07:00 p.m. The evening hours are extended to 09:00 p.m. during the summer.

Minors aged 16 and 17 have the same work-hour restrictions, but they are allowed to work up until 11:00 p.m. on a school night and cannot start work before 05:00 a.m. on any school day.

These limitations can be pushed by half an hour if the minor is employed by their parents or if they have a signed permission form by the Commissioner of Labor and Industry or the parents.

Breaks for Minnesota minors

All employees in the state of Minnesota are given a reasonable amount of time for meal breaks and restroom time, including minors.

The length of each break is determined by the employer, but all meal breaks, 20 minutes or less, are to be paid by the employer.

The general consensus, however, is that most meal breaks for minors last for 30 minutes.

Prohibited occupations for minors in Minnesota

According to the federal law, no minor, regardless of age, will be allowed to work in an environment deemed hazardous by the US Secretary of Labor.

A minor can work in a non-hazardous environment under parental supervision or in a safe environment with proper supervision and permits.

Minors aged 16 and 17 are prohibited from working with:

- Explosives and cutting equipment,

- Motor vehicles (operating or repairing),

- Radioactive materials,

- Dangerous machinery (paper products machines and bakery machines), and

- Coal and logs.

Including the above, minors under the age of 16 are either prohibited or limited from working in:

- Construction,

- Warehousing,

- Storage, and

- Communications.

Minnesota’s state laws further limit minors’ ability to work in places that serve alcohol or have alcohol on the premises.

Surprisingly, there are no state law age restrictions on selling tobacco in Minnesota.

However, there are exceptions to the state laws on employing minors in certain situations. Some of them include:

- A 17-year-old high school graduate,

- A minor that works in a business owned by one or both parents, and

- A minor that works on a site clear of hazardous equipment.

Penalties for people who employ minors in Minnesota

Employers in the state of Minnesota are subject to fines for violating labor laws under the Minnesota Child Labor Act and will face misdemeanor charges if the violations occur on multiple occasions.

The lowest fine that an employer can face is $250 for employing a minor without proof of age — i.e., not obtaining Employment or Age Certifications.

Employers are subjected to fines of $500 if they employ:

- A minor under the age of 14,

- A minor under the age of 16 during school hours,

- A minor under the age of 16 before 7 a.m. or after 9 p.m., and

- A minor under the age of 16 for more than 8 hours a day/40 hours per week.

Employers are subjected to fines of $1,000 if they employ minors under the age of 18 to work in a hazardous environment or perform a line of work that is deemed “not safe” by the state laws.

The same fine applies to employing a high-school student under the age of 18 to work during school hours or during the hours prohibited by the state laws.

The largest fine is reserved for injuries that a minor under the age of 18 has received by working in a hazardous environment, which amounts to $5,000.

Hiring laws in Minnesota

The state of Minnesota does not differ from other US states when it comes to hiring laws.

In general, the salient reason employees brush up on hiring laws is due to discrimination laws that affect job interviews and the day-to-day.

The Minnesota Human Rights Act prohibits all employment practices that discriminate based upon:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Pregnancy and childbirth,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

Furthermore, employers in the state of Minnesota are prohibited from discriminating based on the use of legal consumable products outside of work and work hours.

Minnesota Department of Human Rights“Right to work law” in Minnesota

Minnesota is not in the group of “right to work” states in the US and, therefore, has no laws to clearly state and regulate the relationship between employers and union members.

However, the state of Minnesota does have a Labor Relations Act that serves to protect both employers and employees in case of:

- Strikes,

- Stoppages of work,

- Labor disputes, and

- Lockouts.

Termination laws in Minnesota

Like most states in the US, Minnesota also practices “employment-at-will” — an employment arrangement that supports termination of employment at any time for any lawful reason.

The reasons for termination must be in accordance with labor laws — e.g., discrimination laws and Human Rights Act — or the employer will be faced with violations and fines.

According to state law, there is no legal need to provide notice of separation by employers or employees, but common practice is a 2-week notice.

If, however, the employee requests a reason for termination within a 2-week period after termination, the employer has to provide a written document within 10 days from receiving the request with truthful reasoning behind the termination.

Final paycheck in Minnesota

The state of Minnesota has a strict law regarding the payment of unpaid wages upon termination of employment.

Once the employee requests the amount of all unpaid wages, the employer is obligated to pay within 24 hours.

If an employee has quit, all unpaid wages are due the next pay period that starts 5 days after the last day of employment.

The period in-between must not be more than 20 days in total, unless in cases where the employee is paid once a month, and the termination of the contract has occurred in the first 5 days of a calendar month.

Health insurance continuation in Minnesota (COBRA)

The federal law that protects employees who have lost or quit their jobs in terms of health insurance is called COBRA — The Consolidated Omnibus Budget Reconciliation Act.

There are many requirements that need to be met to apply for COBRA, but the result always entails 18 to 36 months of group health coverage.

However, the federal COBRA law relates only to businesses that have 20 or more employees.

The difference in Minnesota’s state laws is that COBRA covers all businesses, regardless of the annual gross income and the number of employees.

Moreover, the health plan continuation also covers:

- Recently divorced spouses,

- Families of passed employees, and

- Children who lost their dependent status when they turned 26 years of age.

Occupational safety in Minnesota

Back in 1970, when the original Occupational Safety and Health Act was created, all US states implemented it in its laws.

The act is administered by OSHA — Occupational Safety and Health Administration — and it serves to ensure safe and hazard-free working conditions.

The state of Minnesota has its own OSHA laws and standards that serve to protect workers from the following types of hazards:

- Biological

- Chemical

- Work organization

- Safety

- Physical

- Ergonomic

Miscellaneous Minnesota labor laws

Since some of the laws that the state of Minnesota implements cannot be placed under the previously mentioned categories, this section will cover miscellaneous labor laws.

The most noticeable miscellaneous labor laws include:

- Background check law,

- Record keeping laws,

- “Ban-the-box” law,

- Whistleblower law,

- Drug and alcohol testing law, and

- Minneapolis freelance workers protection ordinance.

Background check laws

According to the federal law and the Fair Credit Reporting Act, all information regarding an employee's background is completely protected from being used by medical information companies, credit bureaus, and tenant screening services.

However, the state of Minnesota does require background checks for specific types of employees.

Some of them include:

- Nursing home and home care personnel,

- Residential buildings’ managers,

- School personnel,

- Adult rehabilitation specialists, and

- Long-term health personnel.

Record keeping laws

Employers in the state of Minnesota can be occasionally inspected by the Department of Labor and Industry to check if they’re in compliance with the record keeping laws.

The documents each employer has to have at their disposal are:

- Names and addresses of all employees,

- Payment information — wage rates and dates of payments,

- Record of working hours of all employees,

- Proof of employees’ age,

- Meal credit records — if there are any,

- Personnel policies, and

- Signed contracts of employment.

All records have to be kept at the place of work or at a near location where they can be easily accessed in case they are requested by the commissioner.

“Ban the box” law

There are many US states that have adopted the “ban the box” law, one of which is Minnesota.

The term derives from checking boxes on contracts that were obligatory for ex-offenders and criminals.

Due to a lack of employment opportunities, many US states decided to “ban the box” and prohibit employers from asking an applicant about their criminal history.

However, this law does not apply to employers that have a statutory duty to conduct background checks regarding criminal activity, nor does it apply to the Department of Corrections.

Whistleblower laws

In general terms, all US states implement whistleblowing laws to protect employees from retaliation in case they disclose confidential and incriminating information regarding violations on the working premises or any type of illegal doings by the employer.

In broader terms, employees are protected from retaliation when they:

- Report, in good faith, a suspected or planned violation,

- Participate in an investigation,

- Refuse to help, witness, or aid a violation, and

- Refuse to break federal or state laws.

Drug and alcohol testing laws

According to the Minnesota laws, an employer can request that an employee take a drug and alcohol test once a year if they deliver a notice 2 weeks prior.

However, there are additional situations in which employers can request such tests. Some of them include:

- Offering a job position that entails testing all candidates (according to the firm’s bylaws),

- Random drug testing as a means of preserving safety-sensitive environments,

- Reasonable suspicion testing, and

- Treatment program test.

Minneapolis freelance workers protection ordinance

Even though an ordinance is not technically a law, it is an important authoritative decree that, in this case, involves the freelance workforce that has become a strong pillar in the last few years.

Freelance Worker protections strive toward making sure that everyone gets paid for the work that was previously agreed upon in the contract with the employer.

According to the ordinance rules, each contract between a freelance worker and an employer should include:

- Name and address of the hiring party and the employee,

- Itemized list of all obligations that the employee has to perform,

- Compensation, and

- Pay date of the agreed compensation.

Due to constant shifts and changes in the working requirements, the contract should be created to allow flexibility.

Conclusion/Disclaimer

We hope this Minnesota labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this Minnesota labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

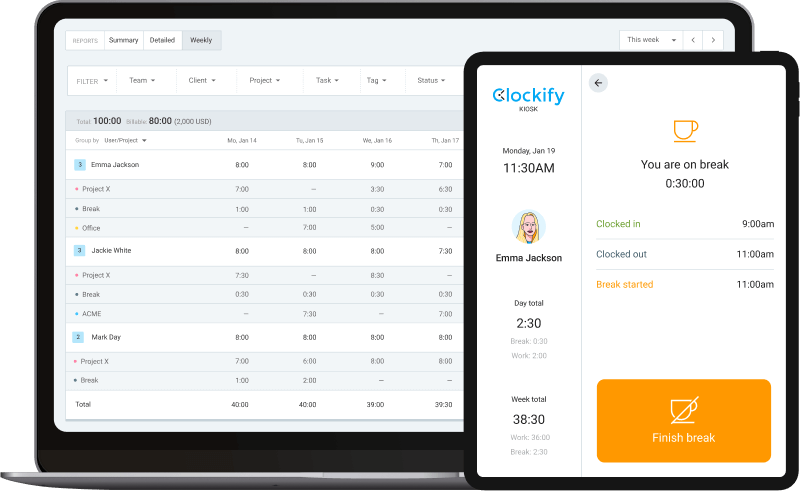

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).