Missouri Labor Laws Guide

Ultimate Missouri labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Missouri Labor Laws FAQ | |

| Missouri minimum wage | $11.15 |

| Missouri overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($16.72 for minimum wage workers) |

| Missouri breaks | Breaks not required by law |

Table of contents

Missouri wage laws

Missouri workers are subject to state laws regarding minimum wage provisions.

The following are the regulations concerning the state minimum, tipped hourly wage, and the youth minimum wage in Missouri.

| MISSOURI MINIMUM WAGE | |||

| Regular minimum wage (private employees) | Regular minimum wage (public employees) | Tipped minimum wage | Subminimum wage |

| $11.15 | Not less than $7.25 | $5.575 | $11.15 |

Missouri minimum wage

Effective January 1, 2022, the minimum wage in the state of Missouri is $11.15 per hour.

The state minimum wage in Missouri has been gradually increasing in the last 5 years.

Continuing on from 2019 to 2023, the state minimum will increase 85 cents per hour until it reaches $12.

Exceptions to the minimum wage in Missouri

However, the minimum wage of $11.15 only applies to private businesses.

Public employers may be paid less, but not lower than the federal minimum wage of $7.25 per hour.

Furthermore, the state minimum doesn't apply to retail and service businesses whose annual gross sales are less than $500,000.

Other occupations and employees who are exempt from the minimum wage by federal law are:

- Executives, administrative workers, learned and creative professionals who are paid on a salary basis and earn not less than $684 per week

- Computer employees who earn $684 per week or at least $27.63 per hour

- Highly compensated employees who earn $107,432 or more a year

- Outside sales employees

Tipped minimum wage in Missouri

Employers in Missouri are required to pay tipped employees at least 50% of the state minimum wage, which comes down to $5.575 per hour.

However, a tipped employee must earn at least the state minimum wage of $11.15 per hour, together with tips combined. If this is not the case — the employer needs to make up the difference.

Missouri subminimum wage

Any employer who employs minors must pay them at least the state minimum wage of $11.15 per hour.

Still, as stated above, this doesn't apply to retail or service businesses whose annual gross income is less than $500,000.

Missouri payment law

All businesses, including persons operating railroads or railroad shops, must pay their employees wages and salaries semimonthly (twice a month).

The wages or salaries due to an employee must be paid within 16 days of the close of each payroll period.

Yet, salespeople, executive, administrative, and professional employees may be paid their salaries or commissions monthly.

Track employee payroll in Missouri with ClockifyMissouri overtime laws

Eligible employees who work more than 40 hours a week in Missouri are entitled to overtime pay at a rate of one and one-half (1.5) times the regular rate of pay.

Under federal and state law, an employee can't give up the rights to be paid overtime and receive straight time instead.

Yet, amusement or recreation business employees must work 52 hours per week to be eligible for overtime pay.

Track employee overtime in Missouri with ClockifyOvertime exceptions and exemptions in Missouri

In Missouri, both federal and state regulations apply when it comes to overtime-exempt occupations and employees.

Federal overtime exemptions

This is the list of employees and occupations that are exempt from overtime pay under the Fair Labor Standards Act (FLSA):

- Executives, administrative employees, learned and creative professionals who earn a salary and make not less than $684 per week

- Computer employees who earn $684 per week or at least $27.63 per hour

- Highly compensated employees who make more than $107,432 a year

- Outside sales employees

Missouri overtime exemptions

The following list exempts certain occupations and employees from overtime pay under state law of Missouri:

- Voluntary work including educational, charitable, religious, or nonprofit organizations

- Foster parents

- Employees who work less than 4 months per year in a resident or day camp for children or youth

- Students who work for an educational organization and don't pay tuition, housing, or other educational fees in return

- Employees who work on or about a private residence not more than 6 hours per shift

- People with disabilities employed in a sheltered workshop, certified by the Department of Elementary and Secondary Education

- Babysitters, golf caddies, newsboys

- Commission-only employees

- Retail or service employees who work in businesses whose gross income is less than $500,000 a year

- Nonviolent criminal offenders in any correctional facility

- Certain agricultural workers

Fluctuating Workweek Method (FWW) in Missouri

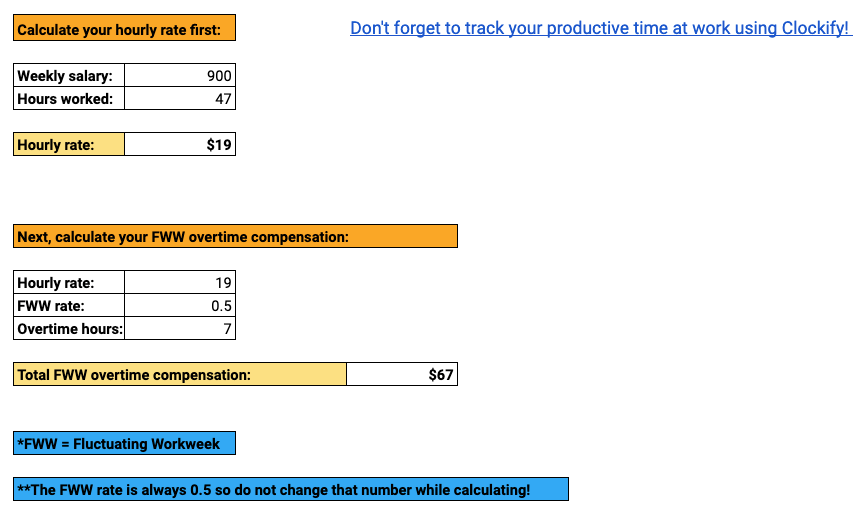

Notwithstanding, certain salaried employees in Missouri can enjoy the perks of the Fluctuating Workweek Method (FWW).

It's a work schedule that varies from week to week, and it entitles nonexempt salaried employees to an overtime premium of one-half (0.5) times their regular hourly rate.

Therefore, if employees earn a fixed salary and their workweek is “fluctuating” — sometimes they work 40 hours a week, sometimes more, or less — they are entitled to overtime, too.

Take a look at the following example:

Let's say an employee's weekly income is $850, and in the preceding week, the employee worked 47 hours.

To be able to calculate overtime hours, you need to calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week.

$850 / 47 = $18 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during the week.

$18 per hour x 0.5 = $9 for each overtime hour worked

Total overtime compensation goes as follows:

$9 x 7 overtime hours = $63

To calculate fluctuating workweek overtime pay hassle-free, we've provided a free calculator for your convenience → Fluctuating Workweek Calculator

Missouri break laws

Missouri doesn't have laws governing employee rest or lunch breaks. If provided, they're usually agreed upon by the employer and employee to increase employee productivity.

Exceptions to break laws in Missouri

Naturally, most employers do provide some kind of a break.

Under federal law, breaks lasting 5 to 20 minutes are paid work hours. Any break lasting more than 20 minutes is not observed as work hours, and such breaks are not compensable.

Finally, employees who are required to work during meal breaks must be paid for that time (telephone operators, for instance).

Missouri breastfeeding laws

Since there are no state-level laws concerning breastfeeding or expressing milk at work in Missouri — federal laws apply instead.

Under federal law, employers must provide mothers with reasonable break time to breastfeed or express breast milk for one year after the child's birth.

Moreover, employers must provide a private room, other than a bathroom, which can be solely used for breastfeeding or expressing breast milk.

Who is entitled to lactation breaks in Missouri?

All hourly employees who are not exempt from overtime pay are eligible for breaks to breastfeed or express milk.

If an employee is exempt from overtime pay, under state law — “a mother may, with discretion, breastfeed her child or express breast milk in any public or private location where the mother is otherwise authorized to be”.

Missouri leave requirements

In the state of Missouri, there are two types of leave days:

- Required leave

- Non-required leave

Missouri required leave

There are some leave days that employers in Missouri are obliged to provide their employees.

Even though such leaves are mandatory — the time off can be either paid or unpaid.

Let's take a look at some of the mandatory leaves of absence in Missouri.

Holiday leave (public employers)

State employees in Missouri are entitled to paid days off for the following legal holidays:

- New Year's Day (January 1)

- Martin Luther King, Jr.'s Birthday (Third Monday in January)

- Lincoln's Birthday (February 12)

- Washington's Birthday (Third Monday in February)

- Truman Day (May 8)

- Memorial Day (Last Monday in May)

- Juneteenth (June 19)

- Independence Day (July 4)

- Labor Day (First Monday in September)

- Columbus Day (Second Monday in October)

- Veterans Day (November 11)

- Thanksgiving Day (Fourth Thursday in November)

- Christmas Day (December 25)

When a legal holiday falls on a Sunday, it will be observed on the following Monday.

Conversely, if a legal holiday falls on a Saturday — it will be observed on the preceding Friday.

Sick leave (public employers)

Full-time state employees are entitled to sick leave with full pay at the rate of 10 hours per month of work or 5 hours of sick leave for each semi-month of service.

On the other hand, part-time employees get sick leave based on a pro-rata basis — proportional to the length of service or hours worked.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal labor law that obliges covered employers to provide eligible employees with up to 12 weeks of unpaid leave during a 12-month period.

Reasons for leave:

This type of leave can be used in the following cases:

- Serious health condition of the employee

- Birth and care of the employee's newborn child

- Adoption or foster care

- Care for an immediate family member (child, spouse, or parent) with a serious health condition

Who is eligible for FMLA?

Employees are eligible for FMLA if they:

- Have worked for their employer at least 12 months or 1,250 hours in the previous year

- Work in a business with 50 or more employees

Donor leave

Missouri grants its employees leave time for:

- Bone marrow donation — Donors obtain 5 workdays off

- Organ donation — Donors obtain 30 workdays off

Donors are entitled to their base rates during the leave of absence.

Jury duty leave

Jury duty is a civic obligation of every US citizen to serve as a juror in a court or judicial proceeding.

No statute in Missouri requires employers to offer their employees paid leave to perform jury service.

However, an employer mustn't require an employee to use annual, vacation, personal, or sick leave for time spent serving on a jury.

Voting leave

Any employee who has a right to vote in the state of Missouri is entitled to 3 hours off for the purpose of voting at any election within the state.

The employer is not allowed to discriminate against the employee who wishes to vote nor deduct any wages due to voting absence.

Leave for victims of domestic or sexual violence

Under the Victims' Economic Safety and Security Act (VESSA) — employees who are victims of domestic or sexual violence are entitled to unpaid leave from work to:

- Seek medical help to recover from physical or psychological violence

- Seek counseling

- Relocate or take other precautions to maintain safety

- Seek legal assistance or remedies

Also, if an employee household member has been a victim of domestic or sexual violence, such employee is entitled to unpaid leave from work, too.

Employers with 50 or more employees must offer employees who are victims of domestic or sexual violence up to 2 workweeks of time off.

On the other hand, employers with at least 20 but not more than 49 employees must provide a total of 1 workweek of unpaid leave.

Volunteering leave

Members of disaster service organizations or certified American Red Cross volunteers may be granted paid leave from work of up to 120 work hours per year to perform disaster relief services.

Such employees shall receive regular wages for the time they are absent from work.

Military leave

All Missouri employees have a right to leave of absence without loss of pay or any other benefit to be engaged in the performance of duty or training in the service of this state.

Employees receive 120 hours (three 40-hour workweeks) of paid military leave per year.

Missouri non-required leave

The following leave benefits are not required by Missouri law but are at the discretion of each employer.

Holiday leave (private employers)

Private employers in Missouri are not required to give employees time off on holidays — paid or unpaid — nor provide premium pay for working on such occasions.

Vacation leave

Employers are not required to provide employees with vacation leave — whether paid or unpaid.

Also, an employer may choose to offer such benefits to some employees and not to others as long as it's not based on discrimination upon age, race, sex, etc.

Sick leave (private employers)

Likewise, private employers don't have to offer sick leave to employees — paid or unpaid.

Bereavement leave

This leave is taken following the death of a relative, coworker, or close friend.

In Missouri, though, employers don't need to provide time off in such circumstances.

Shared leave

The Shared Leave Program of Missouri allows eligible employees to donate their accrued hours to a “shared leave pool”.

Employees (and their immediate family members) who have experienced catastrophic events such as an illness, injury, etc., and spent their own leave benefits can use those shared leave hours from the shared pool to address their issues.

Who can donate hours?

Employees eligible to donate leave to the shared leave pool need to have at least 6 months of service performed — and they can't donate their sick leave.

All donations are voluntary and confidential, and no one can intimidate or threaten another employee to donate or receive leave under this program.

Furthermore, donor employees don't receive any compensation for donating their accrued hours to the shared pool.

Child labor laws in Missouri

Unlike other states, Missouri child labor regulations explicitly apply to minors under the age of 16.

Children under 14 years of age are not allowed to work in Missouri, with some exceptions, including minors working in:

- Agriculture

- Entertainment

- Casual jobs like babysitting, yard work, newspaper delivery, etc.

Employers who employ minors must comply with the child labor provisions to make sure they eliminate hazards but also train minors to recognize hazards in the workplace and carry out work safely.

Anyone who wishes to employ a minor under the age of 16 must obtain a work certificate from the school, or the parent if the minor is home-schooled.

Yet, the work certificate is not needed for minors over 12 who work occasional jobs such as babysitting, yard work, newspaper delivery, etc.

Work time restrictions for Missouri minors

With regards to acceptable work hours for youth employment in Missouri, only minors aged 14 and 15 are subject to restrictions.

| Time restrictions for minors aged 14 and 15 | |

| Labor Day to June 1st (while school is in session) |

June 1st to Labor Day (while school is not in session) |

| 7 a.m. – 7 p.m. | 7 a.m. – 9 p.m.* |

| Up to 3 hours of work a day | Up to 8 hours of work a day (including weekends or school breaks) |

| Up to 6 days a week | Up to 6 days a week (40 hours a week) |

Prohibited occupations for Missouri minors

The following is a list of prohibited occupations and unacceptable workplaces and tasks for minors under the age of 16:

- Door-to-door sales (excluding sales related to churches, scouts, schools, charitable organizations)

- Operating ladders, scaffolding, freight elevators, cranes, hoisting machines, etc.

- Handling/maintaining power-driven machinery (except for lawn/garden equipment in a domestic setting)

- Mining, quarrying, or stone cutting/polishing (except in jewelry shops)

- Transporting or handling Type A and B explosives or ammunition

- Operating any motor vehicle

- Metal-producing industries including stamping, punching, cold rolling, shearing, or heating

- Saw mills or cooperage stock (barrel) mills or where woodworking machinery is used

- Jobs involving ionizing or non-ionizing radiation or radioactive substances

- Jobs in hotels, motels, or resorts unless the work performed is physically separated from the sleeping accommodations

- Jobs in any alcoholic beverage establishments including selling, manufacturing, bottling or storing unless 50 percent of the workplace sales are generated from other goods

- Any job dangerous to the life, limbs, health, or morals of youth

Breaks for Missouri minors

No state or federal laws require or regulate break or meal periods when it comes to youth employment.

However, Missouri law strictly requires breaks and rest periods in the entertainment industry.

Minors employed in the entertainment industry can't work more than five and one-half (5.5) hours without a break.

Also, a 15-minute rest period is required after each 2 hours of work.

Posting requirements for employers hiring minors in Missouri

Employers who wish to hire minors must keep the following documentation in a conspicuous place where a minor is employed:

- A copy of the work certificate

- Name, address, and age of the minor

- Times and hours worked by the minor each day

- Employer's Employing Workers Under the Age of 16 List

Missouri hiring laws

While hiring new employees, certain employment practices in Missouri are considered discriminatory — hence illegal.

No employer can base their hiring decisions on stereotypes, prejudice, or discrimination of any type.

The following are prohibited employment practices in Missouri.

Unlawful employment practices under the Missouri Human Rights Act (MHRA)

The Missouri Human Rights Act (MHRA) makes it illegal for an employer to discriminate against or make any hiring decisions on the basis of:

- Age — The act protects individuals aged 40 to 69 from employment discrimination.

- Race or color — It's illegal to deny employment and offer lower wages due to a person's racial group or race-linked characteristics such as hair texture, color, or facial features.

- Religion — It's forbidden to treat someone unfairly because of their religious beliefs or practices or to force them to participate or not participate in a religious activity as a condition of employment.

- National origin or ancestry — Treating someone unfairly because of their ethnicity, place of birth, or accent — provided that the person in question is in the country legally — is considered illegal.

- Sex — No employer can deny equal employment opportunity based on a person's gender or use any words or perform actions with a sexual connotation, or request for sexual favors as a condition of employment.

- Disability — No employer can treat an individual unfavorably because they have a physical or mental impairment.

- Marriage — Employers mustn't discriminate against an individual based on who they are married to or associated with (person of a particular race, religion, origin, etc.).

The Missouri Human Rights Act (MHRA) applies to all public and private employers with 6 or more employees.

Other unlawful employment practices in Missouri

Furthermore, Missouri hiring laws forbid employers from:

- Using any genetic information or genetic test results of a prospective employee to make unjustified hiring decisions.

- Discriminating against an individual on the basis that such individual has HIV infection or AIDS provided that such condition doesn't prevent that person from performing job-related duties or poses a threat to others.

- Refusing to hire an individual for alcohol or tobacco use off the premises.

However, public employers may show a preference for hiring a fully qualified veteran or a disabled veteran over other applicants.

Missouri termination laws

Missouri is another US state that follows the at-will employment doctrine.

It's an employment agreement where an employer may terminate an employee at any time and for no reason at all. Naturally, this law prohibits discrimination based on sex, age, race, retaliation, etc.

At the same time, an employee may resign from their job at any time for any reason without any losses or penalties.

If someone feels they've been discriminated on a job or during a hiring process — they may file a complaint of discrimination with the Missouri Commission on Human Rights.Missouri final paycheck

Upon termination of employment — whether voluntary or involuntary — employers must pay all wages due to a discharged employee at the time of termination.

If an employer doesn't pay off the discharged employee on time, the employee should request wages via a certified mail receipt. In such a case, the employer must pay the employee wages due within 7 days of receiving the mail.

If, however, the employer doesn't pay the wages due within that period — the employee receives additional wages or can even take legal action against the employer.

Health insurance continuation in Missouri

Missouri applies both federal and state laws concerning health insurance coverage for terminated employees.

The federal Consolidated Omnibus Budget Reconciliation Act (COBRA) covers businesses with 20 or more full-time employees.

Upon job termination — whether voluntary or involuntary — a terminated employee and their dependents (child, spouse) have the right to continue using their health benefits for another 18 to 36 months.

The duration of health coverage depends on the severity of the qualifying events — such as disability, death, divorce, etc.

Since COBRA only covers businesses with 20 and more employees — Missouri State Continuation provides health coverage to employers with 19 or fewer employees.

Finally, no federal or state law allows a terminated employee to extend their health insurance benefits in the case of gross misconduct.

Workplace safety in Missouri

Most work-related injuries happen due to the absence of supervision and workplace safety training.

For that reason, under the Occupational Safety and Health Administration (OSHA) and the Mine Safety and Health Administration (MSHA), employers in Missouri are obliged to comply with safety rules and provide workers with a safe workplace free from recognized hazards.

There are 6 main types of hazards in the workplace recognized by OSHA:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Things that cause stress.

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

OSHA authorities have a right to enter a workplace at any time to make sure regulations and safety measures are being followed.

Workplaces that are not in compliance with the requirements laid out in OSHA can earn fines of up to $145,027.

Visit this website to find the nearest OSHA office → OSHA offices in MissouriMiscellaneous Missouri labor laws

Last but not least, we can review some miscellaneous Missouri labor laws that do not strictly fit into the previously mentioned categories. These include the following:

- Whistleblower laws

- Recordkeeping laws

Missouri whistleblower laws

By the Whistleblower's Protection Act of Missouri, it's unlawful for an employer to take any adverse action against a protected person, i.e., an employee who reports any labor violation to the authorities.

If a protected person suffers any disciplinary action because they've “blown the whistle” — they have a right to file a case and obtain:

- Back pay

- Reimbursement of medical bills

- Double the amount of the foregoing remedies

This law applies to employers with 6 or more employees — but excludes:

- The state of Missouri or its agencies

- Political subdivisions

- Higher education institutions

- State-owned corporations

- Religious or sectarian organizations

Missouri recordkeeping laws

The following is a list of the recordkeeping requirements that each Missouri employer must maintain:

- Name

- Address

- Occupation

- Rate of pay

- The amount paid each pay period

- Hours worked each day and week

- Any goods or services provided by the employer to the employee

Employers must keep the said records on or about the premises for a period of not less than 3 years. Moreover, the records need to be available and open for inspection to the director when requested.

Conclusion/Disclaimer

We hope this Missouri labor law guide has been helpful. We advise you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this Missouri labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

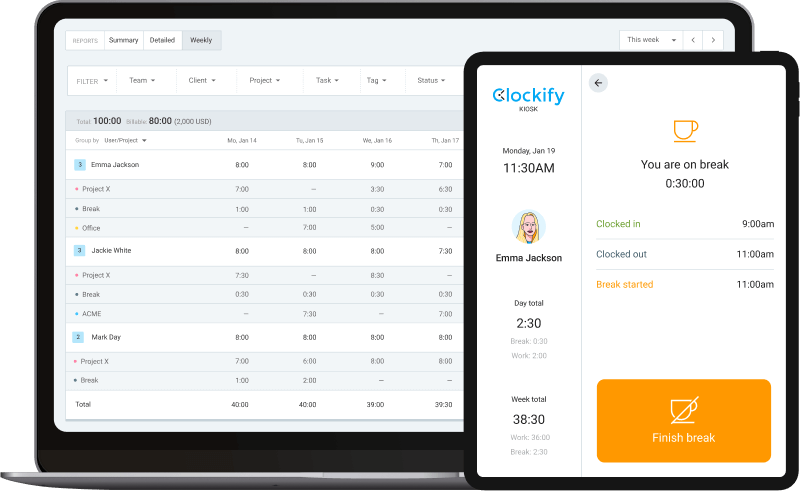

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).