Nebraska Labor Laws Guide

Ultimate Nebraska labor laws guide: minimum wage, overtime, breaks, leave, hiring, termination, and miscellaneous labor laws.

| Nebraska Labor Laws FAQ | |

| Nebraska minimum wage | $9 per hour |

| Nebraska overtime lawss | 1.5 times the rate of regular pay after working 40 hours in a workweek ($13.50 per hour for minimum wage workers) |

| Nebraska break laws | Meal and rest breaks not required by law |

Table of contents

Nebraska wage laws

The first segment of Nebraska labor laws we will cover in this guide are laws concerned with wages. We divided these laws into the following subcategories:

- Minimum wage in Nebraska

- Tipped minimum wage in Nebraska

- Subminimum wage in Nebraska

- Exceptions to the minimum wage in Nebraska

- Nebraska payment laws

| MINIMUM WAGE IN NEBRASKA | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage (Training wage) |

| $9 | $2.13 | $4.25 |

Nebraska minimum wage

Currently, Nebraska’s minimum wage is $9, on an hourly basis.

This amount exceeds the federal minimum wage, which, at this moment, amounts to $7.25.

Nebraska state minimum wage laws do not apply to employers with fewer than 4 employees — the employees are covered by federal law.

Tipped minimum wage in Nebraska

Employees who regularly earn more than $30 a month in tips at their place of employment are considered “tipped employees” under federal law.

Employers can pay this category of employees a tipped minimum wage of $2.13.

However, if the employee’s tips combined with their direct wage do not total at least the federal minimum wage ($7.25) — the employer must cover the difference.

Track work hours and calculate hourly pay with ClockifySubminimum wage in Nebraska

Any wage that is lower than the minimum wage is considered a subminimum wage.

In Nebraska, student learners can be paid at 75% of either the state or the federal minimum wage, whichever one applies.

As for employees with mental or physical disabilities, under the provisions of the FLSA, they can be paid a special subminimum wage, in proportion with the reduced output of the employees.

Furthermore, the only employers that can pay a reduced wage are so-called “sheltered workshops”, certified by the State.

However, a bill to eliminate the subminimum wage for employees with disabilities has been introduced, and is expected to be passed in the near future.

Additionally, Nebraska employers may choose to pay a training wage of $4.25 per hour for employees under 20, for the first 90 days of employment.

Employers may extend this period for an additional 90 days if the training is needed to acquire skills necessary to perform the job and if the Commissioner of Labor has approved of this extension.

Exceptions to the minimum wage in Nebraska

Generally speaking, all Nebraska employers with fewer than 4 employees are exempt from minimum wage requirements.

Among the employers with 4 or more employees, some of the following occupations are also excluded from minimum wage requirements:

- Agricultural workers

- Babysitters employed in private homes

- Executive, administrative, professional employees

- Supervisors and superintendents

- Apprentices

- Children employed by their parents

Nebraska payment laws

Nebraska employers are required to pay all due wages to their employees on regularly scheduled paydays.

Any changes to the payment schedule must be announced to the employee 30 days in advance.

Track employee payroll with ClockifyNebraska overtime laws

Nebraska uses the federal Fair Labor Standards Act (FLSA) laws to regulate overtime requirements, as well as exceptions.

According to this act, all work exceeding 40 hours in a workweek is considered overtime.

Furthermore, all overtime work should be paid at the rate of 1.5 times the regular pay.

Overtime exceptions and exemptions in Nebraska

Occupations which are exempt from overtime requirements include:

- Administrative employees

- Professional employees

- Executive employees

Additionally, in order to be exempt from overtime requirements, these employees must be paid on a salary basis, at a rate of no less than $684 per week.

These provisions of Nebraska law are identical to federal FLSA — the notable discrepancy being that Nebraska state law does not exempt computer employees and outside salespersons.

Nebraska break laws

Broadly speaking, there are no federal or state regulations that require Nebraska employers to provide breaks for their employees.

However, if the employer has a policy allowing breaks, the following federal regulations apply:

- Rest breaks — breaks lasting up to 20 minutes are to be counted into work hours, and paid at the regular rate.

- Meal periods — to be unpaid, meal breaks must be at least 30 minutes long, and the employee must be relieved of all duties for their duration.

Exceptions to break laws in Nebraska

Exceptions to Nebraska break laws exist for employers with one or more employees, operating the following types of businesses:

- Assembling plants

- Workshops

- Mechanical establishments

These employers must provide their employees a meal break of at least 30 minutes.

Additionally, employees are not required to stay on company premises during this period.

Nebraska breastfeeding laws

Under federal FLSA provisions, Nebraska employers with 15 or more employees need to provide reasonable time and facilities for nursing mothers to express their breast milk.

Adequate facilities for this activity must be private and clean, meaning that using toilet stalls is not acceptable.

Employees are entitled to breastfeeding breaks for up to 1 year after childbirth.

Furthermore, Nebraska’s Fair Employment Practice Act provides additional protection for employees not covered by federal law, stating that employers must provide “reasonable accommodation for breastfeeding employees”.

However, this law does not specify the type of facilities the employer must provide, nor the duration of time after childbirth the employee can use breastfeeding breaks.

Track employee productivity with ClockifyNebraska leave requirements

Here, we can review the types of leave required, as well as those not required under Nebraska law.

Nebraska required leave

We can begin with the types of leave required by Nebraska law:

- Family and medical leave

- Sick leave (public employees)

- Jury duty leave

- Voting time leave

- Military leave

- Military family leave

Family and medical leave

Under the federal Family and Medical Leave Act, some Nebraska employees may be eligible for up to 12 weeks of unpaid leave following major life events.

Some types of the qualifying events for the family medical leave include:

- Giving birth and caring for a newborn

- Adopting or taking in a foster child

- Suffering an incapacitating health condition

- Caring for a family member with a serious health condition

As an additional requirement, the employee must have worked for the same employer for at least 12 months before taking the leave, as well as having worked at least 1,250 hours in those 12 months.

Family and Medical Leave Act FAQSick leave (public employees)

State employees have the right to paid sick leave, accrued at the rate of 8 hours per each calendar month of service.

Bereavement leave

State employees are entitled to up to 5 days of bereavement leave if the deceased was part of the immediate family.

Additionally, if the deceased was not a member of the immediate family, the employee’s supervisor can grant 1 day of bereavement leave.

Jury duty leave

Nebraska employees summoned to jury duty should be able to conduct this service without interference from their employer.

Employers are forbidden from discharging, demoting, or in any other way disciplining an employee who chooses to attend jury duty.

Holiday leave

All full-time state employees have the right to paid holiday leave for all state-approved holidays.

Voting time leave

Nebraska employees who do not have 2 consecutive hours of time to vote (due to their work hours) can ask for a paid voting leave.

This request needs to be put in at least two days in advance, and it allows the employee at least two hours of time to vote immediately after or before the polls close.

Military leave

State employees who are members of military service, and who are called to active duty, have a right to military leave.

The first 120 hours of this leave (within a calendar year) are paid, while any exceeding time off for this purpose can be unpaid.

Under provisions of the Uniformed Services Employment and Reemployment Rights Act (USERRA), service members who return to their employment within 5 years have to be reinstated to a similar position, without loss of seniority advancements.

Military family leave

Nebraska employers with at least 15 employees must provide time off to an employee who is the spouse or parent of a military service member called into active duty.

The active duty term must be at least 179 days long.

Additionally, to become eligible for this leave, employees must have worked for the company for at least 12 months and for at least 1,250 hours in the 12 months prior to the beginning of the leave.

The duration of paid family military leave depends on the size of the employer:

- Employers with 15 to 49 employees are required to provide up to 15 days of paid time off

- Employers with 50 or more employees are required to provide up to 30 days of paid leave

Nebraska non-required leave

Following are the types of leave not required by Nebraska law:

- Sick leave (private employees)

- Bereavement leave

- Vacation and holiday leave (private employees)

- Emergency response leave

Sick leave

Private employers do not need to provide sick leave to employees.

Bereavement leave

Nebraska private employers do not need to provide bereavement leave.

Vacation and holiday leave

Private employers do not need to provide vacation or holiday leave to Nebraska employees.

Emergency response leave

Private employers do not have to provide emergency response leave to volunteer employees.

State agencies cannot discharge employees who respond to emergencies, provided that they are government-approved, registered volunteers.

However, the employer does not have to pay the employee for any missed work hours.

Child labor laws in Nebraska

Nebraska uses a combination of federal and state child labor laws to define legal working hours, as well as prohibited occupations for minors.

Legal hours are different for two age groups:

- Minors under 16, and

- Minors aged 16 and 17.

Labor laws for minors under the age of 16

Minors under the age of 16 can work the following hours:

- From 7 a.m. to 7 p.m. while school is in session (extended to 9 p.m. while school is out)

- No more than 3 hours on a school day and no more than 18 hours on a school week

- No more than 8 hours in a day and no more than 40 while school is out of session

In order to work before 6 a.m. or after 10 p.m. (when there is no school the following day), minors must acquire a special work permit.

This permit is issued for a period of up to 90 days, and it can be renewed. Both the permit and the renewal are issued at the price of $10.

Labor laws for minors aged 16 and 17

There are no particular work hours restrictions for minors aged 16 and 17.

Prohibited occupations for minors

Apart from work hour restrictions, minors in Nebraska are also banned from working in hazardous occupations, such as:

- Manufacturing or storing explosives

- Operating motor vehicles

- Coal mining

- Operating power-driven machinery

- Logging and saw milling

- Roofing

Hiring laws in Nebraska

Under the Nebraska Fair Employment Practice Act (FEPA), employers are forbidden from discriminating against applicants in the hiring process, on the basis of their:

- Race or color

- Religion

- Sex

- National origin or ancestry

- Disability

- Marital status

Additionally, the Nebraska Age Discrimination in Employment Act prohibits hirig bias against workers aged 40 and above.

Nebraska Right-to-Work law

Nebraska is one of the 28 US states which have the so-called “Right-to-Work” laws, aimed at limiting the influence of union organizations.

They do this by prohibiting employers from asking applicants to join a union as a term of employment.

Veterans Preference Act

Nebraska laws give hiring preference to eligible veterans, service members, as well their spouses — both in the private and the public sector.

For positions in the private sector (which require numerical scoring), all veterans with passing scores are to get 5% added to their scores. Furthermore, disabled veterans get an additional 5% to their score.

As for the private sector, the Voluntary Veterans Preference Act allows employers to register with the Nebraska Voluntary Veterans Preference Registry, and use their policies in the hiring process.

The Voluntary Veterans Preference Registration FormTermination laws in Nebraska

Nebraska belongs to the majority of US states which employ the doctrine of “at-will” employment.

This means that either party (the employer or the employee) can terminate the employment for any reason, and at any time.

This, however, does not apply to cases where termination happens due to discrimination on the basis of previously listed Fair Eemployment Practices Act (FEPA) requirements..

To briefy rehash said requirements, firing someone due to their race, color, religion, sex, national origin, ancestry, disability, or marital status — is still considered wrongful termination.

Final paycheck in Nebraska

All earned wages for employees who leave or are dismissed from employment are due on the next regularly scheduled payday, or within two weeks of termination — whichever comes first.

Nebraska COBRA laws

Upon termination, workers may use the provisions of the Consolidated Omnibus Budget Reconciliation Act (COBRA) to continue their health insurance for up to 36 months.

This federal act covers employers with 20 and more employees.

But, Nebraska has its own Mini - COBRA laws, which cover smaller employers.

If the employee files a request with the local authorities within 90 days of termination, they may be eligible for a health premium at 102% of the original price.

Occupational safety in Nebraska

Workers’ health and safety in Nebraska is under supervision of the federal Occupational Health and Safety Administration (OSHA).

This agency is in charge of following up on any reports of workplace hazards, as well as conducting workplace safety checks.

Nebraska OSHA OfficesMiscellaneous Nebraska labor laws

In the end, we will take a look at some of the miscellaneous Nebraska labor laws, which do not fit into the previously mentioned categories. These include the following:

- Whistleblower protection laws

- Background check laws

- Employer use of social media regulations

- Drug and alcohol testing laws

- Employee Classification Act

- Record-keeping laws

Whistleblower protection laws (State Government Effectiveness Act)

Nebraska’s State Government Effectiveness Act offers protection for state employees who chose to become whistleblowers for government agency inefficiencies or misconduct.

Cases covered under this act include:

- The violation of any state or federal law

- “Gross” misuse or waste of funds

- “Substantial and specific” instances of situations that represent a danger to public health or safety

The listed violations should be reported to Nebraska’s Ombudsman Office, which will follow up on the report, as well as address any threats or retaliation against an employee filing these claims.

Background check laws

Public sector employers, under Nebraska law, are not allowed to ask an employee or an applicant for information about their criminal record or background.

As for private employers, those who choose to conduct background checks must comply with the federal Fair Credit Reporting Act (FCRA).

Occupations in which background checks are required include:

- Child care providers

- Child center volunteers

- Residential adult care facility staff

Employer use of social media regulations (Workplace Privacy Act)

Under Nebraska’s Workplace Privacy Act, employers are forbidden from asking an employee or an applicant to:

- Provide any login information to a personal account on the Internet

- Log in to their account in the presence of the employer

- Add anyone to their account’s list of contacts

Employers are prohibited from discharging, disciplining, or in any other way retaliating against an employee who refuses to comply with any of the requests listed above.

Drug and alcohol testing laws

Employers in Nebraska are not required to test their employees for the presence of drugs and alcohol.

However, if they choose to do so, any and all results of the testing are to be kept confidential — unless their disclosure is required by law or by the employee.

Employee Classification Act

Nebraska has a special act, called the Employee Classification Act, which prevents the classification of delivery service and construction workers as subcontractors.

This way, employees in these positions are protected from:

- Unfair tax withholding,

- Unemployment insurance, and

- Employee compensation insurance practices.

Record-keeping laws

All Nebraska employers are required to keep records of details of employment for each of their workers for at least 4 years.

Some of the employee information that needs to be kept includes:

- Employee name

- Social security number

- Place of residence

- Type of service the employee provides

- Date of hire

- Amount of wages paid to the employee

In addition to employee information, employers must keep record of general employment practices, such as:

- Start and end date of pay periods

- Total amount of compensation due to be paid to employees in each calendar quarter

- Total amount of compensation paid to employees in each calendar quarter

Conclusion/Disclaimer

We hope this Nebraska labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this Nebraska labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

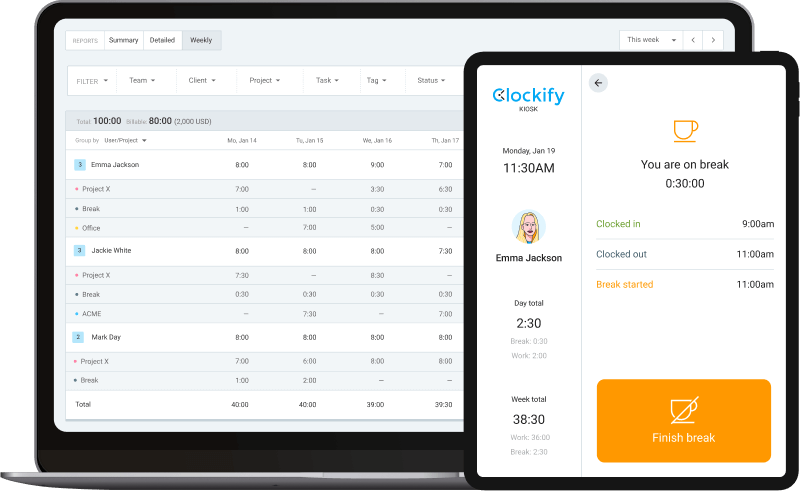

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).