New Hampshire Labor Laws Guide

Ultimate New Hampshire labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| New Hampshire Labor Laws FAQ | |

| New Hampshire minimum wage | $7.25 |

| New Hampshire overtime | 1.5 times the rate of the standard wage ($10.875 for workers earning minimum wages) |

| New Hampshire break laws | 30-minute meal break for all employees working for 5 consecutive hours 24-hour rest day after working for 7 consecutive days |

Table of contents

New Hampshire wage laws

The state of New Hampshire has an amalgamated set of state and federal laws regarding minimum wages — it often relies on federal standards, but there are a few exceptions.

The exact numbers for the regular minimum wage, tipped minimum wage, and subminimum wage in New Hampshire are expressed in the table below.

| NEW HAMPSHIRE MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $3.27 | $7.25 |

New Hampshire minimum wage

State laws require that all New Hampshire employers, regardless of the profession, keep a true record of all work hours on a daily basis for all employees.

The minimum wage rate in New Hampshire matches the federal minimum requirements, which are set at $7.25.

The federal rate has not changed since 2008 when it was last increased by $0.70.

The New Hampshire Minimum WageTipped minimum wage in New Hampshire

The current tipped minimum wage in New Hampshire amounts to at least 45% of the current federal and state minimum wage — which amounts to at least $3.27.

To be eligible for the state tipped minimum wage, a person has to be an employee of food service facilities, such as the following:

- Restaurants,

- Motels,

- Inns,

- Cabins, and

- Hotels.

Also, they have to be regularly receiving at least $30 in tips per month to be considered a tipped employee by federal standards.

New Hampshire tipped employees are in no way required to participate in tip pooling or any sort of tip-sharing arrangements.

However, if they choose to do so, employers can serve as mediators regarding any confusion or dispute concerning the sharing pool.

Track work hours and hourly pay with ClockifyNew Hampshire subminimum wage

The state of New Hampshire has no limitations regarding the subminimum wage, as defined in the Fair Labor Standards Act (FLSA) for people with disabilities.

Therefore, they will not be paid less than the federal minimum wage rate, which amounts to $7.25.

The same minimum wage applies to the following:

- Learners,

- Student-workers, and

- Apprentices.

When it comes to trainees, employers in the state of New Hampshire can pay a training wage of not less than 75% of the state minimum wage — if the trainee has less than 6 months of experience in the field.

Since the minimum wage amounts to $7.25, employers cannot pay trainees less than $5.44 per hour.

If an employee is enrolled in a high school or a post-secondary school, the employer can file for an application with the Department of Labor to pay the student subminimum wages or no wages at all if the student is working for practical experience.

Track employee payroll with ClockifyExceptions to the minimum wage in New Hampshire

Exceptions to the minimum wage can be made for employees exempt on a federal basis under 29 U.S.C. section 213(a).

In federal terms, the exceptions to the minimum wage include the following:

- Executive employees who are paid not less than the state minimum wage,

- Administrative employees who are paid not less than the state minimum wage,

- Professional employees who are paid not less than the state minimum wage, and

- Highly compensated employees who earn more than $500,000 in gross annual incomes.

Moreover, the New Hampshire state laws exempt the following lines of work:

- Household, domestic, and farm labor,

- Newspaper delivery,

- Outside sales,

- Summer camps, and

- Golf and ski track maintenance.

The list also includes tipped employees that receive $3.27 per hour and exempt organizations, such as non-profits and educational institutions.

FLSA minimum wage exemptionsNew Hampshire payment laws

There are no specific laws regarding the frequency of payments.

However, employers can choose whether they’ll make payments on a weekly, bi-weekly, or monthly basis.

If the employer opts for weekly payments, they must make them within 8 days after the workweek has expired.

If, on the other hand, they choose to pay employees on a bi-weekly basis, they must do so within 15 days after the expiration of the two workweeks.

Exceptions can be made for less frequent payments if the employer has filed for authorization from the commissioner of the Department of Labor.

All payments must be made:

- In lawful US money,

- Via electronic fund transfers and payroll cards, and

- Through checks and direct deposits.

New Hampshire overtime laws

The state of New Hampshire follows federal regulations when it comes to overtime laws.

According to the FLSA, all non-exempt employees that work over 40 hours per week are entitled to overtime compensation that amounts to 1.5 times the rate of the minimum wage.

An important thing to keep in mind is that overtime is calculated on a weekly and not daily basis, which is the case with some US states.

The minimum wage in New Hampshire is equal to the federal standard — $7.25 — which means that an hour’s worth of overtime amounts to $10.875.

Track New Hampshire overtime with ClockifyOvertime exceptions and exemptions in New Hampshire

Since the New Hampshire statute follows FLSA regulations on overtime pay, similar conditions apply when it comes to overtime exceptions and exemptions.

Generally, exemptions to overtime in New Hampshire include the following:

- Executive and administrative employees that make a minimum of $684 per week or $35,568 on an annual basis,

- Outside sales employees,

- Professional employees (artists, teachers, skilled computer professionals, etc.), and

- Highly compensated employees who make more than $107,432 a year.

Furthermore, New Hampshire laws also include the following professions in overtime exceptions:

- Household, domestic, and farm labor,

- Newspaper delivery,

- Summer camps, and

- Golf and ski track maintenance.

Also, employees that work in seasonal, recreational, and amusement establishments are exempt from overtime laws if the establishment does not operate on the location for more than 7 months during a calendar year.

New Hampshire break laws

Unlike overtime laws, the state of New Hampshire does not adhere to federal laws when it comes to breaks.

All employees in the state of New Hampshire, regardless of the working sector, are entitled to a 30-minute meal break after working for 5 consecutive hours.

If the employee is a minor, the breaks can be prolonged at the discretion of the employer, in which case the general rule will be overturned.

As for any rest periods — the employer is not obligated to provide any.

Exceptions to break laws in New Hampshire

If the job description allows the employee to work and have a meal at the same time, the break time will be paid — otherwise, the break time is unpaid.

Even though employers are not legally required to provide rest periods, the general consensus is that they will offer a 24-hour rest day after working for 7 consecutive days.

New Hampshire breastfeeding laws

According to New Hampshire law, all mothers are free to breastfeed in public if they are legally allowed to be at the location.

However, when it comes to the workplace, the New Hampshire Breastfeeding Task Force has a difficult task considering that the law has a vague definition of a woman’s right to breastfeed in the workplace.

Namely, the state law does not explicitly state the words “lactation” or “expressing milk” — but the federal law enables women to take reasonable breaks in a designated area for expressing milk.

Still, employers can apply for exemptions if the business has 50 or fewer employees and if the frequent breaks are causing undue hardships.

New Hampshire leave requirements

The FLSA does not require employers to provide time off. Still, many employers will offer paid time off as a way to keep employees satisfied.

On the other hand, there are certain regulations in each state that require employers to offer certain types of time off, in general.

Depending on the circumstances, leave in the state of New Hampshire can be:

- Required

- Non-required

New Hampshire required leave

The following are the types of leave time that employers are obligated to provide to their employees:

- Family and Medical Leave (FMLA)

- Jury duty leave

- Emergency response leave

- Crime victim employment leave

- Pregnancy and disability leave

- Military leave

- Holiday leave (public employers)

Family and Medical Leave (FMLA)

Many US states have their own versions of the Family and Medical Leave (FMLA) — but the state of New Hampshire is not one of them. Therefore, the standard federal leave laws apply.

The Family and Medical Leave laws are designed to protect employees in cases of family and medical emergencies.

Such emergencies include:

- Caring for a sick family member,

- Maternity/paternity leave within a year from the birth of a child,

- Health conditions, and

- Difficulties stemming from a family member being on military duty.

In order to receive FMLA benefits, an employee has to meet certain criteria, such as:

- Be employed at a business for at least a 12-month period,

- Record at least 1,250 hours working hours at a business, and

- Work in a business with at least 50 employees within 75 miles.

If the criteria are met, the employee will be granted 12 weeks of unpaid leave to use once during a period of 12 months. After a calendar year has expired, the FMLA renews and can be used again.

Moreover, the FMLA covers military caregiver leave — a type of leave an employee can use if a spouse or a family member is injured on military duty.

An important note — if the person were to be injured again, the military caregiver leave cannot be used again.

Jury duty leave

New Hampshire employers are required to provide either unpaid or paid leave for jury duty and jury selection.

Based on the time that the employee has spent on jury duty, they might be required to provide jury summons to the employer as validation.

Also, if the absence from work might cause the employer undue hardship, the court can excuse the employee from jury duty with the proper documentation.

Emergency response leave

If an employee finds themselves in a situation where they can act as a “first responder,” the employer must provide a leave of absence in the state of New Hampshire.

Such policies are governed by the Office of Homeland Security and Emergency Preparedness, and they usually apply to people employed as:

- Medical personnel and technicians,

- Firefighters, and

- Law enforcement officers.

Crime Victim Employment Leave Act

As of 2006, New Hampshire has become one of the US states to incorporate the Crime Victim Employment Leave Act into their statute and offer help to employees that are crime victims.

All employers in the state of New Hampshire are required to offer unpaid leave time to an employee under this act if the employee is:

- A crime victim,

- An immediate family member of a homicide victim,

- An immediate family member of an incompetent family member (as defined by the law) who is a crime victim, and

- A legal guardian of a minor who is a crime victim.

After the employee has filed for the proper documentation and provided the employer with it, they will be granted the leave for a required amount of time.

If, however, the leave can put the employer in a position of “undue hardship”, the employer can limit the absence.

Pregnancy and disability leave

New Hampshire state law obliges employers to provide leave to employees if they're unable to work due to the following reasons:

- Pregnancy,

- Childbirth,

- Taking care of a newborn, and

- Pregnancy/childbirth-related medical conditions.

A physical and mental exam by a professional will determine when the employee is fit to return to work, and they will be reinstated to their previous position at the place of work.

Military leave

If a full-time employee is summoned to engage in military drills, training, and/or temporary duty, the employers in the state of New Hampshire are obligated to provide them with a 15-day absence with full pay.

This provision applies to employees that haven’t been inducted or enlisted in active duty in the Armed Forces.

After 15 days have passed, the employee will be granted additional 30 days of absence, if needed, with partial pay, to finish the temporary duty in the Armed Forces.

If the employee is an active soldier in the Armed Forces, the leave is indefinite — i.e., it lasts until the service in the Armed Forces has finished.

New Hampshire veterans benefitsHoliday leave (public employers)

Public employers are not obligated to provide paid holiday leave, but they are required to provide time off for state holidays in New Hampshire.

The following is the list of state holidays:

- New Year’s Day — January 1

- Martin Luther King Jr. Civil Rights Day — observed on the third Monday in January

- Washington’s Birthday — observed on the third Monday in February

- Memorial Day — observed on the last Monday in May

- Independence Day — observed on July 4

- Labor Day — observed on the first Monday in September

- Columbus Day — observed on the second Monday in October

- Election Day — observed every other year

- Veterans Day — observed on November 11

- Thanksgiving Day — observed on the fourth Thursday in November

- Christmas Day — observed on December 25

New Hampshire non-required leave

New Hampshire employers can choose if they’ll implement certain types of leave — but, the types of leaves listed below are not required by law.

The following is the list of the non-required leaves in New Hampshire that employers usually choose to implement:

- Holiday leave

- Sick leave

- Voting leave

- Bereavement leave

Holiday leave (private employer)

A New Hampshire private employer is not required to provide a leave of absence during the holidays to their employees — but they generally choose to do so as a way of improving team dynamics and boosting morale.

However, an employer can also request such employees to work during the holidays for an overtime wage of 1.5x hourly rate — if the contract of employment does not specify otherwise.

Sick leave

Employers are not required to provide sick days under their policies for leaves of absence.

They can choose to do so, in which case they will have to comply with their sick leave policy since it will be reviewed by the commissioner of the Labor and Industry.

The policy has to specify the use of sick days and the accrual methods.

Voting leave

The employers are not required to provide time off for voting purposes under any state law in New Hampshire.

However, there is a section in the statute regarding “absentee voting” — any employee that cannot physically be present at the voting stations due to employment obligations — e.g., traveling on business — will be considered an “absent voter” and granted the right to vote from a different location.

Bereavement leave

In a similar fashion, employers are not required to offer paid or unpaid leave of absence for bereavement — funerals, grieving periods, etc.

If they choose to do so, the exact information regarding the policy has to be delivered to the employees in writing or posted with the rest of the employment policies in a conspicuous place on the working premises.

Child labor laws in New Hampshire

Child labor laws, whether federal or state, are always designed to protect minors from exploitation at work.

This always includes protection from:

- Physical,

- Moral, and

- Emotional hazards.

The state of New Hampshire institutes a set of child labor laws prescribed by both the New Hampshire Department of Labor and the US Department of Labor.

Firstly, no minor under the age of 16 can be employed until they have acquired a New Hampshire Employment Certificate from the Superintendent of Schools in their hometown, i.e., the town/city where they go to school.

The Certificate has to be obtained during the course of the first 3 business days if the employer wants to avoid penalties.

No minor aged 16 and 17 will be employed in the state of New Hampshire until two conditions have been met:

- The minor has graduated from high school or obtained a diploma from a school with similar equivalency, and

- The minor has supplied the employer with a written statement that they are permitted to work.

The written statement has to be issued by the parents or the legal guardians of the minor.

Moreover, the employer must have proof of age at the working premises at all times. The documentation containing the age of the minor can be verified with:

- A birth certificate,

- A passport,

- An immigration record, and/or

- An official identification card — I.D.

Work time restrictions for New Hampshire minors

When it comes to minors under the age of 16, two different sets of restrictions apply, based on whether they fall under the mix of federal and state laws or only state laws.

To know which category the minor employee falls under, please contact the office of the Commissioner of Labor.

Work time restrictions for New Hampshire minors up to 15 years of age

According to the federal/state amalgamation of laws, minors aged 14 and 15 cannot work:

- Before 07:00 a.m. and after 07:00 p.m., except from June 1st up until Labor Day,

- During school hours,

- More than 3 hours on school days and 8 hours on non-school days, and

- More than 18 hours per week and 40 hours on non-school weeks.

If aged 12, 13, 14, and 15 and subjected to state laws only, minors may not work:

- Before 07:00 a.m. and after 09:00 p.m.

- During school hours,

- More than 3 hours on school days and 8 hours on non-school days, and

- More than 23 hours per week and 48 hours on non-school weeks.

Work time restrictions for New Hampshire minors aged 16 and 17

When it comes to minors aged 16 and 17, two divisions can further be made — minors that are in school and minors that have graduated or don’t go to school.

If the employee is aged 16 and 17 and is enrolled in high school, they cannot work:

- More than 30 hours/6 days consecutively during a school calendar week,

- More than 48 hours/6 days consecutively during a vacation week,

- More than 10 hours per day in manufacturing,

- More than 10 ¼ hours per day in mechanical labor, and

- More than 8 hours per night if they’re working a night shift.

If the employee is aged 16 and 17 and doesn’t attend school, they cannot work:

- More than 10 hours per day/48 hours per week in manufacturing,

- More than 10 ¼ hours per day/54 hours per week in mechanical or manual labor, and

- More than 8 hours per shift/48 hours per week if working the night shift.

Breaks for New Hampshire minors

All employees in the state of New Hampshire, regardless of age, are entitled to a 30-minute meal break after working for 5 consecutive hours.

However, If the employee is a minor, their breaks can be prolonged at the discretion of the employer, in which case the standard New Hampshire break rule will be overturned.

Prohibited occupations for minors in New Hampshire

The general consensus in all US states is that no minor can be employed in any occupation that presents a physical, emotional, or moral hazard.

The list of all prohibited occupations for minors in New Hampshire under the age of 18 includes:

- Manufacturing and working with explosives,

- Driving motor vehicles,

- Mining, logging, and sawmilling,

- Working with power-driven machinery — woodworking, metalworking, processing, etc.,

- Manufacturing bricks and tiles,

- Wrecking, demolishing, and any type of dangerous construction work, and

- Roofing and excavation.

Penalties for employing minors in New Hampshire

Employers in the state of New Hampshire can face penalties or even jail time if they violate the previously stated provisions regarding child labor laws.

The fines vary depending on the violation and can be anywhere between $500 and $10,000.

Furthermore, employers can be prosecuted and fined $50,000 in case a minor were to be injured and/or killed due to law violations on the working premises.

If the instance were to be repeated, the fine would be doubled to $100,000.

Also, according to federal law, any willful violation of child labor laws can be fined up to $10,000.

Hiring laws in New Hampshire

As the state of New Hampshire often relies on federal laws, it’s no surprise that hiring laws match the federal criteria described in the FLSA.

Namely, hiring laws are closely connected to discrimination laws that affect hiring decisions, job interviews, and regular employee workdays.

According to the federal law, all employers, regardless of the business sector, are forbidden from discriminating against employees based on:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Pregnancy and childbirth,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

Moreover, the state of New Hampshire is one of the few states that prohibit discrimination based on the use of tobacco and tobacco products outside of work.

Also, during the interview process, employers can use consumer credit reports during background checks under the New Hampshire Fair Credit Reporting Act. However, to receive the report, the employer must request authorization from the employee in writing.

“Right-to-work” law in New Hampshire

In addition, it’s important to note that the state of New Hampshire is not a “right-to-work law” state — a state in which the legislative body guarantees that no employee will be forced to join or be associated with a labor union.

New Hampshire Department of Labor lawsTermination laws in New Hampshire

The state of New Hampshire practices the “employment-at-will” arrangement that many US states have incorporated into their legal systems.

Practically, “employment-at-will” states that employers can terminate an employee’s contract of employment for any lawful reason without repercussions.

However, there are exceptions to the rule, which include:

- Terminations that violate labor laws,

- Terminations that violate required leaves of absence, and

- Violating company policies approved by the commissioner.

In the case of massive layoffs — more than 25 employees terminated at the same time — the employer is required to notify the New Hampshire Department of Employment Security, regardless of whether the layoffs are temporary or permanent.

If the employee is wrongfully terminated, claims and lawsuits can recover:

- Lost wages,

- Back pay,

- 401k contributions, and

- Lost benefits.

Furthermore, the claims can grant employees entitlement to compensation based on the pain, suffering, and emotional distress they might have gone through in the process.

New Hampshire law officeFinal paycheck in New Hampshire

According to New Hampshire Protective Legislation, all unpaid wages shall be paid in full in 3 days (72 hours) following the termination of employment by the employer.

If the employee has resigned, the wages will be paid in full on the next designated payday.

In case the wages are not paid by the next designated payday, the employer will be fined an additional 10% of the total wages for the days that followed the termination — excluding Sundays and non-working holidays.

Health insurance continuation in New Hampshire (COBRA)

The federal law regarding the Consolidated Omnibus Budget Reconciliation Act (COBRA) states that employees have the right to continue receiving their group health benefits in the case of both voluntary and involuntary job loss for the 18 to 36 months following the termination.

All employers are required to provide employees with election notices for COBRA.

After the employee has received the notification, they have 60 days to apply for COBRA, pay a 2% administrative fee, and retain their health coverage.

This law applies to businesses that employ at least 20 workers — which is why a lot of states, including New Hampshire, have incorporated mini-COBRAs.

Mini-COBRAs cover health costs for businesses of all sizes.

New Hampshire COBRA laws grant the employee and their dependents 39 weeks of health continuation after paying the premium.

Occupational safety in New Hampshire

New Hampshire does not have any state plans concerning occupational safety, meaning that the federal OSHA governs the safety measures in the public sector.

In gist, the Occupational Safety and Health Administration Act of 1970 serves to protect all employees that operate and work on dangerous premises.

The most common workplace hazards recognized by OSHA can be classified into:

- Biological,

- Chemical,

- Physical,

- Ergonomic,

- Safety, and

- Work organization.

OSHA’s responsibilities include conducting regular inspections to make sure that all facilities and working premises are safe and that both employees and employers are complying with health standards.

Miscellaneous New Hampshire labor laws

Some New Hampshire laws cannot be put into a specific category, which is why we will cover them in the miscellaneous section. The section includes:

- Background check law,

- Whistleblower law,

- Social media law, and

- Record keeping law.

Background check law

The employers in the state of New Hampshire are allowed to do background checks when hiring new employees — but there are certain regulations that have to be followed.

All screenings and checks have to be in regulation with the Fair Credit Reporting Act and the Equal Employment Opportunity Commission (EEOC) in order for the process to be valid.

Some of the professions that require background checks include:

- School and daycare personnel,

- Foster care agency personnel,

- Residential and children camp personnel, and

- Nursing home personnel.

Also, as previously mentioned, consumer reports can be used during hiring if the job applicant has received written notification from the employer requesting their information.

The request has to be in accordance with the New Hampshire Credit Reporting Act.

Whistleblower law

The New Hampshire Department of Labor protects all employees under section 275-E:2 of the Whistleblower Protection Act who decide to act and report workplace violations.

According to the law, no employee can be harassed, intimidated, threatened, or discharged due to “blowing the whistle.”

An employee cannot be terminated due to:

- Refusal to participate in illegal activities,

- Refusal to break federal and state laws,

- Reporting workplace violations, and

- Participating in an open investigation regarding workplace violations.

Social media law

Employers in the state of New Hampshire cannot request personal information from employees regarding their social media accounts under the guise of “assessment”, such as:

- Usernames,

- Passwords, and

- Authentication information.

Record keeping law

The state of New Hampshire has no distinct laws regarding record keeping, which is why federal rules apply.

According to the FLSA, employers will keep records for 3 years of:

- Payroll information,

- Bargaining agreements,

- Sales and purchases,

- I-9 forms, and

- Certificates and notices.

For 2 years, employers will keep records of:

- Shipping and billing,

- Timecards,

- Wage rate information, and

- Additions and deductions from wages.

Finally, records that the employer is obligated to keep for 1 year are all employment information regarding:

- Hiring,

- Termination, and

- Any extra documentation that was kept during the course of employment.

Conclusion/Disclaimer

We hope this New Hampshire labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this New Hampshire labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

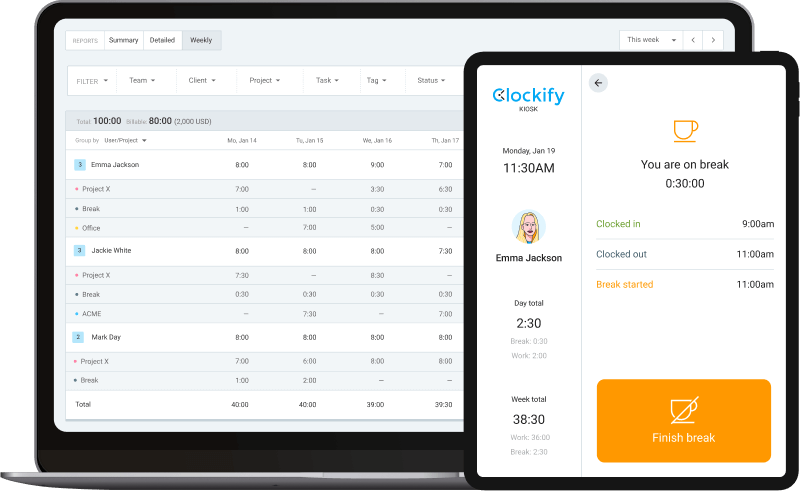

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).