Oregon Labor Laws Guide

Ultimate Oregon labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Oregon Labor Laws FAQ | |

| Oregon minimum wage | $12.50+ ($12.50 in certain non-urban counties, standard $13.50, in Portland Metro $14.75) |

| Oregon overtime laws | 1.5 times the minimum wage for any time worked over 40 hours/week ($20.25 for standard minimum wage workers, $18.75 in certain non-urban counties, and $22.125 in Portland Metro) |

| Oregon break laws | Meal break — 30 min per 6+ hours Rest break — 10 min per 4 hours Rest break for minors — 15 min per 4 hours |

Table of contents

Oregon wage laws

We’ll first deal with the most important laws and regulations regarding minimum, tipped, and subminimum wages in Oregon.

| MINIMUM WAGE IN OREGON | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $12.50+ ($12.50 in certain non-urban counties, standard $13.50, in Portland Metro $14.75) | $12.50+ | 75% of the standard minimum wage for student learners — $9.375 in certain non-urban counties, standard $10.125, and $11.06 in Portland Metro) $12.50 for employees with disabilities |

Oregon minimum wage

The term minimum wage refers to the lowest hourly rate employees can be compensated for their work.

On a federal level, wages are regulated by the Fair Labor Standards Act (FLSA) — but each state has the right for the minimum wage to be higher than the federal minimum wage of $7.25, which is the case for Oregon.

Oregon’s current standard minimum wage is $13.50, with a couple of exceptions:

- In certain non-urban counties — $12.50

- In Portland Metro — $14.75

In accordance with the inflation rates, if there are any, the increase to the minimum wage in Oregon will go into effect on July 1, 2023. The state regularly adjusts the minimum wage based on the US City average Consumer Price Index for All Urban Consumers.

The minimum wage in non-urban counties will continue to be $1 less than the standard rate. In Portland Metro, it will continue to be $1.25 over the standard rate, regardless of whether the minimum wage increase is happening or not.

There are some other exemptions and exceptions to this requirement — for example, for seasonal employees.

Let’s see what else is relevant in terms of fair compensation for Oregon employees.

Find your county or metropolitan area in Oregon to see which rate applies.Tipped minimum wage in Oregon

According to federal law and the Internal Revenue Service (IRS), tips are certain amounts of money that are freely provided by customers to employees.

Tips are closely tied with certain professions, especially in the hospitality industry. To provide a couple of examples — you will leave tips to servers and bartenders, as a recognition for their service.

Tipped employees in Oregon are employees who regularly receive such gratuities.

Under Oregon regulations, the tipped minimum wage is the same as the regular minimum wage. Employers are thus required to pay their employees $12.50, $13.50, or $14.75, regardless of how much they earn from tips.

There’s a common practice related to tips — tip pooling (or tip sharing), and Oregon employers can require employees to participate in tip pools.

The practice refers to all tipped employees sharing a portion of their tips in order for a part to be distributed to employees who usually don’t receive tips, such as:

- Cooks,

- Line cooks,

- Prep-cooks,

- Dishwashers, etc.

Additionally, even if an employer doesn’t require tip pooling, employees can enter into agreements about this among themselves.

It is important to mention that tip credits are illegal, meaning that tips can’t be counted as a part of employees’ hourly pay.

Track work hours and calculate hourly pay with ClockifyExceptions to the minimum wage in Oregon

Certain employment or personal statuses are exempt from the law regarding minimum wage in Oregon. For example — operators of taxicabs.

Let us share the rest of the instances where minimum wage requirements don’t apply, so you can check out who the exemptions are:

- White-collar employees (i.e. bona fide executives, administrative workers, and professionals)

- Outside salespeople — provided they are compensated on a commission basis, by piecework, or flat rate schedules

- Some agricultural workers

- Workers engaged in the range production of livestock

- Domestic workers employed on a casual basis in family homes

- Students enrolled in primary and secondary education institutions who are employed by the same institution

- Operators of taxicabs

- Workers living at the place of employment who must be available for emergency duties

- Workers paid to be available for duty for specified hours

- Managers, assistant managers, and maintenance workers employed and lodged in multi-unit accommodations

- Seasonal workers at educational camps — provided they earn less than $500,000 per year

- Seasonal workers at nonprofit camps

- Workers employed at nonprofit conference areas for educational, religious, and charitable purposes

- Volunteer firefighters

- Companions to elderly, disabled, or infirm people in their family homes

- Resident managers of adult foster care homes

- Inmate labor workers

- Referees of youth and adult recreational soccer matches

- Certain ski patrollers, golf course caddies and marshals

Subminimum wage in Oregon

Minimum wage for certain categories of workers — such as student learners in Oregon — is commonly known as the subminimum wage. The hourly rate is also regulated by the rule of law.

The term “subminimum” already implies that employers are allowed to pay such employees a lower hourly wage.

In Oregon, there are only 2 categories of employees who can be paid at a lower rate:

- Student learners, and

- Employees with disabilities — provided the employer has obtained a special certification for that purpose.

Employers must compensate student learners at a rate of at least 75% of the standard minimum wage.

The number translates to a requirement of at least:

- $9.375 in certain non-urban counties,

- $10.125 where standard rates apply, and

- $11.06 in Portland Metro.

When it comes to employees with disabilities, employers are allowed to compensate them at a rate of $12.50. This law is announced to change starting June 30, 2023, when employees with disabilities will be entitled to a standard hourly rate as well.

Apart from those 2 categories of employees, everyone else is entitled to at least the standard minimum wage.

Therefore, unlike in many other states, employees who are apprentices, trainees, and student workers are also entitled to at least the standard minimum hourly rate.

Oregon payment laws

When it comes to pay frequency in Oregon, employers are required by the law to provide regular compensation for their employees on a monthly basis.

This means that each month is considered a payroll period, and payday periods mustn’t be more than 35 days apart.

Employers can choose the manner of wage payments and pay their employees in the following ways:

- Cash,

- Checks,

- Direct deposit system, ATMs, or other means of electronic transfer, and

- Payroll cards.

Deductions from wages are allowed only if legally required, such as taxes, or if an employee agrees in writing. Each such paycheck must include both the amount and the purpose of the deductions.

Track employee payroll with ClockifyOregon overtime laws

Regulations established by the Fair Labor Standards Act define a working week as any seven consecutive working days. During this period, employees who work up to 40 hours are compensated for their work at least at an hourly rate of a minimum wage, as defined by the Oregon constitution.

Any number of hours exceeding 40 counts as overtime and must be compensated at a higher hourly rate.

Non-exempt employees who do exceed that number are entitled to 1.5 times their regular rate.

Meaning — the number currently translates to:

- $20.25 for standard minimum wage workers,

- $18.75 for minimum wage workers in certain non-urban counties, and

- $22.125 for minimum wage workers in Portland Metro.

Some occupations and conditions can overrule this 1.5 rate requirement.

We’ll explain everything in the following sections, so read on and check out who is eligible for overtime compensation in Oregon, and who is not.

Track Oregon overtime with ClockifyOvertime exceptions and exemptions for white-collar employees in Oregon

Following the federal requirements on the overtime exemptions, 4 main categories of employees are not protected by the law, as they fit into the larger category of white-collar occupations.

When it comes to overtime, provided they earn at least $684 per week, white-collar employees do not have to be paid at a 1.5 rate for working over 40 hours.

White-collar employees are the ones working in any of the following categories:

- Administration — people who perform non-manual work related to business operations, management policies, or administrative training (provided that no more than 20% of the time is spent on activities unrelated to the position) — this category includes accountants, HR team members, market research analysts, etc.

- Executives — business, general, and executive managers who directly manage at least 2 employees.

- Professionals — people whose position calls for advanced knowledge and extensive education, such as software analysts or software engineers (the category also includes artists, certified teachers, and other creative work requiring talent, invention, or imagination).

- Outside sales — outside sales representatives who visit potential and existing customers at their premises.

Oregon overtime restrictions for specific occupations

Besides the federal government exemptions, the state enforces overtime restrictions on some other, more specific occupations.

So, overtime and minimum wage exemptions overlap, but there are additional occupations that are exempt from overtime only.

Here’s the full list:

- Some agricultural workers

- Workers engaged in the range production of livestock

- Domestic workers in family homes, employed on a casual basis

- Students enrolled in primary and secondary education institutions employed by the same institution

- Operators of taxicabs

- Workers living at the place of employment who must be available for emergency duties

- Workers paid for specified hours, to be available for duty

- Managers, assistant managers, and maintenance workers employed and lodged in multi-unit accommodations

- Seasonal workers at educational camps — provided they earn less than $500,000 per year

- Seasonal workers at nonprofit camps

- Workers employed at nonprofit conference areas for educational, religious, and charitable purposes

- Volunteer firefighters

- Companions to elderly, disabled, or infirm people in their family homes

- Resident managers of adult foster care homes

- Inmate labor workers

- Referees of youth and adult recreational soccer matches

- Certain ski patrollers, golf course caddies, and marshals

- Workers of independently owned and operated local enterprises engaged in the wholesale or bulk distribution of petroleum products

- Workers in pursuance of an agreement made as a result of collective bargaining

- Workers residing on the premises of hospitals or other establishments primarily engaged in the care of “the sick, the aged, or the mentally ill and defective” as the Act states

- Workers of nonprofit amusement or recreational park, provided the establishment doesn’t operate more than 7 months per year

- Workers who catch, take, harvest, cultivate, or farm any kind of fish, shellfish, crustacean, sponges, seaweeds, or other aquatic forms of animal and vegetable life, or are involved in the first processing of such products

- Computer system analysts, programmers, software developers, and similarly skilled workers — provided their hourly rate is at least $27.63

Oregon break laws

Employers in Oregon are legally required to provide 2 types of breaks to all their employees — 30-minute meal and 10-minute rest breaks.

The number of breaks depends on the length of their shift — and goes as listed.

Oregon meal breaks:

- Up to 6 hours of work — no meal breaks required

- 6 to 14 hours — 1 meal break

- 14 to 22 hours — 2 meal breaks

- 22 to 24 hours — 3 meal breaks

Oregon rest breaks:

- 0 to 2 hours — no rest breaks required

- 2 to 6 hours — 1 rest break

- 6 to 10 hours — 2 rest breaks

- 10 to 14 hours — 3 rest breaks

- 14 to 18 hours — 4 rest breaks

- 18 to 22 hours — 5 rest breaks

- 22 to 24 hours — 6 rest breaks

All rest breaks must be compensated for and are longer for minors — 15 minutes instead of 10. Employers can choose whether the meal breaks will be paid or unpaid.

Track employee productivity levels with ClockifyThere is an additional required type of break in Oregon — but it applies only to still breastfeeding mothers. It is called a lactating break, and we will elaborate on it in the following section.

Breastfeeding laws in Oregon

All working mothers who gave birth recently and are still lactating and breastfeeding are entitled to take a break for this purpose.

In Oregon, the same as on a federal level, employers are obligated to provide adequate conditions for such female employees.

This type of break can be either paid or unpaid, as predetermined by the company regulations and policy.

By “adequate conditions”, the law refers to employers providing a room or location with a door that can’t be a bathroom stall.

Employers must provide such a location in the nearest possible proximity to the working environment.

Scheduling, breaks, and overtime for domestic workers laws

According to the state laws, domestic workers must have 8 consecutive hours of rest during every 24-hour period.

Additionally, employers of domestic workers are required to provide an appropriate location for uninterrupted sleep.

In case a domestic worker has been summoned to duty during the period of rest, any time worked must be compensated for at a 1.5 rate of their regular wage.

Oregon leave requirements

Now, let’s take a look into what employers in Oregon are entitled to do if an employee asks for a leave of absence from work.

The federal law clearly regulates which types of leave employers are required to provide, with no negative consequences for an employee, upon their return to work.

There are 2 broad categories of leave of absence — required and non-required, according to the US Department of Labor.

However, the types of leave included in the 2 categories are not predetermined, as each state regulates them differently.

Let’s see how Oregon regulates leaves of absence.

Track employee time off with ClockifyOregon required leave

There are instances where an employee is entitled to take a leave of absence, without being punished in any way upon their return to work.

While employers do have to offer and provide some types of required leave to all their employees, they don’t have to compensate them for that period. But, some company policies will offer paid required leave.

Here’s the list of 9 types of leave that employers in Oregon are required to offer by law:

- Sick leave

- Family and medical leave

- Holiday leave

- Jury duty leave

- Witness leave

- Domestic violence or sexual assault leave

- Crime victim leave

- Military leave

- Military family leave

Sick leave

Oregon employers must provide up to 40 hours of sick leave to all their employees.

The total number of employees in the company determines whether the leave will be paid or unpaid, so the regulation goes as follows:

- Employers with 10+ employees must offer paid sick leave

- Employers with less than 10 employees must offer unpaid sick leave

The only exception is the city of Portland, where instead of 10 employees, the distinction is from 6 employees.

Family and medical leave

This is a type of required leave that all employers in the state of Oregon must provide their employees with. Eligibility for this type of leave is regulated by the Family and Medical Leave Act or FMLA.

The FMLA states that all employees are eligible to use 12 weeks of unpaid, job-protected work absence in a one-year period, for many household and medicinal-related reasons.

The reasons are:

- Care of the employee’s own serious health condition

- Care of an immediate family member with a serious health condition

- Care of the employee’s own newly-born child

- Placement for adoption/foster care of a child with the employee

- Any difficulty due to the employee’s immediate family member who is a covered military member on active duty

To be eligible, an employee must have worked for the employer for at least a year and at least 1,250 work hours. Note that, on a federal level, this is applicable for employers with over 50 employees only.

In Oregon, according to state law, the threshold is lower and applies to employers with at least 25 employees.

Additionally, in an effort to protect the families of the Armed Services, Congress amended the FMLA in 2008.

Since then, employers have also been required to provide up to 26 weeks of unpaid leave if an employee needs to take care of a member of the Armed Forces with a serious health condition, injury, or undergoing medical treatment or therapy. This is applicable only if said member is an employee’s spouse, parent, child, or next of kin.

Jury duty leave

If an employee in Oregon is summoned to perform jury duty, employers must allow them to be absent from work during that time. Employers mustn’t require employees to use their sick, vacation, or any other type of leave for this reason.

The law also states employers can’t penalize or discipline their employees in any way for the acceptance of jury duty — but they don’t have to compensate their employees for this period.

Witness leave

The law requires employers to provide either paid or unpaid leave for all their employees who are summoned to be a witness in any court.

Domestic violence or sexual assault leave

Employees who are victims of domestic or sexual violence, sexual assault, or stalking, or who have a minor child or dependent who is such a victim, are entitled to this type of unpaid leave.

Seeking legal or law enforcement assistance and ensuring health and safety of an employee (or their minor child or dependent) are primary goals of this type of leave.

Here are the reasons for which employees are allowed to take this type of leave:

- To prepare and participate in a protective order, civil, or criminal legal proceedings

- To seek medical treatment for or to recover from injuries

- To obtain counseling from a licensed mental health professional

- To obtain services from a victim services provider

- To relocate or take steps to secure a safe domestic environment in another way

Crime victim leave

For employees who are victims of a crime, employers are required to offer paid or unpaid leave for participating in, preparing for, and attending proceedings related to the crime.

The same is applicable if their family or household member is a victim.

Military leave

This type of leave is regulated on a federal level, by the Uniformed Services Employment and Reemployment Act. The act states that all employees in the US must be granted a leave of absence to serve in one of the following:

- The US Armed Forces

- The National Guard

- The state militia

Upon the employee’s return to work, they must be entitled to the same pay increases and other benefits as if they were present at work the whole time.

Oregon implements an additional requirement for employers — employees who are members of another state militia are also entitled to take this leave, provided the governor of that state in question invites them to active duty.

Military family leave

Employees whose spouse or same-sex domestic partner is called to military service are eligible for this type of leave.

Family military leave is unpaid and applies only to employers with at least 25 employees. It can last up to 14 days.

There is only one condition — for an employee to work more than 20 hours per week on average.

Oregon non-required leave

There are 4 categories of leave that, by Oregon state laws, employers are not required to offer to their employees.

Said categories are:

- Vacation leave

- Voting leave

- Bereavement leave

- Volunteer firefighter leave

It is important to mention that the law also doesn’t prohibit or restrict these types of leave.

If an employer chooses to offer any or all, the exact terms need to be stated in the signed contract of employment.

Vacation leave

Oregon employers are not required to offer any paid or unpaid time for vacations. If an employer establishes a vacation policy, they must comply with all the conditions.

Employers are allowed to:

- Establish a “use-it-or-lose-it” policy,

- Cap the amount of vacation time that can be accrued, and

- Deny a payout based on any accrued vacation time upon separation from employment.

Voting leave

Oregon employers are not required to offer this type of leave to any of their employees.

If an employer offers a voting leave in their company policy, the exact terms must be stated in the contract of employment.

Bereavement leave

Oregon employers are not required to offer this type of leave to any of their employees.

If an employer offers a bereavement leave in their company policy, the exact terms must be stated in the contract of employment.

Volunteer firefighter leave

Employers in Oregon are not required to offer volunteer firefighter leave to any of their employees.

However, if an employer establishes a policy that allows volunteer firefighters to be absent in order to perform firefighter duties, an employee in question mustn’t be discriminated against or discharged.

Moreover, employers must return them to the same or equivalent position upon their return to work.

Employers choose whether the leave is paid or unpaid.

Child labor laws in Oregon

The term “minors'' refers to young people, aged under 18. The main purpose of both federal and Oregon child labor laws is to prevent the exploitation of minors. Additionally, to help minors put education first — their employment is only meant to enhance their academic and life experience.

Some of the most relevant limitations regarding the employment of minors can be seen in the following categories:

- Maximum number of work hours

- Nightwork

- Restrictions on specific occupations

While different rules and regulations are applicable to different age groups, there is still one thing applicable to all age groups — minors are forbidden from working in any hazardous positions, according to the federal law.

Next, let’s take a look at some rules and regulations stated in the Oregon Child Labor Laws.

Specific labor laws for minors

In Oregon, child labor laws enforce specific rules for different age groups. The 2 categories put restrictions on the maximum hours of work and nightwork of minors.

There’s another relevant thing to mention — in order to be employed, all minors must obtain a Work Permit certificate.

For the employment of minors, the following rules apply.

The maximum number of work time for minors under 16 years of age — provided that school is not in session — is:

- 10 hours per day,

- 40 hours per week, and

- No more than 6 days per week.

When school is in session, the limit is 3 hours per school day, while the total number of hours for school weeks mustn’t exceed 18.

For ages 16 and 17, Oregon has restrictions on maximum working hours only when it comes to the total for the week, and it is 44 hours, regardless of whether the school is in session or not.

Nightwork restrictions only apply to minors under 16 years of age, and they are prohibited to work between 7 p.m. and 7 a.m. The only exception, when minors under 16 can work until 9 p.m. is in the period from June 1 to Labor Day.

For ages 16 and 17, Oregon has no restrictions on nightwork.

Required forms for employing minors in different industriesProhibited occupations for minors on a federal level

Apart from regulations restricting the hours of work, certain occupations are strictly prohibited for minors.

In compliance with federal restrictions, minors are forbidden from working in any and all occupations that are declared as hazardous. Here are some examples of hazardous occupations:

- Electrical technicians

- Boiler or engine room operators

- Any work with flammable, toxic, or corrosive substances

- Elevator-related work

- Centrifugal machine operators

- Any and all work including climbing

- Any and all work including power-driven machinery

- Any and all work including glazing and glass cutting

Additional prohibited occupations for minors in Oregon

For minors in Oregon, there are additional restrictions, so here’s the full list of state-specific prohibited occupations:

- Work in or about plants or establishments manufacturing or storing explosives and articles containing explosive components

- Motor vehicle drivers or outside helpers who assist in the transportation of goods

- All coal mining occupations for the purpose of extracting, grading, cleaning, or handling coal

- Logging and sawmill operations and any related occupations

- Any and all woodworking occupations involving the use or maintenance of power-driven woodworking machines

- Any and all occupations involving exposure to radioactive substances

- Any and all occupations involving the operation of power-driven hoisting apparatus, such as elevators, cranes, derricks, hoists, fork-lifts, etc.

- Operators and helpers on power-driven metal forming, punching, and shearing machines (excluding machine tools, which may be used by 16- and 17-year-olds)

- Occupations in or on the surface of underground mines or quarries

- Occupations involving slaughtering, meat processing and packing, rendering, and use and repair of the machines used for these purposes

- Occupations related to operating, assisting to operate, repairing, or cleaning power-driven bakery machinery, such as dough and batter mixers, bread dividers and slicers, rounding and molding machines, slicing and wrapping machines, and cake cutting band saws

- Setting up or adjusting cookie and cracker machines

- Occupations of operating or assisting to operate paper product machines, such as cover cutters, staplers, circular and band saws, guillotine cutters, punch presses, etc.

- Any and all work in or about establishments where clay construction and silica brick products are manufactured (except the office work, storages, shipping and drying departments)

- Any and all occupations of operators or helpers of power saws and shears

- Any and all occupations in wrecking, demolition, and shipbreaking

- Any and all occupations in roofing operations, including gutter and downspout work

- Any and all occupations in excavation operations

- All delivery of messages and goods between 10 p.m. and 5 a.m.

There are some additional restrictions and requirements for minors working in agriculture, such as agricultural work of minors being exempt from overtime — unless combined with any type of non-agricultural work in the same week, such as dishwashing or newspaper delivery, for example.

Oregon Bureau of Labor & Industries: Minor Workers SectionTermination laws in Oregon

Like the majority of other states in the US, Oregon also implements an “employment-at-will” doctrine and policy.

What does that mean for both employers and employees?

- Employers — they can terminate their employees’ work engagement anytime, for any reason, or perhaps for no reason at all.

- Employees — they are free to leave a job for any or no reason with no legal consequences.

There are only 2 exceptions in terms of employers’ reasons for termination:

- It mustn’t be on a discriminatory basis

- It mustn’t be retaliation for a rightful action (i.e. whistleblowing)

Final paycheck in Oregon

Employers in Oregon are legally required to provide a final paycheck, including all the wages and benefits, to everyone whose employment was terminated.

According to the Oregon Labor wage laws, final paychecks for laid-off or fired employees are due by the end of the following business day.

The same applies to:

- Employees who come to a mutual agreement with an employer to terminate the employment relationship, and

- Employees who quit with at least 48-hour notice, but their last day is on a weekend or a holiday.

Employees who provide 48-hour notice and their last day of work is on a weekday must receive their final paycheck the same day — i.e. their last day of work.

Employees who quit with less than 48-hour notice (excluding holidays and weekends) must receive their final paycheck within 5 business days, or on the next regularly scheduled payday, whichever comes first.

Oregon Bureau of Labor and Industries: Complaint formsDiscrimination laws in Oregon

According to federal law, discrimination in the workplace is not only unethical but also illegal.

There are many bases of discrimination in the workplace that are forbidden on a federal scale — but the state of Oregon has added additional ones under the Oregon Civil Rights laws.

So, here’s the full list of prohibited bases for workplace discrimination, including both federal and Oregon-specific ones:

- Race

- Color

- Age

- Gender

- Sexual orientation

- Religion

- National origin

- Pregnancy

- Genetic information (including family medical history)

- Physical or mental disability

- Child or spousal withholding

- Military or veteran status

- Expunged juvenile records

- Marital status

- Relation to another employee

- Filing for workers’ compensation insurance

- Domestic violence victim status

- Credit report or credit history

- Access to employer-owned housing

- Workers’ compensation claims

- Lawful off-duty use of tobacco products

- Wage garnishment for consumer debt

- Whistleblower status

- Refusal to attend an employer-sponsored meeting — provided the main purpose is related to the employer’s political or religious views

Additionally, the state of Oregon implements the Equal Pay Act, which prohibits employers from paying different wages and benefits to employees whose work is of comparable character.

Wage discrepancies can exist — but employers must account for them, based on one of the following reasons, or any combination of reasons:

- A seniority system

- A merit system

- A system of measuring earnings by quantity or quality of production

- Workplace location

- Travel — provided it is necessary and regular for an employee

- Education

- Experience

- Training

Occupational safety in Oregon

All employees must have a safe and healthy working environment.

The specific conditions for such an environment are regulated by the federal Occupational Safety and Health Act (OSHA), passed by Congress in 1970 — but there are some additional requirements for employers in Oregon.

OSHA states that employers are required to:

- Provide safe and healthy working conditions,

- Continually inspect for flaws and irregularities, and

- Strive to improve them, if possible.

Employers are required to provide several things to ensure workplace safety to their employees:

- Proper training,

- Education, and

- Continuous assistance.

The main goal of OSHA is — to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

Besides providing necessary training and education for employees, employers must create optimal working conditions — free from any recognized hazards that may cause harm.

Moreover, it is obligatory to conduct safety and health research regularly, as well as undertake safety demonstrations concerning health matters.

Oregon OSHA is under the jurisdiction of the Occupational Safety and Health Administration and is responsible for regulating the workplace safety of all workers.

Federal employers and employees may be excluded from the OSHA regulations.

The Administration has compliance officers who are in charge of implementing and enforcing the Oregon OSHA.

Apart from scheduled inspections that compliance officers regularly conduct, they are allowed to carry out inspections without any notice, at any given time.

Unscheduled inspections can be a result of:

- Imminent danger reports

- Fatalities

- Worker complaints

- Referrals

Additions in Oregon OSHA

There are many unique safety standards that are implemented in the state of Oregon — and those are categorized into:

- General Industry,

- Construction, and

- Agriculture related standards.

General industry additions in Oregon OSHA

The term “general industry” is used to describe standards and directives applicable to all industry types — except agriculture, maritime, and construction industries.

The General Industry standards include:

- Walking-working surfaces

- Means of egress

- Manually propelled elevating aerial platforms

- Scissor lifts — self-propelled elevating work platforms

- Boom-supported elevating work platforms

- Ventilation for abrasive blasting

- Noise exposure

- Hazardous materials and processes

- Personal protective equipment

- Sanitation

- Labor camps

- Accident prevention and tags

- Confined spaces

- Hazardously stored energy

- Medical services and first aid

- Protections for firefighters

- Portable fire extinguishers

- Powered industrial trucks, railcars, and other industrial vehicles

- Cranes and derricks

- Slings and other hoisting equipment

- Aerial cableways and tramways

- Woodworking and metal lathe machinery

- Mechanical, hydraulic, pneumatic, and other power presses

- Compactors, balers, and refuse packing or collection equipment

- Conveyors

- Hand and portable powered tools and other hand-held equipment

- Welding, cutting, and brazing activities

- Pulp, paper, and paperboard mills

- Paper printing operations

- Sawmills and other wood processing activities

- Logging and forestry

- Telecommunications in relation to different types of electrical hazards

- Electric power generation, transmission, and distribution

- Window cleaning

- Tree care and removal

- Working near overhead high voltage lines and equipment

- Commercial diving

- Air contaminants

- Bloodborne pathogens

- Sharps injury log

- Carcinogens in laboratories

- Pesticides and fumigation

- Hazard communication

- Illumination and industrial lighting

- Non-industrial motor vehicles and the transportation of workers over land

Construction additions in Oregon OSHA

Construction is an industry comprising a wide variety of activities such as construction, alteration, and repair. Workers in this industry are often exposed to serious hazards and have to deal with heavy machinery.

As a result, there’s an abundance of specific OSHA standards designed to eliminate such hazards.

The Construction standard includes:

- Sanitation

- Noise exposure

- Air contaminants

- Hazardous waste and emergency response

- Respiratory protection

- Personal protective equipment

- Traffic Control

- Power-actuated tools

- Working near overhead high voltage lines and equipment

- Branch circuits

- Scaffolds

- Fall protection

- Motor vehicles and mechanized equipment

- Excavations

- Concrete and masonry construction

- Steel erection and wood framing

- Electric power transmission and distribution

- Stairways and ladders

- Asbestos

- Cadmium

- Methylenedianiline

- Lead

- Cranes and derricks

- Flooring

- Temporary floors

- Shoring, bracing, or guying of structures

- Project plans

Agriculture additions in Oregon OSHA

One of the major industries in the US is agriculture, which includes growing and harvesting crops, as well as keeping livestock, poultry, and other animals in order to provide products.

Farmworkers can be at high risk for injuries, lung and skin diseases, and even certain cancer types — due to prolonged sun and chemical exposure.

These specific OSHA standards help agriculture employers and employees create a safe and healthy work environment.

The Agriculture standard includes:

- Tractors and other agricultural vehicles

- Conveyors

- Choppers, grinders, abrasive wheels, cutters, spreaders, and saws

- Field sanitation

- Walking-working surfaces

- Exits and emergency action plan

- Man lifts

- Vehicle-mounted elevating and rotating work platforms

- Ventilation

- Noise exposure

- Hazardous materials and processes

- Protective equipment

- Agricultural labor housing and related facilities

- Safety colors for marking physical hazards

- Accident prevention signs

- Confined and hazardous spaces

- Manure lagoons, storage ponds, vats, pits, and separators

- Hazardous stored energy

- Medical services and first aid

- Fire protection and prevention

- Rim wheel and tire servicing

- Helicopters

- Slings and other hoisting equipment

- Small tools

- Guarding and operation of portable powered tools

- Power lawn mowers

- Other portable tools and equipment

- Welding and cutting

- Excavations

- Electrical hazards

- Toxic substances

- Air contaminants

- Bloodborne pathogens

- Ionizing radiation

- Hazardous chemicals in laboratories

- Pesticides

- Hazard communication

- Lighting

- Fall protection

Miscellaneous Oregon labor laws

The above-listed sections were concerned with the most important and common categories of labor laws relevant in Oregon.

Now, we’ll mention several additional laws that may be applicable to your situation.

Here’s what else is regulated by the rule of law in Oregon:

- Whistleblower protection laws

- COBRA laws

- Background check laws

- Credit and investigative check laws

- Arrest and conviction check laws

- Drug and alcohol testing laws

- Social media laws

- Shift scheduling laws

- Portland facial recognition laws

- Record-keeping laws

Whistleblower protection laws

The main purpose of this set of laws is to ensure that employees can exercise all of their legal rights without negative repercussions as a result.

The term “whistleblower” refers to employees who have inside knowledge of an illegal practice or a safety hazard in the workplace. They must be able to report it and continue being employed.

Here’s the list of reasons based on which employees can’t be discriminated against, or treated differently in any way:

- Exercising their rights under the Minimum Wage Act

- Exercising their rights to domestic violence leave

- Filing a claim for occupational disease benefits

- Filing a claim for workers’ compensation

- Filing a complaint and participating in proceedings related to workplace safety (OSHA)

- Filing a complaint, opposing, and participating in proceedings under the Oregon Human Rights Act

COBRA laws

COBRA is a law that operates on a federal level — so let’s start this section by explaining what the acronym means. The Consolidated Omnibus Budget Reconciliation Act (OSHA) allows employees to retain health care insurance and benefits after the termination of employment.

Federal regulations also state the law can be applied to employers with over 20 employees. So, many states have implemented their own regulations, also known as “mini-COBRAs” to cover the businesses with fewer than 20 employees.

The state of Oregon does have a mini-COBRA law, applicable to businesses that employ fewer than 20 employees. Their health coverage is extended for up to 9 months after the employment termination date.

Background check laws

Background checks are allowed for all employers (but not required for all occupations) and are subject to the federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau — all employers must ensure they adhere to those requirements.

Here’s the full list of positions that do require background checks in Oregon:

- School personnel — including personnel in private schools, alternative education programs, and career schools

- Childcare center personnel — including volunteers

- Personnel working for a residential facility, a long-term care facility, an adult foster home, a home health agency, and an in-home care agency

- Mortgage loan originators

- Personnel at bingo, lotto, raffle, or Monte Carlo events

Credit and investigative check laws

The state of Oregon prohibits employers from conducting credit and investigative checks for employment purposes, except in the following circumstances:

- The employer is a federally insured bank or credit union

- The employer is required by the state or federal law to obtain the records

- The employee or applicant is or will be a police officer

- The employer informs in writing how they are using these reports

- The report is substantially job-related — because an essential function of the job requires access to financial information

Employers who conduct credit and investigative checks must carefully follow the procedures stated by the Fair Credit Reporting Act.

Arrest and conviction check laws

When it comes to arrest and conviction checks, Oregon has a “Ban the Box” law. According to the law, employers are forbidden from asking about the criminal records of their applicants.

The initial application mustn't include any questions about the criminal history of a potential employee — but employers are allowed to make an inquiry of this type during the interview process.

The city of Portland has a stricter policy on this issue than the state of Oregon. Only if an employer reviews an application, conducts an interview, and decides to make an offer of employment, are they allowed to ask for this information.

Drug and alcohol testing laws

The state of Oregon doesn’t specifically allow or prohibit employers from testing their applicants and employees for drugs.

Therefore, if a reasonable doubt exists, employers may subject their applicants and employees to a breathalyzer test. If there is a lack of reasonable doubt, applicants or employees can be subject to the test only with their explicit consent.

Social media laws

Oregon employers are prohibited from asking their employees or applicants to disclose information about their personal social media accounts.

In Oregon, it’s illegal for an employer to:

- Ask employees to access their personal accounts in their presence

- Compel them to add certain contacts associated with their business

- Require them to advertise the employer’s business on a personal account

- Ask for a username and/or password, or other means of authentication

Shift scheduling laws

According to the Fair Scheduling Law, all retail, hospitality, and food service businesses with over 500 employees globally must provide their employees with a written estimate of their work schedule at the time of hire.

The estimate must include:

- The median number of hours per month

- Explanation of the voluntary standby list

- Indication of whether an employee can expect to be placed on-call

Additionally, employers are not allowed to schedule an employee to work for a period of 10 hours after the end of their previous shift.

Portland facial recognition laws

As of January 1, 2021, private entities are not allowed to use facial recognition technologies in public accommodation places — except for the following reasons:

- To achieve Compliance with federal, state, or local laws

- For user verification purposes to access own communication and electronic devices

- To carry out automatic face recognition in social media apps

Record-keeping laws

Keeping the records of all their employees is an obligation for all Oregon employers. They must do so for the length of 3 years.

So, what types and categories of information should such records consist of?

Here’s the full list:

- Employee name

- Social security number

- Occupation of the employee

- Date of birth

- Address including ZIP code

- Regular hourly rate of pay

- Basis on which wages are paid

- A daily record of beginning and ending work, if a split shift is in question

- Total daily or weekly net wages and deductions

- Total gross daily or weekly wages

- Date of each payment

- Records of leaves, notice, and policies under the Family and Medical Leave Act

There are some other record-keeping laws that are applicable to specific situations. So, here’s what else employers ought to keep on record, and for how long:

- Records of all job-related injuries and illnesses under OSHA — for 5 years

- Summary descriptions and annual reports of benefit plans — for 6 years

- Specifically dangerous instances under OSHA (e.g. toxic substance exposure) — for 30 years

Conclusion/Disclaimer

We hope this Oregon labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Oregon labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

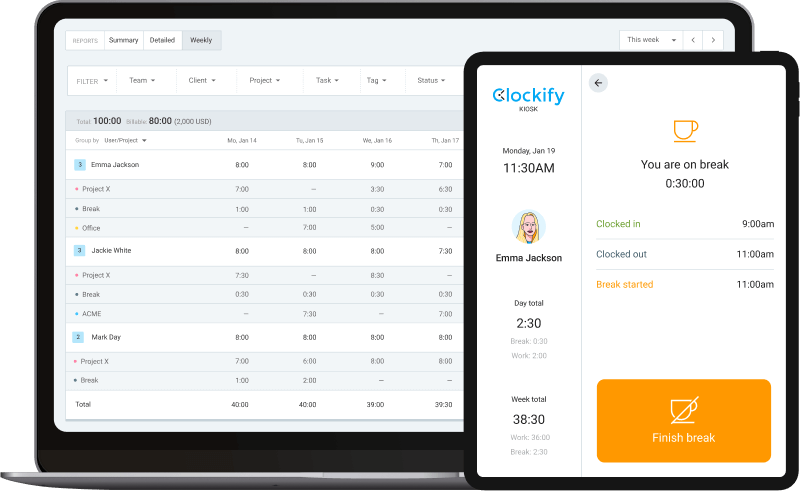

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).