Pennsylvania Labor Laws Guide

Ultimate Pennsylvania labor laws guide: minimum wage, overtime, breaks, leave, hiring, termination, and miscellaneous labor laws.

| Pennsylvania Labor Laws FAQ | |

| Pennsylvania minimum wage | $7.25 |

| Pennsylvania overtime laws | 1.5 times the rate of regular pay after working 40 hours in a workweek ($14.50 per hour for minimum wage workers) |

| Pennsylvania break laws | Breaks not required by law |

Table of contents

Pennsylvania wage laws

The first domain of Pennsylvania labor laws we will be looking at is the one concerned with wage laws. In particular, we will cover the following areas:

- Minimum wage in Pennsylvania

- Tipped minimum wage in Pennsylvania

- Subminimum wage in Pennsylvania

- Exceptions to the minimum wage in Pennsylvania

- Pennsylvania payment laws

| MINIMUM WAGE IN PENNSYLVANIA | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.83 | Training wage not allowed Wage for employees with disabilities — established by a government commission |

Pennsylvania minimum wage

The state minimum wage in Pennsylvania is regulated by the Pennsylvania Minimum Wage Act (PMWA), and it is currently the same as the federal minimum wage — $7.25 per hour.

Recently, Gov. Wolf has proposed a plan to increase the minimum wage in Pennsylvania to $15 by July 1st, 2028. However, this proposal is yet to be passed by the General Assembly.

Tipped minimum wage in Pennsylvania

US federal law uses the term “tipped employees” to describe employees who regularly receive more than $30 monthly in tips.

However, Pennsylvania state law has increased this threshold to $135 in monthly tips.

This is the amount of tips the employee must earn before the employer can pay them a tipped minimum wage rate of $2.83 per hour.

When direct wages are combined with the tips, the resulting amount must be at least equal to the state minimum wage of $7.25. Otherwise, the employer must cover the difference.

Subminimum wage in Pennsylvania

A subminimum wage is any wage lower than the state or federal minimum wage, whichever may apply.

One type of subminimum wage is the so-called training wage.

Under the Fair Labor Standards Act (FLSA), employers can pay a training wage of $4.25 to employees aged 16 to 19 for the first 90 calendar days of employment.

However, as of July 24, 2009 — Pennsylvania has prohibited the training wage.

On the other hand, a different kind of subminimum wage — one applicable to employees with disabilities — is still in effect.

The wage rate for these employees is determined by the US Department of Labor or Pennsylvania’s Bureau of Labor Law Compliance.

The employer must also possess a special license to use this type of subminimum wage.

Track work hours and calculate hourly pay with ClockifyExceptions to the minimum wage in Pennsylvania

In Pennsylvania, certain occupations are exempt from minimum wage provisions.

These occupations include:

- Farm laborers

- Domestic services providers (for services conducted in the employer’s home)

- Newspaper delivery persons

- Outside salespersons

- Administrative, executive, and professional staff — if the employees earn more than $150 per week

Pennsylvania payment laws

When it comes to pay frequency practices, Pennsylvania has a few different options for employers, depending on the type of employment and contractual agreements.

First of all, all employers must establish a regular payday.

This payday is set in accordance with the pay period, which may not exceed:

- A time specified in a contract between the employer and the employee

- A standard time-lapse customary to the trade the business is operating within

- A time period of 15 days — if the previous options do not apply

Pennsylvania overtime laws

According to the Fair Labor Standards Act (FLSA), all work exceeding 40 hours in a workweek is overtime, and must be paid at the rate of 1.5 times the regular pay.

The basis for overtime calculations is the workweek — a regularly recurring period of 168 hours (split into 7 24-hour periods), not necessarily tied to usual time and week days.

The FLSA is a federal law, and Pennsylvania has no particular state law that would regulate overtime.

Overtime exceptions and exemptions in Pennsylvania

Pennsylvania’s PMWA does not demand overtime requirements for some of the following occupations:

- Farm workers

- Seamen

- Salesmen, partsmen, or mechanics primarily dealing with vehicles

- Taxi drivers

- Motion picture theater workers

- Executive, administrative, and professional employees

- Employees in cities or towns with a population of 100,000 or less, if the city is not part of a standard metropolitan statistical area having a total population of more than 100,000 people

- Employees in cities or towns of 25,000 population or less, which are part of a standard metropolitan statistical area but are at least 40 airline miles from the principal city in the area

Pennsylvania break laws

There are no state or federal laws that would require Pennsylvania employers to provide meal breaks or rest periods during working hours.

However, if the employer does provide breaks, they must follow these requirements:

- Rest periods lasting 20 minutes or less must be paid, and calculated towards work hours

- Meal periods must be longer than 20 minutes, and can be unpaid — but the employee must be resolved of all duties for their duration

Exceptions to break laws in Pennsylvania

One exception when the employer is required to provide a break is for minor employees.

Employees of ages 14 through 17 are entitled to at least 30 minutes for a meal or rest period after working for 5 or more consecutive hours.

Pennsylvania breastfeeding laws

Under the federal FLSA law, Pennsylvania employers are required to provide break time for nursing mothers.

This means that employers must provide adequate facilities (other than toilet stalls and restrooms) for employees to express their breast milk.

In addition to facilities, the employer must make sure to provide a reasonable break time for this activity.

The right for nursing breaks lasts up to one year after childbirth.

Pennsylvania leave requirements

Different US states have different rules when deciding if a certain type of leave is required by law or not.

This section of the guide covers both the required and the non-required types of leave in Pennsylvania.

Pennsylvania required leave

First, we can take a look at types of leave required by Pennsylvania law:

- Family and medical leave

- Jury duty leave

- Emergency response leave (for State employees)

- Military leave

- Leave for victims of crime

- Sick leave (for State employees)

- Bereavement leave (for State employees)

- Vacation and holiday leave (for State employees)

- Voting time leave (for State employees)

Family and medical leave

The regulations of the federal Family and Medical Leave Act may allow eligible Pennsylvania employees up to 12 weeks of unpaid leave in case of medical emergencies.

Some of the events that may qualify an employee for family and medical leave include:

- Giving birth and caring for a newborn child

- Adopting or taking in a foster child

- Having an incapacitating health condition that prevents the employee from working

- Caring for a family member with a serious health condition

As additional requirements for employees to take family and medical leave, federal law states that:

- The employee must have worked for the same employer for at least 12 months prior to the leave, and

- The employee must have worked at least 1,250 hours in those 12 months.

Jury duty leave

All Pennsylvania employees can attend jury duty, without interference from their employer.

In practical terms, this means that employers cannot threaten, discipline, or discharge an employee who chooses to attend jury duty.

However, employers can ask their employees to use available vacation time to attend jury duty, and the time off does not have to be paid.

Emergency response leave (for State employees)

Pennsylvania State employees who are also volunteer members of a fire department or an emergency medical service can be absent from work when responding to an emergency.

The State cannot take any adverse action against an employee who is absent from duty due to being on an emergency response call.

However, the employee must provide a statement from the CEO of the volunteer services company stating that the employee responded to the emergency, and noting the time of the emergency call.

Military leave

All members of the uniformed services are eligible for unpaid military leave under the federal Uniformed Services Employment and Reemployment Rights Act (USERRA) law.

Employees may leave for deployment, and upon return be reinstated to their position, if:

- The employee provides a notice of their military service to the employer,

- The total time spent in active military service is under 5 years,

- The military discharge is not dishonorable or disqualifying, and

- The return to work is timely.

Additionally, the employee gets to keep all the benefits, as well as the level of seniority they held prior to the deployment.

Leave for victims of crime

All Pennsylvania employees can take a witness duty/crime victim leave to:

- Attend criminal case court preparations

- Attend court proceedings

- Testify as a witness in a criminal case they were a victim of

- Testify as a witness in a criminal case their family member was a victim of

However, the employer does not have to pay the employee for the duration of this absence.

Sick leave (for State employees)

Pennsylvania public employees who have been employed for at least 30 days get the right to accrue sick leave.

This leave can be used in case of an employee's own illness, or that of a close family member.

The sick leave is accrued up until the maximum allowed time of 5 days per calendar year.

Bereavement leave (for State employees)

State employees are allowed 3 days of paid bereavement leave following the death of a member of the immediate family.

Vacation and holiday leave (for State employees)

Full-time State employees receive accrued vacation leave at different rates, in accordance with the number of years served:

- First 3 years of service — vacation time accrued at the rate of 4.24% of regular hours paid, up to 11 days per year.

- 3–15 years of service — vacation time accrued at the rate of 7.32% of regular hours paid, up to 19 days per year.

- After 15 years — vacation time accrued at the rate of 9.24% of regular hours paid, up to 24 days per year.

In addition to this, State employees have a right to paid leave on all national holidays.

Pennsylvania non-required leave

We can now move on to types of leave not mandated by Pennsylvania law, unless otherwise specified in the contract between employer and employee :

- Sick leave (private employees)

- Bereavement leave (private employees)

- Vacation and holiday leave (private employees)

- Voting time leave

Sick leave (private employees)

There are no regulations which would require private Pennsylvania employers to provide sick leave to their employees.

Bereavement leave (private employees)

Private employers in Pennsylvania are not required to provide bereavement leave to their employees.

Vacation and holiday leave (private employees)

Private Pennsylvania employees are not entitled to vacation or holiday leave, unless otherwise specified in their contract.

Voting time leave

Pennsylvania employers are not required to provide voting time off.

Track employee productivity with ClockifyChild labor laws in Pennsylvania

Under Pennsylvania’s Child Labor Act, minors can be employed at no sooner than 14 years of age.

Additionally, all minors under 16 years of age must provide their employers with a written statement by their parent (or legal guardian) acknowledging the duties and granting them the permission to work.

Parental Acknowledgement of Minor’s Duties and Hours of Employment FormAll minors (under 18) who wish to perform in a live performance, a radio, TV, movie, Internet, or other broadcasts with audiences — must apply with a state agency.

Specific hours also apply for the allowed duration of performances by minors:

| Age | Max. hours at place of employment* | Max. work hours** |

| Under 6 months | 2 | Not applicable |

| 6 months – 1 year | 4 | 2 |

| 2–5 years | 6 | 3 |

| 6–8 years | 8 | 4 |

| 9–15 years | 9 | 5 |

| 16–17 years | 10 | 6 |

* Does not include hours worked at minor’s residence

** Includes hours worked at minor’s residence

Application for Minors in Performances FormWhen it comes to legal working hours for minors, there are different requirements for these two age categories:

- Minors under 16, and

- Minors aged 16 and 17.

Pennsylvania labor laws for minors under the age of 16

Minors under the age of 16 can work the following hours:

- Anytime from 7 a.m. to 7 p.m. on school days

- Anytime from 7 a.m. to 9 p.m. while school is out of session

- No more than 3 hours on a school day

- No more than 18 hours in a week while school is in session (plus 8 hours on both Saturday and Sunday — 16 hours in total)

- No more than 8 hours on a non-school day

- No more than 40 hours in a week while school is out of session

Pennsylvania labor laws for minors aged 16 and 17

Minors aged 16 and 17 can work these hours:

- Anytime between 6 a.m. and 12 p.m. while school is in session

- Anytime between 6 a.m. and 1 a.m. while school is out of session

- No more than 8 hours on a school day

- No more than 28 hours in a week while school is in session (plus 8 hours on both Saturday and Sunday — 16 hours in total)

- No more than 10 hours a day while school is out of session

- No more than 48 hours in a week while school is out of session

Prohibited occupations for minors in Pennsylvania

The Child Labor Act also regulates occupations prohibited to minors, which have been deemed too dangerous for this age group to perform.

In Pennsylvania, prohibited occupations for minors are some of the following:

- Brickmaker

- Crane operator

- Electrical worker

- Excavator

- Forest firefighter

- Mill worker

- Meat processing operator

- Motor vehicle operator/servicer

- Roofer

- Welder

- Occupations in establishments serving alcoholic beverages

As far as performances are concerned, prohibited performance work for minors includes:

- Acrobatic acts, including high-wire, trapeze, unicycle, and bicycle acts

- Activities that involve exposure to dangerous weapons, including pyrotechnical devices

- Activities at high speeds and altitudes

- Sexually abusive acts

- Acts involving animals weighing more than half the weight of the minor

Hiring laws in Pennsylvania

Under the Pennsylvania Human Relations Act, employees have a right to a fair hiring process. Thus, discrimination is prohibited on the basis of:

- Race or color

- Religious creed

- National origin

- Ancestry

- Sex

- Age (for people 40 and over)

- Disability

These provisions ensure that Pennsylvania employers cannot legally refuse to hire or treat differently any job applicants or employees on the basis of the listed characteristics.

Pennsylvania “Ban-the-box” law

Pennsylvania has passed a Fair-Chance hiring policy in 2017, in an effort to provide a better chance for competition during the hiring process.

This is the so-called “Ban-the-box” law, which enables a fairer hiring process by:

- Prohibiting questions about the applicant’s criminal history during the initial job application, and

- Delaying background checks.

At the state level, this law currently only applies to public employees.

However, in the City of Philadelphia, these provisions are extended to private employees, under the regulations of the Fair Criminal Record Screening Standards Ordinance.

Criminal Justice Agencies are exempt from provisions of this ordinance.

Termination laws in Pennsylvania

Pennsylvania is one of many US states which use the doctrine of “employment at-will”.

This signifies an employment relationship that can be terminated by either the employer or the employee, at any time, and with no particular reason.

Unless otherwise stated in their contract with the employer, these terms of employment also apply to private business employees.

Final paycheck in Pennsylvania

Pennsylvania employers need to pay their employee’s final paycheck on or before the next regularly scheduled payday.

This requirement stands, whether the employee was fired or if they quit.

COBRA and Pennsylvania Mini-COBRA laws

Pennsylvania employees who are fired or are having some other significant stressful life event may be eligible for continued health insurance under the provisions of the federal Consolidated Omnibus Budget Reconciliation Act (COBRA).

COBRA laws cover employers with 20 or more employees, and may allow the continuation of health insurance for up to 36 months.

This insurance is usually priced at 102% of the original cost.

Some events that may qualify an employee or their dependents for continued health insurance include the following:

- Termination

- A significant reduction of work hours

- Divorce

- A serious health issue that makes the employee unable to work

- A family member with serious health issues

Smaller businesses (with 2–19 employees) are covered by the Pennsylvania Mini-COBRA, which allows continued insurance for up to 9 months, without extensions.

Pennsylvania Mini-COBRA resourcesOccupational safety in Pennsylvania

Workplace security standards and practices are under the jurisdiction of the federal Occupational Safety and Health Administration (OSHA).

OSHA conducts workplace inspections to ensure all of its requirements are being sustained.

Other than the OSHA, Pennsylvania also has a Health and Safety Division, as well as the Bureau of Occupational and Industrial Safety, which are workplace safety agencies for public employees.

Pennsylvania OSHA contact informationMiscellaneous Pennsylvania labor laws

Lastly, we have a brief review of some of the miscellaneous Pennsylvania labor laws which do not strictly fit into the previously mentioned categories. These include the following:

- Whistleblower protection laws

- Background check laws

- Drug and alcohol testing laws

- Record-keeping laws

Whistleblower protection laws

Pennsylvania’s Whistleblower Law provides protection to public employees who report suspected or witnessed violations of state or federal laws.

This act forbids employers from discharging, threatening, or in any other way retaliating against a whistleblower, provided that they are acting in good faith.

This protection is guaranteed by the Office of State Inspector General, which is charged with investigating reports of violation.

Background check laws

Pennsylvania employers need to make sure to follow the regulations provided in the federal Fair Credit Reporting Act (FCRA) when conducting a background check.

Prior to collecting employee background data, employers need to provide a written notice in advance.

As previously noted in the section on Pennsylvania’s “Ban-the-box” law, employers cannot ask about the applicant's criminal history during the initial application.

However, some occupations where criminal background checks are required include the following:

- Child care staff

- School employees

- Adult care services providers

- Home health agencies staff

- Police officers

- Private detective agency personnel

- Patrol agency personnel

Drug and alcohol testing laws

Pennsylvania requires drug and alcohol testing only for holders of a Commercial Driver’s License.

These workers may be required to undergo drug or alcohol testing in the following situations:

- Prior to employment

- Random testing

- Testing under a reasonable suspicion

- Post-accident testing

- Return-to-duty testing

- Follow-up testing

Record-keeping laws

Pennsylvania Code requires that employers keep accurate and permanent employee records, including the following:

- Name and address

- Social security number

- Total amount of gross earnings (before deductions) for each pay period

- The date and amount of wages paid for each pay period

- The dates of hiring, rehiring, layoff, or termination

- Dates of all absences

- Type of service the employee provided

- Other payments or remuneration, excluding wages

All employee records must be kept for at least 7 years, and be kept in a place that is easily accessible in case of an inspection.

Conclusion/Disclaimer

We hope this Pennsylvania labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Pennsylvania labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

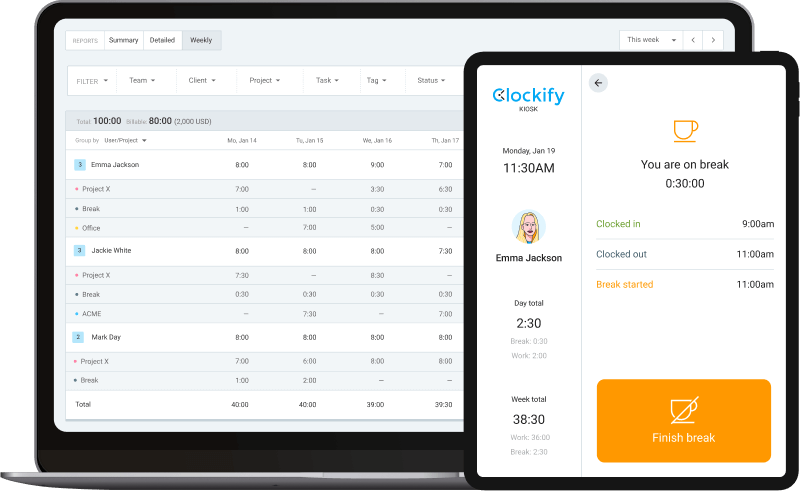

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).