South Carolina Labor Laws Guide

Ultimate South Carolina labor laws guide: minimum wage, overtime, breaks, leave, hiring, termination, and miscellaneous labor laws.

| South Carolina Labor Laws FAQ | |

| South Carolina minimum wage | $7.25 |

| South Carolina overtime laws | 1.5 times the rate of regular pay after working 40 hours in a workweek ($14.50 per hour for minimum wage workers) |

| South Carolina break laws | Breaks not required by law |

Table of contents

South Carolina wage laws

Wage laws in South Carolina mostly rely on federal provisions, with only one exception concerned with wage rates for employees with disabilities.

For easier understanding, we’ve divided the South Carolina wage laws into the following subcategories:

- Minimum wage in South Carolina

- Tipped minimum wage in South Carolina

- Subminimum wage in South Carolina

- Exceptions to the minimum wage in South Carolina

- South Carolina payment laws

| MINIMUM WAGE IN SOUTH CAROLINA | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.83 | Training wage — $4.25 Student-learners — $6.16 |

South Carolina minimum wage

As of August 2022, South Carolina still does not have a state minimum wage law.

This means that the federal minimum wage applies, as defined by the Fair Labor Standards Act (FLSA).

At the moment, the federal minimum wage for employees covered by the FLSA is $7.25 per hour.

Tipped minimum wage in South Carolina

Under US federal law, “tipped employees” are employees who regularly and customarily receive tips at their place of work.

As South Carolina does not have a state minimum wage law, tipped employees can be paid at the federal tipped minimum wage rate of $2.13 per hour.

The employer can pay the employee at this rate — as long as the direct wages combined with the tips amount to at least the federal minimum wage of $7.25. If this is not the case, the employer must cover the difference in pay.

Subminimum wage in South Carolina

Subminimum wage is any wage lower than the federal, state, or local minimum wage — whichever one is applicable.

Under FLSA laws, employers with special certificates could pay employees with disabilities a subminimum wage, determined by a state agency, and in accordance with the employee’s output.

However, South Carolina has recently passed its Senate Bill 533, aimed at eliminating subminimum wage for disabled employees by August 1, 2024.

One different type of subminimum wage is called a training wage. Under federal law, employers can pay this type of wage to employees under 20 years of age, during their first 90 days of employment.

The training wage rate in South Carolina is $4.25.

Lastly, we have the so-called “Student-Learner program”, which allows employers to pay their employees who are full-time students at 85% of the minimum wage requirement.

This program puts the minimum wage rate for students at $6.16.

Track work hours and calculate hourly pay with ClockifyExceptions to the minimum wage in South Carolina

As only the federal FLSA laws apply to South Carolina employees, here are some of the occupations that are exempt from minimum wage requirements under these laws:

- Farm workers

- Seasonal workers

- Newspaper deliverers

- Casual babysitters

- Seasonal amusement park employees

- Executive, administrative, and professional employees whose wage exceeds $684 per week

South Carolina payment laws

South Carolina does not have any laws regulating the frequency at which employers must pay their employees.

However, employers still have to establish regular paydays and inform employees of any changes in advance.

South Carolina overtime laws

When it comes to overtime provisions, South Carolina once again relies on the federal FLSA regulations.

According to these regulations, overtime is defined as all work exceeding 40 hours in a workweek.

The workweek is a regularly recurring period of 168 hours (split into 7 24-hour periods), which does not necessarily correlate to usual time and week days.

All overtime hours worked must be paid at the rate of 1.5 times the regular pay.

Overtime exceptions and exemptions in South Carolina

There is a certain overlap when it comes to occupations which are exempt both from minimum wage and overtime requirements.

However, there are also occupations that are solely exempt from overtime provisions.

Here, we have examples of occupations exempt from both the overtime and minimum wage requirements:

- Executive, administrative, and professional employees earning more than $684 per week

- Farm workers

- Seasonal workers

- Commissioned employees of retail or service establishments in the auto industry

- Railroad employees

- Taxi drivers

- Motion picture theater workers

South Carolina break laws

There are no state or federal laws that would require South Carolina employers to provide meal breaks or rest periods during working hours.

However, if the employer does choose to provide breaks, they must follow these requirements:

- Rest periods lasting 20 minutes or less must be paid and calculated towards work hours

- Meal periods must be longer than 20 minutes and can be unpaid if the employer resolves the employee of all duties for their duration

Exceptions to break laws in South Carolina

There are no particular exceptions when it comes to break laws in South Carolina.

South Carolina breastfeeding laws

Under the federal FLSA law, South Carolina employers need to provide additional break time for nursing mothers.

The employer must give the employee reasonable time and accommodation to express their breast milk.

In addition to more frequent breaks, the employers must provide adequate facilities for nursing mothers — toilet stalls and restrooms are not considered adequate.

The right to nursing breaks lasts up to one year after childbirth.

South Carolina leave requirements

Different US states have different rules when deciding if a certain type of leave is required by law or not.

This section of the guide covers both the required and the non-required types of leave in South Carolina.

South Carolina required leave

First, we’ll take a look at the types of leave required by South Carolina law:

- Family and medical leave

- Jury duty leave

- Witness leave

- Military leave

- Bone marrow donation leave

- Emergency response leave (for State employees)

- Sick leave (for State employees)

- Administrative leave (for State employees)

- Bereavement leave (for State employees)

- Vacation and holiday leave (for State employees)

- Voting time leave (for State employees)

Family and medical leave

Under the federal Family and Medical Leave Act (FMLA), some South Carolina employees may be eligible for up to 12 weeks of unpaid leave in case of medical emergencies.

Some situations that may qualify an employee for family and medical leave include:

- Childbirth and newborn care

- Adoption or taking in a foster child

- A serious health condition that prevents the employee from working

- A family member with a serious health condition

As for the requirements the employees need to fulfill to be able to take the family and medical leave, federal law states that the employee must have worked for the same employer for at least:

- 12 months prior to the leave, and

- 1,250 hours in those 12 months.

Jury duty leave

An employer in South Carolina cannot threaten, discipline, or discharge an employee who chooses to attend jury duty.

However, employers can ask their employees to use available vacation time to attend jury duty, and this time off does not have to be paid.

Witness leave (for private employees)

Private South Carolina employers may not prevent their employees from attending court cases they were subpoenaed to.

However, the employer does not have to pay the employee for the duration of this absence.

Witness leave (for State employees)

If a State employee has been subpoenaed to a litigation in which they do not receive any personal gain, they are entitled to a paid leave.

Additionally, the employee may retain any witness fee or travel expenses.

Military leave

All members of the uniformed services are eligible for unpaid military leave under the federal Uniformed Services Employment and Reemployment Rights Act (USERRA) law.

Employees can leave for deployment and be reinstated to their position once they return.

However, the following conditions must be met:

- The employee must provide a notice of their military service to the employer,

- The total time spent in active military service must stay under 5 years,

- The military discharge cannot be dishonorable or disqualifying, and

- The return to work must be timely.

In addition to reinstatement, the employee is entitled to all the benefits, as well as the level of seniority they held prior to the deployment.

Bone marrow donation leave

South Carolina employees who work in establishments with 20 or more employees may be eligible for paid bone marrow donation leave.

As a requirement, the employee must work an average of at least 20 hours per week, and the leave may not exceed 40 hours total — unless otherwise approved by the employer.

The employer may also require that the employee provide a verification by a physician about the purpose and length of the leave.

Emergency response leave (for State employees)

South Carolina State employees who are certified by the American Red Cross can use up to 10 calendar days per year to participate in disaster relief.

To do this, they must acquire the approval of their agency supervisor.

Sick leave (for State employees)

South Carolina public employees can accrue up to 15 annual days of sick leave.

Up to 10 days of this leave can be used as family sick leave.

Administrative leave (for State employees)

State employees who get hurt while performing their work duties must be placed on an administrative leave, instead of a sick leave.

This type of leave is paid, but cannot exceed 180 calendar days.

Bereavement leave (for State employees)

State employees are allowed 3 days of paid bereavement leave following the death of a member of the immediate family.

The employee must provide a statement to their supervisor, containing the name of the deceased and the employee’s relationship to the deceased.

Vacation and holiday leave (for State employees)

Full-time State employees receive accrued vacation leave at different rates, in keeping with their workweek schedule and years of service:

- Five day, 37.5-hour workweek schedule

| Years of service | Days of leave accrued per year | Hours of leave accrued per month |

| Up to 10 | 15.00 | 9.375 |

| 11 | 16.25 | 10.156 |

| 12 | 17.50 | 10.937 |

| 13 | 18.75 | 11.718 |

| 14 | 20.00 | 12.500 |

| 15 | 21.25 | 13.281 |

| 16 | 22.50 | 14.062 |

| 17 | 23.75 | 14.843 |

| 18 | 25.00 | 15.624 |

| 19 | 26.25 | 16.406 |

| 20 | 27.50 | 17.187 |

| 21 | 28.75 | 17.968 |

| 22 and over | 30.00 | 18.750 |

- Five day, 40-hour workweek schedule

| Years of service | Days of leave accrued per year | Hours of leave accrued per month |

| 1–10 | 15.00 | 10.00 |

| 11 | 16.25 | 10.833 |

| 12 | 17.50 | 11.666 |

| 13 | 18.75 | 12.50 |

| 14 | 20.00 | 13.333 |

| 15 | 21.25 | 14.167 |

| 16 | 2.50 | 15.00 |

| 17 | 23.75 | 15.833 |

| 18 | 25.00 | 16.667 |

| 19 | 26.25 | 17.50 |

| 20 | 27.50 | 18.333 |

| 21 | 28.75 | 19.167 |

| 22 and over | 30.00 | 20.00 |

Voting time leave (for State employees)

Employees who live too far away from work to vote on time may be granted voting time leave.

This leave can last a maximum of 2 hours and must be paid by the employer.

South Carolina non-required leave

We can now move on to types of leave not required by South Carolina law, unless otherwise specified in the contract between employer and employee:

- Sick leave (private employees)

- Bereavement leave (private employees)

- Vacation and holiday leave (private employees)

- Voting time leave

Sick leave (private employees)

There are no regulations which would require private South Carolina employers to provide sick leave to their employees, unless the employer-employee contract states so.

Bereavement leave (private employees)

If this type of clause does not exist in the contract between the two parties, private employers in South Carolina are not required to provide bereavement leave to their employees.

Vacation and holiday leave (private employees)

Private South Carolina employees are not entitled to vacation or holiday leave, unless otherwise stated in their contract.

Voting time leave

South Carolina employers are not required to provide voting time off.

Track employee productivity with ClockifyChild labor laws in South Carolina

In the case of child labor laws, South Carolina again uses only the federal provisions, as defined under the FLSA.

When it comes to legal working hours for minors, FLSA places different requirements for these two age categories:

- Minors under 16, and

- Minors aged 16 and 17.

South Carolina labor laws for minors under the age of 16

Minors under the age of 16 can work the following hours:

- Anytime from 7 a.m. to 7 p.m. on school days

- Anytime from 7 a.m. to 9 p.m. while school is out of session

- No more than 3 hours on a school day

- No more than 18 hours in a week while school is in session

- No more than 8 hours on a non-school day

- No more than 40 hours in a week while school is out of session

South Carolina labor laws for minors aged 16 and 17

There are no particular restrictions when it comes to work hours of minors aged 16 and 17.

Prohibited occupations for minors in South Carolina

The FLSA also regulates occupations prohibited to minors, which have been deemed too dangerous for minors under 18 years old to perform.

In South Carolina, some prohibited occupations for minors are the following:

- Boiler room operator

- Excavator

- Mill worker

- Miner

- Meat processing operator

- Motor vehicle operator/servicer

- Power-driven machinery operator

- Roofer

- Welder

- Occupations in establishments serving alcoholic beverages

Hiring laws in South Carolina

Under the South Carolina Human Affairs Law, job applicants have a right to a fair hiring process.

As such, discrimination is prohibited on the basis of:

- Race or color

- Religion

- National origin

- Sex

- Age

- Disability

These provisions prohibit South Carolina employers from refusing to hire or treating differently any job applicants or employees on the basis of the listed characteristics.

City of Columbia “Ban-the-box” law

Across the US, many states have passed a “fair chance” hiring policy, in an effort to provide a better chance to ex-offenders during the hiring process.

They did so by passing the so-called “Ban-the-box” laws — which enable a fairer hiring process by:

- Prohibiting questions about the applicant’s criminal history during the initial job application, and

- Delaying background checks.

At the state level, South Carolina does not have such a “fair chance” hiring policy.

However, the City of Columbia passed this type of law in 2014, which applies to all employees within city limits.

Specifically, this law prevents the employers from asking about the applicant's criminal history before a “conditional job offer”.

This offer can be rescinded after the results of the criminal background check.

City of Columbia Ban-the-Box law FAQTermination laws in South Carolina

South Carolina is one of many US states which use the principle of “at-will employment”.

This is a type of employment relationship which can be terminated by either the employer or the employee, at any time.

Additionally, neither party needs to provide a particular reason behind the termination.

These terms of employment also apply to private business employees, unless otherwise specified in their contract with the employer.

Final paycheck in South Carolina

Upon termination, employers must pay the employees their final paycheck following either of the two following requirements:

- Within 48 hours of the time of termination

- On or by the next regularly scheduled payday, without exceeding 30 days from the date of separation

COBRA and South Carolina Mini-COBRA laws

South Carolina employees may be eligible for continued health insurance under the provisions of the federal Consolidated Omnibus Budget Reconciliation Act (COBRA).

This insurance is provided for employees who experience termination, or are going through some other highly stressful life event, such as:

- A significant reduction of work hours

- A divorce

- A serious health issue that makes the employee unable to work

- A family member with serious health issues

COBRA laws cover employers with 20 or more employees and may allow the continuation of health insurance for up to 36 months.

This insurance is usually priced at 102% of the original cost.

Smaller businesses (those with fewer than 20 employees) are covered by the South Carolina Mini-COBRA, which allows continued insurance for up to 6 months.

South Carolina Mini-COBRA detailsOccupational safety in South Carolina

Workplace security standards and practices are under the jurisdiction of the federal Occupational Safety and Health Administration (OSHA).

OSHA conducts workplace inspections to ensure all of its requirements are being followed.

All workplace injuries and fatalities should be reported to the South Carolina branch of OSHA.

South Carolina OSHAMiscellaneous South Carolina labor laws

Lastly, we provide a brief overview of some of the miscellaneous South Carolina labor laws which do not strictly fit into the previously mentioned categories.

These include the following:

- Whistleblower protection laws

- Background check laws

- Drug and alcohol testing laws

- Record-keeping laws

Whistleblower protection laws

South Carolina’s whistleblower laws provide a certain level of protection to all employees who report suspected or witnessed violations of state or federal laws.

These laws prohibit employers from discharging, threatening, or in any other way retaliating against a whistleblower.

However, the whistleblower report must be filed in good faith — otherwise, the protection does not apply.

Background check laws

When conducting a background check, South Carolina employers have to make sure to follow the regulations provided in the federal Fair Credit Reporting Act (FCRA).

Before collecting employee background data, employers need to provide written notice in advance.

As previously mentioned in the section on South Carolina’s “Ban-the-box” law, employers cannot ask about the applicant's criminal history during the initial application.

However, some occupations where criminal background checks are required include the following:

- Child care center staff (including family and religious child care centers)

- Charter school personnel

- Direct care providers

- Police officers

- Private investigators

- Firefighters

Drug and alcohol testing laws

There are no laws in South Carolina which prohibit the employer from testing their employees for the presence of drugs or alcohol.

Record-keeping laws

South Carolina Code requires that employers keep accurate and permanent employee records, including the following:

- Name and address

- Social security number

- Total amount of gross earnings (before deductions) for each pay period

- The date and amount of wages paid for each pay period

- The dates of hiring, rehiring, layoff, or termination

- Dates of all absences

- Type of service the employee provided

- Other payments or remuneration, excluding wages

All employee records must be kept for at least 4 years in a place that is easily accessible, in case of an inspection.

Conclusion/Disclaimer

We hope this South Carolina labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this South Carolina labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

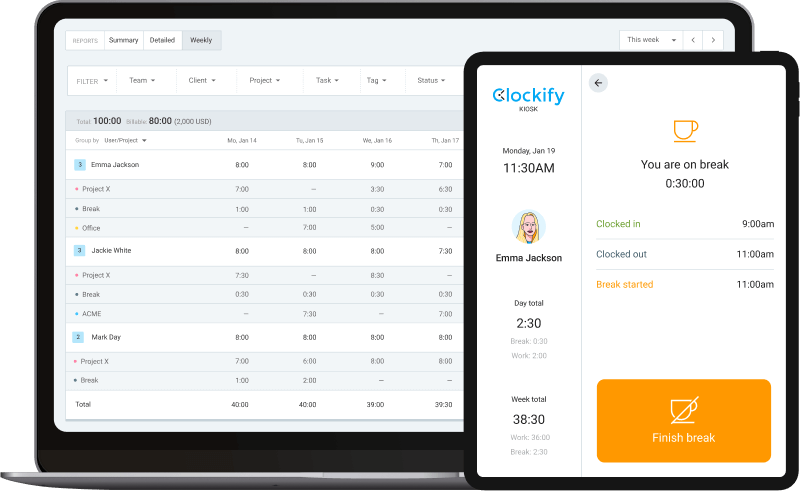

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).