South Dakota Labor Laws Guide

Ultimate South Dakota labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| South Dakota Labor Laws FAQ | |

| South Dakota minimum wage | $9.95 |

| South Dakota overtime | 1.5 times the rate of the standard wage ($14.925 for employees earning minimum wages) |

| South Dakota break laws | There are no existing state or federal laws that require employers to provide rest or meal breaks to employees. If they implement their own policy, all breaks under 20 minutes will be paid. |

Table of contents

South Dakota wage laws

The state of South Dakota used to rely on federal laws until the wages started to adjust to the increase in the cost of living.

As of Jan 1, 2022, the exact numbers for the regular minimum wage, tipped minimum wage, and subminimum wage in South Dakota are expressed in the table below.

| SOUTH DAKOTA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $9.95 | $4.975 | $4.25 |

South Dakota minimum wage

What is South Dakota’s minimum wage as of Jan 1, 2022?

According to the state law, the minimum wage is susceptible to change each time there is an increase in the cost of living. The exact numbers are taken from the CPI — Consumer Price Index — and consequently published by the US Department of Labor.

Based on the recent statistics performed in the year 2021, the state minimum wage was increased to $9.95 per hour for non-tipped employees as of Jan 1, 2022.

South Dakota employees saw an increase of $0.50 — a sum that cannot be decreased or changed.

South Dakota Minimum WageTipped minimum wage in South Dakota

Similarly, the South Dakota legislature increased the tipped minimum wage at the beginning of 2022 — the hourly rate was increased by $0.425 and currently amounts to $4.975 per hour.

The employer is obligated to pay the state minimum wage for tipped employees, but they can partake in the tip pool by taking a tip credit.

Namely, if the total sum of the tips earned by the employee is enough to cover the minimum wage, the employer can partake and pay the wages from the tip pool.

The amount the employer takes cannot be more than 50% — therefore, the employer is obligated to pay at least half of the wages personally and the other half through tips.

However, the rules of the tip credit are reliant on the employer’s policies.

Track work hours and hourly pay with ClockifySouth Dakota subminimum wage

According to the FLSA (Fair Labor Standards Act), subminimum wages can be paid to:

- Student-learners,

- Full-time students that work in retail, agriculture, and service establishments, and

- People with impaired productive capacity — i.e., people who are physically and mentally disabled.

The state of South Dakota adheres to federal laws when it comes to subminimum wages, and therefore, employers can pay hourly wages of $4.25 to individuals under 20 years old for the first 90 days of employment.

On the other hand, full-time students are eligible to receive 85% of the federal minimum wage, which amounts to $6.16 per hour.

Track employee payroll with ClockifyExceptions to the minimum wage

When it comes to exceptions to the minimum wage, South Dakota legislation is mostly based on the federal exceptions, but not exclusively.

According to the FLSA, the following is the list of employees exempt from minimum wage laws:

- Executive workers who are paid on a salary basis and earn not less than $684 per week,

- Administrative workers who are paid on a salary basis and earn not less than $684 per week,

- Learned and creative professionals paid on a salary basis who earn not less than $684 per week,

- Computer employees who earn $684 per week or at least $27.63 per hour,

- Highly compensated employees who earn $107,432 or more a year,

- Outside sales employees — No minimum salary requirement,

- Tipped employees, and

- Minors.

However, state laws have no specific regulations regarding executive, professional, and administrative professions — but they do exempt outside salespersons, according to the SD Statute 60-11-3.

Furthermore, the state laws exempt:

- Babysitters, and

- Employees working in amusement parks, recreational facilities, and any other type of organization that cannot classify them as tipped employees.

South Dakota payment laws

According to the South Dakota legislature, every employer in the state is required to pay monthly wages to their employees at least once a month or on regularly agreed pay days directly stated in the employer’s policies.

In general, payments can be deposited as following:

- Cash,

- Checks, and/or

- Direct deposits.

In cases where none of the above is possible, a different type of agreement can be made between the employee and employer.

South Dakota overtime laws

As is the case with many US states, South Dakota, as well, falls under the federal regulations when it comes to compensatory time or overtime laws.

In other words, since there are no state laws, South Dakota employees are obligated to pay the overtime rate of 1.5 times the hourly rate for each hour worked above the standard 40 hours per week.

The final rule on overtime laws in South Dakota went into effect on Jan 1, 2020 and is still in effect, as of Jan 1, 2022.

This law strictly refers to non-exempt employees that earn a minimum of $684 per week — but there are many exceptions to the rule.

Track South Dakota overtime with ClockifyOvertime exceptions and exemptions in South Dakota

According to the Fair Labor Standards Act (FLSA), employees that make a specified amount or work in a certain field are exempt from overtime.

If the state in question follows the federal regulations completely (and South Dakota does), the following exceptions apply:

- Executive employees who earn a salary and make not less than $684 per week,

- Administrative employees who earn a salary and make not less than $684 per week,

- Highly compensated employees who make more than $107,432 a year,

- Learned and creative professionals who receive a salary and earn not less than $684 per week,

- Computer employees who work on a salary basis and earn no less than $684 weekly, and

- Outside sales employees.

South Dakota break laws

The South Dakota Department of Labor and Regulations has no statutes or codified laws concerning break laws. Therefore, federal rules apply, which yet again state the employer is not obligated or required to provide any breaks — rest or meal — for their employees.

However, employers are permitted to allow rest breaks in their policies, in which case, they are obligated to pay all breaks that last 20 minutes or less.

Similarly, meal breaks follow the same principle — all meal breaks that last under 20 minutes are paid, unless the job description states that the employee can work through a meal.

The only exception to this rule are breastfeeding laws.

South Dakota breastfeeding laws

South Dakota follows many federal regulations regarding labor laws and the same goes for breastfeeding laws.

According to the Section 7(r) of the FLSA, nursing mothers are protected in professional environments in several ways.

The employer is obligated to provide:

- A reasonable time for a nursing employee to express milk or breastfeed the child for 1 year after childbirth — each time the employee has the need to express milk, and,

- A place, other than the bathroom, that allows the employee to freely express milk.

The breastfeeding area has to be free from intrusion and shielded from view.

The time it takes to express milk is relative and depends on the mothers, but the law states it has to be a “reasonable amount of time” during which the mothers will be able to attend to their needs.

However, if the employer has 50 employees or less, they can file a complaint in regards to not being subjected to the aforementioned provisions. Reasons for submitting complaints are usually related to

- Undue hardships,

- Financial losses, and

- Decreased productivity in relation to the business structure.

South Dakota leave requirements

In most cases, employers in South Dakota will offer a leave of absence in certain conditions, even if they are not obligated by law to do so or obligated to pay the said leave.

Still, a comparison has to be made between required and non-required leave.

South Dakota required leave

When it comes to leave in the state of South Dakota, the following are leaves of absence that employers are required to provide to their employees:

- Family and Medical Leave (FMLA)

- Court and jury duty leave

- Voting time leave

- Military leave

Family and Medical Leave (FMLA)

The Family and Medical Leave (FMLA) entitles all eligible employees to receive unpaid leave if certain conditions arise that require an employee to take the said leave.

In most cases, the FMLA covers aspects of sick leave, family leave, and leaves without pay, which is why many states either institute full FMLA or part-coverage with benefits granted under other types of leaves.

The employee can become eligible for 12 weeks of unpaid FMLA leave if they:

- Worked for the employer for at least a year,

- Worked at least 1,250 work hours, and

- Worked at the location with at least 50 employed workers within 75 miles.

The reasons for taking FMLA include:

- Caring for a sick family member,

- Maternity/paternity leave following the year from the birth of a child,

- Bonding with a newborn,

- Diseases preventing employees from working, and

- Taking care of the household while a family member is on military duty.

Another qualifying agency would be caring for a family member that was seriously injured in the line of duty while serving in the National Guard or a government-approved military organization. In this case, the employee will be granted with additional 14 weeks of absence during a 12-month period.

Court and jury duty leave

An employee can be granted jury duty leave in certain circumstances, depending on the legal situations.

If the employee is summoned to testify or is being subpoenaed, they will be granted the leave with pay for the duration of legal proceedings. Depending on the case, the employee could be eligible to receive compensation in expenses according to the state rates.

However, if the employee is a witness in private litigation not related to their capacity, they will not be eligible to receive court leave and will have to resort to unpaid vacation leave or the basic leave without pay.

When it comes to jury duty, the employee is obligated to inform the employer with official paperwork and request to leave the working premises. Once approved, the employee will receive all daily wages during the jury duty and will receive per diem compensation, as per South Dakota Codified Laws.

Voting time leave

During election time, employees are free to vote in their own time. If they do not have the time due to the requirements of their job positions, the employer is obligated to provide 2 paid hours of voting time leave.

Military leave

The state of South Dakota offers two types of military leaves of absence:

- Service leave, and

- Training leave.

Service leave is determined and given to an employee in the same manner as one would receive a vacation leave.

Upon the beginning of the employment, service days are accrued on an annual basis up to 40 hours. This type of leave can be used for all military-related services that a reserve or a national guard may attend to.

On the other hand, training leave is not accumulated and cannot be granted to employees who, at the time, are on vacation leave or terminating their employment.

Furthermore, only permanent employees can become eligible for this type of leave — excluding temporary employees.

An employee that is requesting the training leave shall obtain an order or a letter from the commander of the employee's reserve or national guard unit that clearly states the dates of the training period. This notice shall be submitted to the appointing authority 15 days before the date of the employee's departure for training.

South Dakota non-required leave

Most employers are not required to offer leaves of absence — but, in some cases, they will provide some form of leave in order to improve efficiency.

Non-required leaves include:

- Vacation leave

- Sick days

- Holiday leave

- Bereavement leave

Vacation leave

In general terms, vacation leave is not required to be granted to employees in the state of South Dakota. However, if the employer chooses to grant the leave, there are certain required conditions that must be met.

Each permanent employee is entitled to a vacation leave — i.e. employees with working certificates that are not trainees and temporary employees. Accrual of vacation days starts at the beginning of the employment and lasts until the date of the departure.

Also, the accrued days may not be paid upon separation if the employee has not provided 6 months of continuous employment.

If the employee’s contract of employment becomes terminated, they can take the vacation leave in a lump sum.

Sick days

An employer is not in any way required to provide a leave of absence — paid or unpaid — under the umbrella term for “sick days.”

However, if the company chooses to set specific policies regarding sick days, the employer can create a legal document regarding the accrual and use of said days.

Holiday leave

There are no state or federal laws that require employers to provide holiday leaves to their employers, paid or unpaid. If the employer chooses to do so, certain conditions have to be met.

For example, if the company policy states that the employees are free from work during state holidays, the need not work on the following holidays:

- New Year’s Day — January 1

- Martin Luther King Jr. Civil Rights Day — observed on the third Monday in January

- Washington’s Birthday — observed on the third Monday in February

- Memorial Day — observed on the last Monday in May

- Independence Day — July 4

- Labor Day — observed on the first Monday in September

- Columbus Day — observed on the second Monday in October

- Election Day — observed every other year

- Veterans Day — November 11

- Thanksgiving Day — observed on the fourth Thursday in November

- Christmas Day — December 25

Bereavement leave

Bereavement leave is non-required leave in the state of South Dakota.

However, if the employer chooses to implement a bereavement leave policy, the information regarding the policy has to be delivered to the employees in writing or posted with the rest of the policies in a conspicuous place on the working premises.

Therefore, it’s up to the employer to decide whether the leave will be paid or unpaid.

Child labor laws in South Dakota

Child labor laws, whether federal or state, are always designed to protect minors from exploitation at work.

This includes protection from:

- Physical,

- Moral, and

- Emotional hazards.

When it comes to child labor laws, or youth employment as the Deparment of Labor and Regulations refers to it, there are some requirements that have to be met before a child is legally employed.

For example, the first thing an employer must obtain is the employment certificate from the minor that is usually issued by the Commissioner of Labor.

All regulations, rights, and obligations have to be included in the employment labor poster that is located on the premises.

Work time restrictions for South Dakota minors

Children aged 14 or younger cannot be employed:

- During school hours, and

- Cannot work after 7:00 p.m.

Children aged 16 or younger cannot be employed:

- For more than 4 hours on a school day / 20 hours on a school week,

- For more than 8 hours on a school day / 40 hours on a school week, and

- Later than 10 p.m. on a school night.

There are exceptions to the rule, depending on what the minor’s profession is. In general, occupations exempt from the aforementioned time restrictions include:

- Child actors,

- Jobs that require pumping gas,

- Detasseling hybrid seed corn,

- Home employment — employed by parents, and

- Jobs necessary for a child’s support.

Prohibited occupations for South Dakota minors

When it comes to all minors, the South Dakota law prohibits them from working in the following instances:

- Manufacturing or storing explosives,

- Driving or working outside on motor vehicles,

- Forest fire fighting & prevention,

- Using power-driven woodworking machines,

- Exposure to radioactive substances,

- Using power-driven hoisting apparatus,

- Using power-driven metal-forming, punching and shearing machines; •

- Mining,

- Using meat-processing machines, slaughtering, meat and poultry packing, and processing,

- Using bakery machines,

- Using balers, compactors, and paper-products machines,

- Manufacturing bricks and tiles,

- Using circular, band, chain or reciprocating saws, guillotine shears, wood chippers, and cutting discs,

- Working in demolition,

- Roofing, and

- Trenching or excavating.

Penalties for employing minors in South Dakota

No child in the state of South Dakota can be employed in a working environment that poses dangers to:

- Life,

- Health, or

- Morals.

In the same manner, all minor employees are protected from exploitation by their employees under the protection of a Class 2 misdemeanor.

For all violations of child labor laws, the employers are subjected to $1000 fines and confinement in jail up to 6 months, depending on the weight of the misdemeanor and the judge’s ruling.

Minor misdemeanors that still fall under the Class 2 act include:

- Cleanliness of the interior of the factory,

- Cleanliness of a bathroom or poor ventilation,

- Failure to provide employment records, and

- Failure to provide appropriate seats for children.

As there are no state laws that govern the break time for minor employees, the employer won’t be subjected to fines if they do not decide to implement a break policy.

If they do, a paid 20-minute break is required by the law.

South Dakota Child Labor LawsHiring laws in South Dakota

The state of South Dakota relies on federal laws and it’s no surprise that hiring laws match the federal criteria described in the FLSA.

Namely, hiring laws are closely connected to discrimination laws that affect:

- Hiring decisions,

- Job interviews, and

- Regular employee workdays.

According to the federal law, all employers, regardless of the business sector, are forbidden from discriminating against employees based on:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Pregnancy and childbirth,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

Even though there are federal regulations regarding the production, distribution, and use of tobacco products, South Dakota protects employees from discrimination related to tobacco use, if the proposed use is done off the working premises.

South Dakota Hiring Laws“Right-to-work” law in South Dakota

So far, there are 28 US states that practice the “right-to-work” law — legislation that protects employees from being forced to join or pay fees to labor unions as a condition for employment.

South Dakota belongs to the said group of states and follows federal regulations that are universal for all 28 states.

If a South Dakota employee is coerced into working conditions that go against the right-to-work policies by the employer, the action will be deemed as a Class 2 violation and the appropriate penalties will be enforced.

Termination laws in South Dakota

Aside from the same discrimination laws mentioned in the hiring laws, an employer in the state of South Dakota is otherwise free to terminate an employee’s contract of employment at any time — which makes South Dakota an “employment at-will” state.

No reasons have to be provided for the termination, the same as when an employee leaves a job.

But there are some exceptions. Most general exceptions are:

- Strict employment contracts that clearly specify the end date,

- An attempt to take advantage of a lawful right, and

- Discharging an employee in retaliation for objecting to committing an illegal act.

Furthermore, state law provides protection for smokers that use tobacco and/or tobacco products off the premises.

Of course, there are exceptions to this rule, such as in firefighting facilities or if the smoking prohibition is causing a conflict of interest to any responsibilities to the employer.

South Dakota Termination LawsFinal paycheck in South Dakota

All employees are to receive the final paycheck upon termination no later than the next scheduled payday — either as lump sum payment or semi-monthly.

Failure to do so can result in fines — if the employee provides legal documentation that shows no payments made to their account.

Health insurance continuation in South Dakota (COBRA)

The federal law regarding the Consolidated Omnibus Budget Reconciliation Act (COBRA) states that workers have the right to continue their group health benefits in the case of both voluntary and involuntary job loss for the next 18 to 36 months.

This law applies to businesses that employ at least 20 workers. Therefore, the state of South Dakota has its own mini-COBRA continuation that protects employees that work in businesses with less than 20 employees.

The way South Dakota Health Continuation program functions is clearly stated in the table below:

| Qualifying event | Qualified beneficiaries | Maximum period of coverage |

| Termination or reduction in the hours of employment | Employee Spouse Dependent Child |

18 months |

| >Employee enrollment in MediCare | Spouse Dependent Child |

36 months |

| Divorce or legal separation | Spouse Dependent Child |

36 months |

| Death of the employee | Spouse Dependent Child |

36 months |

| Loss of the status — “dependent child” | Dependent Child | 36 months |

Occupational safety in South Dakota

The state of South Dakota does not have a federally-approved plan for occupational safety. Therefore, it relies on the federal standards that apply to all US states.

All US states institute the Occupational Safety and Health Act of 1970, which is administered by OSHA — Occupational Safety and Health Administration.

OSHA ensures that all workers will operate and work at hazard-free facilities and conditions. It serves to prevent any work-related injuries that could happen due to poor health standards and irregular working standards.

According to OSHA, there are six salient types of hazards in the workplace:

- Biological

- Chemical

- Work organization

- Safety

- Physical

- Ergonomic

Federal OSHA in South Dakota covers both state and private sectors. To learn more about them, visit the nearest OSHA offices near you.

Miscellaneous South Dakota labor laws

Even though South Dakota is generally governed by federally-approved laws, there are still some regulations that cannot be classified into any of the previously mentioned categories.

Therefore, the miscellaneous section of this South Dakota labor laws guide will cover the following laws:

- Recordkeeping laws,

- Background check laws, and

- Whistleblower laws.

Recordkeeping laws

According to the South Dakota law, certain employment records have to be kept for a certain period of time following the termination of an employee’s contract. Such records are expressed in the table below:

| 3 years | 2 years | 1 year |

|

|

All other employment records are advised to be kept at least for a 1-year period. |

Background check laws

All employers in the state of South Dakota are obligated to notify the potential candidates that they will be conducting a background check during the interviewing process.

During the interviewing process, the dissemination of information is controlled by The Fair Credit Reporting Act that protects employees’ rights when it comes to:

- Convictions, and

- Classified criminal records.

There are no state laws that express the need to check criminal records — but the Pre-Employment Inquiry Guide states the interviewers should avoid asking such questions unless there’s a probable cause for concern that would affect the final decision.

Whistleblower laws

As is the case with many US states, the employees in South Dakota are protected when it comes to “blowing the whistle” — i.e. reporting information that might lead to the incrimination of individuals that have committed violations of any provision of law.

South Dakota Codified laws strongly protect employees in the following scenarios:

- Reporting violations of state wage laws (60-11-17.1),

- Reporting sex-based wage discrimination (60-12-21),

- Reporting unlawful discrimination (20-13-26), and

- Grievance procedure for state employees subject to retaliation (3-6D-22).

As for other types of retaliation against blowing the whistle that are not classified in the codified laws, the court of law will determine the correct penalty — usually a Class 2 or 3 misdemeanor.

Conclusion/Disclaimer

We hope this South Dakota labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this South Dakota labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

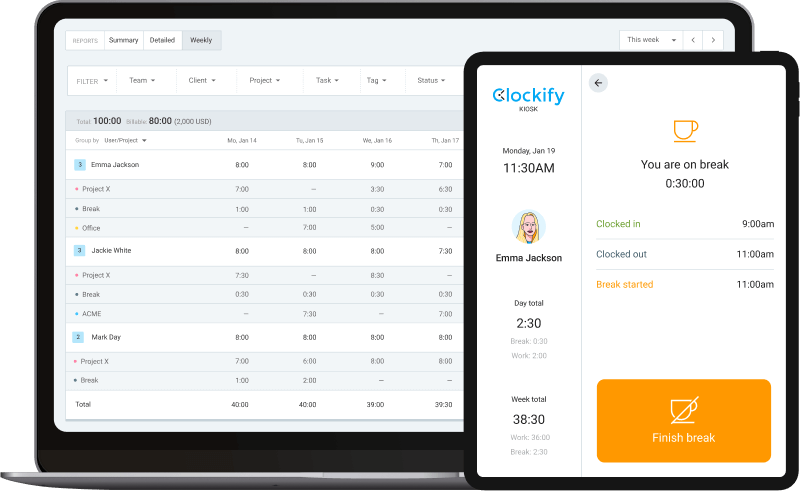

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).