Texas Labor Laws Guide

Ultimate Texas labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Texas Labor Laws FAQ | |

| Texas minimum wage | $7.25 |

| Texas overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| Texas breaks | Breaks not required by law (see below for exceptions) |

Table of contents

Texas wage laws

Since Texas does not have state laws concerning wages — federal laws apply instead.

Thanks to the US Department of Labor (DOL), all employers in the US are liable for paying their employees at least the federal minimum wage — unless exempt. The same refers to Texas employers.

The following are wage regulations regarding:

- State minimum wage,

- Tipped hourly wage, and

- Subminimum wage in Texas.

| TEXAS MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $2.13 | Applies to a certain group of employees (see below) |

Texas minimum wage

We have already said that Texas adopts federal law concerning the minimum wage rate.

Therefore, non-exempt employees in Texas receive $7.25 per hour of work.

Exceptions to the minimum wage in Texas

When it comes to exemptions from the minimum wage, federal and state laws overlap.

Under the Fair Labor Standards Act (FLSA), employees who are exempt from the minimum wage are:

- Executive, professional, and administrative employees who earn not less than $684 a week

- Computer employees who earn not less than $684 per week or $27.63 an hour

- Highly compensated employees who earn $107,432 per year or more

- Farm workers

- Employees in fishing industries

- Seasonal and recreational workers

Meanwhile, Texas minimum wage exemptions include:

- Religious, educational, charitable, or nonprofit organization employees

- Professionals, salespersons, or public officials

- Domestic workers

- Certain youths and students

- Inmates who are employed while imprisoned in the institutional division of the Texas Department of Criminal Justice or local jails

- Family members working for a family business (refers to the employer’s brother, sister, brother-in-law, sister-in-law, child, spouse, parent, son-in-law, daughter-in-law, ward, or person in loco parentis to the employee)

- Amusement and recreational establishment employees

- Non-agricultural employees not liable for state unemployment contributions

- Dairy farming and production of livestock

- Sheltered workshops for people with disabilities

Tipped minimum wage in Texas

Any employee in the state of Texas who receives more than $20 in tips per month is considered a tipped employee under the US Department of Labor.

Tipped employees in Texas receive $2.13 per hour.

Since $2.13 per hour is below the federal minimum wage, tipped employees must make at least $7.25 per hour when the hourly wage and tips combine.

If this is not the case, the employer is liable for making up the difference.

Texas subminimum wage

Subminimum wage allows employers to pay certain employees a wage that is less than the minimum wage.

In Texas, employees who are patients or clients of the Texas Department of Mental Health and Mental Retardation may be paid a lower hourly wage.

Such wage is compensated at a percentage of the base wage, and it depends on the person’s productive capacity (when compared to the capacity of an employee who is not mentally impaired).

Texas subminimum wage may be paid to persons who are:

- Patients or clients of the Texas Department of Mental Health and Mental Retardation

- Mentally impaired, i.e., their productive capacity is weakened

- Assistants in operating the facility as part of their therapy

- Trainees in a sheltered workshop or similar program

Texas payment laws

When it comes to the frequency of wage payments, Texas employers must make payments to non-exempt employees at least twice per month on designated paydays.

In case the employer fails to determine the days for payment, such paydays will automatically be the 1st and 15th day of each month.

At the same time, those employees who are exempt under the FLSA must be paid at least once a month.

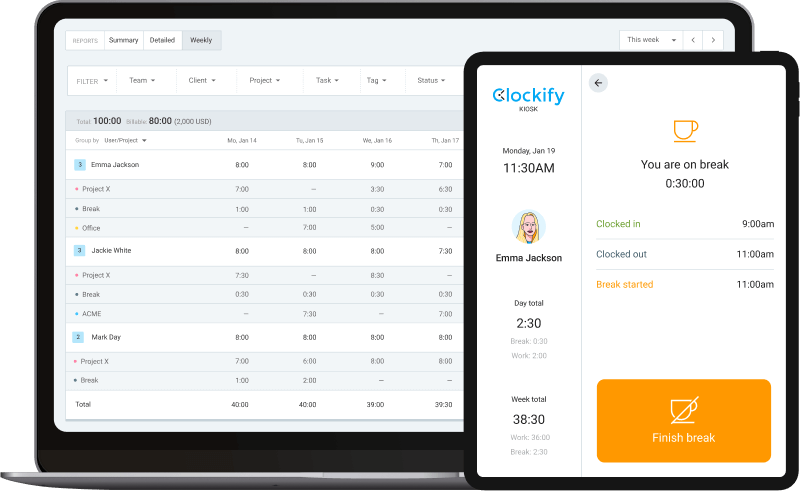

Track employee payroll with ClockifyTexas overtime laws

Non-exempt Texas employees are entitled to overtime pay at a rate of one and one-half (1.5) times the regular rate of pay for hours worked in excess of 40 in a seven-day workweek.

Track Texas overtime with ClockifyOvertime exceptions and exemptions in Texas

Contrarily to the said regulations, exempt employees are not eligible for overtime.

The following are employees who are exempt from overtime pay under Texas law:

- Certain employees who receive a piece rate pay

- Employees in retail or service establishments whose regular rates are at least one and one-half (1.5) times the minimum wage and who earn more than half of their income from commissions

- Local electric railway, trolley, or bus carrier employees

- Public agency employees who receive paid time off for working extra hours

- Employees of certain rail and air carriers

- Outside buyers of poultry, eggs, cream, or milk in their natural state

- Seamen on any vessel

- Any agricultural employee

- Employees who process maple into non-refined sugar or syrup

- Drivers employed by taxicab companies

- Employees of motion picture theaters

Even though registered nurses paid on an hourly basis are entitled to overtime under federal law, a hospital may not demand a nurse to work mandatory overtime. Likewise, a nurse may refuse to work extra hours.

Still, in the event of a health care disaster, such as the outbreak of a contagious disease, said regulations do not apply.

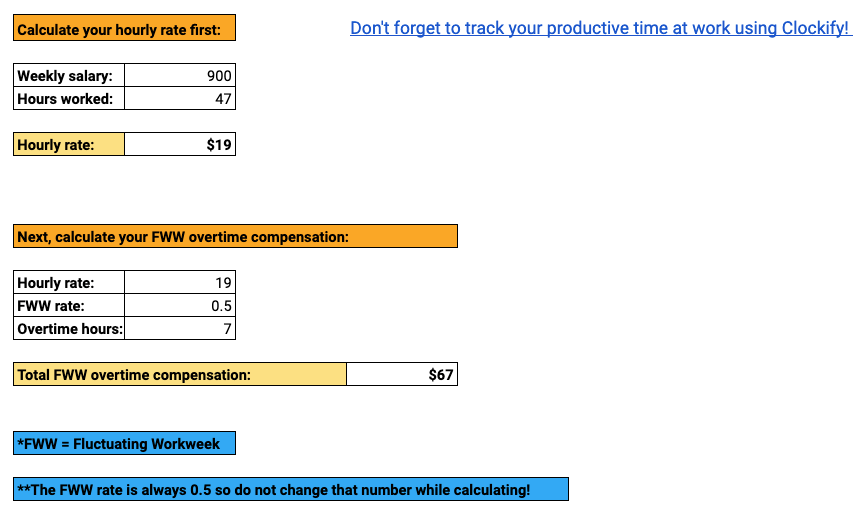

Texas overtime exemptionsFluctuating Workweek Method (FWW) in Texas

Even though federal law proposes that employees who earn a fixed salary are exempt from overtime, there is an exception to this rule.

Under the Fluctuating Workweek Method (FWW), certain employees who receive a fixed salary have the right to overtime pay of one-half (0.5) times their regular hourly rate.

However, having a fixed salary is not the only condition to qualify for overtime pay under FWW.

Eligible employees must have a fluctuating workweek — hence the name of the workweek method — meaning sometimes they work more or less than 40 hours a week.

What’s more, such employees’ minimum hourly wage must equal $7.25 per hour.

Take a look at the following example to see how the Fluctuating Workweek Method (FWW) works in practice:

An employee’s weekly income is, for instance, $1,050.

In the preceding week, the employee worked 48 hours.

To be able to calculate overtime hours, calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week.

$1,050 / 48 = $22 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week.

$22 per hour x 0.5 = $11 for each overtime hour worked

Total overtime compensation goes as follows:

$11 x 8 overtime hours = $88

Fluctuating Workweek Calculator How to cope with working long hours

How to cope with working long hours

Texas break laws

Neither federal nor state law obliges an employer to provide rest or meal breaks to their employees.

Such benefits are left to the discretion of the employer.

Exceptions to break laws in Texas

Still, when breaks are given, employers must comply with the following provisions:

- Breaks lasting 20 minutes or less (such as a coffee break) must be paid,

- Meal breaks lasting 30 minutes or longer are not paid, and employees are fully relieved of their duties during that time, and

- If an employee must work during a meal break (e.g., call agents), such breaks are compensable.

Moreover, construction workers in Austin must be provided a rest break of not less than 10 minutes for every 4 hours worked.

Be that as it may, employers are advised to offer breaks of any kind to their employees to foster a healthy and productive environment in the workplace.

Use the Pomodoro technique to integrate periodic breaks into your workdayTexas breastfeeding laws in the workplace

Texas does not have any state ordinances in terms of breastfeeding in the workplace.

For that reason, non-exempt breastfeeding employees are protected under federal law, which further states:

- Breastfeeding employees must have a “reasonable break time” to express milk each time they have a need to do so

- Such breaks are available up to one year after the child’s birth

- Breastfeeding employees must be provided with a separate room for the purpose of expressing milk — restrooms do not qualify as such separate rooms

- Such breaks are not compensable

Texas leave requirements

In the state of Texas, there are two types of leave days:

- Required leave

- Non-required leave

Texas required leave

The following are leave benefits that Texas employers must provide to their employees.

Such benefits mostly refer to employees employed in public offices, and they include:

- Sick leave (public employers)

- Family and Medical Leave Act (FMLA)

- Parental leave for certain employees

- Holiday leave (public employers)

- Vacation leave (public employers)

- Emergency leave (public employers)

- Military leave (public employers)

- Volunteering leave (public employers)

- Administrative leave (public employers)

- Voting leave (public employers)

- Jury duty leave

- Organ or bone marrow donor leave (public employers)

- Blood donor leave (public employers)

Sick leave (public employers)

State employees in Texas may start accruing sick leave from the first day of state employment.

Full-time employees may accrue 8 hours of sick leave for each month of employment.

Contrarily, part-time employees accrue sick leave on a proportionate basis.

However, eligible employees must have at least 20 hours of work per week for a period of at least 4 and a half months to be able to start accruing days.

Such leave is paid, and eligible employees may use it in the following circumstances:

- Sickness

- Injury

- Pregnancy

- Confinement

- Caring for a sick immediate family member (spouse, child, or parent)

Still, if an employee wants to take more than 3 days of paid sick leave, they must obtain a doctor’s certificate stating the reason for the employee's absence.

Moreover, parents who have children attending nursery school through 12th grade are eligible for additional 8 hours of sick leave each year. They may use that time off to attend educational activities such as a classroom program, field trip, music or theater program, etc.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal law that offers eligible employees up to 12 weeks of unpaid leave per year.

To qualify for FMLA, employees must have worked for their employer for at least 12 months (or 1,250 hours) in the last 12-month period.

Who can use the FMLA?

Eligible employees include:

- All state employees

- Public and private elementary or secondary school employees

- Employees working in companies with 50 or more employees

When to use the FMLA?

Reasons for taking time off under the FMLA include:

- Birth or care for a newborn child

- Adopting or taking in a foster child

- Caring for an immediate family member (child, spouse, or parent) due to a serious health condition

- The employee’s serious health condition

However, under Texas law, the employee must first use all available paid vacation and sick leave before taking the FMLA leave of absence.

Parental leave for certain employees

Unlike the FMLA, state employees who have worked less than 12 months (or 1,250 hours in a 12-month period) are eligible to take parental leave. Such leave is not paid and must not exceed 12 weeks.

Yet, similarly to the FMLA leave, employees must first spend all available paid vacation and sick leave to be able to use the parental leave benefits.

Parental leave becomes valid on the date of birth of a natural child or the adoption or foster care placement — provided that the foster child is younger than 3 years of age.

Holiday leave (public employers)

Texas state employees including temporary, part-time, and hourly employees are entitled to a paid day off during a holiday.

Moreover, eligible employees may get a paid day off before a holiday or after a holiday, or on both days provided that those days are workdays.

Still, employees do not receive a leave of absence if:

- A holiday falls on a Saturday or Sunday, or

- The General Appropriations Act prohibits public offices from observing a holiday.

The following are national holidays in Texas when eligible employees get time off from work:

- New Year’s Day (January 1st)

- Martin Luther King, Jr. Day (third Monday in January)

- Presidents' Day (third Monday in February)

- Memorial Day (last Monday in May)

- Independence Day (fourth day of July)

- Labor Day (first Monday in September)

- Veterans Day (eleventh day of November)

- Thanksgiving Day (fourth Thursday in November)

- Christmas Day (25th of December)

Next are state holidays of Texas when eligible employees get time off from work:

- Confederate Heroes Day (nineteenth day of January)

- Texas Independence Day (second day of March)

- San Jacinto Day (twenty-first day of April)

- Emancipation Day in Texas (nineteenth day of June)

- Lyndon Baines Johnson Day (twenty-seventh day of August)

- Friday after Thanksgiving Day

- The 24th day of December

- The 26th day of December

Finally, optional holidays in the state of Texas include:

- Rosh Hashanah

- Yom Kippur

- Good Friday

An employee may decide to give up a state holiday — provided that it does not fall on a Saturday or Sunday and that the General Appropriations Act does not prohibit from observing — and receive a paid day off on each day of an optional holiday.

However, a state employee must not give up the Friday after Thanksgiving or the 24th or 26th day of December.

Finally, state agencies and higher education institutions in Texas must have enough employees on duty during a state holiday.

Vacation leave (public employers)

Texas state employees (except for higher education employees, faculty members, and instructional employees employed less than 12 months) qualify for paid accrued vacation leave.

The following is the vacation leave accrual schedule concerning full-time employees*:

| Years of service | Hours accrued per month | Maximum hours carried forward from one fiscal year to the next |

| Less than 2 | 8 | 180 |

| 2 but less than 5 | 9 | 244 |

| 5 but less than 10 | 10 | 268 |

| 10 but less than 15 | 11 | 292 |

| 15 but less than 20 | 13 | 340 |

| 20 but less than 25 | 15 | 388 |

| 25 but less than 30 | 17 | 436 |

| 30 but less than 35 | 19 | 484 |

| 35 or more | 21 | 532 |

*Part-time employees accrue vacation leave on a proportionate basis.

Eligible employees may start accruing sick leave from the first day of state employment — but must be employed for 6 continuous months to be able to take days off.

Emergency leave (public employers)

Such leave is taken due to a death in the employee’s family.

State employees are entitled to paid time off in the event of the death of the employee’s spouse, parent, brother, sister, grandparent, grandchild, or child.

Military leave (public employers)

Eligible persons are entitled to a paid leave of absence of up to 15 days a year (from October 1st to September 30th) to serve in the military or authorized training.

Such persons include public officers or employees of Texas, a municipality, county, or another political subdivision who are members of:

- Texas military forces,

- Reserve components of the federal armed forces, or

- A state or federal urban search and rescue team.

In case of a disaster, said employees or officers are entitled to a paid leave of absence (up to 7 days in a year) and relief of duty for each day such person is called to active duty during the disaster.

Volunteering leave (public employers)

State employees who are volunteer firefighters, emergency medical services volunteers, or search and rescue volunteers are granted a paid leave of absence of up to 5 working days per year.

Such leave is taken in case of emergency training practices or to respond to emergencies such as fire, medical, or search and rescue.

Administrative leave (public employers)

Such leave may be granted to employees as a reward for outstanding performance at work.

Eligible employees receive up to 32 hours of paid absence a year.

Voting leave (public employers)

All state agencies are obliged to offer their employees sufficient time off with pay for the purpose of voting in a national, state, or local election.

Jury duty leave

All employees must be excused from work to respond to a jury duty summons.

Yet, under Texas law, employers are not obligated to compensate for hours not worked because of performing jury duty.

Organ or bone marrow donor leave (public employers)

State employees who are volunteer organ or bone marrow donors receive the following benefits:

- Paid leave of absence of up to 5 working days per year for donating bone marrow, or

- Paid leave of absence of up to 30 working days for donating an organ/organs.

Blood donor leave (public employers)

Blood donors — applicable to state employees — are entitled to sufficient time off with pay to donate blood.

Yet, eligible employees must obtain approval from the supervisor before taking time off.

Such leave is limited to 4 times in a fiscal year.

Texas non-required leave

In the state of Texas, most of the leave benefits concerning private employees are left to the discretion of the employer.

When granted, leaves may be paid or unpaid.

Child labor laws in Texas

With regards to child labor provisions in Texas, employees under 18 years of age are covered.

However, under Texas law, minors under the age of 14 are not allowed to work (except when working for a business owned by a parent or legal custodian or as actors and performers).

Child labor laws in Texas offer minors a chance to earn money — but, at the same time, make sure minors work in a hazard-free environment and do not neglect school obligations.

The following are child labor provisions in Texas regarding:

- Hour restrictions

- Break periods

- Prohibited occupations

Work time restrictions for Texas minors

In Texas, work hour restrictions for minors only apply to ages 14 and 15 — state and federal laws overlap.

Time restrictions for minors aged 14 and 15 under Texas law:

- May work no more than 8 hours a day and 48 hours a week

- May not work before 5 a.m. and after 10 p.m. following a school day

- May not work after midnight on a non-school day

Time restrictions for minors aged 14 and 15 under federal law:

- May not work during school hours

- May work no more than 8 hours a day and 40 hours a week on non-school days

- May work no more than 3 hours a day and 18 hours a week on school days

- May work between 7 a.m. and 7 p.m. during the school year (except between June 1st and Labor Day when they may work two hours longer, from 7 a.m. to 9 p.m.)

Under Texas law, authorities may approve a hardship waiver if they determine that a hardship exists for a child in question. When approved, the child is no longer subject to hour limitations.

Breaks for Texas minors

As for rest or meal periods for Texas minors — neither state nor federal laws oblige an employer to provide minors with such breaks.

Prohibited occupations for Texas minors

In Texas, jobs that are considered forbidden and hazardous in child labor are divided into two groups:

- Prohibited occupations for 14 and 15-year-olds

- Prohibited occupations for 16 and 17-year-olds

Prohibited occupations for 14 and 15-year-olds

Texas minors aged 14 or 15 are not allowed to be employed in the following occupations:

- Manufacturing, mining, or processing occupations

- Operating or tending hoisting apparatus or any other power-driven machinery other than office machines

- Operating motor vehicles

- Warehousing and storage

- Cooking and baking — including operating deep fryers, electric or gas ovens, etc.

- Warehouse occupations (except for office and clerical work)

- Construction

Prohibited occupations for 16 and 17-year-olds

Furthermore, minors aged 16 and 17 in Texas are not allowed to work in the following occupations (except for the occupations marked with an asterisk (*) which apply to 16 and 17-year-olds employed as apprentices or student learners):

- Manufacturing or storing explosives

- Operating motor vehicles

- Coal mining

- Logging and sawmill operations

- Operating or assisting to operate power-driven hoisting apparatus such as elevators, cranes, derricks, hoists, and high-lift trucks

- Operating or assisting to operate power-driven bakery machines

- Manufacturing brick, tile, and kindred products

- Operating or assisting to operate power-driven woodworking, metal forming, punching, shearing, meat processing, or paper-products machines, balers, compactors, circular saws, band saws, guillotine shears, abrasive cutting discs, reciprocating saws, chain saws, and woodchippers*

- Roofing and excavation operations*

Texas hiring laws

It is considered an unlawful employment practice if an employer, employment agency, labor organization, or training program fails or refuses to hire, limits, segregates, classifies, or discriminates in any other manner against an individual based on their:

- Race

- Color

- Disability

- Religion

- Sex

- National origin

- Age (applies to individuals aged 40 and over)

The Texas law against employment discrimination applies to private employers with 15 or more employees and all state and local governmental entities no matter how many employees they have.

Moreover, Texas law protects employees from retaliation discrimination. On that account, it is considered unlawful employment practice if an employer takes adverse action against an individual who files a workplace discrimination complaint or participates in the investigation of a discrimination complaint.

Right-to-work law in Texas

Texas is another right-to-work state.

This means that an employee may not be denied or conditioned in terms of employment based on their membership or non-membership in a labor union or organization.

Furthermore, no employer, officer, agent, representative, or member of a labor union may receive or demand fees from a non-union member as a condition for employment.

Under Texas law “workers must be protected without regard to whether they are unionized; The right to work is the right to live.”

Texas termination laws

Texas employers may terminate their employees at any time and for any reason or no reason at all.

This employment law is called employment-at-will.

Similarly, under this law, employees in Texas can quit their jobs at any time and for any reason or no reason at all.

However, there are exceptions to this rule. It is considered “wrongful discharge” if an employer discharges an employee based on:

- Race, color, religion, gender, pregnancy, age, national origin, or disability

- Veteran status

- Sexual orientation

- Filing a claim or bringing suspected wrongdoing to the attention regarding employment discrimination, OSHA standards, wages, etc.

- Military duty

- Jury duty

- Voting

- Union membership

Texas final paycheck

At the time of work separation, the employer must:

- Make a final wage payment within 6 calendar days if an employee has been discharged, or

- Make a final wage payment not later than the next regularly scheduled payday when an employee resigns.

Health insurance continuation in Texas

In case of employment termination, eligible employees and their dependents are still legally allowed to use health insurance under the Consolidated Omnibus Budget Reconciliation Act (COBRA) law.

COBRA is a federal law that covers employers with 20 or more employees and provides health insurance for 18 to 36 months following the work termination.

In addition, there is also a state insurance continuation under Texas law. So, if an employee or their dependent is not eligible for COBRA (or has exhausted their COBRA coverage), they are subject to their former employer’s health plan for another 9 months.

In case they have exhausted their COBRA coverage, they are entitled to additional 6 months of health insurance coverage.

Still, Texas insurance continuation only applies to group health benefit plans (this does not include self-funded ERISA health care plans).

Occupational safety in Texas

The federal Occupational Safety and Health Act (OSHA) makes sure Texas employees work in a healthy and hazard-free working environment.

Thanks to OSHA’s safety standards and regulations, workplace accidents and tragedies are kept to a bare minimum.

Still, OSHA only applies to private employers and their employees.

Under OSHA, the hazards are grouped as follows:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Stress triggers (e.g., workplace violence, excessive workload, and similar)

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

The Texas Occupational Safety and Health Consultation (OSHCON) program helps private employers recognize and eliminate workplace hazards and maintain a hazard-free working environment. Thanks to this program, fewer occupational injuries and illnesses are reported each year.

OSHA offices in TexasMiscellaneous Texas labor laws

We have decided to add a few more laws concerning labor and placed them in the miscellaneous section.

The most significant include:

- Whistleblower laws

- Record keeping laws

Texas whistleblower laws

Whistleblower laws prohibit retaliation such as pay cuts, dismissal, or any other adverse employment action taken against an employee who “blows the whistle” — i.e. reports an illegal activity to the authorities.

In the same manner, the Texas Whistleblower Act protects public employees who in good faith report a violation of law to an appropriate law enforcement authority (reporting a violation to a supervisor is not considered an appropriate law enforcement authority).

In case a public employee has been affected by an adverse employment action (wrongfully suspended, dismissed, etc.), such an employee has the right to sue a state or local governmental entity for:

- Injunctive relief,

- Actual damages,

- Court costs, and

- Reasonable attorneys fees.

In addition, a damaged employee is entitled to reinstatement to their former position and all wages and fringe benefits lost during the period of absence.

If a public employee believes that they have been discriminated against for being a whistleblower, such an employee must initiate their district’s grievance procedure within 90 days after the alleged incident.

A supervisor who takes an adverse employment action against a public employee may be liable for a civil penalty of up to $15,000.

Texas recordkeeping laws

Regarding the retention of personnel records in Texas, there are specified periods of time for different types of records that must be kept by each employer.

Said records include:

- Compensation records — Payroll and other compensation records together with unemployment tax records for at least 4 years.

- Family and Medical Leave (FMLA) records — Payroll, benefits, and leave-related documents for at least 3 years after the conclusion of the leave.

- I-9 records — For at least 3 years after the date of hire or 1 year after the date of separation, whichever is reached later.

- Hiring records — All hiring-related records for at least 1 year after the date of hire.

- Disability-related records (ADA) — For at least 1 year after the date the document was created or the personnel action was taken, whichever comes later.

- Benefit-related information (ERISA and HIPAA) — For at least 6 years after the date of document creation.

- Age-discrimination documentation (ADEA) — Payroll records for at least 3 years and documents concerning personnel actions for at least 1 year.

- OSHA records — For at least 5 years.

- Hazardous materials records — For at least 30 years after the date of employment separation.

- State discrimination laws — For at least 1 year after the date of separation.

- IRS payroll tax-related records — For at least 4 years following the period covered by records.

Moreover, under FLSA, records regarding non-exempt employees must be kept for at least 3 years — said records include:

- Name, address, birth day (if younger than 19), and sex

- Occupation

- Hours worked each day and week

- Exact time and day of the week when employee’s workweek begins

- Basis on which the employee’s wages are paid (e.g., $12 per hour or $400 per week)

- Hourly pay rate

- Total overtime earnings

- Additions or deductions from the employee’s wages

- Total wages paid each pay period

- Date of payment and the pay period

Since federal recordkeeping laws state that payroll records should be kept for at least 3 years, then the state law with the requirement of at least 4 years prevails. In general, the law with the “stricter” or “more beneficial” provisions for the employee (in this case, the state law of Texas) will always overpower the one with the “weaker” or “less beneficial'' provisions (in this case, the federal law).

Conclusion/Disclaimer

We hope this Texas labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Texas labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).