Vermont Labor Laws Guide

Ultimate Vermont labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Vermont Labor Laws FAQ | |

| Vermont minimum wage | $12.55 |

| Vermont overtime | 1.5 times the rate of the standard wage ($18.825 for employees earning minimum wages) |

| Vermont breaks | All employees must be granted a “reasonable opportunity” to eat and use toilet facilities. If the break lasts less than 30 minutes, it is paid. |

Table of contents

Vermont wage laws

The state known for its natural landscapes, maple syrup, and beautiful wooden bridges is unique in many regards — including laws.

When it comes to labor wages, the state of Vermont does not abide by federal laws and regulations — the Department of Labor in Vermont protects minimum and subminimum-wage employees with a set of state rules that all employers must abide by.

The exact numbers for the regular minimum wage, tipped minimum wage, and subminimum wage in Vermont are expressed in the table below.

| VERMONT MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $12.55 | $6.28 | $12.55 |

Vermont minimum wage

Wage laws are designed to protect employees and offer the maximum support when it comes to their quality of life. If the state and federal laws differ in regard to the minimum wage rate, the higher minimum wage prevails.

The Department of Labor in the state of Vermont makes annual adjustments to minimum wages based on the Consumer Price Index — a metric measuring the changes in prices and their effect on the quality of life.

Due to inflation, minimum-wage employees in Vermont have seen an increase in their hourly wages — a rise from $11.75 to $12.55, as of January 1, 2022.

Department of Labor in Vermont — Minimum WagesTipped minimum wage in Vermont

An employee that receives at least $30 per month in tips is considered a tipped employee.

In most US countries, employers are required to provide only a fraction of the minimum wage — $2.13 — if the employee is capable of acquiring the rest of the hourly wage in tips.

However, the state of Vermont operates on a different premise — the employer is obligated to provide 50% of the state hourly wage — which amounts to $6.28 — provided that this sum combined with tips amounts to at least the state minimum wage.

If not, the employer is obligated to pay the difference, so as to reach the minimum wage of $12.55 per hour.

In line with the minimum wage law change, tipped employees also experienced an increase in wages as of January 1, 2022 — tipped minimum wage in 2021 was $5.88.

Track work hours and hourly pay with ClockifyVermont subminimum wage

According to the FLSA (Fair Labor Standards Act), subminimum wages can be paid to:

- Student-learners,

- Full-time students that work in retail, agriculture, and service establishments, and

- People with impaired productive capacity — i.e. people who are physically and mentally disabled.

The federal rate for subminimum wages amounts to $4.25 — 60% of the federal minimum wage.

In Vermont, people with disabilities used to work in “sheltered workshops” — facilities that employed workers to perform simple tasks for extremely low wages.

Due to widespread discrimination and lack of opportunities for people with disabilities, Vermont Civil Rights Commission ended the subminimum wage in 2002.

As of 2022, all earners are entitled to the state minimum wage — $12.55 — while exempting the tipped employees.

Track employee payroll with ClockifyExceptions to the minimum wage in Vermont

Exceptions to the minimum wage in the state of Vermont somewhat overlap with the federal requirements. But, there are a couple of state-unique professions that you should know about.

A unified list of exempt occupations includes:

- Employees working in agriculture,

- Domestic service or private home employees,

- Government-employed workers,

- Non-profit organization employees,

- Newspaper delivering or marketing employees,

- Taxi-cab drivers,

- Outside salespersons, and

- Part-time student employees.

Furthermore, it’s important to mention that the occupations that are always exempt from minimum wage laws, on both the federal and state level, are:

- Executive employees who are paid not less than the state minimum wage,

- Administrative employees who are paid not less than the state minimum wage,

- Professional employees who are paid not less than the state minimum wage, and

- Highly compensated employees who earn more than $500,000 in gross annual incomes.

Vermont payment laws

The state of Vermont has a specific payment plan that relates to all employers, whether private or public.

All employers are obligated to pay all wages due, at least once a week.

However, if the employers submit a notice to all employees which everyone agrees on, the payment plan can be changed to a bi-weekly basis.

The exact payday has to be 6 days within the last day of the pay period.

Furthermore, employers must provide a statement on every payday regarding:

- Total hours worked,

- Hourly rate,

- Gross pay, and

- Itemized deductions.

Vermont overtime laws

The federal overtime requirements for all employees in the US are the following:

- Employees have to be non-exempt from the law in question,

- Employees have to work at least 40 hours per week, and

- Employees have to be lawfully employed by the employer.

If the conditions are met, the employees are entitled to 1.5x overtime pay for all excess hours worked over the standard 40-hour work week.

Since the state minimum wage amounts to $12.55, the hourly overtime pay amounts to $18.825 for employees earning minimum wage.

Overtime exceptions and exemptions in Vermont

To be affected by overtime laws, an employer must have at least 2 workers, unless the said employees are specifically exempted by the Vermont Statute.

The overtime exemptions and exceptions include employees that work in:

- Retail or service establishments,

- Amusement or recreational establishments,

- Hotel, motel, or restaurant establishments,

- Hospitals and public health centers,

- Nursing, maternity, and therapeutic homes,

- Transporting persons or property to whom the FLSA overtime requirements do not apply, and

- Political subdivisions of the state.

Vermont break laws

Since the state of Vermont — i.e., Vermont Legislature — has no specific laws regarding break laws, federal rules apply. However, state law implies that an employer should provide all employees with “a reasonable opportunity” to eat, rest, and use toilet facilities.

According to the FLSA, employers are not required to provide breaks. But, if they choose to do so under their own policies, all breaks that last under 30 minutes will be considered paid breaks.

Vermont breastfeeding laws

Prior to 2008, employers in the state of Vermont were free to set their own policies regarding breastfeeding in the working premises and the breaks directly related to nursing mothers.

However, on July 1, 2008, legislation regarding nursing mothers was passed into law, which provided protection for new mothers in the workplace.

Since then, nursing mothers have to be accommodated and provided with:

- An appropriate private space (cannot be a bathroom stall) to express milk, and

- Reasonable time — compensated or uncompensated — to express milk and tend to their newborn.

The employer can file for an exemption in cases where the said breaks could cause undue hardship to the business.

Still, if the employee acts within their rights under the breastfeeding law, the employer is prohibited from retaliating or discriminating.

Vermont break lawsVermont leave requirements

Regardless of the state they reside in, US employees are entitled to receive days of absence under certain conditions.

The laws that regulate their absence are referred to as leave laws.

Employee leave can be either required or non-required.

In any case, it is up to the employer to decide whether the leave will be paid, except in rare circumstances we’ll discuss below.

Let’s see what types of leave are required and what types of leave are not required in the state of Vermont.

Vermont required leave

The leaves of absence that employers are required to provide to their employees in the state of Vermont are the following:

- Sick leave

- Family and Medical leave (FMLA)

- Jury duty leave

- Crime victim and witness leave

- Town meeting leave

- Military service leave

Sick leave

According to the Earned Sick Time Rules — issued by the Commissioner of Labor — an employee is eligible to start accruing sick leave if their place of residence is the state of Vermont, where they are also employed.

For every 52 hours worked, an employee accrues 1 hour of sick leave, which can be capped at 40 hours on an annual basis. So, the maximum number of hours an employee can receive is 40 hours — provided that they accrued that many hours.

The employer is not obligated to track any accruals in increments of less than an hour’s worth of time.

However, not all employees are eligible for sick leave. The exceptions include:

- US government employees,

- Part-time employees — employees that work less than 18 hours per week on average,

- Seasonal employees,

- Per diem health care workers,

- Substitute teachers,

- Minors,

- Sole proprietors or partner owners of an unincorporated business,

- Executive officers, managers, or members of a corporation or a limited liability company for whom the Commissioner has approved an exclusion, and

- Individuals that work on an intermittent basis.

Family and Medical Leave (FMLA)

The Family and Medical Leave Act is a federal law that offers eligible employees an unpaid leave of up to 12 workweeks within a consecutive 12-month period.

This type of leave can be used for:

- The birth of a child and care for the newborn,

- Adoption or foster care, and

- A serious health condition of an employee or their immediate family member.

To qualify for FMLA, an employee must have worked for the employer for 12 months or 1,250 hours within those 12 months.

In addition to the federal FMLA, Vermont employees are granted further relief with the state-approved FMLA.

The cases where an employee can use this type of leave are:

- Pregnancy, childbirth, and/or adoption of a child up to 16 years of age — if the employer has at least 10 employees, and

- Medical emergencies regarding employee’s or a family member’s illness — if the employer has at least 15 employees.

Furthermore, Vermont’s Small Necessities Law states that employers with at least 15 employees must allow employees to take up to 24 hours of leave on an annual basis, with no more than 4 hours taken in any 30-day period, for the employee to:

- Participate in school activities directly related to the educational advancement of the employee's child,

- Attend or accompany a family member to routine medical or dental appointments,

- Accompany the employee's parent, spouse, or parent-in-law to appointments for professional services related to their care and well-being, and

- Respond to a medical emergency involving a family member.

Also, if needed, under the provisions of the Flexible Working Arrangements Law in the state FMLA, employees can request that their working schedule be arranged differently, due to family and medical reasons.

Jury duty leave

If and when an employee is summoned to serve as a juror, the employer is obligated to provide a leave of absence for the duration of court proceedings.

In such cases, the employer is forbidden from terminating or penalizing the employee since jury duty is a federal requirement.

However, in the state of Vermont, employers are not required to pay the wages lost during the leave since the court will cover daily expenses and offer a small pay.

An employer who violates a provision of the jury duty law shall be fined not more than $200.

Crime victim and witness leave

No employer is allowed to discharge or penalize an employee that is summoned by the court of law to testify as a witness to a crime, especially if the said employee is a crime victim in the criminal proceedings.

The crime victim and witness law refers to any court summons, including:

- Civil and criminal prosecutions, and

- Board, commission, or any other tribunal in the state court.

During this time, the employee will be considered to be in the service of the employer — which means this type of leave will not affect employee’s:

- Fringe benefits,

- Credit towards vacation,

- Rights,

- Privileges, and

- Benefits of employment.

Town meeting leave

If an employee notifies their employer at least 7 days prior to the annual town meeting, they are free to take a leave of absence to attend it.

However, it’s up to the employer to choose whether the leave will be paid or unpaid.

Military service leave

If an employee is a member of Reserve Components of the US Armed Forces — or any other organized unit of the Vermont National Guard — they will be granted a leave of absence after duly notifying the employer of their deployment.

Military leave also includes:

- Training,

- Military drills, or

- Special military activities.

During this time, all employees will receive the same benefits and seniority as if they were working.

However, the employer decides whether the leave will be paid. In practice, the first 2 weeks of military service leave are usually paid.

Vermont non-required leave

According to the state law, there are certain types of leaves that employers are not obligated to offer to their employees.

However, it almost always depends on the employer whether they’ll allow them or not. When it comes to Vermont, the following are the non-required leaves of absence:

- Bereavement leave

- Vacation leave

- Holiday leave

Bereavement leave

Bereavement leave is a non-required type of leave in the state of Vermont that presents a time-off from work when a loved one has passed.

If the employer chooses to implement a bereavement leave policy, the information regarding the policy has to be posted with the rest of the policies in a conspicuous place on the working premises.

It’s up to the employer to decide whether the leave will be paid or unpaid — if they decide to implement it.

Still, employers are not required to provide bereavement leave by the court of law and, therefore, cannot be penalized for not providing it.

Vacation leave

There are no provisions regarding vacation leave, either in the federal or Vermont’s state plan.

Therefore, it’s up to the employer to decide whether they will offer a vacation leave or not.

If they do, it’s advised to construct an accrual plan regarding the days and the hours necessary to become eligible for the said vacation leave.

Holiday leave

In Vermont, employers are not obligated to provide a holiday leave.

But, if they do, the following are the holidays that could be included in the employer’s policy:

- New Year’s Day — January 1

- Martin Luther King Jr. Civil Rights Day — observed on the third Monday in January

- Washington’s Birthday — observed on the third Monday in February

- Memorial Day — observed on the last Monday in May

- Independence Day — observed on July 4

- Labor Day — observed on the first Monday in September

- Columbus Day — observed on the second Monday in October

- Election Day — observed every other year

- Veterans Day — observed on November 11

- Thanksgiving Day — observed on the fourth Thursday in November

- Christmas Day — observed on December 25

Child labor laws in Vermont

Child labor laws, whether federal or state, are always designed to protect minors from exploitation at work, such as:

- Working excessive hours,

- Operating unsafe machinery, and

- Working in dangerous conditions.

This law also includes protection from:

- Physical,

- Moral, and

- Emotional hazards.

In general, employers are required to provide employment certificates for all minor employees.

However, the state of Vermont does not require the provision of such certificates in cases when:

- The minor is 16 years of age and older, and

- The minor is not employed during school hours.

Still, the employer has to keep a record of all employed minors, including the proof of age. This provision relates to all minors under the age of 19.

Work time restrictions for Vermont minors

Minors aged 16 and older have no work time restrictions that differ from those for adult employees. However, one provision states that such minors cannot be employed in a manufacturing establishment for more than 9 hours a day/50 hours per week.

When it comes to minors aged 15 and younger, there are strict regulations regarding their work time restrictions.

Such minors cannot work:

- During school hours,

- Before 7:00 a.m. or after 7:00 p.m. — after 9:00 p.m. between June 1st and Labor Day,

- More than 3 hours per day/18 hours per week during school time,

- More than 8 hours per day/40 hours per week during non-school time, and

- More than 6 days per week.

Minors aged 14 and 15 years are permitted to handle only the following types of work:

- Office and clerical work,

- Cashiering, selling, modeling, art work, work in advertising departments, window trimming,

- Price marking and tagging,

- Errand and delivery,

- Cleanup work — using vacuum cleaners and non-commercial floor waxers,

- Kitchen work,

- Work related to trucks and automobiles, and

- Cleaning vegetables and fruit.

Prohibited occupations for Vermont minors

The following are the prohibited occupations and work activities for all minors under the age of 19:

- Manufacturing or storing explosives,

- Driving or working outside on motor vehicles,

- Forest fire fighting & prevention,

- Using power-driven woodworking machines,

- Exposure to radioactive substances,

- Using power-driven hoisting apparatus,

- Using power-driven metal-forming, punching, and shearing machines,

- Mining,

- Using meat-processing machines, slaughtering, meat and poultry packing and processing,

- Using bakery machines,

- Using balers, compactors, and paper-products machines,

- Manufacturing bricks and tiles,

- Using circular, band, chain, or reciprocating saws, guillotine shears, wood chippers, and cutting discs,

- Working in demolition,

- Roofing, and

- Trenching or excavating.

Penalties for employing minors in Vermont

There are no specific state laws that determine penalties for violating any provisions of the child labor laws in Vermont.

However, under federal law, all violations are subject to civil penalty up to $10,000.

Child labor laws — VermontHiring laws in Vermont

According to the federal law, all employers, regardless of the business sector, are forbidden from discriminating against employees based on:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Pregnancy and childbirth,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

Interestingly, Vermont is also one of the states that has anti-discrimination rules in the hiring process when it comes to:

- Credit report and history,

- Medical records and history involving HIV/AIDS, and

- Wage garnishments for consumer debts.

“Right-to-work” law in Vermont

Since many US states are a part of the “right-to-work” movement, it is important to note that Vermont does not classify as such a state.

In other words, the state of Vermont does not protect employees from being forced to join a labor union and pay union-related fees as a precondition to employment.

Termination laws in Vermont

Similar to many US states, Vermont practices the “employment at-will” doctrine. This means that an employer can terminate a contract of employment with any employee for any reason.

The reasons for termination must not be based on discrimination.

But if there’s a justifiable reason to terminate an employee that does not violate any of the employee’s rights, the employer can do so.

In the case of massive layoffs — i.e. firing at least 50 employees in a 90-day window — employers must provide at least a month and a half’s notice to the Commissioner of Labor for the layoffs to be considered legal.

Final paycheck in Vermont

Similarly to many US states, all Vermont employers must pay all due wages after termination within 72 hours of the designated payday.

The wages can either be directly deposited to the employee’s bank account or delivered to them directly, as per contract agreement.

Health insurance continuation in Vermont (COBRA)

The federal law that applies to businesses with 20 employees or more regarding the Consolidated Omnibus Budget Reconciliation Act (COBRA) states that workers have the right to continue their group health benefits in the case of both voluntary and involuntary job loss for the following 18 to 36 months.

Since the federal COBRA does not cover smaller businesses, state plans are often introduced to alleviate some of the hardships that employees go through.

The Vermont state COBRA plan covers all beneficiaries for 18 months after termination or death of an employee (the plan is transferred to their family members in the latter case).

Other qualifying events for state COBRA can include:

- Voluntary or involuntary job loss,

- Reduction in the hours worked,

- Loss of the “dependent child” status,

- Employee enrollment in Medicare, and

- Divorce.

Occupational safety in Vermont

The most common workplace hazards recognized by OSHA can be classified into:

- Biological,

- Chemical,

- Physical,

- Ergonomic,

- Safety, and

- Work organization.

OSHA’s responsibilities include conducting regular inspections to make sure that:

- All facilities and working premises are safe, and

- Both employees and employers are complying with health standards.

The federally approved state OSHA serves to:

- Provide safe and healthy working conditions,

- Continually inspect for flaws and irregularities, and

- Strive to improve work conditions, if possible.

Employers are required to provide several things to ensure workplace safety to their employees in compliance with OSHA:

- Proper training,

- Education, and

- Continuous assistance.

Miscellaneous Vermont laws

All of the aforementioned laws can be placed in one category or another, but there are some regulations difficult to categorize.

That’s why we present them in a separate, miscellaneous category.

Some of these laws include:

- Record-keeping law

- Background check law

- Social media law

Record-keeping law

According to the federal law, employers are required to keep certain employee records during employment and after termination of employment.

The records should include:

- Name,

- Occupation,

- The rate of pay,

- The amount paid on each paid period, and

- The hours worked each day and week.

Here’s a list of other information employers should keep and how long they should keep them:

- Selection, hiring, and employment records — 1 year after creating the contracts (2 years for federal agencies and contractors)

- Payroll records and timesheets — 3 years (no obligation, but it is advised to keep them for legal purposes)

- I-9 forms — 3 years after the initial hiring date

- Employment benefits — 6 years after the termination of employment

- Tax records — 4 years from the date the tax is paid

- Safety data — 5 years following the year records pertain to

- FMLA records — 3 years after the termination of employment

- Polygraph test records — 3 years after doing doing the test

- Drug test records — 1 year after doing the test

Background check law

In 2016, Vermont legislature passed the “ban-the-box” law, which stipulates that no employer can request a candidate’s criminal history during the interview process — unless the job in question has a certain exception that would otherwise require the employer to do so.

The types of professions for which employers are required to conduct a background check include the following:

- Nursing home and home care personnel,

- Residential buildings’ managers,

- School personnel,

- Adult rehabilitation specialists, and

- Long-term health personnel.

Social media law

According to the Vermont Statute — and approved by the Commissioner of Labor — no employer can require, request, or coerce employees to:

- Disclose social media usernames and passwords,

- Divulge personal information from social media,

- Change their privacy settings, and

- Add personnel or contacts to their private social media contact lists.

Any violations of the subdivision 495(a)(8) in the Vermont Statute will result in penalties.

Conclusion/Disclaimer

We hope this Vermont labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Vermont labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

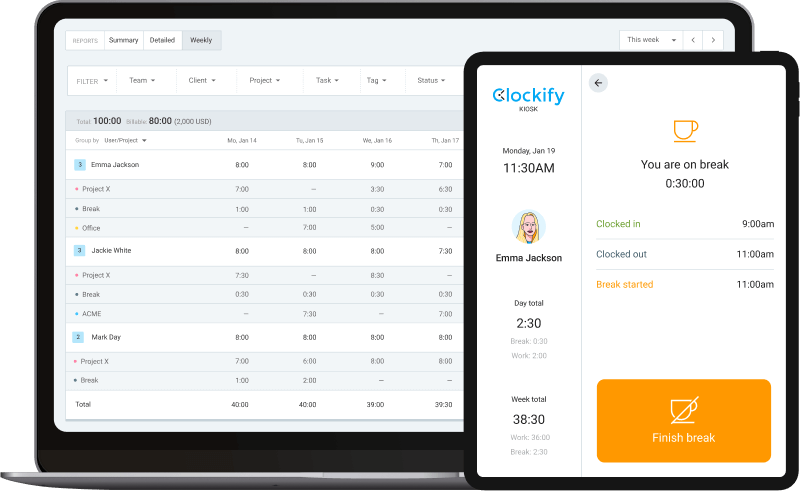

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).