Virginia Labor Laws Guide

Ultimate Virginia labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Virginia Labor Laws FAQ | |

| Virginia minimum wage | $11 |

| Virginia overtime laws | 1.5 times the minimum wage for any time worked over 40 hours/week ($16.5 for minimum wage workers) |

| Virginia break laws | Meal break for minors under 16 — 30 min per 5 hours |

Table of contents

Virginia wage laws

We’ll first deal with the most important laws and regulations regarding minimum, tipped, and subminimum wages in Virginia.

| MINIMUM WAGE IN VIRGINIA | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $11 | No established tipped minimum wage — the total of the tips and what employers provide must equal at least the regular minimum wage of $11 | Training wage — $4.25 Student workers employed on a part-time basis — 85% of regular minimum wage ($9.35) |

Virginia minimum wage

The term minimum wage refers to the lowest hourly rate employees can be compensated for their work.

At the federal level, wages are regulated by the Fair Labor Standards Act (FLSA) — but each state has the right to make the state minimum wage higher than the federal minimum of $7.25 — which Virginia did.

Virginia’s current standard minimum wage is $11, but it is set to increase as follows:

- $12 per hour, effective January 2023

- $13.50 per hour, effective January 2025

- $15 per hour, effective January 2026

There are some other exemptions and exceptions to this requirement — for example, for summer camp employees.

Let’s see what else is relevant in terms of fair compensation for Virginia employees.

Further details on Virginia minimum wage increaseTipped minimum wage in Virginia

According to federal law and the Internal Revenue Service (IRS), tips are certain amounts of money that are freely provided by customers to employees.

Tips are closely tied with certain professions, especially in the hospitality industry. To provide a couple of examples — you can leave tips to servers and bartenders, as a recognition for their service.

Tipped employees in Virginia are employees who regularly receive such gratuities.

The tipped minimum wage is not regulated under Virginia laws. Therefore, employers can offer a tipped position to employees, but the total of tips earned and what employers contribute must at least amount to the regular minimum wage of $11.

Virginia law doesn’t regulate a common practice related to tips — tip pooling (or tip sharing). This means that Virginia employers can require employees to participate in tip pools.

The practice refers to all tipped employees sharing a portion of their tips in order for a part to be distributed to employees who usually don’t receive tips, such as:

- Cooks,

- Line cooks,

- Prep-cooks,

- Dishwashers, etc.

Additionally, even if an employer doesn’t require tip pooling, employees can enter into agreements about tip distribution among themselves.

Track work hours and calculate hourly pay with ClockifyExceptions to the minimum wage in Virginia

Certain employment or personal statuses are exempt from the law regarding minimum wage in Virginia.

Here’s a list of all the exemptions to the minimum wage in Virginia:

- White-collar employees (i.e. bona fide executives, administrative workers, and professionals)

- Outside salespeople — provided they are compensated on a commission basis, by piecework, or flat rate schedules

- Farm workers

- Volunteers engaged in the activities of educational, charitable, religious, and nonprofit organizations

- Caddies on golf courses

- Operators of taxicabs

- Minors employed by their parents or guardians

- Workers who are confined in penal and correctional facilities

- Summer camp workers

- Minors under 16, regardless of the employer and job

- Student workers participating in bona fide educational programs

- Minors who are enrolled in secondary and trade schools, or other institutions of education — provided they work up to 20 hours per week

- Any person who is enrolled in secondary and trade schools, or other institutions of education — provided they are employed by same institution

- Babysitters who work up to 10 hours per week

- Any person participating as an au pair in the US Department of State's Exchange Visitor Program (living in a host family)

- Any person employed as a temporary foreign worker

Subminimum wage in Virginia

Minimum wage for certain categories of workers — such as student workers in Virginia — is commonly referred to as the subminimum wage. The hourly rate for this type of wage is also regulated by law.

The term “subminimum” already implies that employers are allowed to pay such employees a lower hourly wage than the minimum wage.

In Virginia, there are only 2 categories of employees who can be paid at a rate lower than the state minimum:

- Student workers employed on a part-time basis, and

- Trainees under 20 years of age, for the first 90 days of employment.

Employers must compensate student workers at a rate of at least 85% of the standard minimum wage.

The number translates to a requirement of at least $9.35 per hour.

Employers must compensate trainees under 20 years of age at a rate of at least $4.35. This is applicable only for the first 90 days of employment.

Apart from those 2 categories of employees, all other non-exempt employees are entitled to at least the standard minimum wage.

Virginia payment laws

When it comes to pay frequency in Virginia, employers are required by law to provide regular compensation for their employees on a semi-monthly basis.

This means that every two weeks are considered a payroll period.

There is an exception to the rule, and it is applicable only to employees who earn at least 150% of the state-defined average weekly wage. Provided they agree in writing, such employees may be compensated on a monthly basis.

Employers can choose the manner of wage payments and pay their employees in the following ways:

- Cash,

- Checks,

- Direct deposit system, ATMs, or other means of electronic transfer, and

- Payroll cards.

Deductions from wages are allowed only if legally required (e.g. taxes), or if an employee agrees in writing. Each such paycheck must define both the amount and the purpose of the deductions.

Track employee payroll with ClockifyVirginia overtime laws

Regulations established by the Fair Labor Standards Act define a working week as any seven consecutive 24-hour periods. During this period, employees who work up to 40 hours are compensated for their work at least at an hourly rate of a minimum wage, as defined by the Virginia constitution.

Any number of hours exceeding 40 counts as overtime and must be compensated at a higher hourly rate.

Non-exempt employees who do exceed that number are entitled to 1.5 times their regular rate.

In other words, overtime pay currently translates to $16.5 for minimum wage employees.

Some occupations and conditions can overrule this 1.5 rate requirement.

We’ll explain everything in the following sections, so read on and check out who is eligible for overtime compensation in Virginia, and who is not.

Track Virginia overtime with ClockifyOvertime exceptions and exemptions for white-collar employees in Virginia

Following the federal requirements on the overtime exemptions, 4 main categories of employees are not protected by the law, as they fit into the larger category of white-collar occupations.

When it comes to overtime, provided they earn at least $684 per week, white-collar employees do not have to be paid at a 1.5 rate for working over 40 hours.

White-collar employees are the ones working in any of the following categories:

- Administration — people who perform non-manual work related to business operations, management policies, or administrative training (provided that no more than 20% of the time is spent on activities unrelated to the position) — this category includes accountants, HR team members, market research analysts, etc.

- Executives — business, general, and executive managers who directly manage at least 2 employees.

- Professionals — people whose position calls for advanced knowledge and extensive education (e.g. software analysts, software engineers, artists, certified teachers, and other creative work requiring talent, invention, or imagination).

- Outside sales — outside sales representatives who visit potential and existing customers at their premises.

Virginia overtime restrictions for specific occupations

Besides the federal government exemptions listed above, the state enforces overtime restrictions on some other, more specific occupations.

Overtime and minimum wage exemptions overlap, but there are additional occupations that are exempt from overtime only.

Here’s the full list of overtime exemptions in Virginia:

- Farm workers

- Volunteers engaged in the activities of educational, charitable, religious, and nonprofit organizations

- Caddies on golf courses

- Taxicab drivers

- Minors employed by their parents or guardians

- Workers who are confined in penal and correctional facilities

- Summer camp workers

- Minors under 16, regardless of their employer or job type

- Student workers participating in bona fide educational programs

- Minors who are enrolled in secondary and trade schools, or other institutions of education — provided they work up to 20 hours per week

- Any person who is enrolled in secondary and trade schools, or other institutions of education — provided they are employed by the said institution

- Babysitters who work up to 10 hours per week

- Any person participating as an au pair in the US Department of State's Exchange Visitor Program

- Any person employed as a temporary foreign worker

- Salespeople, vehicle parts people, and mechanics who are primarily engaged in selling or servicing automobiles, trucks, and farm implements — provided they are employed by nonmanufacturing establishments

- Salespeople who are primarily engaged in selling trailers, boats, and aircraft — provided they are employed by non-manufacturing establishments

Virginia break laws

Employers in Virginia are legally not required to provide any breaks to their employees, excluding minors under 16 years of age.

So, employees who are 14 and 15 years old are entitled to meal breaks of 30 minutes per every 5-hour shift.

When it comes to all other employees, it is important to mention that even though the law doesn’t require employers to offer meal or rest breaks, they can choose to do so. Many Virginia employers do offer such breaks in order to boost their employees’ productivity levels.

However, if an employer’s policy includes breaks under 20 minutes, employees must be compensated for that period. For longer breaks, employers may choose whether the said break will be paid or unpaid.

Track employee productivity levels with ClockifyThere is an additional required type of break in Virginia — but it applies only to breastfeeding mothers. It is called a lactating break, and we will elaborate on it in the following section.

Breastfeeding laws in Virginia

All working mothers who gave birth recently and are still lactating and breastfeeding are entitled to take a break for this purpose.

In Virginia, the same as at the federal level, employers are obligated to provide adequate conditions for such employees.

This type of break can be either paid or unpaid, as predetermined by the company regulations and policy.

By “adequate conditions”, the law refers to employers providing a room or location with a door that can’t be a bathroom stall.

Employers must provide such a location in the nearest possible proximity to the working environment.

Virginia leave requirements

The federal law clearly regulates which types of leave employers are required to provide, with no negative consequences for an employee upon their return to work.

There are 2 broad categories of leave of absence — required and non-required — according to the US Department of Labor.

However, the types of leave included in the 2 categories are not predetermined by the federal law, as each state regulates them differently.

Let’s see how Virginia regulates leaves of absence.

Track employee time off with ClockifyVirginia required leave

There are instances where an employee is entitled to take a leave of absence, without being punished in any way upon their return to work.

While employers do have to offer and provide required leave to all their employees, they don’t necessarily have to compensate them for that period.

Still, some company policies will offer paid required leave.

Here’s the list of 5 types of leave that employers in Virginia are required to offer by law:

- Family and medical leave

- Jury duty leave

- Witness leave

- Crime victim leave

- Military leave

Family and medical leave

This is a type of required leave that all employers in the state of Virginia must provide their employees with. Eligibility for this type of leave is regulated by the Family and Medical Leave Act or FMLA.

The FMLA states that all employees are eligible to use 12 weeks of unpaid, job-protected work absence in a one-year period, for many household and medicinal-related reasons.

Those reasons include:

- Care of the employee’s own serious health condition

- Care of an immediate family member with a serious health condition

- Care of the employee’s own newly-born child

- Placement for adoption/foster care of a child with the employee

- Any difficulty due to the employee’s immediate family member who is a covered military member on active duty

To be eligible, an employee must have worked for the employer for at least a year and at least 1,250 work hours within a 12-month period. Note that, at the federal level, this is applicable for employers with over 50 employees only. For Virginia, the same is applicable at the state level.

Additionally, in an effort to protect the families of the Armed Services, Congress amended the FMLA in 2008.

Since then, employers have also been required to provide up to 26 weeks of unpaid leave if an employee needs to take care of a member of the Armed Forces with a serious health condition, injury, or undergoing medical treatment or therapy.

This is applicable only if said member is an employee’s spouse, parent, child, or next of kin.

Jury duty leave

If an employee in Virginia is summoned to perform jury duty, employers must allow them to be absent from work during that time.

Employers mustn’t require employees to use their sick, vacation, or any other type of leave for this reason.

The law also states employers can’t penalize or discipline their employees in any way for the acceptance of jury duty — but they don’t have to compensate their employees for this period.

Employers are not allowed to require employees who spent 4 hours or more on jury duty to work a shift under the following conditions:

- Starting on or after 5 p.m. on the same day, and

- Starting before 3 a.m. on the following day.

Witness leave

The law requires employers to provide either paid or unpaid leave for all their employees who are summoned to be a witness in any court.

Employers mustn’t require employees to use their sick, vacation, or any other type of leave for this reason.

Employees are required to provide reasonable notice of the need for witness leave.

Crime victim leave

For employees who are victims of a crime, employers are required to offer paid or unpaid leave for participating in, preparing for, and attending proceedings related to the crime.

Virginia employers are allowed to request the form from the relevant law enforcement agency, or a copy of the notice of each scheduled proceeding.

Military leave

This type of leave is regulated at the federal level, by the Uniformed Services Employment and Reemployment Act. The act states that all employees in the US must be granted a leave of absence to serve in one of the following:

- The US Armed Forces

- The National Guard

- The state militia

Upon the employee’s return to work, they must be entitled to the same pay increases and other benefits as if they were present at work the whole time.

Virginia implements an additional requirement for employers — the same must be applied to the members of the Civil Air Patrol. Their leave of absence is capped at:

- 10 days per year for training, and

- 30 days per year for responding to duty.

Virginia non-required leave

There are also 5 categories of leave that, by Virginia state laws, employers are not required to offer to their employees.

Said categories are:

- Sick leave

- Vacation leave

- Holiday leave

- Voting leave

- Bereavement leave

It is important to mention that the law also doesn’t prohibit or restrict the employer from providing these types of leave.

If an employer chooses to offer any or all, the exact terms need to be stated in the signed contract of employment.

Sick leave

In the state of Virginia, employers are not required to offer any paid or unpaid sick days.

If an employer establishes a policy allowing sick leave, they must comply with all their own established conditions.

Vacation leave

Virginia employers are not required to offer any paid or unpaid time for vacations.

If an employer establishes a vacation policy, they must comply with all their own established conditions.

Holiday leave

In the state of Virginia, employers are not required to offer any paid or unpaid holiday leave.

If an employer offers a holiday leave in their company policy, the exact terms must be stated in the contract of employment.

Voting leave

Virginia employers are not required to offer this type of leave to any of their employees.

If an employer offers a voting leave in their company policy, the exact terms must be stated in the contract of employment.

Bereavement leave

Virginia employers are not required to offer this type of leave to any of their employees.

If an employer offers a bereavement leave in their company policy, once again, the exact terms must be stated in the contract of employment.

Child labor laws in Virginia

The term “minors'' refers to young people aged under 18.

The main purpose of both federal and Virginia child labor laws is to prevent the exploitation of minors, as well as to help minors put education first — their employment is only meant to enhance their academic and life experience.

Some of the most relevant limitations regarding the employment of minors can be seen in the following categories:

- Maximum number of work hours

- Nightwork

- Restrictions on specific occupations

While different rules and regulations are applicable to different age groups, there is still one rule applicable to all age groups — minors are forbidden from working in any hazardous positions, according to the federal law.

Next, let’s take a look at some rules and regulations stated in the Virginia Child Labor Laws.

Labor laws specific to minors

In Virginia, child labor laws enforce specific rules for different age groups:

- Minors under 16, and

- Minors aged 16 and 17.

The 2 categories put restrictions on the maximum hours of work and nightwork of minors.

In order to be employed, minors under 16 years of age must obtain a Work Permit and/or an Age Certification document.

The maximum number of work time for minors under 16 years of age — provided that school is not in session — is:

- 8 hours per day,

- 40 hours per week, and

- No more than 6 days per week.

When school is in session, the limit is 3 hours per school day, while the total number of hours for school weeks mustn’t exceed 18.

For ages 16 and 17, Virginia doesn’t have restrictions on maximum working hours, provided the minor in question complies with the compulsory school attendance law.

Nightwork restrictions only apply to minors under 16 years of age, and they are prohibited to work between 7 p.m. and 7 a.m when school is in session.

When school is not in session, minors under 16 can work until 9 p.m.

For ages 16 and 17, Virginia has no restrictions on nightwork.

The Virginia Employment Certificate Application SystemProhibited occupations for minors on a federal level

Certain occupations are strictly prohibited for minors.

In compliance with federal restrictions, minors are forbidden from working in any and all occupations that are declared as hazardous.

Here are some examples of hazardous occupations and activities:

- Electrical technicians

- Boiler or engine room operators

- Any work with flammable, toxic, or corrosive substances

- Elevator-related work

- Centrifugal machine operators

- Any and all work including climbing

- Any and all work including glazing and glass cutting

Additional prohibited occupations for minors in Virginia

For minors in Virginia, there are additional restrictions, so here are some other, state-specific prohibited occupations:

- Motor vehicle occupations

- Logging and saw-milling operations and occupations

- Manufacturing and storage occupations involving explosives

- Power-driven hoisting apparatus occupations

- Power-driven bakery machine occupations

- Fire fighting

- Occupations in excavation operations

- Occupations in connection with any mining operations

- Occupations involving exposure to radioactive substances

Termination laws in Virginia

Like the majority of other states in the US, Virginia also implements an “employment-at-will” doctrine and policy.

What does that mean for both employers and employees?

- Employers — they can terminate their employees’ work engagement anytime, for any reason, or perhaps for no reason at all.

- Employees — they are free to leave a job for any or no reason with no legal consequences.

There are only 2 exceptions in terms of employers’ reasons for termination:

- It mustn’t be based on discrimination

- It mustn’t be retaliation for a rightful action (i.e. whistleblowing)

Final paycheck in Virginia

Employers in Virginia are legally required to provide a final paycheck, including all the wages and benefits, to everyone whose employment was terminated or who has resigned.

According to the Virginia labor wage laws, final paychecks for employees are due either on the regularly scheduled payday or before that date.

Virginia Bureau of Labor and Industries: Complaint formsDiscrimination laws in Virginia

According to federal law, discrimination in the workplace is not only unethical but also illegal.

There are many bases of discrimination in the workplace that are forbidden on a federal scale — but the state of Virginia has determined additional ones under the Virginia Human Rights Act.

So, here’s the full list of prohibited bases for workplace discrimination, including both federal and Virginia-specific ones:

- Race

- Color

- Age

- Gender

- Sexual orientation

- Religion

- National origin

- Pregnancy

- Genetic information (including family medical history)

- Physical or mental disability

- Child or spousal withholding

- Military or veteran status

- Citizenship or immigration status

- Expunged criminal records

- Non-conviction arrest records

- Status as a smoker or non-smoker

- Lactation

Occupational safety in Virginia

All employees must have a safe and healthy working environment.

The specific conditions for such an environment are regulated by the federal Occupational Safety and Health Act (OSHA), passed by Congress in 1970 — but there are some additional requirements for employers in Virginia.

OSHA states that employers are required to:

- Provide safe and healthy working conditions,

- Continually inspect for flaws and irregularities, and

- Strive to improve the conditions, if possible.

Employers are required to provide several things to ensure workplace safety to their employees:

- Proper training,

- Education, and

- Continuous assistance.

The main goal of OSHA is to reduce and further try to eliminate the possibility of workplace injuries, illnesses, and fatalities.

Besides providing necessary training and education for employees, employers must create optimal working conditions — free from any recognized hazards that may cause harm.

Moreover, it is obligatory to conduct safety and health research regularly, as well as undertake safety demonstrations concerning health matters.

Virginia OSHA is under the jurisdiction of the Occupational Safety and Health Administration and is responsible for regulating the workplace safety of all workers in Virginia.

Federal employers and employees may be excluded from the OSHA regulations.

The Administration has compliance officers who are in charge of implementing and enforcing the Virginia OSHA.

Apart from scheduled inspections that compliance officers regularly conduct, they are allowed to carry out inspections without any notice, at any given time.

Unscheduled inspections can be a result of:

- Imminent danger reports

- Fatalities

- Worker complaints

- Referrals

Additions in Virginia OSHA

There are some unique safety standards that are implemented in the state of Virginia — and those are categorized into:

- General Industry,

- Construction, and

- Agriculture related standards.

General industry additions in Virginia OSHA

The term “general industry” is used to describe standards and directives applicable to all industry types — except agriculture, maritime, and construction industries.

The General Industry standards include:

- Reverse signal operation safety requirements for vehicles, machinery, and equipment for general industry

- Telecommunications, in terms of electrical hazards

- Confined spaces in the telecommunications industry

- Tree trimming operations

- Overhead High Voltage Line Safety Act

Construction additions in Virginia OSHA

Construction is an industry comprising a wide variety of activities such as construction, alteration, and repair. Workers in this industry are often exposed to serious hazards and have to deal with heavy machinery.

As a result, there’s an abundance of specific OSHA standards designed to eliminate such hazards.

The Construction standard includes:

- Medical services and first aid

- Sanitation

- Steel erection

- Reverse signal operation safety requirements for vehicles, machinery, and equipment for the construction industry

- Overhead High Voltage Line Safety Act

Agriculture additions in Virginia OSHA

One of the major industries in the US is agriculture, which includes:

- Growing and harvesting crops, and

- Keeping livestock, poultry, and other animals in order to provide products.

Farmworkers can be at high risk for injuries, lung and skin diseases, and even certain cancer types — due to prolonged sun and chemical exposure.

These specific OSHA standards help agriculture employers and employees create a safe and healthy work environment.

The Agriculture standard includes only one additional OSHA regulation — field sanitation.

Hazards and controls in agricultural operationsMiscellaneous Virginia labor laws

The above-listed sections were concerned with the most important and common categories of labor laws relevant in Virginia.

Now, we’ll mention several additional laws that can’t be categorized into any of the above sections.

Here’s what else is regulated by the rule of law in Virginia:

- Whistleblower protection laws

- COBRA laws

- Background check laws

- Credit and investigative check laws

- Arrest and conviction check laws

- Drug and alcohol testing laws

- Social media laws

- Hiring of veterans laws

- Record-keeping laws

Whistleblower protection laws

The main purpose of this set of laws is to ensure that employees can exercise all of their legal rights without negative repercussions as a result.

The term “whistleblower” refers to employees who have inside knowledge of an illegal practice or a safety hazard in the workplace. They must be able to report it and continue being employed.

Here’s the list of reasons based on which employees can’t be discriminated against, or treated differently in any way:

- Exercising their rights regarding workplace safety (OSHA)

- Opposing a violation of the Virginia Fraud Against Taxpayers Act

COBRA laws

COBRA is a law that operates at a federal level. The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees to retain health care insurance and benefits after the termination of employment.

Federal regulations also state the law can be applied to employers with over 20 employees. So, many states have implemented their own regulations, also known as “mini-COBRAs” to cover businesses with fewer than 20 employees.

The state of Virginia does have a mini-COBRA law, applicable to businesses that employ fewer than 20 employees. Their health coverage is extended for up to 12 months after the employment termination date.

Background check laws

Background checks are allowed for all employers (but not required for all occupations) and are subject to the federal Fair Credit Reporting Act.

This act regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau — all employers must ensure they adhere to those requirements.

Here’s the full list of positions that do require background checks in Virginia:

- School personnel — including personnel in private schools

- Nursing homes personnel — including volunteers

- Assisted living facilities personnel

- Adult day care centers personnel

- Child welfare agencies personnel, provided the employee is involved in day-to-day operations, or if they spend time alone with children

- Family day homes personnel, provided the employee is involved in day-to-day operations, or if they spend time alone with children

- Hospital personnel, provided the employee will have access to controlled substances and aren’t licensed by the Board of Pharmacy

- Hospice and home care organizations personnel

- Community group homes personnel — including volunteers

- Firearm sellers

- Law enforcement personnel — including jail officers

- Behavioral health and developmental services personnel — including providers of such services in personal homes

- People in shared living arrangements who provide medical assistance services

- Children residential facilities personnel — including volunteers who spend time alone with children

- Corporate officers, owners, administrators, and any other people who are authorized to conduct safety training courses

- Private security businesses personnel

Credit and investigative check laws

The state of Virginia doesn’t specifically allow or prohibit employers from conducting credit and investigative checks for employment purposes.

That means that employers may obtain credit reports on all their applicants and employees if they consider that information relevant.

Arrest and conviction check laws

The state of Virginia doesn’t specifically allow or prohibit employers from conducting arrest and conviction checks for employment purposes.

The only exception employers are prohibited from asking applicants about is — applicants’ expunged criminal records.

Drug and alcohol testing laws

The state of Virginia doesn’t specifically allow or prohibit employers from testing their applicants and employees for drugs.

Therefore, employers are free to subject their applicants and employees to a breathalyzer test. If there is a lack of reasonable doubt, applicants or employees can be subject to the test only with their explicit consent.

The only exception is the category of state contractors and subcontractors of more than $10,000. Such employers must ensure that the workplace is drug-free during the performance of the contract.

Social media laws

Virginia employers are prohibited from asking their employees or applicants to disclose information about their personal social media accounts.

In Virginia, it’s illegal for an employer to:

- Ask an employee for their social media usernames and/or passwords, or other means of authentication

- Add an employee to the list of contacts associated with their personal social media account

- Take action against or penalize an employee in any way for exercising their rights under this section

Hiring of veterans laws

There is an additional law concerning all Virginia veterans, as well as the spouses of veterans with a service-connected total disability.

This law allows employers to give preference to such applicants and employees for hiring or promotion-related decisions.

Record-keeping laws

Keeping the records of all their employees is an obligation for all Virginia employers. They must do so for the length of 3 years.

So, what types and categories of information should such records consist of?

Here’s the full list:

- Employee name

- Social security number

- Occupation of the employee

- Date of birth

- Address — including ZIP code

- Regular hourly rate of pay

- Basis on which wages are paid

- A daily record of beginning and ending work, if a split shift is in question

- Total daily or weekly net wages and deductions

- Total gross daily or weekly wages

- Date of each payment

- Records of leaves, notice, and policies under the Family and Medical Leave Act

There are some other record-keeping laws that are applicable to specific situations. So, here’s what else employers ought to keep on record, and for how long:

- Seniority and merit systems — for 2 years

- Records of all job-related injuries and illnesses under OSHA — for 5 years

- Summary descriptions and annual reports of benefit plans — for 6 years

- Specifically dangerous instances under OSHA (e.g. toxic substance exposure) — for 30 years

Conclusion/Disclaimer

We hope this Virginia labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Virginia labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

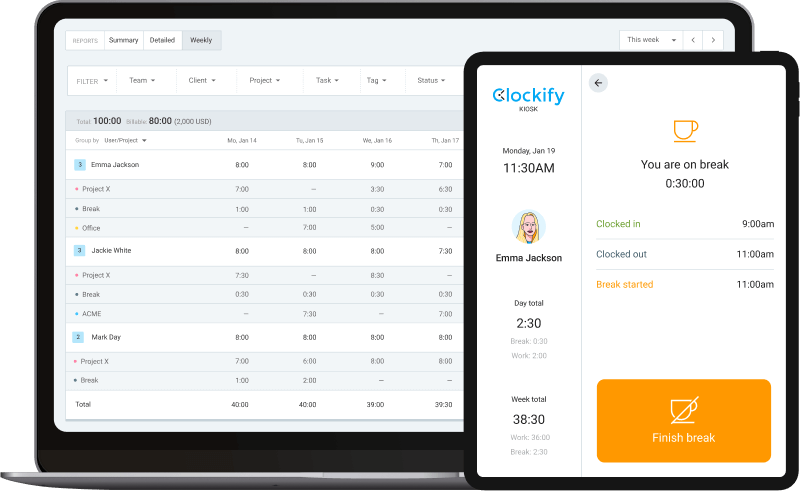

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).