Washington Labor Laws Guide

Ultimate Washington labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Washington Labor Laws FAQ | |

| Washington minimum wage | $14.49 |

| Washington overtime | 1.5 times the rate of the standard wage ($21.735 for employees earning minimum wages) |

| Washington break laws | Rest meals of at least 10 minutes for every 4 hours worked. Employees must be provided with “reasonable time” for restroom breaks — employers are not permitted to include the restroom break during policy-scheduled breaks Meal breaks of at least 30 minutes after working for 5 hours. |

Table of contents

Washington wage laws

The governing body of the state of Washington has been making strides toward improving the minimum wage for a while now.

In fact, the first state changes for minimum wages were made in 1961 and they are still being regulated on an annual basis.

The following are Washington’s regulations concerning:

- The state minimum,

- Tipped hourly wage, and

- The subminimum wage in Washington.

| WASHINGTON MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $14.49 | $14.49 | $10.87 $12.32 — for 14 and 15-year-old employees |

Washington minimum wage

What is Washington’s minimum wage as of Jan. 1, 2022?

As of Jan. 1, 2022, the minimum wage in the state of Washington amounts to $14.49.

Each year, the Washington State Department of Labor and Industries is required by law to make adjustments to the minimum wage in order to compensate for cost-and-living changes in the state.

Therefore, the minimum wage was increased from $13.69 in 2021 to the current rate, which represents an increase of $0.80. The change will remain in effect until December 31 — i.e., until the next change goes into effect.

However, the state of Washington recognizes different minimum wage laws for two separate districts:

- Seattle

- SeaTec

The locality of Seattle is operated under the Minimum Wage Ordinance — stating that all employers that work with at least 501 employees must pay them an hourly rate of no less than $17.27.

If the company has 500 or less employees, the hourly rate can be deduced from the following table:

| The employer pays medical benefits fees | The employer does not pay medical benefits fees | Employee earns $1.52 per hour in tips | Employee does not earn $1.52 per hour in tips |

| $15.75 | $17.27 | $15.75 | $17.27 |

On the other hand, the employees of the locality of SeaTec are entitled to a rate no less than $17.54 per hour for the city’s Hospitality and Transportation Industry employees.

Washington Minimum Wage websiteTipped minimum wage in Washington

According to the state laws, all employers operating in the state of Washington are required to pay tipped workers the minimum wage rates, regardless of the amount of tips they accumulate.

Therefore, tipped employees are entitled to $14.49/hour instead of the FLSA-regulated requirements of $2.13/hour.

Track work hours and hourly pay with ClockifyWashington subminimum wage

In general, all employees are entitled to the state minimum wage in Washington.

However, under certain circumstances, employers can file a request to pay certain workers the subminimum wage rates.

Such circumstances usually include the following:

- Employees with a disability,

- Learners,

- Student learners,

- Student workers, and

- Apprentices.

If the employer proves a reasonable likelihood that the employees will not do the same type or amount of work due to their circumstances, the following subminimum wages can be approved:

| Employees with a disability | Learners | Student learners | Student workers | Apprentices |

| $10.87 | $12.32 | $10.87 | 10.87 | $10.87 |

All employees with special circumstances must provide their employers with certificated or legal documentation that further support the conditions required for approval of subminimum wages.

Track employee payroll with ClockifyExceptions to the minimum wage in Washington

Washington is one of the US states that have exceptions to the minimum wage covered by federal and state laws.

In federal terms, the exceptions to the minimum wage include the following:

- Executive workers who are paid on a salary basis and earn not less than $684 per week,

- Administrative workers who are paid on a salary basis and earn not less than $684 per week,

- Learned and creative professionals paid on a salary basis who earn not less than $684 per week,

- Computer employees who earn $684 per week or at least $27.63 per hour,

- Highly compensated employees who earn $107,432 or more a year,

- Outside sales employees — No minimum salary requirement,

- Tipped employees, and

- Minors.

The same rules apply to the state exceptions. However, the state of Washington has different interpretations of the professions and exceptions described by the federal law due to differences in salaries and job requirements.

Therefore, the differences in federal and state laws are nuanced and should be explored in-depth.

For example, both laws exempt learned professionals and creative professionals — but the state law indicates that such individuals must be paid at least 2.5 times the rate of the state minimum wage to be considered as such.

The state website on workers’ rights.Washington payment laws

All employees must be paid the wages they’ve earned, regardless of the manner of employment — hourly wages, flat rates, etc.

The employers are obligated to make payments at least once a month or on the scheduled paydays, as per the employment agreement.

Depending on the company’s policy, workers can also be paid for the hours not worked, which usually include:

- Travel time,

- Wait time,

- On-call time,

- Time taken to dress/undress a uniform, and

- Training time.

Sometimes, the policy can include break time — which is reliant on multiple factors which we’ll cover later on.

Washington overtime laws

All eligible employees that work more than 40 hours per week must be paid the overtime rate of no less than 1.5 times their regular hourly wage.

In other words, the cash sum of all hours that go toward overtime will amount to $21.735 for workers earning minimum wages.

The employees that are eligible for overtime are:

- Hourly, piece rate, and commissioned employees,

- Salaried employees who do not fall under the categories covered by “executive, administrative, and professional” definitions, and

- Employees earning prevailing wages.

Furthermore, the 2021 legislative session expanded the overtime laws to include agricultural workers — specifically, the ones referred to as “dairy” workers.

As of Jan. 1, 2022, the non-dairy workers have started phasing into the law. However, the requirement they have to meet to qualify for overtime is to work for more than 55 hours per week.

Track Washington overtime with ClockifyOvertime exceptions and exemptions in Washington

According to federal law, most US states are obliged to exempt certain employees and professions from overtime pay, such as:

- Highly compensated employees that make more than $107,432 a year,

- Executive and administrative employees that make at least $684 per week,

- Professional employees — e.g. artists, researchers, scientists, skilled computer professionals., and

- Outside salespeople.

The same rules apply to Washington’s state laws, while also excluding some minors and employees that do not meet the definition of “an employee” under the Minimum Wage Act.

Washington overtime lawsWashington break laws

According to the L&I — i.e. Washington Labor and Industries — all employees in the state of Washington must be allowed a paid break of at least 10 minutes after having worked for 4 hours.

Therefore, the state obliges all employers to give their employees 20 minutes of total break time for a regular 8-hour shift.

Furthermore, employers should have the following in mind:

- Breaks must be scheduled towards the middle of the work shift (or as close to it as possible),

- Rest breaks must be taken on the job site, if the nature of the job requires it, and

- Rest time is considered to be “hours worked.”

Exceptions to break laws in Washington

Employers also must allow meal breaks to their employees after working 5 hours in a shift. The period must be at least 30 minutes long and start between the 2nd and the 5th hour of the shift.

The meals are not paid for, except when:

- Employees have to work through a meal break,

- The employer requires the employee to stay on-call, and

- The meal break is interrupted due to the nature of the job.

Also, agricultural workers and minor employees might succumb to different regulations regarding break laws.

Washington breastfeeding laws

According to the Washington State Legislature — Revised Code 43.10.005 — employers must provide breastfeeding mothers with:

- A flexible schedule to pump milk or attend to the newborn,

- A convenient location (cannot be a bathroom stall) that is private, and

- 2 years of protected accommodations.

Washington leave requirements

Washington state employees have many benefits when it comes to leaves of absence.

However, employers are not obliged to provide them with these benefits in some cases — which is why we’ll classify the following segment into:

- Required leave

- Non-required leave

Washington required leave

The following is the leave time that Washington employers are required to assign to their employees:

- Family and Medical Leave (FMLA)

- Sick days leave

- Jury duty leave

- Domestic violence and sexual assault leave

- Military leave

- Bereavement leave

Family and Medical Leave (FMLA)

Administered by the Employment Security Department, the state FMLA is a mandatory state-wide program that covers all employees in Washington. It works hand-in-hand with the federal FMLA and offers employees relief in areas that are not covered by the federal program.

To qualify for the state FMLA, the employee must have worked at least 820 hours in the state of Washington.

When it comes to the “family” segment in the FMLA, employees are eligible to get the benefits in cases when:

- They leave to bond with a newborn or an adopted child for the first 12 months,

- They have to take care of a family member, and

- They have to leave for a military emergency (exigency).

The medical leave covers the employee’s medical problems, which can often be classified as:

- Serious illnesses or incapacitations,

- Chronic illnesses,

- Pregnancy issues, and

- Medical treatments.

The leave’s duration is 12 weeks or more, depending on the situation.

For example, if the federal and state FMLA combine, the employee could be eligible for additional weeks off work.

Sick days leave

Passed by voters in 2016, the Paid Sick Leave law states that all employees can earn 1 hour of paid sick leave for every 40 hours worked.

However, employers can offer even better benefits if they choose so, under their own policies.

The accrual of sick leave starts at the beginning of the calendar year — i.e., Jan. 1.

If the employee does not use all of their sick days, they will be transferred to the next calendar year.

Employees can use this leave:

- For a mental or physical illness or health condition,

- If a family member needs to be taken care of due to a mental or physical illness or health condition,

- If the employee’s workplace or their child’s school or place of care has been closed, and

- If the employee is absent from work for reasons that qualify for leave under the state’s Domestic Violence Leave Act (DVLA).

Jury Duty leave

Under Washington law, no employer can penalize or terminate an employee for reporting to jury duty or jury selection.

All employers must provide an unpaid leave of absence for jury duty, but employees might have to justify the leave by providing the jury summons.

Employers are not required to pay for jury duty leave, but can do so if they have established policies regarding jury duty leave.

Domestic violence and sexual assault leave

All employees that are victims of sexual assaults, domestic violence, and stalking are eligible to take the time off from work — this refers to both employees and their immediate family.

This type of leave is often used to:

- Seek legal and medical help,

- Contact social services and receive help,

- Plan a safety program, and

- Relocate.

If the situation requires it, the employee can also request time off for this purpose under:

- Sick leave,

- Leave without pay, and

- Paid time off.

Military leave

Under the federal Family and Medical Leave Act (FMLA), employees can use military leave under these conditions:

- Up to 26 workweeks of unpaid leave during a 12-month period to care for a covered service member with a serious injury or illness, and

- Up to 12 workweeks of unpaid leave during a 12-month period for qualifying exigencies that arise when the eligible employee’s spouse, son, daughter, or parent is on covered duty or has been notified of an impending call or order to covered active duty.

To qualify for the FMLA military leave:

- The employer must have 50 or more employees during 20 or more calendar months working within 75 miles of the employer’s worksite.

- The employee must have worked at least 1,250 hours in the past 12 months (they need to be consecutive).

In addition, each state employee, whether regular or temporary, shall be granted paid military leave of 31 working days in each 12-month period between October 1st and September 30th of the following year.

The location of military service is not relevant since the employee will be treated as a Washington worker and will receive their standard wages for the time served.

Also, if the employee in question is an elected official, the legislative body will grant them an extended leave of absence for the active duty period.

Bereavement leave

According to the Washington State Legislature, all employees in the state are entitled to 3 days of paid leave for bereavement — funerals, grieving periods, etc.

If they do not need the full 3 days, they can request a shorter period of time for bereavement.

Washington non-required leave

As is the case with most US states, Washington also has non-required leaves of absence, and it is up to employers to choose whether they’ll implement them or not.

The non-required leaves in Washington are:

- Holiday leave

- Voting time leave

- Vacation leave

Holiday leave

Washington state does not require employers to provide time off for holidays, unless they have other policies that indicate differently.

However, in some situations, there are occurrences that fall under the Family Care Act where the employee can use the holiday leave to:

- Provide treatment or supervision for a child with a health condition, and

- Care for a qualifying family member with a serious or emergency health condition.

Voting time leave

If the employee’s working schedule does not allow them to vote during the election day, the employer should offer time off for 2 hours — but only if the employee has given the employer a fair time’s notice.

Otherwise, the employer in the state of Washington is not obligated to offer time off for voting.

Vacation leave

Similar to the holiday leave, the employer is not obligated to provide the vacation leave unless in specific circumstances when the employee can use the vacation leave — such as taking care of a family member under the Family Care Act.

Child labor laws in Washington

In comparison to adults, minors in the state of Washington are allowed to work, but after certain conditions are met.

Firstly, every minor employee needs to have an employment certificate issued by the minor’s school or the L&I.

Secondly, in most cases, age certifications are a must when employing underage workers. Failure to obtain such certifications can result in penalties for the employers.

These regulations are put in place in order to protect minors from:

- Physical,

- Moral, and

- Emotional hazards.

Work time restrictions for Washington minors

Minors under the age of 14 fall under the same rules and laws that relate to 14 and 15-year-olds — except that they have to acquire a permit to work from a superior court in Washington.

When it comes to 14 and 15-year-olds, the work time restrictions are the following:

| Week type | Hours per day | Hours per week | Days per week | Start – end time |

| School week | 3 | 16 | 6 | 7 a.m. – 7 p.m. |

| Non-school week | 8 | 40 | 6 | 7 a.m. – 7 p.m. (or 9 p.m. from June 1 to Labor Day) |

And, the following table relates to work time limitations for 16 and 17-year-olds:

| Week type | Hours per day | Hours per week | Days per week | Start – end time |

| School week | 4 | 20 | 6 | 7 a.m. – 10 p.m.* |

| Non-school week | 8 | 48 | 6 | 5 a.m. – midnight (can work until midnight during weekends) |

Breaks for Washington minors

When it comes to breaks, the state of Washington has very specific rules for different age groups.

Needless to say, all minors are entitled to a paid break in all employment scenarios.

However, youth under the age of 16 must take a rest break after 2 hours of working.

The meal break can be taken after 4 hours of working and every 2 hours of work equals 10 minutes of meal break. For example, working 6 hours will grant the minor 30 minutes of break time.

Youth aged 16 and 17 are entitled to a rest break after continuously working for 3 hours, while the meal break can be taken for 30 minutes if the employee has worked for at least 5 hours.

Washington minors break lawsProhibited occupations for minors in Washington

The following jobs and duties are prohibited for minors working in any industry in the state of Washington:

- Slaughtering, meat processing, rendering, and packing,

- Any work including operation, repair, oiling, cleaning, adjusting, or setting up of:

- Power-driven woodworking machines,

- Circular, band, or chain saws,

- Power-driven metal forming, punching, and shearing machines, including guillotine shears,

- Wrecking, demolition, and excavation,

- Roofing,

- Handling or exposure to highly toxic, carcinogenic, corrosive, and poisonous chemicals, especially agricultural chemicals of Category I or II toxicity (does not include handling sealed containers in retail situations),

- Handling, use, or manufacture of explosives or blasting agents, and

- Working where a strike, labor dispute, or lockout exists.

Furthermore, the state of Washington has strict prohibitions for minors under the age of 16 that include:

- Driving an automobile,

- House-to-house sales,

- Cooking,

- Operating or cleaning meat slicers,

- Operating food processors,

- Operating any power-driven machinery,

- Construction,

- Manufacturing,

- Processing operations,

- Public messenger,

- Amusement parks,

- Loading or unloading trucks,

- Transportation, warehouse, storage and work around conveyors,

- Ladders and scaffolds (including window washing), and

- Maintenance and repair in gas stations.

Penalties for employing minors in Washington

There are no specific state laws that determine penalties for violating any provisions of the child labor laws in Washington.

However, under federal law, all violations are subject to a civil penalty of up to $10,000.

Washington child labor lawsHiring laws in Washington

Washington employers, the same as in all other states, are prohibited from discriminating against employees during interviews and employment based on the following criteria:

- Race and color,

- Creed,

- Religion,

- National origin,

- Sex,

- Pregnancy and childbirth,

- Marital and familial status,

- Disability and age, and

- Sexual orientation.

An interesting anti-discrimination law in Washington states that no employer can discriminate against a person that is disabled and has a service animal by their side.

Furthermore, under the Washington Equal Pay Act, employees are greatly protected when it comes to gender pay gaps.

In other words, employers are prohibited from offering different paychecks based on gender, if the two employees in question perform the same job with the same duties.

Washington hiring laws“Right-to-work” law in Washington

It should also be noted that Washington is not a “right-to-work law” state — a state in which the legislative body guarantees that no employee will be forced to join or be associated with a labor union.

No employee in the state of Washington abides by the “Workplace Freedom” law — meaning that union fees have to be paid, regardless of the employee’s decision to take part in union activities.

Termination laws in Washington

Washington is an at-will employment state — employers in the said state can terminate an employee’s contract of employment without any reason.

In the same manner, employees can also quit their jobs without providing a specific reason and not suffer any legal consequences.

However, if the employee exercises a right that is protected, the termination will not be considered legal.

For example, the state law protects employees in the following situations:

- Safety complaints,

- Minimum Wage Act,

- Injured worker’s claim,

- Protected leave, and

- Equal Pay and Opportunities Act.

In cases when the employee is protected by the above-mentioned instances, the employer is prohibited from retaliating.

Furthermore, the employer cannot:

- Terminate, suspend, demote, or deny a promotion,

- Reduce hours or alter the employee’s work schedule,

- Reduce the employee’s rate of pay,

- Threaten to take action based upon the immigration status of an employee or an employee’s family member, and

- Subject the employee to discipline.

Final paycheck in Washington

When the termination is lawful, the employer is required to pay all remaining wages on the first regular payday.

If, for some reason, the employee cannot collect the wages in person, they can request the wages be sent by mail — and the employer has to agree to do so.

The state law has no specifics regarding paying the wages to a terminated employee that is on strike or in legal proceedings directly related to their termination. In such cases, the employer’s company policies will be in effect.

Health insurance continuation in Washington (COBRA)

The federal law regarding the Consolidated Omnibus Budget Reconciliation Act (COBRA) states that workers have the right to continue their group health benefits in the case of both voluntary and involuntary job loss for the next 18 to 36 months.

When it comes to health coverage after a job loss in Washington, the federal COBRA comes to aid if the firm or company in question has more than 20 employees.

Surprisingly, the state of Washington is one of the US states that does not have a federally-approved mini-COBRA plan that covers businesses with less than 20 employees.

Occupational safety in Washington

All US states institute the Occupational Safety and Health Act of 1970, which is administered by OSHA — Occupational Safety and Health Administration.

OSHA ensures that all workers will operate and work at hazard-free facilities and conditions. But, it also serves to prevent any work-related injuries due to poor health standards.

According to OSHA, there are six salient types of hazards in the workplace:

- Biological

- Chemical

- Work organization

- Safety

- Physical

- Ergonomic

Furthermore, the state of Washington has 2 federally-approved programs that work hand-in-hand with OSHA:

- WISHA, and

- DOSH.

WISHA — Washington Industrial Safety and Health Administration requires all employers to provide a hazard-free environment thanks to additional regulations to ones that OSHA offers.

DOSH — Division of Occupational Safety and Health in the Department of Labor and Industries (L & I) serves to inspect facilities and worksites in order to report all irregularities.

Moreover, DOSH provides training, safety, and health programs to all employees. Some programs are obligatory as per federal law, but a multitude of additional safety training programs are available as well.

Washington OSHA officesMiscellaneous Washington laws

Some laws that are specific to the state of Washington are hard to classify and categorize, which is why we’ve dedicated a miscellaneous section to cover some of the laws that are directly related to labor — but cannot be placed in the above-covered categories.

The ones you might be interested in include:

- Background check law

- Whistleblower law

- Salary history law

- Social media law

Background check law

Under Washington State Legislature’s Codified laws — RCW 49.94.010 in particular — ban-the-box law is in full effect all across the state.

In other words, no employer — public or private — can ask questions during interviews or employment regarding an employee's criminal history and convictions.

Also, the locality of Seattle has its own set of laws that states a similar premise, yet allows employers to ask about the history after the initial screening for a job.

Whistleblower law

Washington state policies regarding whistleblowing encourage employees to speak out whenever a criminal act has taken place on the working premises.

According to the law, no employee can be harassed, intimidated, threatened, or discharged due to “blowing the whistle.”

To be more detailed, an employee cannot be terminated due to:

- Refusal to participate in illegal activities,

- Refusal to break federal and state laws,

- Reporting workplace violations, and

- Participating in an open investigation regarding workplace violations.

Salary history law

Even though employees can voluntarily disclose information regarding their salary and salary history, an employer is prohibited from:

- Seeking the wage or salary history of an applicant for employment from the applicant or a current or former employer, or

- Requiring that an applicant's prior wage or salary history meet certain criteria if they’ve disclosed it voluntarily.

If the employer violates the salary history law, they can be subjected to penalties under the RCW 49.58.060.

Social media law

Employers in the state of Washington cannot request personal information from employees regarding their social media accounts under the guise of “assessment”, such as:

- Usernames,

- Passwords, and

- Authentication information.

All employers that violate this law can be subjected to penalties, according to the RCW 49.44.200.

Conclusion/Disclaimer

We hope this Washington labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Washington labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

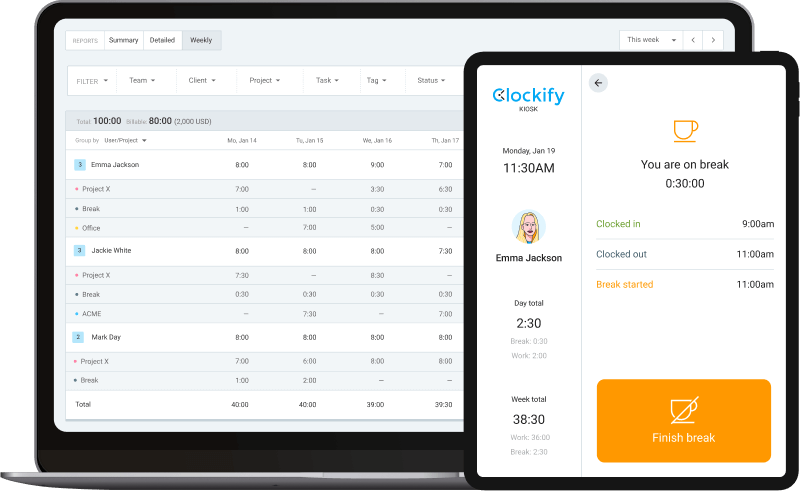

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).