Wisconsin Labor Laws Guide

Ultimate Wisconsin labor laws guide: minimum wage, overtime, breaks, leave, hiring, termination, and miscellaneous labor laws.

| Wisconsin Labor Laws FAQ | |

| Wisconsin minimum wage | $7.25 |

| Wisconsin overtime laws | 1.5 times the rate of regular pay after working 40 hours in a workweek ($14.50 per hour for minimum wage workers) |

| Wisconsin break laws | Breaks not required by law |

Table of contents

Wisconsin wage laws

We’ve outlined the following subcategories of Wisconsin wage laws, in an attempt to make the otherwise dense information more accessible:

- Minimum wage in Wisconsin

- Tipped minimum wage in Wisconsin

- Subminimum wage in Wisconsin

- Exceptions to the minimum wage in Wisconsin

- Wisconsin payment laws

| MINIMUM WAGE IN WISCONSIN | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | Regular tipped minimum wage — $2.33 Opportunity employees — $2.13 |

Opportunity employees — $5.90 Employees with disabilities — rate determined by government agency |

Wisconsin minimum wage

All private and public employees, including non-profit organizations, are subject to Wisconsin’s state minimum hourly wage.

Currently, the minimum wage in Wisconsin is $7.25.

This amount is equal to the federal minimum wage — the only difference being that the Wisconsin state Minimum Wage law covers all employers, including those otherwise not covered by federal provisions.

Tipped minimum wage in Wisconsin

All employees who regularly receive more than $30 in monthly tips fall into the category of “tipped employees” under US federal law.

Tipped employees in Wisconsin can be paid a special, reduced minimum wage of $2.33 per hour.

Additionally, Wisconsin law defines one more category of employees who can be paid lower than the minimum wage — the so-called “opportunity employees”.

Tipped employees, who are also opportunity employees, can be paid at the rate of $2.13 per hour.

It is also important to note that if the direct wages, when combined with tips, do not meet the regular minimum wage of $7.25 — the employer should cover the difference.

Subminimum wage in Wisconsin

Subminimum wage is any wage lower than the applicable federal, state, or local minimum wage.

Under the Wisconsin Code of law, employers can apply for a special license in order to pay a subminimum wage to employees with disabilities.

The wage rate for employees with disabilities is determined by a government agency, and is supposed to reflect the employee’s productive capacity.

There are also employees under 20 years of age, who can be paid an “opportunity wage” of $5.90 during their first 90 days of employment.

Track work hours and calculate hourly pay with ClockifyExceptions to the minimum wage in Wisconsin

There are also several exceptions to minimum wage requirements in Wisconsin:

- Agricultural workers — employers can deduct the following amounts from the employee’s wages:

- For lodging — $8.30 per day, $58 per week

- For meals — $4.15 per meal, $87 per week

- Camp counselors — employees of seasonal recreational or educational camps have the following special minimum wage rates:

- If the employer does not provide meals and lodging — $350 per week

- If the employer only provides meals — $265 per week

- If the employer provides both the meals and the lodging — $210 per week

- Golf caddies — minimum wage rate for this type of employees is based on the number of holes they caddy:

- 9 holes — $5.90 per hour

- 18 holes — $10.50 per hour

Additionally, the law exempts the following categories from minimum wage requirements:

- Persons employed casually and intermittently in the employer’s home, who work fewer than 15 hours per week.

- A person with a physical or mental illness due to old age, working fewer than 15 hours of general household work for the employer.

- An elementary or secondary school student performing work-like duties at their school.

Wisconsin payment laws

Wisconsin employers must establish regular pay periods, lasting no longer than 31 days.

If they so choose, the employers may establish more frequent paydays — e.g. semimonthly or weekly.

However, there are some exceptions:

- Employees who engage in logging must be paid at least quarterly

- Farm laborers must be paid at least quarterly

- Unclassified employees of the University of Wisconsin system are left to the University’s internal systems

- Technicians must be paid at least annually, at regular intervals

Wisconsin overtime laws

According to Wisconsin state regulations, all work exceeding 40 hours in a week is considered overtime.

In this context, a week is defined as a recurring period of 7 days, which does not necessarily correlate to the usual time of day and weekdays.

All overtime hours worked must be paid at the rate of 1.5 times the regular pay.

However, the employers are free to schedule employees as they wish — meaning that overtime can be mandatory.

Wisconsin overtime FAQOvertime exceptions and exemptions in Wisconsin

Wisconsin law has also outlined occupations that are exempt from overtime provisions:

- Salaried executive, administrative, and professional employees earning more than $700 per month

- Agricultural workers

- Employees providing domestic services in the home of the employer

- Employees of federal agencies

Wisconsin break laws

There are no particular state or federal laws that would require Wisconsin employers to provide meal breaks or rest periods during work hours.

If the employer chooses to provide breaks as a company benefit, they must follow these requirements:

- Rest periods of up to 30 minutes must be paid, and counted as work time.

- Meal periods must be longer than 30 minutes to be unpaid, and the employee must be relieved of all duties and free to leave the premises.

Exceptions to break laws in Wisconsin

The only exception Wisconsin break laws make is one for minor employees — allowing them a 30-minute break after working 6 consecutive hours.

Wisconsin breastfeeding laws

Under the federal Fair Labor Standards Act (FLSA), Wisconsin employers have to provide additional break time for nursing mothers for up to one year after childbirth.

This means that the employer is responsible for providing the employee with reasonable time and accommodation to express their breast milk.

In addition to more frequent breaks, the employers must provide adequate facilities.

Toilet stalls and restrooms do not meet the requirements for “adequate facilities”.

Wisconsin leave requirements

This section of the guide covers both the required and the non-required types of leave in Wisconsin.

Wisconsin required leave

First, we can take a look at types of leave required by Wisconsin law:

- Family and medical leave

- Jury duty leave

- Witness leave

- Military leave

- Voting time leave

- Emergency response leave (for State employees)

- Sick leave (for State employees)

- Bereavement leave (for State employees)

- Vacation and holiday leave (for State employees)

Family and medical leave

The federal Family and Medical Leave Act (FMLA) provides eligible Wisconsin employees up to 12 weeks of unpaid leave in case of medical emergencies.

Some types of events that may qualify an employee for family and medical leave include:

- Childbirth and care for a newborn

- Adoption or taking in a foster child

- A serious health issue that prevents the employee from working

- A family member with a serious health issue

As for the additional requirements the employees need to fulfill, federal law requires that the employee must have:

- Worked for the same employer for at least 12 months prior to requesting the leave, and

- Worked at least 1,250 hours in those 12 months.

Jury duty leave

No employer in Wisconsin can legally threaten, discipline, or discharge an employee who chooses to attend jury duty.

Otherwise, they may be subject to a $200 fine, and be required to reinstate the employee, as well as provide all back pay.

Witness leave

Wisconsin employees are entitled to the so-called witness leave, allowing them to be absent for court with full pay.

This means that employers may not legally prevent their employees from attending court cases they were subpoenaed.

If this does happen, the employer may be subject to a $200 fine, and be required to make full restitution to the employee.

Military leave

All members of the uniformed services are eligible for unpaid military leave under the federal Uniformed Services Employment and Reemployment Rights Act (USERRA) law.

This law allows employees to leave for deployment, and be reinstated to their position once they return.

However, they must meet the following conditions:

- The employee must provide a notice of their military service to the employer,

- The total time spent in active military service must remain under 5 years,

- The military discharge cannot be dishonorable or disqualifying, and

- The return to work must be timely.

Additionally, the employee is entitled to keeping all the benefits, as well as the level of seniority they held prior to the deployment.

Voting time leave

Wisconsin employers are required to provide up to 3 consecutive hours of voting time leave to their employees.

However, the employer is free to:

- Determine the time when the employee gets the leave,

- Request that the employee notify them in advance, and

- Withhold pay for the duration of the leave.

Emergency response leave (for State employees)

Wisconsin State employees who are certified members of the American Red Cross can get an emergency response leave in order to participate in disaster relief.

As a condition, the American Red Cross must submit a written request, detailing who has requested their services in that particular disaster.

Sick leave (for State employees)

Wisconsin public employees can accrue sick leave at the rate of 5 hours per biweekly period, and up to 130 hours per year.

Additionally, sick leave can be accumulated from year-to-year, with no upper limit to the amount of accrued hours.

Vacation and holiday leave (for State employees)

Full-time State employees receive accrued vacation leave at different rates, in accordance with the number of years served and FLSA coverage:

| Years of service | FLSA non-exempt (hours) | FLSA exempt (hours) |

| During first 5 years | 104 | 120 |

| 5+ to 10 years | 144 | 160 |

| 10+ to 15 years | 160 | 176 |

| 15+ to 20 years | 184 | 200 |

| 20+ to 25 years | 200 | 216 |

| 25 years and over | 216 | 216 |

Additionally, employees are entitled to holiday leave on days of these 9 national holidays:

- New Year's Day (January 1)

- Martin Luther King Jr. Day (third Monday in January)

- Memorial Day (last Monday in May)

- Juneteenth (June 19)

- Independence Day (July 4)

- Labor Day (first Monday in September)

- Veterans Day (November 11)

- Thanksgiving Day (fourth Thursday in November)

- Christmas Day (December 25)

If the holiday falls on a Sunday, public offices will be closed on the next day.

Wisconsin non-required leave

Here we have the types of leave not required by Wisconsin law, unless otherwise specified in the contract between employer and employee:

- Sick leave (private employees)

- Bereavement leave

- Vacation and holiday leave (private employees)

Sick leave (private employees)

There are no laws which would require private Wisconsin employers to provide sick leave to their employees, without a contractual agreement between the two parties.

Bereavement leave

Neither private nor public employers in Wisconsin are required to provide bereavement leave to their employees, unless contractually obliged.

However, public employees can use up to 3 days of their accrued sick leave as a bereavement leave.

Vacation and holiday leave (private employees)

Without a written agreement, private Wisconsin employees are not entitled to vacation or holiday leave.

Track employee productivity with ClockifyChild labor laws in Wisconsin

Most Wisconsin minors must be 14 years of age to be employed.

However, there are a few exceptions where minors must be at least 12 years old to work, including:

- Agriculture

- Newspaper delivery

- Door-to-door sales

- Golf course caddies

As already stated, all work is allowed to 14-year-olds, provided that they are under parental or guardian supervision.

There are also activities without a set legal age limit, such as:

- Court ordered juvenile restitution

- Street trades for a nonprofit organization

- Theater, musical, and other public performances

- Farm labor at the family home

Most employers who employ minors aged 12–15 must possess a valid work permit for each minor, before the work begins.

All minors must have a 30-minute break after working 6 consecutive hours.

When it comes to legal working hours for minors, Wisconsin has different requirements for these two age categories:

- Minors under 16, and

- Minors aged 16 and 17.

Wisconsin labor laws for minors under the age of 16

Minors under the age of 16 can work the following hours:

- Anytime from 7 a.m. to 7 p.m. on school days

- Anytime from 7 a.m. to 9 p.m. while school is out of session

- No more than 3 hours on a school day

- No more than 18 hours in a week while school is in session

- No more than 8 hours on a non-school day

- No more than 40 hours in a week while school is out of session

Wisconsin labor laws for minors aged 16 and 17

Minors aged 16 and 17 who are employed after 11 p.m. must have 8 hours of rest between the end of one shift and the start of the next shift.

Wisconsin guide to employment of minorsProhibited occupations for minors in Wisconsin

Wisconsin law also regulates occupations prohibited to minors, which are considered too dangerous for employees under 18 years old to perform.

In Wisconsin, prohibited occupations for minors are some of the following:

- Any work dealing with asbestos and similar toxic materials

- Mining

- Work in a confined space

- Excavation

- Operating a meat slicer

- Work in establishments that serve alcohol

- Work that involves the use of bakery machines

Hiring laws in Wisconsin

Under the Wisconsin Fair Employment Law, job applicants have a right to a fair hiring process, protected by prohibiting discrimination on the basis of:

- Race and color

- Religion

- National origin and ancestry

- Sex

- Sexual orientation

- Disability

- Age (40 and over)

- Marital status

- Arrest and conviction record

- Military status

- Use of lawful products outside work premises and work hours (for example, alcohol and tobacco)

- Genetic testing

These provisions prohibit Wisconsin employers from refusing to hire or treating differently any job applicants or employees on the basis of any of the listed characteristics.

Wisconsin “Ban-the-box” law

Many US states have a “fair chance” hiring policy issued in an attempt to provide a better chance for competition during the hiring process for people with a criminal record.

Wisconsin is one of these states, having included the so-called “Ban-the-box” law in their Fair Employment Law.

This type of law enables a fairer hiring process by:

- Prohibiting questions about the applicant’s criminal history during the initial job application, and

- Delaying background checks until a later point in the hiring process.

Termination laws in Wisconsin

Wisconsin is one of the majority of US states which use the doctrine of “at-will employment” to regulate their termination policies.

To be employed under these terms means that the employment can be terminated by either the employer or the employee, at any time.

Moreover, neither party needs to provide a particular argumentation for the termination.

Final paycheck in Wisconsin

Upon termination, employers must pay the employees their final paycheck by the next regularly scheduled payday.

If the employer fails to pay the employee within this time period — the employee can file a wage complaint with the Wisconsin Department of Workforce Development.

File An Online Wage ComplaintCOBRA and Wisconsin Mini-COBRA laws

Under the federal Consolidated Omnibus Budget Reconciliation Act (COBRA), some Wisconsin employees may be eligible for continued health insurance.

COBRA insurance is provided for employees who are experiencing a major stressful life event, such as:

- Termination

- A significant reduction of work hours

- Divorce

- A serious health issue that makes the employee unable to work

- A family member with serious health issues

COBRA laws cover employers with 20 or more employees, and may allow the continuation of health insurance for up to 36 months.

Additionally, all employees — including those with fewer than 20 employees — are covered by the Wisconsin Mini-COBRA.

Mini-COBRA provisions allow continued insurance for up to 18 months, and can be used as additional insurance once the federal COBRA has expired.

Both the COBRA and the Mini-COBRA usually have a price cap at 102% of the original cost.

Wisconsin Mini-COBRA informationOccupational safety in Wisconsin

Wisconsin has a state plan for workplace safety, approved by the federal Occupational Safety and Health Administration (OSHA).

This state plan was established by the Wisconsin Department of Health Services, and contains information for both the workers and the employers about safe workplace practices and responsibilities.

The Department of Health Services is also responsible for conducting workplace inspections, and ensuring proper workplace safety measures are followed.

File a Safety and Health ComplaintMiscellaneous Wisconsin labor laws

In the end, we have a brief review of some of the miscellaneous Wisconsin labor laws which do not strictly fit into the previously mentioned categories. These include the following:

- Cessation of Healthcare Benefits law

- One Day of Rest in Seven law

- Whistleblower protection laws

- Background check laws

- Drug and alcohol testing laws

- Record-keeping laws

Cessation of Healthcare Benefits law

All Wisconsin employers who have 50 or more employees who plan on discontinuing their health care benefits to their current or retired employees, or their dependents — must provide a 60-day notice.

These employers must provide a written notice, as well as post a cessation of healthcare benefits poster in a conspicuous place in the workplace.

If a violation occurs, the employer may need to pay the employee who filed a complaint:

- The value of the insurance premiums for the period without advance notice, or

- The value of medical expenses incurred during the 60 days of the notice period.

One Day of Rest in Seven law

Under Wisconsin law, all employees in factory and retail establishments are entitled to one day off per calendar week (i.e. a Sunday–Saturday week).

The law does not require that the rest day must be given every 7 days.

This means that the employer may legally schedule work for 12 consecutive days within a 2-week period if the days of rest fall on the first and last days of the 2-week period.

Whistleblower protection laws

Wisconsin’s whistleblower laws provide protection to all employees who report suspected or witnessed violations of state or federal laws.

Whistleblower laws prohibit employers from discharging, threatening, or in any other way retaliating against an employee filing a complaint in good faith.

Background check laws

Wisconsin employers have to make sure to follow the regulations provided in the federal Fair Credit Reporting Act (FCRA) when conducting employee background checks.

As a prerequisite, employers need to provide written notice in advance to employees whose background data they plan on collecting.

There are some occupations where criminal background checks are required, and these include the following:

- Child care center staff (including family and religious child care centers)

- Foster parents

- School personnel

- Direct care providers

- Certain public transit personnel

- Certain packaging service agency personnel

Drug and alcohol testing laws

Employers who choose to test their employees must have a written drug or alcohol testing policy.

Additionally, Wisconsin law states that no employee can be forced to pay for a medical exam, including drug and alcohol testing.

Record-keeping laws

Wisconsin laws require that employers maintain accurate and permanent employee records, including records for the following employee information:

- Name and address

- Date of birth

- The dates of hiring and termination

- Time of beginning and end of each work day

- Time of beginning and end of each meal period

- the Total number of hours worked per day and week

- Rate of pay

- Wages paid each pay period

- Amount and reasons for any deductions

- Output of the employee, if they are not paid on a time basis

All employee records must be kept for at least 3 years, and be kept in a place that is easily accessible for inspection.

Conclusion/Disclaimer

We hope this Wisconsin labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Wisconsin labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

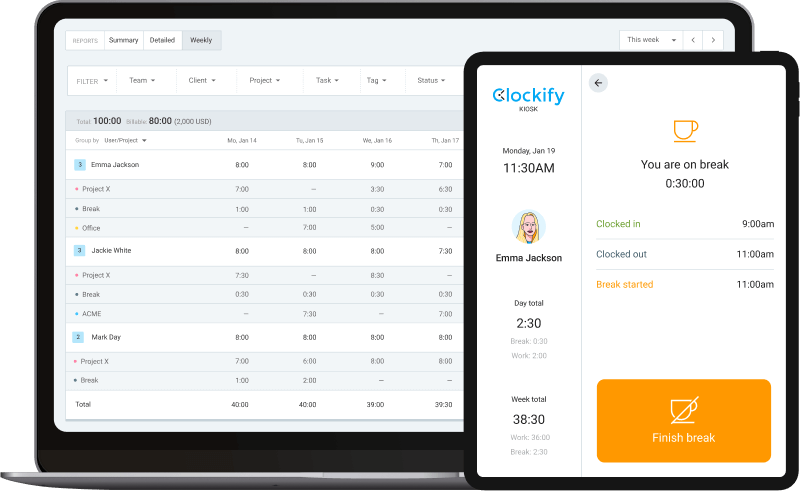

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).