Wyoming Labor Laws Guide

Ultimate Wyoming labor laws guide: minimum wage, overtime, breaks, leave, hiring, termination, and miscellaneous labor laws.

| Wyoming Labor Laws FAQ | |

| Wyoming minimum wage | $5.15 |

| Wyoming overtime laws | 1.5 times the rate of regular pay after working 40 hours in a workweek $10.88 per hour for minimum wage workers under federal provisions $7.72 per hour for minimum wage workers under state provisions |

| Wyoming break laws | Breaks not required by law |

Table of contents

Wyoming wage laws

First on our list of state labor laws are Wyoming wage laws.

Here they are, divided into several subcategories:

- Minimum wage in Wyoming

- Tipped minimum wage in Wyoming

- Subminimum wage in Wyoming

- Exceptions to the minimum wage in Wyoming

- Wyoming payment laws

| MINIMUM WAGE IN WYOMING | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $5.15 | $2.13 | Youth minimum wage — $4.25 Employees with disabilities — rate determined by government agency |

Wyoming minimum wage

Wyoming has its own state minimum wage of $5.15 per hour.

However, as this amount is lower than the federal minimum wage — currently $7.25 — most employers must pay their employees at least the federal minimum wage rate.

When it comes to minimum wage coverage, the following rules apply:

- Employees not covered by the Fair Labor Standards Act (FLSA) are entitled to the state minimum wage, unless specifically exempt

- Employees covered by the FLSA are entitled to the federal minimum wage, unless specifically exempt

- Employees covered by both the FLSA and the state minimum wage law are entitled to the federal minimum wage

Tipped minimum wage in Wyoming

Employees who regularly receive more than $30 in monthly tips are considered “tipped employees” under both federal and Wyoming state law.

Tipped employees in Wyoming can be paid a reduced tipped minimum wage of$2.13 per hour.

However, if the direct wages, when combined with tips, do not meet the regular minimum wage of $5.15 (or $7.25 — whichever one is applicable) — the employer should cover the difference.

Subminimum wage in Wyoming

Subminimum wage, by definition, is any wage lower than the applicable federal, state, or local minimum wage.

Under FLSA provisions, Wyoming employers can apply for a special license in order to pay a subminimum wage to employees with disabilities.

The wage rate for employees with disabilities is determined by a government agency, and should reflect the productive capacity of the employee.

Additionally, Wyoming employees under 20 years of age can be paid a “youth minimum wage” of $4.25 during their first 90 days of employment.

Track work hours and calculate hourly pay with ClockifyExceptions to the minimum wage in Wyoming

There is significant overlap between categories of employees exempt from the state and federal minimum wage requirements.

As such, here are a few examples of occupations exempt from both:

- Agricultural workers

- Individuals employed in domestic services

- Outside salespersons

- Professional, administrative, and executive staff (exempt under federal laws if they earn more than $684 per week, entirely exempt under state law)

Wyoming payment laws

Most Wyoming employers are not required to establish a regular pay schedule.

Exceptions exist for the following occupations:

- Railroad operation

- Mining

- Refinery operation

- Prospecting and the production of oil and gas

- Factory work

- Mill operation

- Workshop work

Employers operating in the listed industries are required to pay their employees on a semimonthly schedule.

This means that wages earned during the first half of one month must be paid on or before the first day of the following month.

Wages earned during the latter part of the month must be paid on or before the fifteenth day of the following month.

Wyoming overtime laws

For employees covered by the federal FLSA regulations, all work exceeding 40 hours in a workweek is considered overtime.

For the purposes of overtime calculation, a workweek is defined as a recurring period of 7 days (168 hours), which does not necessarily correlate to usual time of day and week days.

All overtime hours worked must be paid at the rate of 1.5 times the regular pay.

Overtime exceptions and exemptions in Wyoming

Wyoming state law also defines occupations exempt from overtime provisions, including:

- Salaried supervisors

- Salaried professionals

- Salaried administrative employees

- Employees working in a retail store on a commission basis

- Outside salespersons

All of the listed categories are also exempt from federal overtime requirements.

However, federal exemptions apply only to supervisors, professionals, and administrative employees who earn more than $684 per week.

Track Wyoming overtime with ClockifyWyoming break laws

There are no particular state or federal laws requiring Wyoming employers to provide meal breaks or rest periods during work hours.

Employers under federal provisions who choose to provide breaks as a company benefit must follow these requirements:

- Rest periods of up to 30 minutes are to be counted as work time and must be paid.

- Meal periods must be longer than 30 minutes to be unpaid, and the employee must be relieved of all duties

Exceptions to break laws in Wyoming

There are no particular exceptions to break laws in Wyoming.

Wyoming breastfeeding laws

Under the federal FLSA provisions, Wyoming employers have to provide additional break time for nursing mothers.

This means that the employer is responsible for providing the employee reasonable time and accommodation to express their breast milk.

In addition to more frequent breaks, the employers must provide adequate facilities for this purpose — other than toilet stalls and restrooms.

The right to additional breaks is extended up to one year after childbirth.

Wyoming does not have any additional state laws concerning breastfeeding in the workplace.

Wyoming leave requirements

This section of the guide covers both the required and the non-required types of leave in Wyoming.

Wyoming required leave

First off, we have the types of leave required by Wyoming law:

- Family and medical leave

- Jury duty leave

- Military leave

- Voting time leave

- Sick leave (for State employees)

- Annual and holiday leave (for State employees)

Family and medical leave

The federal Family and Medical Leave Act (FMLA) provides eligible Wyoming employees up to 12 weeks of unpaid leave in case of medical emergencies.

Some types of events that may qualify an employee for family and medical leave include:

- Childbirth and care for a newborn

- Adoption or taking in a foster child

- A serious health issue that prevents the employee from working

- A family member with a serious health issue

As for the basic requirements the employees need to fulfill to be eligible for this type of leave, federal law requires that the employee must have:

- Worked for the same employer for at least 12 months prior to requesting the leave, and

- Worked at least 1,250 hours in those 12 months.

Jury duty leave

No employer in Wyoming can legally threaten, discipline, or discharge an employee who chooses to attend jury duty during work hours.

Provided that any offenses to this rule are brought to court within 6 months, employers may be liable for up to $1,000 dollars in damages for each violation.

Military leave

All members of the uniformed services are eligible for unpaid military leave under the federal Uniformed Services Employment and Reemployment Rights Act (USERRA) law.

This law allows employees to leave for deployment, and be reinstated to their position once they return.

However, they must meet the following conditions:

- The employee must provide a notice of their military service to the employer,

- The total time spent in active military service must remain under 5 years,

- The military discharge cannot be dishonorable or disqualifying, and

- The return to work must be timely.

Additionally, the employee is entitled to keeping all the benefits, as well as the level of seniority they held prior to the deployment.

Voting time leave

Wyoming employers are required to provide 1 hour of voting time leave to their employees without loss of pay.

This rule does not apply to employees who have at least 3 consecutive hours off duty while the polls are open.

Sick leave (for State employees)

Wyoming public employees can accrue sick leave at the rate of 8 hours per month, amounting to 12 days per year.

Additionally, sick leave can be carried over from year-to-year, with no upper limit to the amount of accrued hours.

Annual and holiday leave (for State employees)

Full-time State employees receive accrued annual leave at different rates, in accordance with the number of months served:

|

Months served |

Monthly hours earned |

|

0–48 months |

8 hours |

|

49–108 months |

10 hours |

|

109–168 months |

12 hours |

|

169–228 months |

14 hours |

|

229 or more months |

16 hours |

Any unused annual leave can be carried over from one year to the next, as long as it does not exceed the following carry-over maximum:

|

Months served |

Carry-over maximum |

|

0–108 months |

240 hours (30 days) |

|

109–168 months |

288 hours (36 days) |

|

169–228 months |

336 hours (42 days) |

|

229 or more months |

384 (48 days) |

Additionally, employees are entitled to holiday leave on 9 national holidays:

- New Year's Day — January 1

- Martin Luther King, Jr. Day (Wyoming Equality Day) — third Monday in January

- President's Day — third Monday in February

- Memorial Day — last Monday in May

- Independence Day — July 4

- Labor Day — first Monday in September

- Veteran's Day — November 11

- Thanksgiving Day — fourth Thursday in November

- Christmas Day — December 25

If the holiday falls on a Sunday, public offices will be closed on the next day.

Wyoming non-required leave

Moving on, we have the types of leave not required by Wyoming law, unless otherwise specified in the contract between employer and employee:

- Sick leave (private employees)

- Bereavement leave

- Vacation, annual, and holiday leave (private employees)

Sick leave (private employees)

There are no regulations which would require private Wyoming employers to provide sick leave to their employees.

Bereavement leave

Neither private nor public employers in Wyoming are required to provide bereavement leave to their employees.

Vacation, annual, and holiday leave (private employees)

Private Wyoming employees are not entitled to vacation, annual, or holiday leave.

Track employee productivity with ClockifyChild labor laws in Wyoming

Most working minors in Wyoming are subject to federal FLSA regulations.

To be exempt from federal provisions, and subject to Wyoming state ones, businesses must:

- Not ship or receive any goods across the Wyoming state border

- Have two or fewer employees

- Have a gross income of less than $500,000 in sales

- Operate on a cash-only basis

Wyoming state child labor laws regulate the working hours of minors this way:

- No minor can work more than 8 hours in any 12-hour period

- No minor can work before 5 a.m. and after 10 p.m. on days followed by a school day

- No minor can work before 5 a.m. and after midnight on days not followed by a school day

- Minors not enrolled in school can work for an 8-hour period between the hours of 5 a.m. and midnight

As opposed to the state regulations, federal regulations differentiate these two age categories when it comes to legal working hours for minors:

- Minors under 16, and

- Minors aged 16 and 17.

Wyoming labor laws for minors under the age of 16

Minors under the age of 16 can work the following hours:

- Anytime from 7 a.m. to 7 p.m. on school days

- Anytime from 7 a.m. to 9 p.m. while school is out of session

- No more than 3 hours on a school day

- No more than 18 hours in a week while school is in session

- No more than 8 hours on a non-school day

- No more than 40 hours in a week while school is out of session

Wyoming labor laws for minors aged 16 and 17

There are no particular laws concerned with working hours of minors aged 16 and 17.

Prohibited occupations for minors in Wyoming

Federal law also regulates occupations prohibited to minors, which are considered too dangerous for employees under 18 years old to perform.

In Wyoming, prohibited occupations and activities for minors are some of the following:

- Operating power-driven machinery

- Mining

- Working in a confined space

- Excavation

- Operating a meat slicer

- Working in establishments that serve alcohol

In addition to federal regulations, minor employees covered by state law cannot:

- Operate heavy construction equipment

- Be exposed to explosives or toxic chemicals in the workplace

- Act or perform in a venue where alcohol is sold or given away

- Work for any illegal or immoral purposes

- Work in any place or occupation that is damaging to their health, safety, or morals

Hiring laws in Wyoming

Under the Wyoming Fair Employment Practices Act (WFEPA), job applicants have a right to a fair hiring process, protected by prohibiting discrimination on the basis of:

- Race and color

- Creed

- National origin and ancestry

- Sex

- Pregnancy

- Disability

- Age (valid for those 40 and over)

These provisions prohibit Wyoming employers from refusing to hire or treating differently any job applicants or employees on the basis of any of the listed characteristics.

General Discrimination Complaint Form Employees With Disabilities Discrimination Complaint FormTermination laws in Wyoming

Wyoming is one of the majority US states which use the principle of “at-will employment” to regulate their termination policies.

Being employed under these terms means that the employment relationship can be terminated by either the employer or the employee, at any time.

Additionally, neither party needs to provide a particular argumentation for the termination.

Final paycheck in Wyoming

Upon termination, employers must pay the employees their final paycheck before or on the next regularly scheduled payday.

If the employer fails to pay the employee within this time period — the employee can file a wage complaint with the Wyoming Department of Workforce Development.

File an Online Wage ClaimCOBRA and Wyoming Mini-COBRA laws

Under the provisions of the federal Consolidated Omnibus Budget Reconciliation Act (COBRA), Wyoming employees may be eligible for continued health insurance following a termination, or a significant stressful life event, such as:

- A significant reduction of work hours

- Divorce

- A serious health issue that makes the employee unable to work

- A family member having serious health issues

COBRA laws cover employers with 20 or more employees, and may allow the continuation of health insurance for up to 36 months.

Additionally, employees working in businesses with fewer than 20 employees are covered by the Wyoming Mini-COBRA, which allows continued insurance for up to 12 months.

Both the COBRA and the Mini-COBRA usually have a price cap at 102% of the original cost.

Wyoming Mini-COBRA informationOccupational safety in Wyoming

Wyoming has a state plan for workplace safety, approved by the federal Occupational Safety and Health Administration (OSHA).

This state plan has established the Wyoming Department of Workforce Services, devoted to ensuring safe working conditions for Wyoming workers.

The agency does this by performing workplace inspections, as well as processing safety hazard complaints, in order to make sure that workplaces are free from known hazards.

Wyoming OSHA contact informationMiscellaneous Wyoming labor laws

In the end, we have a brief review of some of the miscellaneous Wyoming labor laws which do not strictly fit into the previously mentioned categories.

These include the following:

- Wyoming Preference Act

- Whistleblower protection laws

- Background check laws

- Drug and alcohol testing laws

- Record-keeping laws

Wyoming Preference Act

According to the Wyoming Preference Act, all contractors working on public projects must employ only Wyoming skilled laborers.

To employ laborers form outside Wyoming, the employer must prove that:

- There are no skilled laborers from within the state available for work

- The available workers are not qualified to perform the required work

Additionally, the employer must contact the nearest state employment office to notify them that their employment needs could not be filled from the provided listings.

Whistleblower protection laws

Wyoming’s whistleblower laws provide a level of protection to public employees who report suspected or witnessed violations of state or federal laws.

These laws prohibit employers from discharging, threatening, or in any other way retaliating against a whistleblower filing a complaint in good faith.

Background check laws

Wyoming employers have to make sure to follow the regulations provided in the federal Fair Credit Reporting Act (FCRA) when conducting employee background checks.

As a general rule, criminal background checks are only required before hiring:

- Staff working as a substitute care provider, certified by the Department of Family Services

- Staff contracted with either the Department of Health or the Department of Family Services who provide specialized home care or respite care to minors

Drug and alcohol testing laws

There are no regulations regarding employee drug and alcohol testing in Wyoming.

However, the state of Wyoming offers a 10% discount on employee compensation insurance premium base rates to employers who implement a drug-free workplace program.

Additionally, if drug or alcohol testing is required as a condition of employment — the applicant may be required to cover the cost of the testing.

Record-keeping laws

Wyoming regulations require that employers maintain accurate and permanent employee records, including the following information:

- Name

- Address

- Occupation

- Hours worked each day and each week

- Rate of pay

- Wages paid each pay period

All employee records must be kept for at least 2 years, and be kept in a place that is easily accessible in case of an inspection.

Conclusion/Disclaimer

We hope this Wyoming labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Wyoming labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

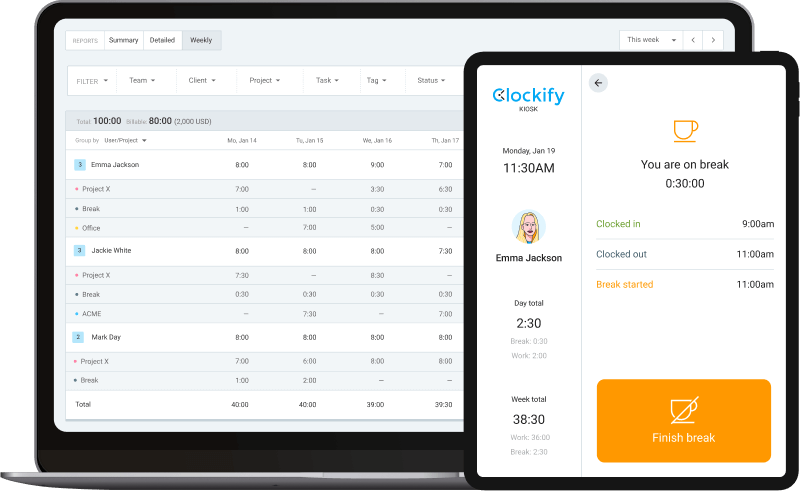

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).