North Dakota Labor Laws Guide

Ultimate North Dakota labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| North Dakota Labor Laws FAQ | |

| North Dakota minimum wage | $7.25 |

| North Dakota overtime | 1.5 times the minimum wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| North Dakota breaks | 30-minute meal period in each shift exceeding 5 hours of work |

Table of contents

North Dakota wage laws

Concerning minimum wages in North Dakota, federal and state laws overlap.

The following are wage regulations regarding:

- State minimum wage,

- Tipped hourly wage, and

- Youth minimum wage in North Dakota.

| NORTH DAKOTA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25 | $4.86 | $7.25 (for minors) $6.16 (for students in vocational education or related programs) No training wage |

North Dakota minimum wage

As of July 24, 2009, North Dakota employees are entitled to the federal minimum wage of $7.25 per hour.

Exceptions to the minimum wage in North Dakota

Certain employees in North Dakota are exempt from the minimum wage of $7.25 per hour. Said employees include:

- Employees who work in nonprofit camps for youth education

- Guides, cooks, or camp-tenders for a hunting or fishing guide service

- Golf course caddies

- People in employment programs for youthful or first-time offenders

- Prison or jail inmates performing work directly associated with the prison, jail, institution, state, or a political subdivision

- Actors or extras for motion pictures

- Babysitting workers who work less than 20 hours per week

- Volunteers who work on a part-time basis for public services, religious, nonprofit and charitable organizations, hospitals, etc.

- Student trainees of vocational schools, provided that they don’t replace regular employees and don’t receive wages

Tipped minimum wage in North Dakota

Any service employee in North Dakota who regularly receives more than $30 a month in tips is considered a tipped employee.

Under North Dakota laws, an employer may take a tip credit of not more than 33% of the minimum wage. That being said, the tipped minimum wage in North Dakota adds up to $4.86 per hour.

Still, a tipped employee's total earnings per hour (tipped hourly wages + tips) must equal at least the federal minimum wage of $7.25.

In line with that, if the tipped employee does not earn $7.25 per hour in total (tipped hourly wages + tips), the employer must pay the difference.

North Dakota subminimum wage

Students enrolled in vocational education or related programs mustn’t be paid less than 85% of the state minimum wage per hour.

Nevertheless, this rule only applies during the first year of employment, and said students are entitled to at least $6.16 per hour.

Moreover, persons with disabilities are paid a commensurate wage. Such wage is based on the employee's productivity, skills, or knowledge in proportion to the productivity, skills, or knowledge of a person without a disability performing the same type of work.

Finally, training programs and similar activities in North Dakota are not considered working time and are thus not compensable.

North Dakota payment laws

North Dakota employers must pay their employees all wages earned at least once each month on a regularly scheduled payday.

Other most common pay frequency schemes in the USA include:

- Weekly — Employees are paid once a week (52 paychecks per year).

- Biweekly — Employees are paid every other week (26 paychecks per year).

- Semi-monthly — Employees are paid twice a month (24 paychecks per year).

North Dakota overtime laws

Overtime is considered any hour worked over 40 hours per workweek — bearing in mind that paid holidays, paid time off, and sick leave are not considered overtime.

North Dakota eligible employees must receive overtime pay at a rate of one and one-half (1.5) times the regular rate of pay.

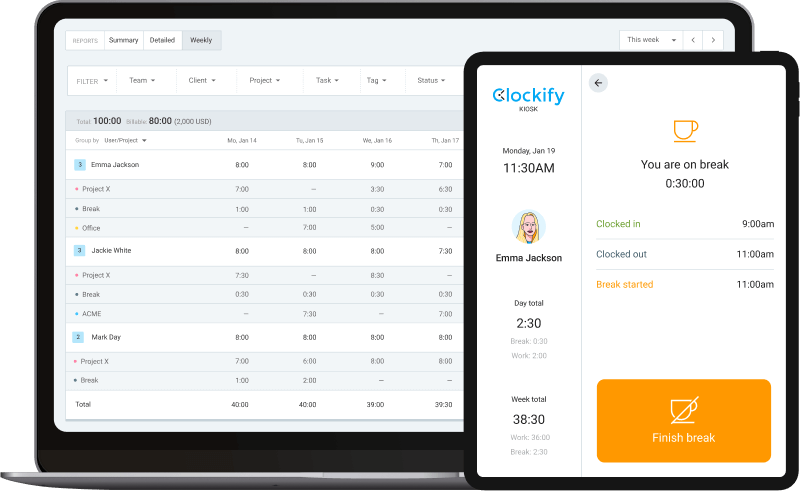

Track North Dakota overtime with ClockifyOvertime exceptions and exemptions in North Dakota

Still, certain employees and jobs are exempt from overtime pay:

- Bona fide executive, administrative, and professional employees

- Agricultural workers

- Employees who spend at least 51% of their working time providing care in foster homes, shelters, and related facilities

- Domestic service employees who reside in the households where they work

- Commissioned sales representatives employed in retail automobile, trailer, boat, truck, aircraft, or farm dealerships (provided that a representative is not required to be on the premises for more than 40 hours a week)

- Computer employees who are paid at least $27.63 per hour

- Fieldwork employees who work in sales or take orders (non-outside sales work may not exceed 20% of the work hours per week)

- Mechanics who receive a percentage of a flat rate schedule

- Retail employees whose regular rate of pay exceeds 1.5 times the minimum hourly rate and 51% of their compensation is derived from commission on goods or services (for a period of not less than 1 month)

- Announcers, news editors, or chief engineers employed at a radio or television station

- Artistic or creative professionals such as editors, musicians, actors, writers, publishers, etc.

- Covered motor carriers specified by the Motor Carriers Act

- Teachers, instructors, or lecturers employed in a school or educational system

- Highly compensated employees who earn more than $100,000 a year — provided that at least $455 is paid per week, whether on a salary or fee basis, and that the primary duties include office or non-manual work

- Employees who provide care for aged or disabled persons — provided that no more than 20% of the work is household work (cleaning, cooking, etc.)

Unlike federal provisions which exempt taxi drivers from overtime pay — North Dakota law obliges employers to pay taxi drivers overtime for all hours worked in excess of 50 hours during a workweek.

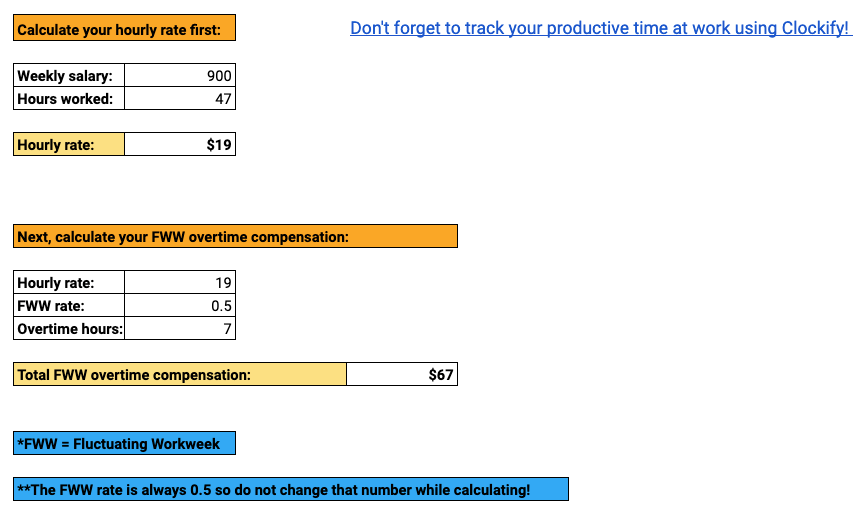

Fluctuating Workweek Method (FWW) in North Dakota

In North Dakota, certain employees who receive a fixed salary qualify for overtime pay under the provisions of the Fluctuating Workweek Method (FWW).

Who is eligible for FWW?

Employees who are paid a fixed salary and whose workweek hours “fluctuate” qualify for FWW — sometimes they work more than 40 hours a week and sometimes less.

So, for instance, a salaried nonexempt employee receives a fixed salary whether they work 35 or 45 hours a week. However, for every hour worked over 40 a week — said employee gets overtime pay of one-half (0.5) times the regular hourly rate.

Take a look at the example of the FWW:

Let’s say an employee’s weekly income is $950, and in the preceding week, the employee worked 46 hours.

To be able to calculate overtime hours, calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week.

$950 / 46 = $21 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week.

$21 per hour x 0.5 = $10.5 for each overtime hour worked

Total overtime compensation goes as follows:

$10.5 x 6 overtime hours = $63

Fluctuating Workweek Calculator | Best ways to track employee hours

Fluctuating Workweek Calculator | Best ways to track employee hours

North Dakota break laws

Even though federal law doesn’t require breaks in the workplace — North Dakota employees are entitled to a minimum 30-minute meal period in each shift exceeding 5 hours of work.

This way, North Dakota law fosters a healthy workplace environment and increases employee productivity.

However, such meal periods are not paid and can be provided if there are 2 or more employees on duty.

Track employee productivity with ClockifyExceptions to break laws in North Dakota

Meanwhile, employees who are not relieved of their duties while on a meal break are entitled to a paid meal period.

What’s more, break periods lasting less than 30 minutes (such as a 15-minute coffee break — if provided by an employer — must be compensated.

North Dakota breastfeeding laws in the workplace

In North Dakota, an employer may choose to use the designation “infant friendly” for their business to support breastfeeding in the workplace.

If they choose to do so, employers must adopt a workplace breastfeeding policy that offers:

- Flexible work scheduling together with reasonable breaks for the expression of breast milk

- A private space for the expression of breast milk (other than a bathroom)

- A water source for washing hands and breast-pumping equipment

- A hygienic refrigerator for breast milk storing

North Dakota leave requirements

In the state of North Dakota, there are two types of leave days:

- Required leave

- Non-required leave

North Dakota required leave

The following are leave benefits that North Dakota employers are required to provide to their employees:

- Annual leave (public employers)

- Holiday leave (public employers)

- Sick leave (public employers)

- Family leave (public employers)

- Military leave

- Disaster services, emergency medical services, and firefighter volunteers leave

- Bone marrow and organ donation leave (public employers)

- Honor guard leave

- Jury duty leave (public employers)

- Witness leave (public employers)

- Funeral leave

Annual leave (public employers)

All state and local government agencies, departments, institutions, boards, and commissions qualify for paid absence from work called annual leave.

Employees may begin to accrue days of annual leave from the first day of employment based on the following annual leave accrual schedule:

| Years of service | Hours earned per month |

| 0–3 | 8 |

| 4–7 | 10 |

| 8–12 | 12 |

| 13–18 | 14 |

| 18 and more | 16 |

The maximum annual leave carryover amount is 240 hours.

Finally, if an eligible employee decides to leave the service, such an employee will be paid for all accrued hours of annual leave.

Holiday leave (public employers)

The following is a list of state holidays recognized by North Dakota when all state employees receive a paid day off:

- New Year’s Day (January 1st)

- Martin Luther King Day (3rd Monday in January)

- George Washington’s Birthday (3rd Monday in February)

- Good Friday (the Friday preceding Easter Sunday)

- Memorial Day (last Monday in May)

- Independence Day (July 4)

- Labor Day (1st Monday in September)

- Veterans’ Day (November 11th)

- Thanksgiving Day (4th Thursday in November)

- Christmas Day (December 25th)

- Any day appointed by the President of the United States or by the governor of North Dakota for a public holiday

- Every Sunday

Furthermore, if Christmas Eve falls on a workday, all state offices must close at noon.

If a holiday falls on a Sunday — such holiday will be observed on the following Monday. And, if a holiday falls on a Saturday, the preceding Friday shall be the holiday.

Sick leave (public employers)

All state and local government agencies, departments, boards, and commissions must grant their employees paid sick leave.

Employees may start accruing sick leave from the first day of employment by following this accrual schedule:

| Years of service | Hours earned per month |

| Zero to all | 8 |

Qualifying events for sick leave (with certain limitations):

- Illness or injury of an employee

- Appointment for the diagnosis or treatment of an employee

- Illness or injury of the employee’s eligible family member* (eligible employees may only use up to 80 hours of sick leave per calendar year)

- Birth or placement adoption (eligible employees may use up to 6 weeks of their accrued sick leave)

- Seeking services for themselves or their eligible dependents in case of domestic violence, sex offense, stalking, or terrorizing (eligible employees may use up to 40 hours per calendar year)

- Death of a child (up to 160 hours)

* Eligible family members include the employee’s spouse, parent, child (natural, adoptive, foster, or stepchild) or any other family member who is financially or legally dependent on the employee.

Family leave (public employers)

This type of leave is granted to the state employees in the following cases:

- The birth of the employee’s child

- Adopting or taking in a foster child

- Caring for an immediate family member (child, spouse, or parent) due to a serious health condition

- A serious health condition

An eligible employee may take family leave of up to 12 workweeks in any 12-month period.

Unlike sick leave, family leave in North Dakota is granted without pay.

Military leave

The following are employees and officers of the state of North Dakota or its political subdivisions who are eligible for military leave of absence:

- Members of the National Guard

- Members of the armed forces reserve of the USA

- Anyone called in the federal service by the president of the USA

- Anyone who wishes to volunteer for such service

Eligible persons are entitled to a leave of absence without loss of status or efficiency rating when called to active duty.

However, if an employee has been employed for 90 days before the absence, then such an employee receives 20 paid workdays a year for military service.

Moreover, in case of full or partial mobilization or emergency active duty, individuals receive paid leave of absence for the first 30 days.

Finally, if leave falls on a weekend or on a day when the officer or employee is scheduled to work — such person must either be given unpaid time off or the opportunity to reschedule the work period.

Disaster services, emergency medical services, and firefighter volunteers leave

In case of a disaster of at least level II or emergency, the American Red Cross volunteers may be granted a leave of absence to participate in disaster relief services.

Furthermore, emergency medical service volunteers or firefighter volunteers may be granted a paid leave of absence to respond to an emergency at the request.

Such leaves may not exceed 5 working days during any calendar year.

Bone marrow and organ donation leave (public employers)

State agencies may grant up to 20 workdays of paid absence to state employees who donate an organ or bone marrow.

Honor guard leave

Such leave is granted to guards of honor who provide final tribute services for deceased military members at a funeral.

Honor guard leave is paid leave of absence of up to 24 working hours per calendar year.

Jury duty leave (public employers)

All state and local government agencies, departments, boards, and commission employees selected for jury duty must receive paid absence from work.

Even though the juror receives juror fees from the court for jury duty services, the employer is still obliged to pay the difference if that amount doesn’t cover the employee's regular pay.

For instance, if the juror was absent for two days for which they would normally receive $200, and the court only paid them $120 — the employer must pay the employee $80 to equal their regular pay.

Finally, if the employee who must perform jury duty is on authorized annual leave — they may retain both the court fees and regular pay for days of performing juror services.

Witness leave (public employers)

If an employee is called as a witness on behalf of the employer, such an employee is entitled to receive compensation for mileage, meals, and lodging from the employer.

In that case, the employee may not ask for additional compensation for mileage, food, and lodging, and must be paid their regular pay for the time spent as a witness.

Yet, if the employer doesn’t compensate for mileage, food, and lodging, such an employee may retain a witness fee paid by a party (this also applies if an employee is on authorized leave).

Funeral leave (public employers)

Employees of the state or local government agencies, departments, boards, and commissions have the right to paid funeral leave of up to 24 working hours in case of a death in the employee’s family or the family of the employee’s spouse.

North Dakota non-required leave

Unlike public employers, private sector employers in North Dakota are not obligated to assign days of absence — including:

- Annual leave

- Holiday leave

- Sick leave

- Family leave

- Bone marrow and organ donation leave

- Jury duty leave

- Witness leave

Child labor laws in North Dakota

To ensure a safe and healthy working environment for minors, both federal and North Dakota laws restrict the hours and types of work that minors can perform.

Unlike for minors 16 and 17 years of age, North Dakota employers must obtain a work permit for workers aged 14 and 15.

However, under North Dakota law, such work permits may be granted only if the minor maintains a passing grade in all subjects.

Students who have unsatisfactory grades and who are often absent from school are not eligible for work permits in North Dakota.

The following are certain work regulations and restrictions regarding child labor in North Dakota.

Work time restrictions for North Dakota minors

In North Dakota, there are no hour restrictions on the employment of minors aged 16 and over.

Still, minors aged 14 and 15 may work under the following conditions:

- Between 7 a.m. and 7 p.m. (until 9 p.m. from June 1st to Labor Day)

- Up to 3 hours on a school day

- Up to 8 hours on a non-school day

- 18 hours on a school week

- 40 hours on a non-school week

Breaks for North Dakota minors

Even though federal law doesn’t regulate breaks or meal periods regarding youth employment, under North Dakota law, each worker must be granted a 30-minute meal period in each shift exceeding 5 hours of work (provided that there are 2 employees on duty).

Prohibited occupations for North Dakota minors

Under North Dakota law, the following occupations are considered forbidden for minors aged 14 and 15:

- Working with power-driven machinery — except for office machines (e.g. adding machines or typewriters), retail store machines (e.g. pricing machines, tagging machines, etc.), domestic machines (e.g. blenders, toasters, etc.), lawnmowers, and car cleaning machines

- Working at the construction site (except for cleaning, errand running, loading or unloading materials by hand)

- Participating in lumbering or logging operations

- Working in sawmills or planing mills

- Working with explosive

- Operating with any steam boiler or machinery

- Operating with laundry machinery

- Working with or near acids, paints, colors, white lead, herbicides, or any other toxic substances

- Working with or near medical waste

- Working in a mine or quarry

- Operating or assisting with passenger or freight elevators

- Manufacturing goods for immoral purposes

- Working in an occupation that includes using ladders or scaffolds higher than 6 feet from the ground

- Operating weapons

- Door-to-door sales (except for newspaper and shopper carriers)

- Handling or storing blood, blood products, body fluids or tissues

- Cooking, baking, grilling, or frying

- Working in a warehouse or storage

- Trucking or commercial driving

- Any job that requires standing (except for minors who work as singers or musicians in a church, school, or academy)

Still, minors aged 14 and 15 are allowed to perform farm labor, operate farm machinery, or work in domestic service (gardening, house cleaning, etc).

Even though there are no state restrictions on employment of minors aged 16 and over, there are federal provisions that prohibit certain occupations for minors under 18 years of age.

Child Labor Provisions of the Fair Labor Standards Act (FLSA) for Nonagricultural Occupations | Agricultural OccupationsAny person or entity that disregards any of the provisions relating to prohibited occupations said above will be guilty of an infraction.

Posting requirements for employers employing minors in North Dakota

Any employer who employs minors aged 14 and 15 must post a printed notice that states:

- Minors’ hours of work for each day of the week

- Workday start and end times

- Break start and end times (if provided)

Such notice must be displayed in a conspicuous place in each establishment where minors are employed.

North Dakota hiring laws

In the state of North Dakota, it’s considered “discriminatory practice” for an employer or employment agency to discharge, promote, compensate, refuse to hire, or treat unequally a potential employee or existing one based on the employee’s:

- Race

- Color

- Religion

- National origin

- Age

- Sex

- Physical or mental disability

- Mariage or public assistance status

- Participation in lawful activity off the employer’s premises during non-working hours

Yet, an employee 65 years of age — but not 70 — who is employed in a bona fide executive or high policy-making position may be retired compulsorily, and this is not a discriminatory practice.

Furthermore, religion, sex, national origin, physical or mental disability, or marital status may be “allowable” bona fide occupational qualifications for certain businesses.

That being said, it’s lawful to discharge, refuse to refer or hire an individual based on their gender, marital status, etc., in situations where such factors are bona fide occupational qualifications necessary for a certain position.

Finally, an employer or employment agency may require an individual to undergo a physical examination or provide access to medical records — to see if such a person is capable of performing the job in question.

Right-to-work law in North Dakota

North Dakota is one of the first states to adopt the right-to-work law in the USA.

The right-to-work law allows employees the opportunity of choosing whether or not to be a member of a labor union in the workplace.

That being said, no employee of the state of North Dakota may be forced to associate with fellow employees, join, form, or assist a labor union as a condition of employment.

North Dakota termination laws

North Dakota is another at-will employment state.

The definition of at-will employment indicates that an employee may be terminated at any time and for any reason (or no reason at all) — unless there’s an employment contract or specified term saying otherwise.

However, there are instances when an employer is not allowed to fire an employee. If fired, such termination of employment is called wrongful termination.

Here are some of the most common reasons that count as wrongful termination:

- Discrimination — An employer cannot fire an employee due to their race, color, religion, pregnancy, disability, or gender.

- Witness or jury duty services — An employer cannot fire an employee who receives a call by authority to perform jury or witness duty.

- Retaliation — An employer cannot fire an employee if an employee refuses to perform the employer’s orders that the employee believes break or act against a law, rule, or agreement.

Under North Dakota law, if there is a specified term between the employer and the employee, the at-will law is no longer valid — and employment may only be terminated for the following 4 reasons:

- The expiration of the term

- The death of the employee

- The employee’s neglect of duty

- The extinction of a job (e.g, jobs that will be lost to automation)

North Dakota final paycheck

If a person’s employment has ended — whether voluntary or involuntary — wages due to such an employee must be paid on the regular payday.

Health insurance continuation in North Dakota

Under North Dakota law, employees whose employment has ended have the right to continue their or their eligible dependents’ health insurance coverage for 39 weeks after the termination of employment.

Such health insurance covers:

- Hospital,

- Surgical, and

- Major medical expenses.

Who is eligible for health insurance continuation in North Dakota?

Eligible employees and their dependents are those who have been continuously insured under the group policy for 3 months ending with the termination.

Still, persons covered by the government national health insurance program Medicare are not eligible for the continuation of health care benefits.

Furthermore, the state continuation of medical coverage doesn’t include dental, vision care, or prescription drug benefits.

Occupational safety in North Dakota

Since there is no state plan regarding safety and health in the workplace — the federal law called Occupational Safety and Health Administration (OSHA) applies.

OSHA makes sure all persons work in a safe and healthy environment by enforcing standards that all businesses must comply with.

What’s more, OSHA provides training, assistance, and education to raise safety awareness in the workplace.

Yet, OSHA covers only private sector employees and their employers.

There are 6 main types of hazards in the workplace recognized by OSHA:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Things that cause stress such as excessive workload, sexual harrassment, workplace violence, etc.

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

Miscellaneous North Dakota labor laws

There are certain laws concerning labor that don’t fall under any of the categories listed above — so that’s why we’ve decided to place them in the miscellaneous section.

In the miscellaneous section, we’ll cover the following labor laws:

- Whistleblower laws

- Recordkeeping laws

North Dakota whistleblower laws

Since there is no single whistleblower law in North Dakota, other laws provide whistleblower protection.

North Dakota laws that provide protection from workplace retaliation are:

- Public Employee Relations Act

- North Dakota Century Code Chapter 34-01-20

Public Employee Relations Act

Any employee providing services for the state, county, city, or other political subdivision has the right to report any job-related violation of law, rule, ordinance, regulation, or misuse of public resources for private gain.

Such violations may be reported in writing without fear of being dismissed or discriminated against in any way.

If an employee suffers any damages for blowing the whistle — such an employee may appeal to the human resources department or the district court to file a complaint. This must be done within 300 days after the suspected wrongdoing.

North Dakota Century Code Chapter 34-01-20

No employer may discharge, discipline, penalize, or otherwise discriminate against an employee who:

- Reports, in good faith, a violation of a federal, state, or local law, rule, ordinance, or regulation,

- Participates in an investigation, a hearing, or an inquiry, and

- Refuses to perform an action they think violates federal, state, or local law, rule, ordinance, or regulation.

Each employee is within their rights to report a violation and bring a civil action within 180 days after the alleged violation.

If the court finds the allegation true, it may order:

- Re-employment of the employee

- Any unpaid wages owed to the employee to be paid (for no more than 2 years after the violation)

- Any employee benefits to be reinstated (e.g., company car, paid time off, etc.)

- Temporary or permanent injunctive relief

North Dakota recordkeeping laws

North Dakota employers must make and maintain written records of their employees during the time of their employment — and 2 years after.

Such records must show:

- Wages

- Wage rates

- Job classifications

- Terms and conditions of employment

What’s more, where tip pooling is voted, the employer must keep a written record of each vote on tip pooling — together with the names of employees who voted.

Furthermore, federal provisions regarding recordkeeping also apply.

Under the Fair Labor Standards (FLSA), each employer must preserve certain records of nonexempt workers for at least 3 years.

The following are records that every employer covered by the FLSA must maintain:

- Name, address, birth day (if younger than 19), and sex

- Occupation

- Hours worked each day and week

- Exact time and day of the week when employee’s workweek begins

- Basis on which the employee’s wages are paid (e.g., $12 per hour or $400 per week)

- Hourly pay rate

- Total overtime earnings

- Additions or deductions from the employee’s wages

- Total wages paid each pay period

- Date of payment and the pay period

Conclusion/Disclaimer

We hope this North Dakota labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q2 2022, so any changes in the labor laws that were included later than that may not be included in this North Dakota labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).