Oklahoma Labor Laws Guide

Ultimate Oklahoma labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| Oklahoma Labor Laws FAQ | |

| Oklahoma minimum wage | $7.25 |

| Oklahoma overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($10.87 for minimum wage workers) |

| Oklahoma breaks | Breaks not required by law |

Table of contents

Oklahoma wage laws

In Oklahoma, the Fair Labor Standards Act (FLSA) establishes minimum wages affecting employees in all sectors (except for some occupations — see the section below to find out about exempt occupations).

Take a look at the breakdown of Oklahoma minimum wages concerning:

- The state minimum,

- Tipped employees, and

- Subminimum wages.

| OKLAHOMA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $7.25* | $2.13 | $7.25 (with some exceptions) |

Oklahoma minimum wage

First of all, let’s discuss the minimum wage in the state of Oklahoma.

A minimum wage is the lowest remuneration that employers are lawfully obliged to pay their employees.

As of July 24, 2009, the minimum hourly wage in Oklahoma is $7.25, which is also the federal minimum hourly wage.

* Under Oklahoma laws, employers must pay their employees the regular minimum wage if their company has at least 10 full-time employees or gross profits of more than $100,000 per year. Contrarily, if a company has less than 10 employees and gross profit of $100,000 or less — the minimum wage is as low as $2 per hour.

Exceptions to the minimum wage in Oklahoma

Not all employees qualify for the minimum wage of $7.25 per hour. In line with that, employees are grouped into two categories:

- Exempt employees — Employees who are paid on a salaried basis (executive or professional jobs) and don’t qualify for minimum wage or overtime.

- Nonexempt employees — Employees who are paid by the hour and must earn at least a minimum wage and overtime pay.

Including the condition for minimum wages stated above, employees who are exempt from minimum wage under the Fair Labor Standards Act (FLSA) are:

- Executive, professional, and administrative employees who earn not less than $684 a week

- Computer employees who earn not less than $684 per week or $27.63 an hour

- Highly compensated employees who earn $107,432 per year or more

- Farm workers

- Employees in fishing industries

- Seasonal and recreational workers

Tipped minimum wage in Oklahoma

While the term “tipped employee” is not specified in the state of Oklahoma, employees who receive tips from customers (such as waiters, servers, cleaning staff, etc.) are entitled to the federal tipped minimum wage of $2.13 per hour.

However, an employer may pay a tipped employee the hourly rate of $2.13 as long as the tipped employee receives at least the federal minimum of $7.25 per hour (when wages and tips combine).

If a tipped employee doesn’t make the federal minimum from the tipped minimum wage plus tips — the employer is obliged to pay the difference.

Oklahoma subminimum wage

In Oklahoma, trainees must be paid at least the current minimum wage ($7.25) for all hours of training — unless training is contracted with a third party and done away from the workplace.

In contrast, learners, apprentices, and messengers who are employed in delivering letters and messages can be paid wages lower than the current minimum.

What’s more, full-time students and workers with physical or mental deficiency or injury may also be paid lower wages.

Oklahoma payment laws

Oklahoma employers must pay their employees as frequently as twice each calendar month on scheduled paydays.

However, the following categories can be paid once per month:

- State employees,

- County employees,

- Municipal employees,

- School district employees,

- Technology center school district employees,

- Non-private foundation employees, and

- Exempt employees.

The employer must pay out wages due not later than 11 days after the end of the pay period (there is a 3-day grace period though).

Track employee payroll with ClockifyOklahoma overtime laws

Under the Fair Labor Standards Act (FLSA), eligible employees who work over 40 hours in a workweek qualify for overtime pay at a rate of one and a half (1.5) times the regular rate.

Track Oklahoma overtime with ClockifyOvertime exceptions and exemptions in Oklahoma

Yet, not all employees qualify for overtime pay.

There are certain requirements that must be met to have overtime-exempt employee status:

- Minimum salary requirement of $684 per week

- Fixed salary no matter how many hours of work

Also, certain duties, industries, or job positions may influence whether or not an employee qualifies for overtime

That being said, here are employees who are exempt from overtime pay under FLSA:

- Executive, administrative, and professional employees who receive a fixed salary of at least $684 per month (or $35,568 per year)

- Computer employees who earn not less than $684 a week or $27.63 per hour

- Highly compensated employees who earn $107,432 per year or more

- Outside sale employees

- Agricultural or horticultural employees

- Commissioned sales employees in retail or service establishments who receive more than half of their earning from commissions on goods or services

- Motor carrier employees (e.g. drivers, driver’s helpers, loaders, or mechanics providing services in transportation on highways in interstate or foreign commerce)

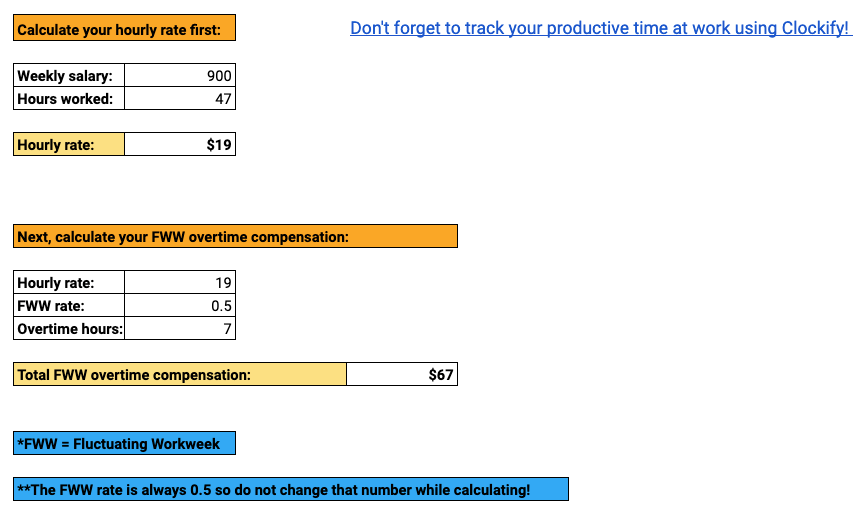

Fluctuating Workweek Method (FWW) in Oklahoma

Certain employees who receive a fixed salary are eligible for overtime pay under the Fluctuating Workweek Method (FWW).

The following conditions must be met for the FWW to apply:

- Fixed salary — Employees receive a fixed salary no matter how many hours they work

- Fluctuating workweek — Employees sometimes work more or less than 40 hours a week

- Minimum hourly wage must be $7.25 per hour

Employees who calculate their overtime hours under the FWW provisions are entitled to:

- Bonuses

- Commissions

- Hazard pay

Let’s see how the Fluctuating Workweek Method (FWW) works in practice:

An employee’s weekly income is, for instance, $700.

In the preceding week the employee worked 47 hours.

To be able to calculate overtime hours, calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week.

$700 / 47 = $15 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week.

$15 per hour x 0.5 = $7.5 for each overtime hour worked

Total overtime compensation goes as follows:

$7.5 x 7 overtime hours = $53

Best ways to track employee hoursOklahoma break laws

No federal or state law of Oklahoma requires an employer to provide rest or lunch breaks to workers above the age of 16.

Yet, this doesn’t mean an employer shouldn’t provide breaks to their employees.

As a matter of fact, rest and meal breaks foster a healthy workplace environment and prevent employee burnout. If a break or meal period is promised in the employment contract, the employer must comply with such a promise — otherwise it’s a breach of contract.

How to recognize if you’re being overworkedExceptions to break laws in Oklahoma

When provided, rest periods or meal breaks lasting 30 minutes or more are not compensable, while breaks lasting less than 30 minutes — such as a coffee break — must be compensated.

Oklahoma breastfeeding laws in the workplace

When it comes to breastfeeding breaks and rights that nursing mothers have in the workplace — state and federal laws overlap.

Under Oklahoma breastfeeding law, an employer is required to:

- Provide unpaid break time to an employee to breastfeed or express breast milk in the workplace — during the employee’s lunch break or any other break (paid or unpaid). Still, if an employer believes a breastfeeding break will create “undue hardship” to the business — they are not obliged to offer such a break.

- Provide a private room — other than an office bathroom — for an employee to breastfeed or express milk.

Unlike Oklahoma breastfeeding law, federal law concerning breastfeeding at work states:

- A breastfeeding mother receives a reasonable unpaid break time to breastfeed or express milk for 1 year after the child’s birth each time she has the need to do so.

- Businesses with more than 50 employees — nonexempt employees — are covered by federal law.

Which law applies to you?

If an employee is subject to both laws — the one with strongest protection for the employee will prevail.

Oklahoma leave requirements

In the state of Oklahoma, there are two types of leave days:

- Required leave

- Non-required leave

Oklahoma required leave

The following are leave benefits that Oklahoma employers are required to provide to their employees by law:

- Annual leave

- Sick leave (public employers)

- Family and Medical Leave Act (FMLA)

- Holiday leave (public employers)

- Jury duty leave

- Voting leave

- Military leave

- Enforced leave

- Donor leave (public employers)

Annual leave

Annual leave refers to paid time off granted by employers to their employees to be used for any reason, such as vacation, personal time off, or due to an illness (when sick leave is used up).

Probationary and permanent employees may accrue annual leave based on their years of service.

The following is the annual leave accrual and accumulation schedule:

| Years of service | Accrual rate per year | Annual accumulation limit |

| Less than 5 | 15 days | 45 days |

| 5 but less than 10 | 18 days | 78 days |

| 10 but less than 20 | 20 days | 80 days |

| 20 and more | 25 days | 80 days |

Sick leave (public employers)

Full-time state employees may accrue sick leave days based upon hours worked during a pay period — overtime work is not included.

Eligible employees may use sick leave in the following circumstances:

- Sickness or injury

- Pregnancy

- Medical, surgical, dental, or optical examination or treatment

- In the case employee’s condition jeopardizes the health of other employees in the workplace

The following is the sick leave accrual schedule:

| Years of service | Sick leave days per year |

| Less than 5 | 15 days |

| 5 but less than 10 | 15 days |

| 10 but less than 20 | 15 days |

| 20 and more | 15 days |

Even though eligible employees get 15 days of sick leave, whether they’ve worked less than 5 or more than 20 years, there is no limit on sick leave accumulation.

Still, temporary and other limited-term employees are not eligible for sick leave use or accrual.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal law that obliges employers to provide eligible employees unpaid time off for certain family health or medical reasons.

Under FMLA, employees are entitled to up to 12 weeks of unpaid, job-protected leave per year.

FMLA covers:

- Employees working in all types of public agencies

- Employees working in public and private elementary or secondary schools

- Employees working in companies with 50 or more employees

- Employees who fulfill the points stated above who have worked for their employer for a least 12 months (1,250 hours) in the last 12-month period

Leaves of absence under the Family and Medical Leave Act (FMLA) may be given for the following reasons:

- Birth or care for a newborn child

- Adopting or taking in a foster child

- Caring for an immediate family member (child, spouse, or parent) due to a serious health condition

- Due to the employee’s serious health condition

Holiday leave (public employers)

State employees in Oklahoma — except for temporary and other limited-term employees — are entitled to a day off from work without loss of pay on the following holidays:

- New Year’s Day (January 1st)

- Martin Luther King, Jr. Day (third Monday in January)

- Presidents' Day (third Monday in February)

- Memorial Day (last Monday in May)

- Independence Day (fourth day of July)

- Labor Day (first Monday in September)

- Veterans Day (eleventh day of November)

- Thanksgiving Day (fourth Thursday in November)

- Christmas Day (25th of December)*

* State employees in Oklahoma get 2 days off around Christmas. If Christmas falls on a workday, employees get the day before or after Christmas off (including Christmas Day); if Christmas falls on a Saturday, they receive the preceding Thursday and Friday off; if Christmas falls on a Sunday, employees receive the following Monday and Tuesday off.

If any holiday, other than Christmas, falls on a Saturday, the preceding Friday shall be considered as a day off. If any holiday (again, other than Christmas) falls on a Sunday, the following Monday shall be a holiday.

Finally, if an eligible employee is required to work on any of the said holidays, such an employee is entitled to a paid leave of absence on an alternative date.

Jury duty leave

Jury duty or jury service is a civic duty of each US citizen who receives a summons from a court to serve on a jury.

In Oklahoma, employees have the right to take unpaid time off for jury duty without being discriminated against or forced to use sick, annual, or vacation time to serve as jurors.

Voting leave

Employers must grant employees who are registered to vote up to 2 hours of paid time for voting.

However, employees won’t be granted time off to vote if there’s a three-hour voting period before or after the employee’s regular working hours.

For instance, if the polls are open from 6 a.m. to 9 p.m., and the employee works from 9 a.m. to 5 p.m. — the employer is not obligated to provide leave of absence for voting purposes.

Military leave

Employees who are members of the National Guard or reserve component of the Armed Forces (Army, Navy, Air Force, Marine Corps, and Coast Guard Reserves) are entitled to paid leave of absence to perform active or inactive military duty.

Yet, eligible employees are only paid for the first 30 work days of such leave (from October 1 through September 30).

Enforced leave

Permanent or probationary employees may be granted enforced leave of up to 10 paid working days in the following circumstances:

- Illness or injury of an immediate family member

- Mental or physical disability of the employee’s child (biological, adopted, foster, legal ward, or a child/children from a prior marriage or relationship) who is incapable of self-care

- Death in the immediate family or household

Donor leave (public employers)

Any employee of the state of Oklahoma, its departments or agencies, qualifies for a leave of absence for the following reasons:

- Bone marrow donation — 5 workdays of paid time off

- Human organ donation — 30 workdays of paid time off

Oklahoma non-required leave

Unlike public employers, private sector employers in Oklahoma are not obligated to assign days of absence — including:

- Sick leave

- Holiday leave

- Donor leave

Child labor laws in Oklahoma

Both federal and state laws make sure minors work in an environment that is free from recognized hazards — but also limit child labor to foster regular school attendance.

The following are child labor provisions regarding:

- Hour restrictions

- Break periods

- Prohibited occupations

Work time restrictions for Oklahoma minors

Since Oklahoma minors are protected under the Fair Labor Standards Act (FLSA) concerning hours of work, there are no hour restrictions when it comes to employment of workers aged 16 and older.

However, if an employer wishes to employ workers aged 14 and 15, such employer must comply with the following hour restrictions and regulations:

- Work is allowed between 7 a.m. and 7 p.m. (or until 9 p.m., from June 1st to Labor Day)

- Up to 3 hours of work on a school day

- Up to 8 hours of work on a non-school day

- Up to 18 hours of work on a school week

- Up to 40 hours of work on a non-school week

Breaks for Oklahoma minors

According to the Oklahoma law, minors under the age of 16 must be given:

- A one-hour break for shifts lasting 8 consecutive hours, or

- A 30-minute break after 5 consecutive hours worked.

Workers aged 16 and above are not entitled to break periods of any kind.

Prohibited occupations for Oklahoma minors

Any employer who employs minors under 16 years of age must create a safe and healthy working environment, free of hazards.

That being said, no child under 16 years of age shall be employed in the following occupations:

- Manufacturing, mining, or processing occupations

- Working with hoisting equipment or any other power-driven machinery (except for office machines such as typewriters or adding machines)

- Operating motor vehicles

- Public messenger services

- Occupations involving transportation of persons or property by rail, highway, air, water, pipeline, or other means

- Warehousing and storage

- Occupations in connection with communications and public utilities

- Demolition and repair

Yet, minors under the age of 16 are allowed to work on farms or for parents’ businesses, in the sale or delivery of newspapers.

In addition to the said hazardous occupations, occupations declared to be hazardous to all minors under the FLSA also apply in Oklahoma.

Child Labor Provisions of the Fair Labor Standards Act (FLSA) for Nonagricultural Occupations | Agricultural OccupationsAny employer or entity that disregards any of the restrictions or prohibitions stated above will be guilty of a misdemeanor and subject to a fine of not more than $500 for each offense, or imprisonment for not less than 10 nor more than 30 days.

Oklahoma hiring laws

By the Oklahoma law, it is a discriminatory practice for an employer, employment agency, labor organization, or training program to fail or refuse to hire, to discharge, expel from a labor organization, segregate, or treat an applicant, member of a labor organization, or employee less favorably merely because of such person’s:

- Race

- Color

- Religion*

- Sex**

- National origin

- Age

- Genetic information

- Disability***

* Except for religious corporations, educational institutions, associations, or societies when it comes to employing individuals of a certain religion to perform religion-related activities or curriculum.

** Unless it is required or permitted by Oklahoma laws to make differences between sexes in terms of employment and it’s not discriminatory to provide different benefits and annuity to widows and widowers of employees.

*** Unless such disability can harm normal operations of a business.

Furthermore, no employer, labor organization, or employment agency is allowed to print or publish a notice or advertisement indicating a preference, limitation, or otherwise discrimination based on the said discriminatory practices above.

Still, such a notice or advertisement may display preference, limitation, or discrimination based on religion, sex, or national origin where such factors are bona fide occupational qualifications necessary for a certain position.

Also, religion, sex, national origin, age, disability, or genetic information are considered bona fide occupational qualifications with respect to hiring, classifying, or referring for employment when such qualifications are reasonably necessary to the normal operations of a business.

Moreover, an employee 65 years of age who is employed in a bona fide executive or high policy-making position (2 years before retirement) may be retired compulsorily if such person is entitled to a nonforfeitable annual retirement of at least $44,000, and this is not a discriminatory practice.

Right-to-work law in Oklahoma

Oklahoma is another right-to-work state.

This means that employees in Oklahoma may choose whether or not to join a labor union without being afraid of or losing their job.

On that account, no person in the state of Oklahoma can be required, as a condition or continuation of employment, to:

- Join a labor union

- Resign or refrain from a labor union membership

- Pay money or any other compensation to a labor organization, charity, or other third parties (which are otherwise required of labor organization members)

- Be recommended, approved, referred, or cleared by a labor organization

However, said regulations only apply to the employees who got employed after Oklahoma's right-to-work law entered into force — September 28, 2001.

What’s more, fire and police department members are not entitled to engage in any work stoppage or slowdown strikes.

Any person or organization that violates any of the provisions stated above will be guilty of a misdemeanor.

Oklahoma termination laws

Oklahoma is another state that recognizes at-will employment.

The at-will employment doctrine allows employers to discharge employees at any time and for good cause or no cause at all — without being legally responsible.

At the same time, an employee may terminate their employment at any time and for any reason.

Still, no employer may discharge an employee based on the employee’s:

- Skin color,

- Gender,

- Religion,

- Pregnancy, or

- Other protected status.

Such termination of employment is called wrongful termination.

In addition to said wrongful termination situation, no employer may terminate or otherwise take adverse action against an employee for the following reasons:

- If an employee files a complaint about occupational safety and health conditions in the workplace, such as poor office hygiene, protective equipment missing, etc.

- If an employee is called for jury duty, provided that such employee notifies the employer within a reasonable time after receiving notice.

- If an employee uses tobacco products while off-duty and away from work.

- If an employee takes a family or medical leave or military leave.

Yet, these are just some of the most common legal grounds to sue an employer for wrongful termination in Oklahoma.

To find out more about wrongful termination and violations of employees’ rights, one should contact an employment lawyer.

Oklahoma final paycheck

Whenever a person’s employment ends in Oklahoma — whether voluntary or involuntary — the employer is obliged to pay the employee’s wages in full at the next regularly designed payday.

Health insurance continuation in Oklahoma

Upon termination of employment, eligible employees and their dependents are entitled to a temporary health insurance continuation under the federal Consolidated Omnibus Budget Reconciliation Act (COBRA) law.

Such health insurance may be extended for up to 36 months.

However, COBRA applies to plans offered by private-sector employers having 20 or more full-time employees.

For those not covered by COBRA, Oklahoma requires employers to provide healthcare insurance under the group policy to their employees (and their dependents) for at least 63 days after termination.

Such insurance provides:

- Hospital, medical, or surgical benefits

- Christian Science care

- Treatment expense benefits

- Hospital or medical or indemnity coverage

- Prepaid health plan

- Health maintenance organization subscriber contract

Occupational safety in Oklahoma

Regarding workplace safety in the state of Oklahoma, both federal and state laws apply.

On that account, private sector employees are covered by the federal Occupational Safety and Health Administration (OSHA) law, while the Public Employees Occupational Safety and Health (PEOSH) law conducts safety and health provisions in public sectors.

Occupational Safety and Health Administration (OSHA)

Under Occupational Safety and Health Administration (OSHA), private sector employers must provide a hazard-free and healthy working environment to their employees.

Not only does OSHA enforce workplace safety laws and standards that must be followed — but also provides education and assistance to reduce work fatality and injury rates.

There are 6 main types of hazards in the workplace recognized by OSHA:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Things that cause stress such as excessive workload, sexual harassment, workplace violence, etc.

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

Public Employees Occupational Safety and Health (PEOSH)

The intent of PEOSH is the same as OSHA — ensuring healthy and hazard-free working conditions for public employees, and reducing workplace fatalities to a minimum.

Apart from setting safety and health regulations in the workplace, PEOSH addresses the following:

- Fatalities in the workplace

- Employers’ incident or illness rates

- Complaints from employees

- Common event hospitalization or sickness (five and more employees)

- Training and outreach activities

- State-driven rulemaking

Miscellaneous Oklahoma labor laws

Finally, we’ll cover some of the miscellaneous labor laws concerning Oklahoma — such as:

- Whistleblower laws

- Recordkeeping laws

Oklahoma whistleblower laws

Whistleblower laws protect employees from retaliation or any other adverse action taken against an employee who “blows the whistle” i.e., reports any illegal or immoral activity to the authorities.

As previously stated, it is considered discriminatory practice if an employer — with respect to the Occupational Safety and Health Act (OSHA) — discharges or takes any adverse personnel action against an employee who:

- Reports any OSHA policy violation,

- Files a complaint about unsafe working conditions, or

- Testifies in any proceeding regarding a violation of OSHA policies.

Moreover, the Oklahoma Whistleblower Act encourages state employees who “blow the whistle” and report any suspected improper governmental activities to the authorities.

Therefore, no officer or employer shall prohibit or take any adverse personnel action against an employee of a governmental agency for:

- Disclosing public information such employee believes is a violation of the Oklahoma Constitution or law

- Reporting an abuse of authority in the workplace, waste of public funds, or mismanagement

- Discussing the operations of the agency with the Governor, members of the Legislature, media, or any other person responsible for investigating

Any aggrieved state employee may file an appeal with the Oklahoma Merit Protection Commission within 60 days of the alleged violation.

Oklahoma recordkeeping laws

Regarding retention of employee employment records, federal provisions apply. Under the Fair Labor Standards (FLSA), each employer must preserve certain records of nonexempt workers for at least 3 years.

The following are records that every employer covered by the FLSA must maintain:

- Name, address, birth day (if younger than 19), and sex

- Occupation

- Hours worked each day and week

- Exact time and day of the week when employee’s workweek begins

- Basis on which the employee’s wages are paid (e.g., $12 per hour or $400 per week)

- Hourly pay rate

- Total overtime earnings

- Additions or deductions from the employee’s wages

- Total wages paid each pay period

- Date of payment and the pay period

Conclusion/Disclaimer

We hope this Oklahoma labor law guide has been helpful. We advise you to make sure you’ve paid attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this Oklahoma labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).