Tipped wages by state — Guide for 2023

Giving tips for certain jobs is standard in the US. While working, employees such as waitresses and bartenders usually get an additional amount of money from their customers as a sign of appreciation for their services.

If you want to find out how much a server in the US can earn and whether tipped wages vary from state to state, stick with us.

In this tipped wages by state guide for 2023, we’ll cover:

- Some basics regarding tipped wages in the US,

- All the states and territories and their tipped wages, and

- Frequently asked questions about tipped wages by state.

So, let’s begin.

Table of Contents

Tipped wages in the US — the basics

First, to cover certain basics regarding tipped wages in the US, we’ll answer the following questions:

- Who qualifies as a tipped employee,

- What qualifies as a tip,

- How tipped wages work, and

- What the federal minimum wage for tipped employees is.

So, let’s start with the first one.

Who qualifies as a tipped employee?

According to the US Department of Labor, “a tipped employee engages in an occupation in which he or she customarily and regularly receives more than $30 per month in tips.”

Some examples of tipped employees include:

- Bartenders,

- Waiters,

- Delivery drivers,

- Hairstylists, and similar positions — most of which are in service industries.

What qualifies as a tip?

As the IRS explains, “tips are optional or extra payments determined by a customer that employees receive from customers.”

The IRS further classifies tips as:

- Tips from customers received through electronic payment (credit card, debit card, gift card, etc.),

- Cash tips from customers,

- Tips received from other employees (through tip pools, tip splitting, or other formal/informal tip sharing agreement), and

- Noncash tips, such as tickets, for example.

How do tipped wages work?

In the US, a tipped wage is the base wage paid to employees who receive a significant portion of their compensation from tips.

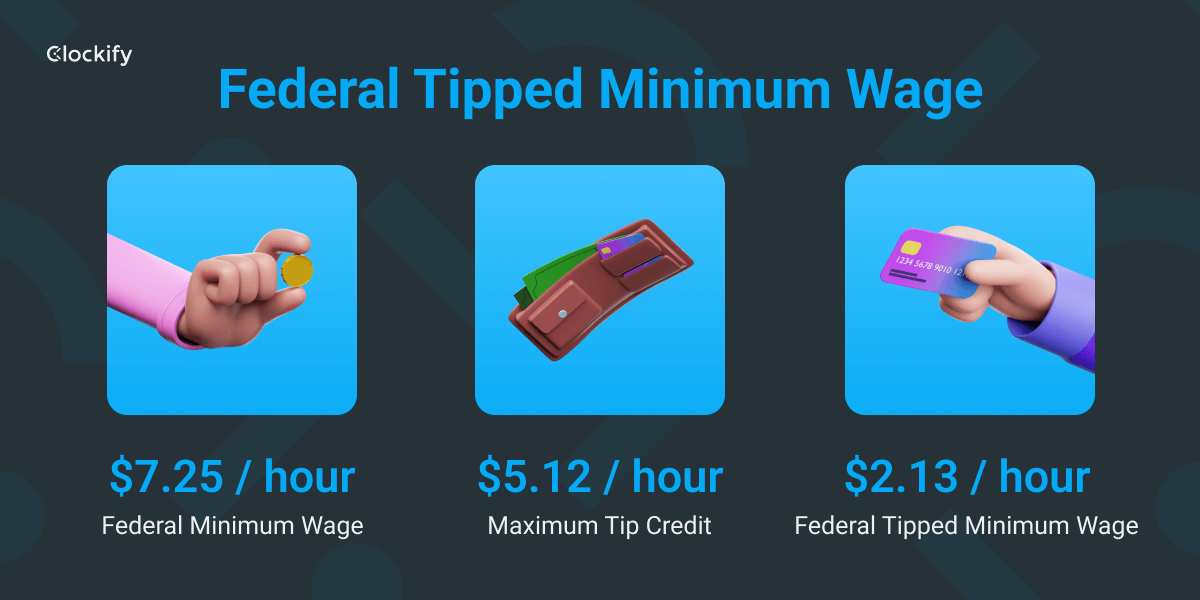

In relation to the definition of a tipped employee, the US Department of Labor also states that “an employer of a tipped employee is only required to pay $2.13 per hour in direct wages if that amount combined with the tips received at least equals the federal minimum wage.”

In other words, if you make a total of $7.25 or more, your employer is allowed to pay you only $2.13 an hour because your tips cover the amount needed to meet the federal minimum wage.

What is the federal minimum wage for tipped employees?

The federal minimum wage for covered nonexempt employees is $7.25 per hour, as the US Department of Labor states. Therefore, tipped employees’ wages and tips combined have to equal $7.25 per hour or exceed that.

But what happens when an employee’s wages and tips combined amount to less than $7.25 per hour?

Let’s take a look at an example.

If a server named Lucy made $10 in tips during her 5-hour shift, and her hourly rate is $2.13, she made $20.65 in total wages for the day.

Take a look at the calculation below:

$2.13 x 5 hours = $10.65 (The amount Lucy earned for 5 hours)

$10.65 + $10 in tips = $20.65 (Lucy’s total wages for the day)

When we divide her total wages for the day ($20.65) with 5 hours worked, we see that Lucy made $4.13 per hour. Following the FLSA, it’s clear that this amount is below the federal minimum wage of $7.25 per hour.

However, federal law mandates that the employer must make up the difference if the employee’s tips combined with the employer’s direct wages of at least $2.13 per hour do not equal the federal minimum hourly wage.

So, let’s see how Lucy’s employer calculates the difference:

$7.25 per hour – $4.13 per hour Lucy made = $3.12 per hour (the amount Lucy’s employer has to pay additionally for each hour she worked)

As she worked 5 hours (5 x $3.12 per hour), Lucy will be paid the additional $15.60 from her employer.

The amount of money Lucy earned in total is calculated this way:

$20.65 (Her total wages for the day) + $15.60 (She got from her employer as the difference) = $36.25

Tipped wages by state

The following states require employers to pay tipped employees the full state minimum wage before tips. There is no maximum tip credit per hour and no specified definition of a tipped employee.

| State | Minimum wage rate per hour | Total tipped minimum wage per hour |

|---|---|---|

| Alaska | $10.85 | $10.85 |

| California | $15.50 | $15.50 |

| Minnesota (Large employer) | $10.59 | $10.59 |

| Minnesota (Small employer) | $8.63 | $8.63 |

| Montana (Business with gross annual sales over $110,000) | $9.95 | $9.95 |

| Montana (Business not covered by the FLSA with gross annual sales of $110,000 or less) | $4.00 | $4.00 |

| Nevada (Employees not offered qualifying health insurance by employer) | $10.50 | $10.50 |

| Nevada (Employees offered qualifying health insurance by employer) | $9.50 | $9.50 |

| Oregon | $13.50 (standard) $14.75 (Portland Metro) $12.50 (Nonurban Counties) | $13.50 |

| Washington | $15.74 | $15.74 |

The following states require employers to pay tipped employees a minimum cash wage above the minimum cash wage required under the federal Fair Labor Standards Act ($2.13 per hour).

| State | Minimum wage rate per hour | Maximum tip credit per hour | Total tipped minimum wage per hour | Tipped employee definition |

|---|---|---|---|---|

| Arizona | $10.85 | $3.00 | $13.85 | N/S |

| Arkansas | $2.63 | $8.37 | $11.00 | N/S |

| Colorado | $10.63 | $3.02 | $13.65 | More than $30 |

| Connecticut (Hotel or restaurant staff) | $6.38 | $7.62 | $14.00 | N/S |

| Connecticut (Bartenders who customarily receive tips) | $8.23 | $5.77 | $14.00 | N/S |

| Delaware | $2.23 | $9.52 | $11.75 | More than $30 |

| District of Columbia | $5.35 | $10.75 | $16.10 | N/S |

| Florida | $7.98 | $3.02 | $11.00 | N/S |

| Hawaii | $11.00 | $1.00 | $12.00 | More than $20 |

| Idaho | $3.35 | $3.90 | $7.25 | More than $30 |

| Illinois | $7.80 | 40% of the applicable minimum wage ($5.20) | $13.00 | N/S |

| Iowa | $4.35 | 40% of the applicable minimum wage ($2.90) | $7.25 | More than $30 |

| Maine | $6.90 | 50% of the applicable minimum wage ($6.90) | $13.80 | More than $30 |

| Maryland | $3.63 | $9.62 | $13.25 | More than $30 |

| Massachusetts | $6.75 | $8.25 | $15.00 | More than $20 |

| Michigan | $3.84 | $6.26 | $10.10 | N/S |

| Missouri | $6.00 | 50% of the applicable minimum wage ($6.00) | $12.00 | N/S |

| New Hampshire | 45% of the applicable minimum wage ($3.26) | 55% of the applicable minimum wage ($3.99) | $7.25 | More than $30 |

| New Jersey | $5.26 | $8.87 | $14.13 | More than $30 |

| New Mexico | $3.00 | $9.00 | $12.00 | More than $30 |

| New York | Tipped workers’ minimum wage rates vary by region. For more information, visit New York State Department of Labor’s website. | $14.20 (the minimum wage rate is increasing until it reaches $15.00) | ||

| New York (Tipped Food Service Workers) | $9.45 | $4.75 | $14.20 | N/S |

| New York (Tipped Service Employees) | $11.85 | $2.35 | $14.20 | N/S |

| North Dakota | $4.86 | 33% of applicable minimum wage ($2.39) | $7.25 | More than $30 |

| Ohio* | $5.05 | $5.05 | $10.10 | More than $30 |

| Oklahoma | $2.13 | $5.12 | $7.25 | N/S |

| Pennsylvania | $2.83 | $4.42 | $7.25 | $135 per month |

| Rhode Island | $3.89 | $9.11 | $13.00 | N/S |

| South Dakota | $5.40 | 50% of applicable minimum wage ($5.40) | $10.80 | More than $35 |

| Vermont** | $6.59 | $6.59 | $13.18 | More than $120 |

| Wisconsin | $2.33 | $4.92 | $7.25 | N/S |

| West Virginia | $2.62 | 70% of applicable minimum wage ($6.13) | $8.75 | N/S |

*Applies to employers with annual gross receipts of $372,000 or more.

**Applies to an employee of a hotel, motel, tourist place, or restaurant who customarily and regularly receives more than $120.00 per month in tips for direct and personal customer service.

In the following states state minimum cash wage payment is the same as that required under the federal Fair Labor Standards Act ($2.13 per hour):

| State | Minimum wage rate per hour | Maximum tip credit per hour | Total tipped minimum wage per hour | Definition of tipped employee |

|---|---|---|---|---|

| Alabama | $2.13 | $5.12 | $7.25 | More than $30 |

| Georgia | $2.13 | $5.12 | $7.25 | More than $30 |

| Indiana | $2.13 | $5.12 | $7.25 | N/S |

| Kansas | $2.13 | $5.12 | $7.25 | N/S |

| Kentucky | $2.13 | $5.12 | $7.25 | More than $30 |

| Louisiana | $2.13 | $5.12 | $7.25 | More than $30 |

| Mississippi | $2.13 | $5.12 | $7.25 | More than $30 |

| Nebraska | $2.13 | $8.37 | $10.50 | More than $30 |

| North Carolina | $2.13 | $5.12 | $7.25 | More than $20 |

| South Carolina | $2.13 | $5.12 | $7.25 | More than $30 |

| Tennessee | $2.13 | $5.12 | $7.25 | More than $30 |

| Texas | $2.13 | $5.12 | $7.25 | More than $20 |

| Utah | $2.13 | $5.12 | $7.25 | More than $30 |

| Virginia | $2.13 | $9.87 | $12.00 | More than $30 |

| Wyoming | $2.13 | $5.12 | $7.25 | More than $30 |

During 2023, there will be certain changes in minimum wages in the following states:

- On July 1, 2023, the Nevada minimum wage will increase to:

- $11.25 per hour for employees not offered qualifying health insurance, and

- $10.25 per hour for employees offered qualifying health insurance.

- The Oregon minimum wage — adjusted annually for inflation on July 1.

- The Connecticut minimum wage is scheduled to increase to $15.00 per hour on June 1, 2023.

- The Florida minimum wage is scheduled to increase to $12.00 on September 30, 2023.

Minimum wage regulations for 5 inhabited US territories in the Caribbean and the US Pacific Islands region are presented in the table below.

| State | Minimum wage rate per hour | Maximum tip credit per hour | Total tipped minimum wage per hour | Tipped employee definition |

|---|---|---|---|---|

| American Samoa | $2.13 | / | Special minimum wage rates | More than $30 |

| Guam | $9.25 | / | $9.25 | N/S |

| Commonwealth of the Northern Mariana Islands | $2.13 | $5.12 | $7.25 | More than $30 |

| Puerto Rico | $2.13 | $6.37 | $8.50 | More than $30 |

| US Virgin Islands | 40% ($4.20) | $6.30 | $10.50 | N/S |

The Puerto Rico minimum wage is scheduled to increase to $9.50 per hour, on July 1, 2023.

FAQs about tipped wages by state

To find out more on this subject, let’s take a look at some of the frequently asked questions about tipped wages by state.

Do waiters really get paid less than minimum wage?

The federal minimum wage for employees is $7.25 an hour, so it’s illegal to pay your employees anything below that.

However, if a waiter, for example, makes the minimum wage or more in tips, an employer can pay them at a lower rate.

As waiters, among other employees who are servers, earn the majority of their profits through tips, depending on the state and federal laws, their employer will calculate how much they earned in total for the day.

In certain states where tip credit is allowed, if a waiter earns more than $30 per month in tips, their employer can claim a tip credit and include tips as part of their wage calculation.

🎓 Clockify Pro Tip

If you need an easier and faster way to calculate your employees’ payroll but also track their hours worked, take a look at our guide below:

Why do servers only make $2.13 an hour?

The reason why servers only make $2.13 per hour in direct wages is because the money they earn through tips usually exceeds the federal minimum wage.

In most cases, servers can earn far more than the federal minimum wage of $7.25 per hour — they can earn almost twice that amount (however, in case a server earns less than the federal minimum wage, the employer must make up the difference).

This applies to states where minimum cash wage payment is the same as that required under the federal FLSA ($2.13 per hour). But there are some states where employers are required to pay tipped employees a minimum cash wage above the minimum cash wage of $2.13 per hour.

🎓 Clockify Pro Tip

To learn more about DOL’s FLSA timekeeping compliance, check out our blog post on FLSA regulations below:

What is tip credit against minimum wage?

Tipped employees can be paid a cash wage lower than the established minimum wage through a tip credit system that allows employers to include employees’ tips when calculating minimum wages.

According to the US Department of Labor, “the maximum FLSA hourly tip credit an employer may take in a non-overtime workweek is $5.12 per hour” (this is on the federal level, but on the state level, tip credit varies depending on the state).

Here’s an example of a tip credit calculation.

Let’s say Mary is a waitress, and she’s worked a total of 30 hours a week. She earned $370 in tips, so to calculate the tips she earned per hour, her employer has to divide the total tips by the hours worked.

The employer does it like this:

$370 in tips / 30 hours she worked = $12.33 tips per hour

As $12.33 per hour exceeds the maximum tip credit of $5.12 per hour, the employer can claim the full tip credit of $5.12 per hour (this is the amount the employer doesn’t have to pay).

If Mary earned, say, $100 in tips, the situation would be different:

$100 in tips / 30 hours she worked = $3.33 tips per hour

As $3.33 per hour is less than the maximum tip credit of $5.12 per hour, not only is Mary’s employer not allowed to claim the full tip credit of $5.12 per hour, but they also have to make up the difference.

Let’s see how much her employer has to add to her normal wages:

$5.12 the maximum tip credit – $3.33 per hour = $1.79 per hour

$1.79 per hour x 30 hours she worked = $53.70 in total that the employer has to add as the difference

Which states allow tip credit?

As the possibility of using a tip credit system varies from state to state, let’s first see which states allow tip credit.

The DOL lists the following states as the states where tip credit is allowed:

- Alabama,

- Arizona,

- Arkansas,

- Colorado,

- Connecticut,

- Delaware,

- District of Columbia,

- Florida,

- Georgia,

- Hawaii,

- Idaho,

- Illinois,

- Indiana,

- Iowa,

- Kansas,

- Kentucky,

- Louisiana,

- Maine,

- Maryland,

- Massachusetts,

- Michigan,

- Mississippi,

- Missouri,

- Nebraska,

- New Hampshire,

- New Jersey,

- New Mexico,

- New York,

- North Carolina,

- North Dakota,

- Ohio,

- Oklahoma,

- Pennsylvania,

- Rhode Island,

- South Carolina,

- South Dakota,

- Tennessee,

- Texas,

- Utah,

- Vermont,

- Virginia,

- West Virginia,

- Wisconsin, and

- Wyoming.

And, the US territories that allow tip credit are:

- American Samoa,

- Commonwealth of the Northern Mariana Islands,

- Puerto Rico, and

- The US Virgin Islands.

The DOL also highlights some additional state rules listed below:

- In Hawaii, the tip credit is allowed if the amount that the employee receives from the employer plus the tips they make is at least $7.00 more than the applicable minimum wage.

- In New Jersey, an employer can use a tip credit against the full state minimum hourly wage only if the tipped employees have first been notified of the amount of the cash wage they get and the amount of the tip credit the employer claims. Also, all the tips are retained by employees (except in the case of tip pooling).

- In North Carolina, the tip credit is allowed only after the employer obtains a signed certification of the number of tips each employee received.

Which states don’t allow tip credit?

Although the majority of states allow tip credit, these are the states where tip credit isn’t allowed:

- Alaska,

- California,

- Minnesota,

- Montana,

- Nevada,

- Oregon, and

- Washington.

Also, Guam is a US territory that doesn’t allow tip credit.

What are the states that use the federal tipped minimum wage?

In terms of the tipped wage, certain states follow the federal rate of $2.13 per hour. In other words, state minimum cash wage payment in the following states is the same as that required under the federal Fair Labor Standards Act ($2.13 per hour):

- Alabama,

- Georgia,

- Indiana,

- Kansas,

- Kentucky,

- Louisiana,

- Mississippi,

- Nebraska,

- North Carolina,

- South Carolina,

- Tennessee,

- Texas,

- Utah,

- Virginia, and

- Wyoming.

The US territories that use the federal tipped minimum wage are:

- American Samoa,

- Commonwealth of the Northern Mariana Islands, and

- Puerto Rico.

Some additional state rules stated by the DOL are covered below:

- In Georgia, a state minimum wage law does not apply to tipped employees. In this state, employers must pay employees covered by the federal Fair Labor Standards Act at least the federal minimum wage.

- Oklahoma’s tipped minimum wage is currently $2.13 — but the US Department of Labor classifies Oklahoma as a state with a higher tipped minimum wage than the federal rate. For more information, contact Oklahoma’s Department of Labor.

🎓 Clockify Pro Tip

For more detailed information about wage laws, payment laws, and other laws concerning workers in Oklahoma, check out our labor laws guide for the state of Oklahoma:

What are the states that have state tipped minimum wages?

The majority of states have their own tipped minimum wages.

These states require employers to pay tipped employees a minimum cash wage above the minimum cash wage required under the federal FLSA ($2.13 per hour):

- Arizona,

- Arkansas,

- Colorado,

- Connecticut,

- Delaware,

- District of Columbia,

- Florida,

- Hawaii,

- Idaho,

- Illinois,

- Iowa,

- Maine,

- Maryland,

- Massachusetts,

- Michigan,

- Missouri,

- New Hampshire,

- New Jersey,

- New Mexico,

- New York,

- North Dakota,

- Ohio,

- Oklahoma,

- Pennsylvania,

- Rhode Island,

- South Dakota,

- Vermont,

- Wisconsin, and

- West Virginia.

The US Virgin Islands also has its own rules regarding tipped minimum wage.

Some additional state and US territory rules — as well as scheduled changes — are as follows:

- In Connecticut, the minimum cash wage differs for employees working in hotels and restaurants ($6.38) and bartenders who customarily receive tips ($8.23).

- The District of Columbia minimum cash wage for tipped workers is expected to increase to $6.00 per hour beginning May 1, 2023.

- In New York, the minimum cash wage differs for Tipped Food Service Workers ($9.45) and Tipped Service Employees ($11.85).

- In the US Virgin Islands, the Wage Board has been authorized since 2020 to increase the minimum cash wage for tipped tourist service and restaurant employees to a rate not greater than 45% of the minimum wage or less than the federal minimum wage for tipped employees.

What is tip pooling?

Tip pooling is a form of tip distribution where all of the servers’ tips are accumulated into one lump sum, which is then divided (most of the time, equally — but not always) among the employees.

Tip pooling is a common practice in the hospitality industry, and it is introduced together with the predetermined tip distribution system.

For example, tips can be split based on:

- The hours worked, or

- A point system where different types of employees are given a certain number of points which determine the percentage of the tip pool they receive. These points are distributed to all workers who helped during that shift such as:

- Bussers,

- Bartenders,

- Servers,

- Hostesses,

- Food runners, etc.

However, tip pooling must be legal and in accordance with state and federal regulations.

To create a proper tip pooling policy for your business, it has to cover the following details:

- Whether the tip pooling is mandatory or voluntary,

- Which employees must participate in tip pooling (if the tip pooling is mandatory),

- How much must each employee contribute to the “pool,” and

- How you will divide the tips.

Once you have a tipping policy in place, the rules will be clearer to your employees, and tip pooling can even strengthen their relationships at work by creating a more collaborative atmosphere.

Can an employer force you to participate in tip pooling?

The short answer is — yes, they can, in a way.

Federal law allows employers to require employees to participate in tip pooling and share tips with other employees.

However, as the Code of Federal Regulations (CFR) states, while employers are allowed to require employees to participate in a tip pool, they must also “notify their employees of any required tip pool contribution amount and may not retain any of the employees’ tips for any other purpose.”

How much do most servers make a shift?

How much a server will make per shift depends on several factors, such as:

- The location and popularity of the server’s work place — if a restaurant a server works in is located in one of the major cities in the US and is also popular and has a lot of visitors, there’s a greater chance they’ll get more tips than someone who, for example, works in a small town in Alabama.

- The type of shift they are working — the amount of tips a server can make largely depends on the time of day because not every type of shift covers a lot of customers. For example, someone who works on a busy weekend night has more opportunities to get tips than someone who works during a slower shift, such as a lunch shift.

- The server’s skill level — a server with a higher skill level will more likely be awarded for their service than a server with a lower skill level (they also probably won’t be scheduled for busier shifts as often as someone who’s more experienced).

In the United States, servers make a median average of $100 in tips per day, depending on the factors we mentioned and the state they’re working in. As the US Bureau of Labor Statistics also states, “the median income for tipped workers across the country in 2021 was $12.50 per hour.”

What is the lowest tipped minimum wage?

The lowest a tipped employee can be paid is $2.13 per hour (and that’s the minimum they must be paid). They are also entitled to more if their tips don’t equal at least the federal minimum wage.

What is the highest tipped minimum wage?

As the US Department of Labor states, the states in the country that have minimum hourly wages at or above $15 as of Jan. 1, 2023 are:

- California — $15.50 per hour,

- Connecticut — the Connecticut minimum wage is scheduled to increase to $15.00 per hour on June 1, 2023,

- Massachusetts — $15.00 per hour,

- Washington — $15.74 per hour, and

- New York — $15.00 per hour in Long Island, Westchester, and New York City, and the remainder of the New York state expects an increase until the rate reaches $15 minimum wage.

What’s more, residents of Washington, D.C., supported a ballot initiative that requires employers to pay tipped employees $16.10 an hour, regardless of how much they earn in gratuity (following Initiative 82).

🎓 Clockify Pro Tip

Do you want to learn more about labor laws in the District of Columbia? Check out our District of Columbia labor laws guide:

Is it mandatory to give tips in the US?

Although tipping is not mandatory in the US (there are no laws that require you to give someone a tip), a tip is expected, in a way. In most states, it’s customary to leave a tip even if the service wasn’t the best.

In cases of large parties, some restaurants will even add an automatic gratuity — it’s usually a set percentage of the pre-tax total, so if gratuity is included, you don’t have to pay extra.

Do tips get taxed?

Tips are considered a form of income, so they are subject to federal income tax like any other income.

Every employee is responsible for reporting their tips to their employer. However, if your total tips for a month are less than $20, you don’t need to report the tips for that month to that employer.

As the IRS states, as an employee who receives tips, you must do 3 things:

- Keep a daily tip record,

- Report tips to the employer (unless the total is less than $20 per month per employer), and

- Report all tips on an individual income tax return — according to the IRS, any tips that the employee didn’t report to the employer must be reported separately on Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to include as additional wages with their tax return. The employee must also pay the employee share of Social Security and Medicare tax owed on those tips.

The amount the employer will withhold from your paycheck is based on your total wages plus tips, so all cash and non-cash tips received have to be reported to the employer.

These are the tips that must be reported and taxed:

- Cash tips from customers,

- Charged tips (such as credit and debit card charges) given to the employee by their employer, and

- Tips received from other employees under a tip-sharing agreement.

🎓 Clockify Pro Tip

Have you ever wondered how overtime is taxed? Do you want to learn more about the difference between regular pay and overtime pay? Find answers to these questions and more in the blog post below:

What is tipped minimum wage in NY?

According to the New York State Department of Labor, the minimum wage rates for the state of New York depend on the region, and as of December 31st, 2022, the tipped minimum wages go as presented in the following table.

| Minimum wages for tipped workers in New York State | New York City | Long Island and Westchester County | Remainder of New York State |

|---|---|---|---|

| Service Employees (Cash Wage) | $12.50 | $12.50 | $11.85 |

| Service Employees (Tip Credit) | $2.50 | $2.50 | $2.35 |

| Food Service Workers (Cash Wage) | $10.00 | $10.00 | $9.45 |

| Food Service Workers (Tip Credit) | $5.00 | $5.00 | $4.75 |

What is minimum wage for waitresses in Florida?

As the Florida Restaurant & Lodging Association (FRLA) states, “effective September 30, 2022, the minimum wage in Florida increased to $11.00 an hour, and the required cash wage for tipped employees increased to $7.98.”

However, in 2023, the minimum wage for tipped employees (such as waiters and waitresses) in Florida is expected to increase to $8.98.

Tipped wages by state conclusion and disclaimer

As we can see, the rules regarding tipped wages in the US differ depending on where in the country you’re working.

To be fully informed of all your rights as a tipped employee, be sure to check:

- What federal and state laws say about tipped employees and their wages,

- What the law in your state says about tip credit, and

- What the IRS says about taxation of tips.

In case you wanted to learn more about tipped wages and how they differ from state to state, we hope this guide has been helpful.

For more detailed information, make sure you pay attention to the links we’ve provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q1 of 2023, so any changes in the labor laws that were introduced later than that may not be included in this guide.

We also want to highlight that this guide offers a general overview of information and does not consist of legal advice, so we recommend that you consult with the appropriate institutions and/or authorized representatives before taking any legal action.

Clockify is not responsible for any losses or risks incurred should this guide be used without further guidance from legal or tax advisors.

Sources for the tables:

- Alaska Department of Labor and Workforce Development

- Arkansas Department of Labor and Licensing

- California Department of Industrial Relations

- Colorado Department of Labor and Employment

- Connecticut Department of Labor

- Delaware Department of Labor

- Department of Labor Government of Guam

- District of Columbia Department of Employment Services

- Idaho Department of Labor

- Illinois Department of Labor

- Indiana Department of Labor

- Industrial Commission of Arizona

- Florida Restaurant and Lodging Association

- Georgia Department of Labor

- Kansas Department of Labor

- Maryland Department of Labor

- Massachusetts Department of Labor and Workforce Development

- Minnesota Department of Labor and Industry

- Michigan Department of Labor and Economic Opportunity

- Missouri Department of Labor and Industrial Relations

- Montana Department of Labor and Industry

- New Hampshire Department of Labor

- New Jersey Department of Labor and Workforce Development

- New York State Department of Labor

- North Carolina Department of Labor

- Office of the Labor Commissioner

- Ohio Department of Commerce

- Oklahoma Department of Labor

- Oregon Bureau of Labor and Industries

- Pennsylvania Department of Labor and Industry

- South Dakota Department of Labor and Regulation

- State of Nevada Department of Business and Industry

- State of Hawaii Department of Labor and Industrial Relations

- State of Rhode Island Department of Labor and Training

- State of Vermont Department of Labor

- Texas Workforce Commission

- United States Department of Labor

- US Virgin Islands Department of Labor

- Utah Labor Commission

- Virginia Department of Labor and Industry

- Washington State Department of Labor and Industries

- West Virginia Division of Labor

- Wisconsin Department of Workforce Development