Construction accounting 101: An expert guide for contractors

According to The Business Research Company, early 2023 saw the construction market’s worth spike to $15,461.84 billion globally. This is, however, an expected turn of events bearing in mind the sector’s constant growth. With so much at stake, it’s undeniable that construction accounting experts must find a flawless way to:

- Report on,

- Collect, and

- Spend their resources.

The future of any construction company depends on how it keeps track of its spending. In fact, accurate bookkeeping helps the business make long-term predictions.

In this guide to construction accounting basics, you will:

- Learn what it takes to run successful construction projects,

- Find the best billing and revenue recognition methods,

- Discover the most useful types of reports,

- Learn how to manage your payroll, and

- Get insight into a foolproof system to keep track of time, labor, and materials.

Without further ado, let’s get started with construction accounting 101!

Table of Contents

What is construction accounting?

In simple terms, construction accounting is a specific type of bookkeeping that consists of elaborate methods, systems, and reports for predicting a construction company’s financial health — with focus on the state of its individual projects.

In other words, construction bookkeeping helps:

- Protect project budgets,

- Track costs and revenue accurately,

- Find ways to reduce costs, and

- Manage projects effectively.

For clarity’s sake, construction accounting consists of 3 fundamental pillars:

- It’s project-based,

- It has decentralized production, and

- It has long-term contracts.

Next, let’s explore the 3 core ingredients of construction accounting.

1st Pillar of construction accounting: project-based operations

In construction projects, contractors treat every project as a unique, short-term profit center. That means that each project creates value individually. Think of it this way:

- One project may be estimated at $10,000,000, carrying its own expenses and costs that bookkeepers record.

- Another project can be assessed as worth half that amount, and this project’s costs and expenses are recorded separately.

For practical purposes, these 2 projects are individual endeavors, and accountants track their progress separately. This leads to unique challenges, such as different client requirements and the ebbs and flows in expenditure.

Conversely, a chain of pneumatic-valve manufacturers or designer cupcake shops have much more predictability and stability in their everyday operations.

For example, the cupcake shop may be able to predict the cost of sugar and other ingredients fairly regularly for months. And even if changes do happen, they are unlikely to affect the cupcake business’s financial bottom line.

That’s unlike a construction project, where accountants need to take into account — pun intended — labor costs in different states and localities (more on that later).

Additionally, the costs of building materials may change quickly and are sure to be part of each project in construction accounting. Even when projects have similar requirements in terms of production, they often have to deal with fluctuations such as:

- Site conditions,

- Labor variability, and

- Local legislation.

Apart from keeping tabs on all these factors, construction accountants also need to be careful about estimating quotes. The benefits? It helps them remain competitive and profitable at the same time.

For example, local taxes may significantly differ according to:

- Location of the building,

- Type of the building.

Now that you know all this, let’s move on to the next critical component of construction accounting: decentralized production.

2nd Pillar of construction accounting: decentralized production

With factories and plants, production primarily happens on a single site. Construction work production activities, however, usually take place on different job sites — often at the same time.

For example, a construction company may need to move equipment and labor every few days or weeks from site to site. In turn, this leads to mobilization costs. To account for these expenditures, contractors typically reference them as pre-contract costs to prepare a job site before the contract implementation starts.

In simple terms, mobilization requires contractors to:

- Move around heavy mechanical equipment continually,

- Focus on different projects at the same time, and

- Consider narrow profit margins.

In other words, contractors need to find ways to reduce mounting costs when changing job sites. Most do it by leasing rather than purchasing vehicles and equipment.

With that out of the way, let’s discuss the third critical aspect of construction accounting: long-term contracts.

3rd Pillar of construction accounting: long-term contracts

Construction accounting deals with long-term, flexible contracts with a ton of irregularities — in comparison to other sectors, like retail.

According to Statista’s research, it took approximately 15 months for a construction contractor to build a privately-owned residential building in the United States in 2021. Similarly, the US Census Bureau data reveals that nonresidential construction projects valued at over $10,000,000 take around 28 months to complete. The data is similar in other sectors.

At any rate, all this information proves that construction contracts have long production cycles that often last for longer than a year. In addition, work in this sector tends to be seasonal, making it difficult to estimate when contractors will land new jobs.

If that wasn’t enough, construction projects can stretch out due to:

- Bad weather,

- Raw material shortages,

- Project mistakes, and

- Equipment failures.

For illustration, imagine a business like a car dealership. In this sector, the contract is over as soon as the transaction is made. Unlike car dealerships, construction contracts sometimes take years, with multiple extended payments.

What type of accounting is used in construction?

For starters, construction accounting tracks multiple projects, accounts, and localities, as opposed to regular accounting — which typically focuses on sectors like retail or manufacturing. In industries like retail and manufacturing, business is usually the same day in and day out, with costs that stay relatively predictable over time.

In contrast, construction companies face a different and much more complicated series of challenges.

For illustration, a construction business may need to juggle multiple projects, each with a beginning, middle, and end. In fact, contractors sometimes face large gaps between projects. Conversely, a retail store may have continuous operation throughout the year.

In construction accounting, financial experts typically use software, general ledgers, and specialized methods as one system. That’s in contrast to how regular bookkeepers might handle workflows — at least for the most part.

So, let’s visualize the differences between regular accounting and construction accounting.

| Construction accounting | Regular accounting |

|---|---|

| Decentralized production, mobile workforce | Production happens in fixed locations, like retail stores, factories, and hangars |

| Multiple and mutually varying projects, with individual specifics, requirements, and challenges | Focused on product lines, retail outlets, or other services with fairly simple streams of revenue |

| Fluctuating direct costs that are difficult to predict | Relatively predictable direct costs |

| The vast majority of projects has a long-term contract, including complex revenue recognition rules and payment schedules | Typically standardized contracts and payments occurring at specified points |

| Change orders happen often — it’s a rule, not an exception | Change orders to services and goods are rare |

| Uses job costing to get a granular breakdown of expenses for each project | Doesn’t use job costing per se, except for in manufacturing, for example |

What does a construction accountant do?

According to the career website Zippia, almost 1,100,000 accountants work in the United States as of 2022. Similarly, the European Union is home to more than 1,000,000 qualified bookkeepers and other professionals in this sector.

However, not all specialize in construction accounting — but rather standard or regular accounting.

On the construction side of things, the individuals doing this type of work include construction bookkeepers or construction accountants — or, more generally, bookkeeping professionals.

With regard to their daily workflow, construction accountants typically:

- Scrutinize a project’s costs and profitability,

- Plan budgets for ongoing and future projects,

- Record transactions diligently in multiple ways, and

- Review invoices, contracts by suppliers, and purchase orders.

In other words, imagine that a homebuilding or facility construction project is underway. In this case, a construction accountant’s job would be to oversee how, when, and where money is spent, among other things.

As opposed to accountants who need to look at a company’s finances over the course of a set period, construction accountants have to deal with fluctuations every day. They need to adapt to ever-changing:

- Client requests,

- State regulations, and

- Labor requirements.

On this difficult path, construction accountants need all the help they can get.

Let’s quickly take a look at a few rules they all stick to in their daily work — the GAAP principles.

What is GAAP construction accounting?

Every industry actor in every industry follows certain codes that help it come on top of its competitors. The same applies to construction accounting.

Experts in this sector need to adhere to 10 core rules established by the Financial Accounting Standards Board, called Generally Accepted Accounting Principles — or GAAP (if you don’t want to spell it out every single time as it could probably turn into a huge time-waster, trust us.)

For illustration, you can think of GAAP as rules for doing business in the construction industry. However, note that only publicly traded companies or businesses that release financial statements to the public are obligated to adhere to GAAP.

Companies that fall outside this definition don’t have to work in line with these principles. Still, both FASB and GASB in the US recommend that all companies in this sector follow GAAP.

As there must be something to it, let’s examine each principle closely — and then get into the 3 foundational pillars of construction accounting.

The 10 principles of GAAP

To get the best results in construction accounting, adhere to the 10 principles of GAAP:

- Regularity — The accounting staff and entire business apply GAAP as standard practice.

- Consistency — Accountants implement the same standards at every step of the reporting process, applying standards in all reporting cycles equally.

- Sincerity — Bookkeeping staff provides accurate and objective information about company finances.

- Permanence — Accountants use consistent procedures in financial reporting. As a result, such practice enables business finances to be compared from one report to the next.

- Non-compensation — Bookkeepers provide complete transparency of negative and positive factors. For instance, they can’t compensate for an expense with revenue or a debt with an asset.

- Prudence — Accountants make sure that financial information stems from documented facts and that data isn’t influenced by guesswork.

- Continuity — The assumption that business operations, invoicing, and billing will continue to operate. Collecting financial data and valuating assets shouldn’t disrupt everyday business operations.

- Periodicity — Bookkeepers should organize and report on financial data in line with relevant accounting periods. For example, accountants should report on expenses or revenue within the corresponding quarter or another reporting period.

- Materiality — Accountants should rely on material facts, disclosing all material accounting and financial facts in their reports.

- Good faith — It’s expected that accountants and relevant staff are honest in collecting and reporting on financial information.

Now that we have set the stage, let’s dissect revenue in construction accounting.

What is revenue recognition in construction accounting?

Revenue recognition is how construction contractors collect financial means for their business.

Sometimes called income recognition, it refers to a principle that helps a contractor determine when they have officially earned revenue on a project — and when they should record an expense officially. By “officially,” we mean on the bookkeeping record.

More often than not, long-term contracts result in delayed payments. This creates headaches for the contractor, as they aren’t able to:

- Complete,

- Bill, and

- Collect on a contract in the same month.

That’s where revenue recognition comes into play. Construction contractors often use 3 major revenue recognition methods to help them on this uphill journey:

- Cash-basis method,

- Completed-contract method, and

- Percentage-of-completion method.

These 3 methods sound pretty self-explanatory, and contractors use them to determine when expenses and income “count” — so to speak. Sometimes, they use one method for their bookkeeping and another for tax reporting. All this is legal — and even advisable — but the only thing is to remain consistent over time.

Next up, we go in-depth on the 3 revenue recognition methods.

What are revenue recognition methods in construction?

With that in mind, we turn our eyes to the top 3 revenue recognition methods in construction accounting. The first is the cash-basis method.

Revenue recognition method #1: Cash-basis method (CBM)

The first and simplest method to recognize revenue in construction projects is the cash-basis method — also known as the cash method. When contractors use it, they report expenses only when they actually pay:

- Subcontractors,

- Materials, and

- Equipment.

In simple terms, cash-basis accounting means that contractors recognize income and costs only when the cash changes hands.

One positive aspect of the cash method is that it provides an accurate representation of cash flow. As a result, this leads to accountants not having to keep tabs on what has been paid and what hasn’t.

It’s also true that this method is flexible and simple, leading to less confusion in financial statements. Yet, not every construction business can use the cash-basis method.

The reason is that the US Internal Revenue Service (IRS) stipulates that only construction companies with less than a set average annual revenue can use it for tax purposes. In most cases, this amount shouldn’t exceed $26,000,000 in gross receipts for the past 3 years.

So, if the sales of a construction business surpass the said amount, accountants have to use another method for tax purposes.

In this case, the company can use a different method for its bookkeeping — and these other methods are called accrual methods. In short, an accrual method recognizes expenses when they’re incurred and revenue when it’s earned, even if cash hasn’t come in or out yet. Accrual simply means “accumulate.”

Next, we explore the second method to recognize revenue with a different way of recording expenses and income — the completed-contract method.

🎓 Clockify Pro Tip

For a deep dive into paying employees in arrears, read our blog post:

Revenue recognition method #2: Completed-contract method (CCM)

With this method, the contractor doesn’t report on income and expenses until project completion. In other words, profits don’t become official until the project is completed.

For instance, homebuilding contractors often use the completed-contract method because they build in line with specifications and only recognize their income once they sell the house.

Another way of thinking about this method is — everything gets onto the income statement at one single point.

Preferred by many construction contractors, the completed-contract method allows them to defer taxable revenue for the current year if the contract is set to be completed within the following tax year.

Here’s what this looks like in practice — suppose you are a contractor working on a 1-year project spanning from November 2024 until November 2025. Typically you would have to pay taxes by April 2024. However, the completed-contract method allows the contractor to defer paying tax until a year later. That’s why it’s popular among many construction companies.

Yet, there’s a catch — the IRS stipulates that a business can implement the completed-contract method if it meets either of the following 2 exceptions. In other words, that it’s:

- Any home construction project, or

- Any other construction project where the taxpayer can estimate that

- the contract will be completed within 2 years, and

- the average annual gross receipts for 3 years doesn’t surpass $25,000,000.

Important remark: Because revenue is recognized after costs have been incurred, this method of income recognition is not GAAP-approved.

🎓 Clockify Pro Tip

Learn how to get better at taxes as an independent contractor:

Revenue recognition method #3: Percentage-of-completion method (PCM)

All long-term construction contracts have to use the percentage-of-completion method, according to the US Internal Revenue Service. The only exception to this rule includes:

- Home construction projects, and

- Small contractor contracts.

Unlike the previous method of recognizing revenue, the percentage-of-completion method allows contractors to recognize revenue as they earn it over time.

This method is helpful because it allows the contractor to bill for the work as they go, especially when they have multiple ongoing projects. In most cases, the percentage-of-completion method works in stages or payment milestones.

For example, suppose a project costs $100,000, and $50,000 in costs have been incurred. In this instance, the customer and contractor consider the project to be 50% complete. Based on this calculation, the contractor can recognize 50% of the project’s income. Likewise, the company can recognize 50% of the expected:

- Revenue,

- Expense, and

- Profit.

In simple terms, the contractor records the earned revenue each time they issue an invoice. This process keeps going until the project is finished. But usually, the issuing of invoices happens every month.

Since everything looks better in a table, here’s one to help you remember the 3 critical revenue recognition methods.

| Method of revenue recognition | How it works in practice |

|---|---|

| Cash-basis method | Recognizes revenue when cash is paid out and received (when cash changes hands) |

| Completed-contract method | Contractors don’t report on income and expenses until project completion |

| Percentage-of-completion method | Revenue is recognized in stages or payment milestones (each time the contractor issues an invoice) |

Now you have adopted the concepts regarding the most frequently used revenue recognition methods. So, let’s take a closer look at new revenue recognition standards.

New revenue recognition standards for construction accounting

Effective since December 2020, the Accounting Standards Codification Topic 606: Revenue from Contracts with Customers — also known as ASC 606 — requires that entities recognize revenue when the promised services or goods are transferred to the customer. Also, bear in mind that updates are happening every year.

Simply, ASC 606 was introduced to:

- Provide greater transparency in recognizing revenue,

- Spot and fix revenue issues on the fly, and

- Standardize how companies recognize revenue in various sectors.

Apart from ASC 606 being best practice, contractors who do implement it gain credibility in the eyes of customers.

Practically speaking, ASC 606 helps contractors understand if they should recognize revenue on their books:

- Over time (as with the percentage-of-completion method), or

- At a single point in time (as with the completed-contract method).

As it turns out, this makes all the difference in how a construction company does business.

Equally important, ASC 606 deals with how control over an asset (like a building) transfers from the contractor to the customer’s ownership. Here are 2 real-life examples:

- Suppose the constructed asset is on the customer’s land. In this case, the building’s foundation comes under the customer’s control as soon as the concrete is poured or the building’s frame as soon as it’s put up.

- Imagine a total development project is underway. Here, the control transfer doesn’t happen until the contractor hands over the keys to the customer. A total development project is just what it sounds like — all undertakings necessary for administration, planning, site acquisition, demolition, construction, or equipment.

Parties — the customer and contractor — have to agree ahead of time when control transfer happens (over time or at a specific point in time). This, in turn, helps account for income.

What aspects of revenue recognition do contractors need to consider?

To explore revenue recognition methods, we partnered up with Tom Zauli, Senior Vice President at the revenue management system provider SOFTRAX. Tom brings home the point on the complexity of revenue recognition in accounting:

“First, contractors must cost out projects — with an eye for both competitive bidding and profit in mind. Recognition of revenue is complex, and often occurs either as a percent of completion or based on the rate of cost spend against the overall cost budget.”

Likewise, revenue is recognized when the contractor meets a performance obligation by transferring goods or services to the customer for a fee. To that effect, Tom Zauli mentions the critical elements to consider.

“The aspects that contractors should pay attention to in regard to revenue recognition are:

- Compliance with ASC 606 or IFRS 15,

- Understanding of projected revenue, cost, profit,

- Understanding of recognized revenue, cost, profit,

- Managing either % of completion (% of transfer) or cost-based accounting,

- Speed to report (shortened close period), and

- Handling of changes to project scope and schedule.”

With these considerations in mind, let’s get into the arguably most relevant topic of construction accounting — job costing.

How to use job costing in construction accounting?

Job costing entails a granular breakdown of expenses attached to each project. As a result, it helps contractors spot potential problems and more easily plan similar projects in the future.

When they use job costing, accountants do the following 2 things:

- Assign project costs to a specific job (or project), and

- Track those costs throughout the project’s life cycle.

When done properly, job costing helps construction managers and accountants predict costs and assess project budgets more precisely. Speaking of which, job costing concerns itself with 2 types of costs — direct and indirect costs.

Let’s take a look at both:

- Direct costs: Labor, consulting and architectural fees, materials, equipment, etc.

- Indirect costs: Software, supervision, transportation, repairs to equipment, support costs, insurance — in other words, any expenses essential to running the business.

When bookkeeping professionals record both indirect and direct costs, this lets contractors spend efficiently. As we have learned, keeping record of all costs is essential in construction projects because contractors bid for new projects all the time while implementing ongoing projects.

To investigate this topic further, we asked Tom Zauli to give us his 2 cents. Tom said:

“Job costing gives the most detailed view of a project. Construction businesses compete based on cost, but also need to ensure they are putting forward competitive bids. Those that have a good handle on job costing — particularly in the face of constantly changing input costs — can maintain a competitive position while ensuring strong margins.”

For illustration, here’s a table with a job costing example:

| Roofing job | Price of item |

|---|---|

| Labor — Roof preparation | $2,000 |

| Labor — Installation | $3,500 |

| Materials — Decking | $950 |

| Materials — Underlayment | $430 |

| Equipment — Rentals | $400 |

| Total | $7,280 |

Job costing and G/L in construction accounting

Although job costing is critical, we don’t want to underestimate the importance of a general ledger (G/L). A general ledger is a valuable tool in any construction business because it provides an overview of:

- Inventory,

- Payroll and payments,

- Accounts payable and accounts receivable, and

- Loan debt, among other things.

For clarity, job costing focuses on the project level — it’s like zooming in to one project in a company. Conversely, the general ledger keeps tabs on the bigger financial picture — it’s like zooming out on all projects in a company.

In more detail, the general ledger is a series of project-based accounts that accountants use to record all transactions regardless of the project.

In contrast, job costing is focused on individual:

- Projects — houses, production facilities, and swimming pools,

- Cost activities — construction equipment, materials procurement, laborforce management, and

- Cost types — direct, indirect, fixed, and variable costs.

For illustration, you can think of job costing as a powerful microscope that helps you take a closer look at estimated vs. actual production reports. Again, this comes in handy to gain an edge over the competition and protect narrow profit margins.

In simple terms, job costing results in actionable reporting that contractors use for better:

- Estimating,

- Bidding, and

- Cost control.

Finally, the general ledger looks at overall dollar amounts, while job costing calculates:

- Hours for the labor used,

- Units for physical completion, and

- Dollars for costs faced.

With these important considerations out of the way, let’s look at how it all seeps into construction billing.

🎓 Clockify Pro Tip

Get pricing and labor costs right the first time with our blog post on this topic:

How construction billing works

Unlike other sectors, the construction industry is well-known for costly overhead and slow payments. In fact, contractors often rely on credit to keep a project moving forward. With so many moving parts, construction managers need to find ways to:

- Increase invoice accuracy,

- Speed up payments, and

- Satisfy all project stakeholders.

To help themselves on this bumpy path, construction companies often use 3 billing options:

- Advanced billing: Billing before the start of a project — usually in the form of a lump sum payment.

- Arrears billing: Billing after project completion — paid out as a lump sum as soon as all stakeholders approve the final product.

- Progress billing: Billing as the project progresses — based on the percentage of completion of work to date and a detailed payment schedule.

You can put these billing options into work in any of the 4 detailed billing methods (no matter which one you choose — except for AIA):

- Fixed price,

- Unit price,

- Time and material, and

- AIA progress billing.

Let’s get started with construction billing methods!

🎓 Clockify Pro Tip

To get the hang of billing and time software + invoice management, read our articles:

Billing method #1: Fixed-price billing

One of the most popular billing methods, fixed-price billing, is based on a detailed estimate that provides the total cost of a project. Unlike other billing methods, fixed-price billing means that the client and construction company agree to a set price for the services at the onset of a project — thus the name fixed price.

In fact, this method of billing has 2 main modes:

- Fixed-price hard bid means that the contractor builds a project for a certain amount of money no matter what, implying that the contractor takes on the heavy risk.

- Fixed-price negotiated bid leaves room for emergencies and unforeseen events, especially in case of severe weather fluctuations, changed site conditions, or input costs.

Finally, fixed-price billing is common in procuring specific goods or limited-scope services. For example, contractors can use it to purchase or repair vehicles.

Billing method #2: Time and material billing

The second billing method on our list concerns itself with time and materials. This method implies that the contractor charges the customer for — you guessed it — time and materials.

We asked Francis Fabrizi from Keirstone Limited to weigh in on this topic. He said:

“Time and material billing is best suited for small projects with uncertain costs, while fixed-price billing is appropriate for well-defined projects with fixed costs.”

With time and material billing, the contractor bills the client for:

- Every labor hour, day, or month spent on the project, and

- Any materials purchased for that job.

Additionally, time and material billing also takes into account project overruns. This means that even if the project passes the estimated deadline, the contractor would still be covered because this method isn’t exclusively tied to deadlines. However, cost overruns and associated problems do happen even in this case.

To tackle this problem, contractors can include a maximum price for the project. This stipulation is often referred to as the ‘not-to-exceed clause,’ and it serves as a guarantee to protect the client against runaway costs.

🎓 Clockify Pro Tip

If you want to learn how to set rates for and track billable hours, check out our blog post:

Billing method #3: Unit-price billing

Contractors implement unit-price billing when they can’t estimate the unit production cost for the project with a lot of certainty. With this method, billing works on a fixed price-per-unit basis.

In simple terms, unit-price billing is particularly effective in cases where:

- The price depends heavily on the materials, and

- The total amount of work might not be obvious from the very start.

Due to constant fluctuations in the market, the unit-price billing method is common among heavy-highway and utility construction companies.

With unit-price billing the contractor doesn’t charge the customer for the total amount at once. Conversely, the contractor bills the client per line item, with each line item identifying separate tasks or scopes of work.

Some examples of line items in unit-price billing include:

- Taxes,

- Material costs,

- Profit,

- Permit and inspection costs,

- Workforce costs, and

- Overhead costs.

Next up, we discuss an industry standard in billing methods.

Billing method #4: AIA progress billing

The AIA progress billing method gets its name after the organization that produces its official contract forms — the American Institute of Architects. For simplicity’s sake, AIA billing is a form of progress billing that uses specific, standard documents, such as:

- G703 Continuation Sheet, where the contractor provides an update of the work in line with the schedule of values (a start-to-finish list of work items on any individual project.)

- G702 Application and Certificate for Payment, where the contractor provides information about the status of the total dollar amount of work done during the construction project.

As an industry standard, AIA progress billing is one of the most widely used forms of contract in the construction industry.

Most beneficially, if they implement this billing method, construction companies can bid for large, multi-year projects.

Due to standardized invoicing, tried-and-tested practices, and the language used, AIA billing can speed up payments and reduce the margin of error. Secondly, this ensures that the contractor complies fully with industry standards. In turn, this increases their capacity to commit to long-term jobs.

List of major billing methods in construction accounting

For better clarity, here are all the billing methods with short explanations of how they work in everyday operations.

| Billing method | How it works in practice |

|---|---|

| Fixed price | The client and construction company agree to a set price for the services at the onset of a project |

| Time and material | The contractor bills the customer for time and materials spent as the project progresses |

| Unit price | The contractor bills the client per line item, with each line item identifying different tasks or scopes of work, like permits, labor costs, overhead costs |

| AIA progress billing | The contractor bills the customer based on their own progress on the job — if the contractor is done with 25% of the job, they bill 25% of the contracted amount |

Pros and cons of billing methods in construction accounting

To help you assess the major advantages and disadvantages of each billing method, here’s a quick visual summary.

| Billing method | Pros of billing method | Cons of billing method |

|---|---|---|

| Fixed price | – Provides more certainty to the customer – Facilitates the bidding process as all parties know the total price from the start – Gives contractors a lot more control — in terms of how profitable projects are — than other billing methods | – Contractors often charge more than they would even for a variable price |

| Time and material | – Allows the customer to pay only for the work completed – Creates conditions for more accurate billing – Makes it possible to efficiently and quickly scale down or up in resources | – Overall expenses might easily and considerably exceed what the contractor expects to pay at the start |

| Unit price | – Makes it easy for the client to compare and benchmark prices – Allows an early start to project works – Provides more flexibility and transparency for large projects | – Inability to identify total costs until after work completion |

| AIA progress billing | – Complies with industry standards – Expedites payments – Reduces the possibility of errors | – Challenging if the contractor doesn’t have a sound job costing system in place |

Payroll in construction accounting

Construction is one of those rare industries that face rigorous compliance requirements, followed by multiple profit centers and decentralized production. All this carries into how unique and complex payrolls are in this sector.

Any accountant with their eyes fixed on success in this area needs to understand how tracking payroll in construction accounting works. In other words, they need to account for labor and site conditions changes.

For example, labor costs are unpredictable due to interruptions and unexpected events, including:

- Illness,

- Weather,

- Season,

- Political and economic fluctuations, and

- Many other unforeseen circumstances.

Therefore, the payroll needs to adapt to the changing site conditions and other requirements on the go.

For this segment, we explore 3 of the most common types of payroll in construction accounting:

- Prevailing wage,

- Local union, and

- Multiple states, localities, and rates.

Let’s dive right in!

🎓 Clockify Pro Tip

Learn more about wage types and employment types in payroll right here:

Construction accounting payroll #1: Prevailing wage

The prevailing wage simply means the standard hourly rate for a worker in a particular locality or state — as determined by the Department of Labor of that state or by local regulatory agencies.

Experts also refer to the prevailing wage as the Davis-Bacon Act. This regulation stipulates that contractors and subcontractors performing on federally funded or assisted contracts “must pay their laborers and mechanics employed under the contract no less than the locally prevailing wages and fringe benefits for corresponding work on similar projects in the area.”

In simple terms, the prevailing wage is much like a minimum wage because contractors can’t pay their workforce less than what’s paid locally. In addition, prevailing wage sometimes comprises non-cash compensation called “fringe benefits,” including:

- Continuing education, or

- Healthcare.

The prevailing wage differs significantly based on the US state in question, and the amount changes every 6 months to a year. The changes in the amount depend on the classification and levels within a classification in different jurisdictions — not just the area in question.

The most important factor in prevailing wage is that it’s area-dependent. In other words, laws on prevailing wage mandate that contractors pay a rate of compensation that’s not lower than the compensation determined for each worker classification or similar jobs in an area.

Note: 24 US states don’t have prevailing wage laws. In this case, the contractor must pay their employees the minimum wage at the very least. If the contractor is in doubt about whether to pay the state or federal minimum wage, the law prescribes that they pay whichever amount is higher.

🎓 Clockify Pro Tip

To stop struggling with compliance, here’s an overview of state labor laws:

Construction accounting payroll #2: Local union

The task of union payroll is to track and report wage and fringe obligations to the local workers union. Yet, this becomes complicated with multiple unions.

For example, suppose one worker lives in Alabama but goes to Washington to work there. To which union in the 2 states should this person report?

The short answer is that they need to make a balance between contributions in 2 separate unions (in Washington and Alabama), including:

- Healthcare contributions,

- Pension deductions,

- Political action contributions, and

- Dues.

To tackle this problem, construction contractors must check with the workers’ local union business manager to find out about requirements for paying union contributions. Not doing so could lead to costly non-payment consequences, potentially resulting in a legal seizure of property to satisfy a tax debt (also known as a levy).

Overall, here are the most important items that need to feed into a local union payroll:

- Job code, job name, expense by job, cost code,

- Overtime, regular hours, and double-time hours,

- Employee name and hourly rate,

- Employee’s union division/classification, and

- Temporary or alternate employee union benefits.

In any case, it’s critical to have a sound reporting and tracking system that can keep tabs on all these items and more!

🎓 Clockify Pro Tip

The mention of commissions, bonuses, wages, and other payment terms may sound overwhelming. Read this guide on pay rates to ease your headache:

Construction accounting payroll #3: Multiple states, localities, and rates

As is often the case in construction, workers have to switch between job sites in multiple states and cities. In turn, this allows employees to have multiple tax withholdings on a single payroll.

If not done correctly, contractors who operate in multiple jurisdictions can become subject to double taxation of their workforce.

Yet, some states have a reciprocity relationship (such as the case of Virginia). This means that the worker’s state of residence can issue credit for taxes paid on income that’s earned in a different state. As a result, this creates conditions for contractors not to pay taxes twice.

However, it requires careful attention to:

Similarly, construction companies have to be careful not to overpay unemployment tax. For an employee working in multiple states, unemployment is often owed only to one state per employee.

In the absence of state reciprocal relationships, it’s not always clear where unemployment should be paid. Thus, the Department of Labor suggests that contractors consider 4 factors:

- Are the services localized in this state or another state?

- Does the worker perform any service in the state in which their base of operations is located?

- Is this employee performing any service in the state from which the services are controlled and directed?

- Does the worker perform any service in the state in which they live?

Finally, contractors need to pay particular attention to payroll reporting requirements influenced by multiple factors, such as:

- Union reports,

- Workers’ compensation,

- New hire reporting, and

- Equal employment opportunity minority compliance.

All these factors can vary from the federal down to the local level.

Common reports in construction accounting

So far in this construction company accounting guide, we have covered payrolls, billing, and revenue recognition. Now that you are familiar with these topics, we can ease our way into 11 useful reports in construction accounting to get a better sense of where, how, and when money is spent — among other things.

Type #1: Accounts payable aging report

The accounts payable aging report offers a crystal-clear image of what contractors owe at a certain date and what they will owe in the future. It’s one of the most effective ways to manage cash flow. With the accounts payable aging report, companies can avoid unexpected bills.

For example, this type of report lays out:

- When payments are due,

- Whether you can save money by paying early or paying later, and

- How much your balance is.

Apart from these, the accounts payable aging report should consist of the vendor’s name and payment terms.

Type #2: Accounts receivable aging report

The accounts receivable aging report is periodic. In simple terms, this report categorizes the services or goods delivered but unpaid (by customers) since an invoice was sent to the customer at a single point in time. Accounts receivable are the legal claims for payment of those unpaid services and goods.

Interestingly, the accounts receivable aging report is useful because it can act as a warning sign.

Consider, for example, that the contractor collects the receivables slower than what is usually the case. This could be a red flag for company management. In other words, it may hint that business is experiencing a downturn or that the company is taking greater credit risk in sales.

For simplicity’s sake, the accounts receivable aging report ensures that the contractor collects unpaid invoices on time. And in case the company wants to pursue old debts, it can:

- Sell the debt to collections,

- Pursue them in court, or

- Write them off.

At any rate, the accounts receivable aging report grants this helpful overview to the construction business.

Type #3: Balance sheet report

A balance sheet report is a document that lists a company’s liabilities and assets.

First, we can categorize liabilities as equities or debts. Second, assets are categorized as everything the company owns, including:

- Intellectual property,

- Equipment, and

- Cash.

The name balance sheet comes from the fact that this report balances the contractor’s books. In effect, this means that the balance sheet report assesses a project and the company’s financial health. Practically speaking, this type of report lets you know what you:

- Own,

- Plan to pay out, and

- Expect to take in.

It’s a matter of adding and subtracting numbers that come from the liabilities and assets. For instance, suppose a company:

- Owns $100,000,000 in assets, and

- Has liabilities amounting to $90,000,000.

According to this estimate, the company is $10,000,000 above water, so to speak.

In the words of American investor Peter Lynch in his book Beating the Street:

“Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.”

Type #4: Profit and loss report

Also known by the names income statement or statement of operations, the profit and loss report presents a financial statement that summarizes a business’ total income and total weekly, monthly, quarterly, or annual expenses.

Based on revenues and expenses, the profit and loss report shows information about the net profit or loss. It helps contractors assess their ability to manage their profits by driving revenue and cutting costs.

Depending on the business type and its complexity, the profit and loss report takes different shapes. However, some typical components include:

- Revenues — The total amount of money that a company receives from carrying out its business activities.

- Gross profit — The financial gain of a firm after deducting costs necessary to distribute and manufacture its services or goods.

- Operating income — The adjusted revenue of a business after subtracting all expenses of operation.

- Operating expenses — Ongoing costs for running a business or system (like rent, marketing, payroll, and equipment).

- Net profit — The amount of money a business earns after deducting interest, operating, and tax expenses.

Overall, the profit and loss report helps construction businesses learn where profits are coming from and manage costs efficiently.

Type #5: Cash balance or cash flow report

Also known by the name cash flow statement, this type of report shows the amount of cash (or cash equivalents) that enter and leave a company.

This financial tool measures how well a construction company manages and generates cash to pay its debt and fund operating expenses. Sometimes, the cash balance report stems from the profit and loss report from the previous segment.

The 3 critical items in a cash flow report include cash from:

- Investing activities, such as the purchase of a property plant and equipment,

- Operating activities, like receipts from sales of services and goods, and

- Financing activities, such as paying dividends, stock repurchases, and loans.

The cash and balance report is closely knit to the profit and loss report.

For illustration, the cash balance report shows cash coming in and going out. Conversely, the profit and loss report lists the assets and liabilities that result from the activities on the cash balance report.

Type #6: Job cost report

Job cost reports are financial tools that help companies:

- Get a clear overview of how efficient production is,

- Spot change orders that are missing, and

- Obtain data for future estimations.

Job cost reports make this possible by looking at a project’s:

- Estimated costs,

- Actual costs, and

- Projected income.

When contractors conduct them regularly, job cost reports make tracking project progress easier.

One of the most frequent use cases of job cost reports is avoiding overruns by projecting costs into the future. Since most construction projects last for months, a monthly job cost report can find budget problems well before project completion.

During an ongoing project, the amount subcontractors demand can change, resulting in changes to actual costs. Most of the time, this isn’t a huge problem — until too many changes pile up. As a result, contractors need to deal with a major increase in cost.

With a job cost report, however, you can see these changes coming and react appropriately on time.

Type #7: Earned value report

An earned value report is one of the most efficient financial tools to learn if construction tasks are behind schedule and see exactly which tasks are over budget. The earned value report allows contractors to find out this information even at the start of a project.

Generally speaking, the earned value report compares 3 aspects:

- Planned value,

- Earned value, and

- Actual cost.

Instead of waiting until the end of a project to discover if overruns or delays will happen, the contractor can use the earned value report to see this information at the beginning of a project.

In a nutshell, here is how to implement this report in practice:

- Gather information on performance, like task name, start and end dates, and budget.

- Establish the status of the schedule to learn if the task is behind, ahead, or on schedule.

- Determine the status of the costs to find out if the task is over or under budget.

- Use forecasting to discover whether future tasks and budgets are aligned.

- Report on the results, offering deeper insight into cost estimates and schedules.

In simple terms, the earned value report allows contractors to respond to project-wise issues more quickly as they can identify them sooner.

Type #8: Job profitability report

Most construction companies are only concerned about the bottom line on their financial statements. However, many sometimes overlook the bottom line of their individual projects.

That’s where a job profitability report comes to the rescue. A job profitability report summarizes each construction project’s costs and income, listing:

- Total costs to date,

- Total income to date, and

- The difference between these 2 amounts.

In other words, each project has its own line on the job profitability report.

Unlike other reports on this list, contractors benefit from the job profitability report because it doesn’t have to be done in a set period. Contractors can complete it within the first 2 weeks, 3 months, or any other time they see fit.

For illustration, here’s how to create a job profitability report from scratch:

- Create a job list — a list of active or completed projects (or “jobs”) for the period you want to evaluate.

- Establish the total of direct job costs to date per project — this entails only the costs that you can directly assign to the project in question.

- Determine the total income to date per project — this is the amount you have billed your customers for each listed project.

- Specify the difference between the last 2 items — this is the gross profit where you subtract the total amount of the direct job costs from the total income per project.

Finally, you can use the information you get from a job profitability report to calculate key performance indicators (KPIs).

Type #9: Work-in-progress report

Accounting for construction in progress often seems elusive to many construction contractors.

But work-in-progress reports are critical tools in construction that help manage risk. Some of the major benefits of this type of report include:

- Improving transparency — as contractors use work-in-progress reports to identify problems and handle them on time.

- Identifying opportunities — since a contractor can use these reports to find opportunities to improve the efficiency of the project, resulting in reduced spending and maximized profits.

- Ensuring contract compliance — as contractors use the work-in-progress report to adhere to contract specifications and prove to the customer that they followed the contract’s terms if the customer feels they have been wronged.

As an important financial tool for any construction business, the work-in-progress report tracks the total costs for current progress. Some of these costs might include:

- Raw materials,

- Labor, and

- Overhead costs for different building stages.

The work-in-progress report is also helpful in projecting profit trends.

Type #10: Payment application report

Often called pay application or pay apps, the payment application report is a series of documents that contractors exchange with one another during payment.

Typically, a payment application should include the following items:

- Continuation sheets or a schedule of values listing all the materials you delivered or the work you completed during the pay period.

- Photo documentation that you can use as backup evidence of the work you completed or the materials you delivered.

- Daily reports that elaborate on the details of the job and site, providing a record that keeps subcontractors and stakeholders in the loop.

- Lien waivers signed by the party that submits the pay application, but also lien waivers that contractors collect from subcontractors, suppliers, and other vendors.

- Approved payroll reports on a prevailing wage job.

Because the pay application process is complicated, many contractors avoid doing it more often than monthly. Yet, it’s one of the things that construction accountants recommend to improve financial outcomes long-term.

🎓 Clockify Pro Tip

Learn about safe and easy-to-use payment apps in our comprehensive guide:

Type #11: Compliance reporting

Apart from meeting local tax requirements, contractors have to track and often report on compliance with employment regulations. This may involve reporting to:

- Federal,

- State, and

- Local agencies.

Speaking of the federal-state level, the Occupational Safety and Health Administration (OSHA) prescribes that all employers must report work-related deaths and serious injuries.

At the same time, the Equal Employment Opportunity Commission (EEOC) requires employers with more than 100 employees to submit an annual report with data about the employee’s:

- Ethnicity,

- Race, and

- Gender.

At any rate, compliance reporting — including compliant timesheets — can help contractors spot trends in injuries or worse. In turn, this can lead to profound changes in internal policies.

🎓 Clockify Pro Tip

Find out the nitty gritty about the most relevant timekeeping laws in our blog post:

Construction accounting software

Most reports, billing methods, and financial statements are best made via construction accounting software. But you probably knew that. What you may not have realized is that you should consider the following criteria when choosing software:

- Price — or offering as much value as possible without upgrading.

- Customization — most relevant for large companies that want special reporting.

- Ease of use — clients, subcontractors, and company employees need to feel comfortable using it.

With that in mind, the following segment explores some of the best construction accounting software on the market.

List of the best construction accounting software

For the sake of simplicity, we present you with premiere construction accounting software alongside its best use cases.

| Construction accounting software | Best for… |

|---|---|

| Freshbooks | Small to mid-sized companies |

| Sage 100 Contractor | Small to mid-sized companies |

| ComputerEase | Small to large companies |

| CoConstruct | Small to mid-sized companies |

| Jonas Premier | Small to large companies |

| Foundation | Mid-sized to large companies |

| QuickBooks for Construction | Small to mid-sized companies |

| BuilderTREND | Small to mid-sized companies |

| CMiC | Small to large companies |

| Procore | Small to mid-sized companies |

| RedTeam | Small to mid-sized companies |

Pros and cons of the best construction accounting software

Perhaps you have now decided on which software suits your needs size-wise. So, let’s now explore the advantages and disadvantages of each construction accounting software.

| Construction accounting software | Software pros | Software cons |

|---|---|---|

| Freshbooks | – Intuitive and easy to use – Double-entry accounting reports – Affordable prices | – Additional monthly cost to add members – Few customization options |

| Sage 100 Contractor | – Good integration with general ledger – Easy navigation through the system | – System glitches – Tax calculations aren’t properly sorted |

| ComputerEase | – Intuitive interface – Good customer support – Great customization options | – No time clock integration – Steep learning curve |

| CoConstruct | – Centralized job tracking feature – Useful estimating tool – Good customer service | – No centralized dashboard – Makes simple tasks complicated |

| Jonas Premier | – Saves a lot of time due to handy features – Good customer support – Simple workflows | – Inability to have different units of measure – Inventory setup is often challenging |

| Foundation | – Job costing integration with general ledger – Good customer service – Adequate training support | – Reporting is limited – Layers on the platform seem unintuitive |

| QuickBooks for Construction | – Reporting helps in decision-making – Easy implementation – Uncomplicated tracking of cash flow | – Limited customer and training support – Fixing mistakes takes time and effort |

| BuilderTREND | – Useful employee tracking – Cloud-based software – Good tool to manage customers | – Sometimes glitchy and goes offline – Counter-intuitive creation of proposals |

| CMiC | – Easy to onboard – Fast export of data – Robust enterprise resource planning system | – Training docs not helpful – Support fees increase yearly |

| Procore | – Dynamic analytics – Easy to connect business partners – Cloud-based software | – Complicated to invite team members – Some features and integrations are buggy |

| RedTeam | – Advanced financial tools – Good customer support – User-friendly | – Sometimes glitchy – Estimating, bidding tools need improvement |

🎓 Clockify Pro Tip

Read about accounting tools and which type is best for you right here:

Best practices of construction accounting

In the last part of our guide on accounting for construction companies, we will use everything learned so far to gear you with 12 foolproof tips to protect the bottom line of your business.

Without further ado, let’s jump right in!

Tip #1: Record daily transactions consistently

You can record daily transactions anywhere — on a spreadsheet, on paper, or in an accounting software program. Some examples of daily transactions include paying equipment rental, employee wages, or subcontractors specialized in specific areas of construction.

Our interlocutor and specialist in the field, Tom Zauli, gives his recommendations:

“Have a system to automate both billing and revenue recognition in light of complex billing requirements and the inherent complexities of ASC 606. In a worst-case scenario, not having one can impact stakeholder confidence in the business and impact your ability to react to changing business conditions.”

Similarly, other experts in this field suggest keeping business receipts in one unified database. For example, you can separate them into:

- Accounts payable — these are bills like rent, utilities, insurance, and equipment.

- Accounts receivable — these include record payments of clients, like dates, client names, amounts, and outstanding balances.

- Job costs — these entail payroll, material purchases, subcontractor payments, and more.

At any rate, do everything in your power to have an all-encompassing database that helps you keep track of things.

Tip #2: Keep backups of transactions

As with any industry, construction sometimes falls prey to malicious actors or plain human mistakes.

Steven Peterson, the author of the book Construction Accounting and Financial Management, has a thing or two to say about this issue:

“The systems should allow for easy backup and recovery in the event of a loss of data due to virus, hardware failure, or another unexpected event. The data in the accounting system is valuable to a construction company and duplicate copies need to be maintained and stored in a safe, off-site location.”

In fact, properly backed-up record-keeping protects the company against theft or embezzlement from within the business itself.

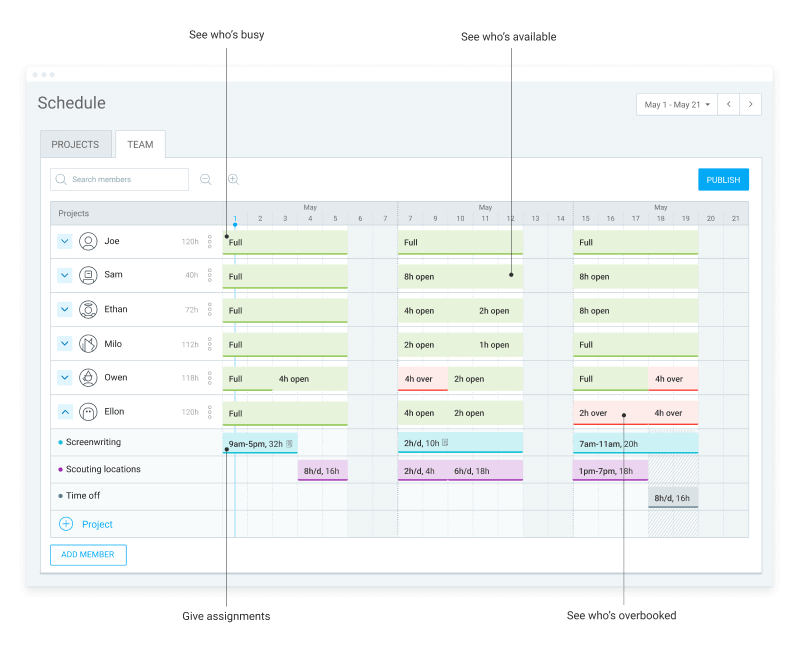

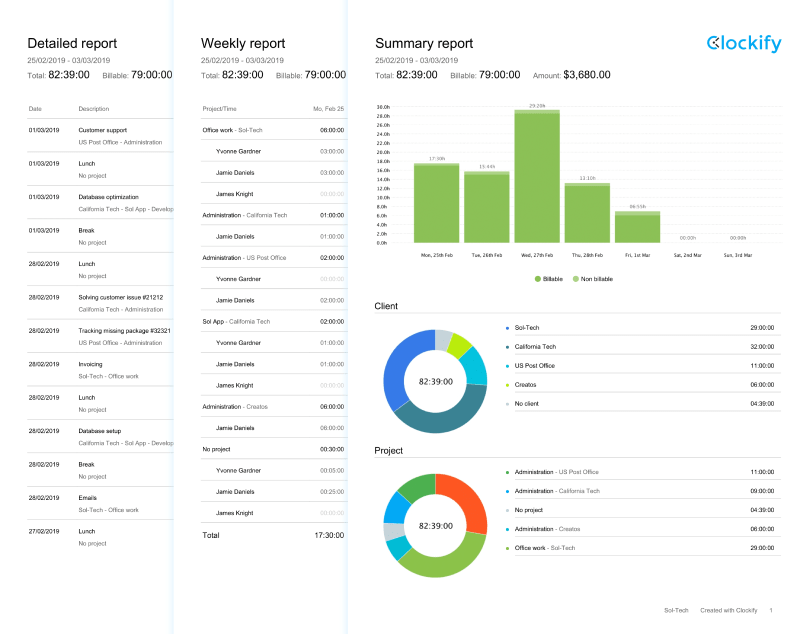

Tip #3: Use a time-tracking and scheduling tool to oversee activities

With hundreds of clever digital tools out there, it’s not advisable to keep an analogous schedule for a busy construction team.

Instead, use digital tools to:

- Track work hours,

- Schedule accounts payable, and

- Keep tabs on employee attendance.

For illustration, Clockify benefits construction workers and project managers in this field by:

- Simplifying clocking in and out,

- Scheduling crews and shifts, and

- Making calculating payments easy through in-depth reports.

🎓 Clockify Pro Tip

Get everything you need for clocking in and clocking out at a construction site:

Tip #4: Factor in rental or owned equipment

Construction contractors need up-to-date flawless equipment to do their job properly. So, they can do one of 2 things:

- Rent the equipment, or

- Buy the equipment.

In the first case, a contractor must factor in rental equipment costs and the invoicing due dates to obtain the equipment rental.

As for the second case — purchasing equipment — the construction business needs to consider the maintenance costs of the equipment. Most importantly, buying equipment also means hiring more administrative staff, such as:

- Schedulers,

- Controllers, and

- Foremen or forewomen.

Finally, remember that you must store the equipment in a safe facility. In turn, this means that the construction company must pay the rent or mortgage for the facility.

Tip #5: Hire a bookkeeper with industry experience

This point bears repeating — you need a professional accountant with industry knowledge to keep your books in order. This person (or people) can help ensure that nothing slips through the cracks.

As a result, you won’t have to worry if you are overdue with payments or if a customer is unhappy with your untimely reports.

To multiply the value of a bookkeeper, it’s worth employing time and billing software. Getting an app of this kind can help you:

- Track expenses,

- Customize timesheets,

- Set currencies and hourly rates, and

- Invoice and report seamlessly.

Any accountant’s job would be far more productive and easy if they used time and billing software suited for the construction industry.

Tip #6: Harness the power of job costing

As we already discussed above, job costing is one of the most critical aspects of bookkeeping for construction. In a nutshell, we advise using job costing as it helps contractors calculate:

- Labor costs,

- Material costs,

- Overhead costs, and

- Costs of charging for future projects.

If you get a clear overview of these items, you can outshine the competition and ensure customers hire you long-term.

Tip #7: Break down big projects

This one is easy. If you have ever participated in any project, you know that breaking down projects into smaller chunks does wonders. That’s why we recommend breaking down:

- Projects into phases,

- Phases into tasks, and

- Tasks into 3 expense categories: labor, materials, and overhead.

If you do this, you allow breathing room in between phases, tasks, and projects. In fact, this technique will make your everyday workload more manageable.

🎓 Clockify Pro Tip

Learn how to identify tasks, set milestones, and more in our blog post:

Tip #8: Use milestone payments

The main benefit of milestone payments is that you, as the contractor, don’t need to wait for payment until project completion. This tip works well with the previous tip, as it allows companies to receive payments by phases — not projects.

Expectedly, milestone payments act as incentives to the contractor. In other words, they know they can get paid as soon as they achieve a milestone.

Thanks to a tightly-knit project timeline, milestone payments help companies stay financially afloat.

🎓 Clockify Pro Tip

Find out how task dependencies and project milestones feed into each other:

Tip #9: Open multiple bank accounts

One of the biggest mistakes some construction companies make is only using one bank account for their whole business. Yet, a group of accounting professionals — and authors of the Construction Accounting: A Practical Guide to Company Management book — beg to differ.

They argue that several bank accounts fit for purpose help you see your financial health (or otherwise) with clarity. That way, as soon as you go to one account, there is less confusion about what you need to pay or order.

To help you out with that, here are 8 common types of accounts you can open:

- Current assets,

- Non-current assets,

- Current liabilities,

- Long-term liabilities,

- Equity,

- Cost of goods sold,

- Indirect expenses, and

- Administrative expenses.

Equipped with these bank accounts, you can significantly increase the performance of your construction business.

Tip #10: Be wary of contract retainage

In accounting for construction projects, it often so happens that clients decide to withhold payment due to several reasons, like:

- Failure by the contractor to adhere to contract stipulations, and

- Lack of the customer’s satisfaction with the final product.

The act of withholding payment is called contract retainage and is part of a contract signed by the contractor and customer before the project’s implementation.

As a side effect, contract retainage incentivizes contractors and subcontractors to finish their job timely and in line with the contract.

That’s why you need to prepare for contract retainage on time. In simple terms, you do this by including 2 sets of information on invoices when customers withhold payments:

- The first set covers information about the progress milestones met and how this reflects the total amount authorized for the services.

- The second set contains information about the retainage value, where it’s shown as a credit on the invoice.

As a result, the net amount of the invoice reflects the actual amount in dollars the client owes you.

Tip #11: Use the double-entry method

A general ledger is a powerful tool in bookkeeping for a construction company.

Apart from that, you can use its full-blown potential with the double-entry method. In short, the double-entry method requires making 2 entries to a general ledger to record each transaction.

As the approved method for recording financial transactions in construction, the double-entry method is typically used via software. Still, smaller construction companies can record their transactions in spreadsheets or another simple format.

Tip #12: Settle on a foolproof tax strategy

For the final tip in our article on construction accounting for dummies: taxes.

To reduce tax liability, contractors working on home construction projects can use the completed contract method. This method recognizes revenue and expenses only after project completion. As a result, the construction contractor can postpone revenue and associated income tax to a future point (typically next year).

Finally, partners or owners of construction firms need to consider the tax implications of their business structures.

For instance, all of the income of the partnership needs to be reported as it was distributed to the partners. As a result, each partner shares in the losses and profits of the joint partnership. In effect, this means that each member of the partnership pays separate taxes.

In any case, we recommend hiring a bookkeeping accountant with experience and expertise to handle the critical aspect of doing taxes.

Conclusion: Success in construction depends on detailed reports and practical software

In this construction accounting 101 guide, we covered everything you need to know about this complex yet profitable sector.

But before we wrap up, here are the main takeaways:

- Remember that construction bookkeepers must adhere to 10 GAAP rules,

- Use multiple reporting, billing, and revenue recognition methods for different purposes,

- Keep in mind that accountants and software make the perfect bookkeeping combo,

- Account for the unpredictable by factoring in unlikely costs, and

- Stay up to date with changes in regulation just in case some of it affects doing business.

That wraps it up. If you have any doubts about the meaning of any terms, abbreviations, or phrases, check out the glossary of terms below.

Glossary of basic construction accounting terms

- Accounts payable (AP) — The bills a company must pay to subcontractors, vendors, etc; it’s the money a business owes suppliers for provided goods and services.

- Accounts receivable (AR) — The bills that a business holds for goods or services delivered that customers have ordered but not paid for.

- Accounting Standards Codification Topic 606 or ASC 606 — An accounting standard outlining how to recognize revenue that arises from customer contracts.

- Advanced billing — Billing before the start of a project — usually in the form of a single payment.

- Arrears billing — Billing after project completion — paid out as a single end-of-project payment as soon as all stakeholders approve the final product.

- Contract retainage — An amount that a customer withholds from the contractor (or subcontractor) until the project is done; predefined in a contract agreed on by the customer and contractor.

- Cash equivalents — Short-term investments securities with maturity periods of 3 months or less, also described as the most liquid current asset on a business balance sheet. For example, cash equivalents include banker’s acceptances, bank certificates of deposit, commercial paper, and other money market instruments.

- Chart of accounts for construction projects — A listing of the general ledger (or G/L) accounts used for categorizing transactions, including a list of names and brief descriptions of each account.

- Construction accounting jobs — Called construction accountants or construction bookkeepers, these professionals typically calculate and oversee all finances company-wide or individual projects.

- Contractor — An individual or a company that implements construction projects on a contractual basis.

- Double-entry method — A bookkeeping method used by accountants to record entries in at least 2 accounts as a debit or credit for each business transaction.

- Fringe obligations — Additions or benefits to employee compensation, a form of pay for performing services. They include continuing education, healthcare, using company vehicles, etc.

- G/L or general ledger — A series of accounts that are used to record transactions. They help track the whole company’s financial big picture.

- Generally Accepted Accounting Principles (GAAP) — A set of accounting standards, practices, and requirements that US-based bookkeepers in construction should follow. Created and maintained by FASB and GASB.

- Job costing — A form of accounting that tracks costs and revenues by project, enabling reporting of profitability by project or “job.” Job costing assigns job numbers to each item of revenue and expense.

- Lien waivers — A document that the customer and contractor or subcontractor exchange for payment. The party that makes the payment requires the party that receives the payment to sign a lien waiver.

- Lump sum payment — A bulk payment. A single payment of money from the customer to the contractor — it’s different from a series of payments made over time (as with milestone payments).

- Net profit — The revenue that remains after covering expenses. The actual amount of money a business earns after deducting all interest, operating, and tax expenses over a period.

- Prevailing wage — An hourly wage paid to the majority of mechanics, laborers, and workers in a particular area. It includes usual benefits and overtime.

- Publicly traded companies — Firms whose shares are listed on the stock exchange and can be readily sold or purchased by the public (the public in this context means shareholders who have claim to a part of the company’s profits or assets.)

- Progress billing — Billing as the project progresses, based on the percentage of completion of work to date and a payment schedule.

- Schedule of values (SOV) — A list of all work items on a project, including the value and cost of each item, often submitted as part of the payment process for projects.

- Subcontractor — A person or firm hired by someone other than the owner to provide services or labor on a construction project.