What is full-time equivalent and how to calculate it (+ free FTE calculators)

Last updated on: January 30, 2023

In general terms, full-time equivalent (or FTE) is a unit of measure that plays an important role in calculations used in businesses, project management, or federal programs for eligibility purposes.

For instance, in terms of business, calculating FTEs may be of great use when determining how many hours part-time employees should work to equal the number of hours full-time employees work. Such calculations facilitate accounting processes such as estimating wages, payroll, costs, etc.

In this article, we’ll talk about:

- FTE basics,

- Purpose of calculating FTEs,

- How to calculate FTEs (+ examples), and

- Why businesses need FTEs.

We’ll also show you how to perform various calculations that involve FTEs, and provide you with automatic calculators that will help make the process easier.

Table of Contents

What is the full-time equivalent (FTE)?

A full-time equivalent (FTE) — also known as a whole-time equivalent or WTE — represents the sum of all full-time hours employees work in a certain company. Along with counting the hours worked, FTEs show how many full-time employees a particular company employs within a fiscal year or needs to employ to carry out a project.

The calculation is straightforward — divide the employee’s scheduled hours by the number of hours that represent an official weekly full-time schedule in a company (e.g., 40 hours per week).

Employee’s scheduled hours / official weekly full-time workweek = FTE

Outside the business environment, this unit of measure is also used to measure a student’s class load or involvement in a school project.

What is a full-time equivalent employee?

Considering that the FTE unit of measure is based on the total number of hours worked — it may not indicate the actual number of people working in a company.

Here’s how full-time and part-time employees may equal 1 full-time equivalent employee in your company based on the formula we’ve provided above:

Scenario #1:

1 full-time employee working 1 official full-time schedule = 1 full-time equivalent employee:

1 x 40 hours worked / 40-hour workweek = 1.0 FTE

Scenario #2:

2 part-time employees working exactly half of the company’s official full-time schedule = 1 full-time equivalent employee:

2 x 20 hours worked / 40-hour workweek = 1.0 FTE

Scenario #3:

4 part-time employees working exactly a quarter of the company’s official full-time schedule = 1 full-time equivalent employee:

4 x 10 hours worked / 40-hour workweek = 1.0 FTE

💡 Clockify Pro Tip

To track employee work hours and decide whether your employees are full-time equivalents, try using Clockify, our free time tracker for teams:

What is the purpose of FTE?

Businesses use the FTE calculations for a variety of purposes, and the most common ones are presented below.

1. FTEs in the workplace

While hiring part-time employees often turns out to be less expensive than hiring full-time employees, sometimes it’s hard to determine their effectiveness in a company. For that purpose, FTE calculations help businesses to:

- Determine hours worked (either by full-time or part-time employees),

- Calculate profits per each employee,

- Determine wages based on hours worked,

- Calculate the number of accrual hours for PTO per employee,

- Calculate expenses, and more.

Moreover, project managers and budget analysts also use the FTE unit of measure to estimate how many hours (i.e., full-time schedules) it will take to finish a project and whether the said project will require full-time or part-time employees (and how many of each). They also use it to calculate labor costs for the expected project workload and subsequently define the funds needed to finish a project.

2. FTEs for federal programs and benefits

What’s more, FTE calculations help determine eligibility for different federal programs and benefits such as:

- Eligibility for the Paycheck Protection Program (PPP) — Eligible employers may receive limited financial aid (of up to 8 weeks) to cover payroll costs, benefits, utilities, rent, or mortgage interests. Such financial aid is subject to forgiveness if the borrower makes a request for it within 10 months of the end of the covered period.

- Eligibility for the Small Business Tax Credit Program — Applies to small businesses whose revenues have decreased or who have been shut down between the period of March 12, 2020, and December 31, 2020. If eligible, employers may receive a tax credit of up to 50% of the wages paid. For the year 2021, the maximum benefit equals $28,000 for the entire year.

- Eligibility for the Public Service Loan Forgiveness (PSLF) program — State-employed workers with 10 years or more of work experience have the opportunity to be relieved from their student debts under this program. This is applicable if an employee has made 120 qualifying monthly payments while working as a full-time employee (at least 30 hours of work per week). Calculating the FTE may help you receive forgiveness regarding your student loan debt. In this particular case, your FTE must be 1.0 (working 40 hours a week) or 0.75 (if you work 30 hours a week) as the minimum requirement.

3. FTEs under the Affordable Care Act (ACA)

Applicable Large Employers (ALE) who employ at least 50 full-time employees (full-time equivalent employees) per year are subject to the shared responsibility provisions, which require an employer to:

- Provide their full-time equivalent employees and their dependents a minimum health insurance coverage, and

- Regularly report information on minimum health insurance coverage to both employees and the IRS as part of their responsibilities under the ACA.

Therefore, eligible employees may obtain affordable and minimum health insurance coverage thanks to FTE calculations under the Affordable Care Act. Any employee having at least 30 working hours per week (or 130 a month) is considered a full-time employee under this act.

To help you determine if you qualify for an Applicable Large Employer, visit this website.

What is a typical official full-time schedule?

The expected length of a full-time schedule has changed a lot throughout history — full-time employees now work about 20 or 30 hours per week less than they did in the 19th century.

Even today, these numbers greatly vary across countries. According to OECD statistics on average weekly hours worked on the main job from 2021, Denmark has an average of 33.7 hours per week compared to Columbia and its average of 47.8 hours during a workweek. The US falls somewhere in the middle when compared to other countries, with 38.8 hours of work time per week, on average.

However, the IRS mandates only 30 hours per week or 130 hours per month for an employee in the US to be considered full-time in terms of the type of employment.

In practice, these numbers still usually fall somewhere between 32 and 40 hours per week, with 40 hours per week (8 hours per day, 5 days per week) being a common norm for a full-time schedule.

💡Clockify Pro Tip

Here are some tips on how to make the most of your 8-hour workday:

What is 100% FTE?

A 100% FTE is the same as a 1.0 FTE — it may point to one person working a full-time schedule or several people fulfilling the duties of one full-time position.

In one company, a full-time schedule may be 40 hours per week. In another, it may be 37.5 hours per week. Since both are considered to be full-time schedules in their respective companies, both count as a 100% or 1.0 FTE.

An FTE calculation for all employees in a company needs to be rounded down to the nearest whole number (usually, 1.0 FTE or greater).

On the other hand, the FTE for individual employees may be:

- 80% (0.8) FTE,

- 75% (0.75) FTE,

- 70% (0.7) FTE,

- 50% (0.5) FTE, or

- Any other FTE equivalent of a shorter work schedule than 100% FTE.

How to calculate FTE for individual employees (+ examples)

To calculate the full-time equivalent in your company for each employee, you’ll need to account for:

- The hours of a full-time weekly schedule, and

- The actual hours your employees are scheduled to work.

Example #1

Let’s say that a full-time weekly schedule in your company is 40 hours per week, and your employees are scheduled with 40 hours of work a week. This is a straightforward example since each employee who works 40 hours per week in your company has a 1.0 FTE.

40 / 40 = 1.0 FTE

Example #2

What about the employees whose contracts mandate they work less, such as part-time workers?

Say that a worker named Karen works 20 hours per week in the same company. To calculate her FTE, simply divide the actual hours Karen is scheduled to work by the full-time weekly schedule of your company:

20 / 40 = 0.5 FTE

Example #3

The same would go for Arthur, who works 25 hours in a company where, this time, 38 hours is considered a full-time schedule:

25 / 38 = 0.6 FTE

What is 75% FTE? When is 75% FTE or higher considered full-time?

An employee with a regular budgeted assignment of 75% of a full-time job position has a 0.75 FTE.

This usually amounts to:

- The total of 28 hours per week for non-exempt positions who work 37.5 hours per week under normal conditions, or

- The total of 30 hours for exempt positions who work 40 hours per week under normal conditions.

However, temporary job positions are excluded from this rule.

Whether an FTE of 0.75 is considered full-time will depend on the company policy made by the employer. If 0.75 FTE is considered full-time in a company, such employees may qualify to apply for the Public Service Loan Forgiveness (PSLF) program, as stated above.

However, bear in mind that this only applies to positions that work 30 hours per week when assigned a 0.75 FTE position, i.e., the IRS minimum for a full-time definition. In contrast, non-exempt positions who typically work only 28 hours per week on a 0.75 FTE schedule do not qualify, even if the employer policy defines them as full-time.

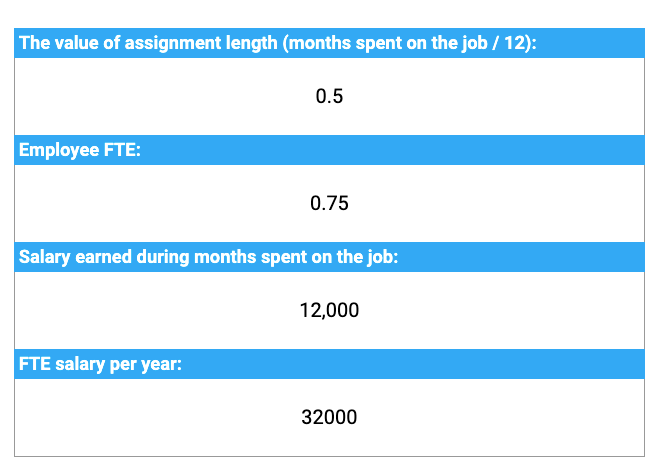

What is an FTE salary? How to calculate an FTE salary?

An FTE salary is an employee salary converted into a full-time equivalent salary within a full year, regardless of whether the said employee holds a full-time or part-time position. The actual workload is not taken into consideration for this calculation.

Example: Let’s say that an employee has held a job for 6 months (0.5 time of a full year) at an FTE of 70% (0.7) and earned $12,000 during this time.

The FTE salary calculation for this employee goes as follows:

$12,000 / ( 0.5 x 0.7 ) = $34,285 per year

FTE salary calculator

To easily convert an employee salary into a full-time equivalent salary within a full working year, you can use the following calculators free of charge:

⏬ Download the FTE salary calculator in Excel

⏬ Download the FTE salary calculator in Google Sheets

How to convert FTEs to work hours? (+ FTE hours requirements)

We already discussed how to use work hours to calculate FTE for individual employees. But what if we start from an FTE to calculate work hours?

For example, you may want to do this when you want to make an FTE offer to a new employee during a job interview. And the actual number of hours attached to an FTE will also depend on your organization’s policy.

For inspiration, let’s look at a chart compiled by Northern Michigan University.

Here’s how they classify working hours for different assignment lengths based on predefined FTE measurements within a fiscal year in 2022 (ended June 30, 2022) and 2023 (ends June 30, 2023).

| Assignment length | FTE | Working hours |

|---|---|---|

| 12 months | 1.0 | 2,088 |

| 11 months | 0.9167 | 1,914 |

| 10 months | 0.8333 | 1,740 |

| 9 months | 0.75 | 1,566 |

When classifying FTEs and working hours in your company’s policy, you can follow suit, or define your own FTE measurements.

How do you convert FTE to hours?

To calculate the number of hours your employee is expected to work based on their FTE, you’ll need to reverse the previously mentioned process of calculating FTE based on the number of hours worked.

Example: Let’s say you have an employee named Olivia who has a 0.7 FTE in a company that counts 40 hours as a full-time schedule. How many hours does Olivia work per year?

If Olivia has a 0.7 FTE on a yearly basis, you’ll need to multiply her FTE with the average number of hours worked for a full-time work schedule in your company a year (40 hours per week x 52 weeks per year = 2,080 average number of hours per year):

0.7 x 2,080 = 1,456 hours per year

Bear in mind that this is just the expected number of hours Olivia may work with a 0.7 FTE — she will likely use some of these hours for PTO.

💡Clockify Pro Tip

If you thought PTO and vacation mean the same thing — think again. In the following blog post, you’ll learn the difference between PTO and vacation:

Why is FTE important for PTO?

FTEs may also influence how many hours employees can accrue for PTO. The actual PTO an employee can accrue may depend on several factors, including years of employment that dictate an employee’s hourly PTO accrual rate. These rates will depend on the PTO accrual rate policies of a company, organization, or institution.

For example, at the University of Utah Health, eligible hospital and clinics staff members who work the equivalence of 0.50 to 0.74 FTE of a full-time schedule will accrue at 50% of the full-time benefit rate (distributed based on their FTEs).

💡Clockify Pro Tip

Use pre-made PTO templates created to suit your business and implement an employee time off request system here:

Examples of how to calculate FTE for all employees

To calculate the FTE for all employees in your company, consider the full-time and part-time employees you employ.

Example #1: 1 full-time employee / 40-hour workweek

A full-time employee working 40 hours in a company that views 40 work hours as a full-time schedule is counted as having a 1.0 or 100% FTE (40 / 40 = 1.0 FTE). In line with that, you may have 10 full-time employees, who’ll equal 10.0 FTEs in total (1.0 FTE each).

However, if your company employs part-time employees as well, several of them together may equal 1.0 FTE.

Example #2: 1 part-time employee / 40-hour workweek

A part-time employee working 20 hours in a company that views 40 work hours as a full-time schedule is counted as having a 0.5 or 50% FTE (20 / 40 = 0.5 FTE). Two such part-time employees together equal one full-time employee equivalent (0.5 + 0.5). In line with that, if you have 20 part-time employees, they will once again equal 10.0 FTEs (0.5 FTE each x 20).

Now, this was a simple calculation, but what if your part-time employees are NOT working exactly half of your company’s official full-time schedule?

Example #3: 2 full-time employees and 5 part-time employees / 40-hour workweek

Say you have 2 full-time employees and 5 part-time employees, out of which:

- 2 work for 23 hours,

- 2 work for 25 hours, and

- One works for 28 hours per week.

The simplest approach to calculate the FTE for part-time employees is to add up the listed hours (2 x 23 + 2 x 25 + 28 = 124) and divide that total by the number of hours that mark a full-time schedule in your company (once again, let’s say that that’s 40 hours per week):

124 / 40 = 3.1

In the end, round this down to the nearest whole number (3 FTE), and add the 2 full-time employees (2 FTE) to get the final FTE in this scenario:

3 FTE + 2 FTE = 5 FTE

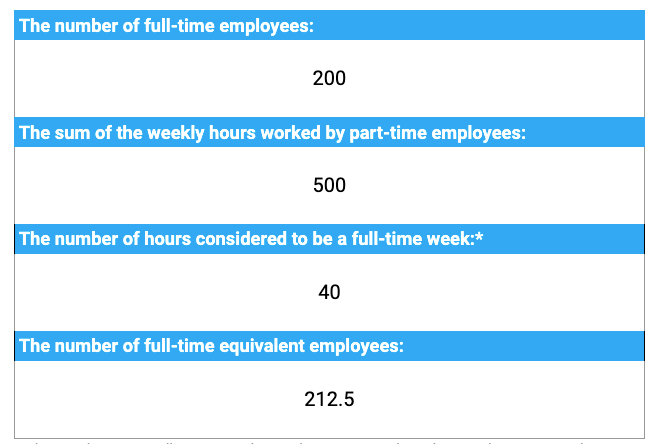

FTE calculator for all employees

To easily calculate the FTE for all your employees — part-time and full-time — use our free calculators provided below:

⏬ Download the FTE calculator for all employees in Excel

⏬ Download FTE calculator for all employees in Google Sheets

Simply enter the number of full-time employees, then add up all the hours worked by part-time employees (for the previous week), and don’t forget to enter the hours of your standard workweek (which is generally 40). This way, you will be able to determine the number of full-time equivalent workers in your company even when you have part-time workers on-site.

Bear in mind that these are just simple FTE example calculations — project managers approach FTE from a different angle while federal programs use different FTE calculation methods.

How to calculate FTEs to determine the headcount needed for a project?

Say that you want to determine your resource requirements for a project estimated to take 600 hours to complete and on which your team will work 8 hours per day. To calculate how many days your team will need to work to accomplish this and how many people in the team you need to begin with, first, divide 600 by 8:

600 / 8 = 75 hours per day

So, 75 is the number of hours needed per day to finish the said 600-hour project. However, it will be up to you to decide how many people you’ll want to employ to carry this out and what type of employment you will offer them.

Take a look at the following solutions that we’ve provided for you:

- Suitable Solution 1: You can choose to employ 10 full-time employees (10.0 FTE) who will finish the job in 7 and a half days (75 / 10).

- Suitable Solution 2: You can choose to employ 7 full-time employees and 1 part-time employee (7.5 FTE) who will finish the project in 10 days. In this case, we’ll take the number of hours a day needed to finish the project (75) and divide it with the part-time employee’s FTE (7.5) to get 10 days (75 / 7.5).

- Suitable Solution 3: If you’re looking to speed up the process, you can also choose to employ a team of 15 full-time employees (15 FTE) who’ll finish the project in 5 days (75 / 15).

- Suitable Solution 4: If you’re less concerned about the speed, you can employ a team of 5 full-time employees (5 FTE) who will finish the project in 15 days (75 / 5).

As evident, once you have the total number of hours per day, you’ll be able to pick whatever days/employees ratio you want to carry out the estimated workload.

💡Clockify Pro Tip

Try using Clockify to help you manage your time better by making precise work time estimates:

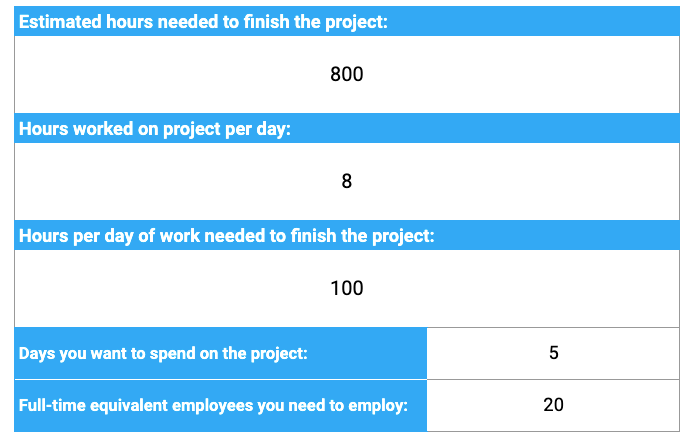

FTEs calculator for project managers

To easily calculate how many full-time equivalent employees you need to finish a project, you can use the following calculator free of charge:

⏬ Download the FTE calculator for project managers in Excel

⏬ Download FTE calculator for project managers in Google Sheets

As you can see from the example above, you can easily calculate how many full-time equivalent employees you need to hire to successfully complete a project. All you need to do is enter how many hours of work are required to complete the whole project (estimated time), and then how many hours a day your employees will work on that specific project.

FTEs calculation methods for federal programs and benefits

The FTE calculation methods we’ll discuss here are concerned with calculating FTEs for:

- Business owners who want to determine the size of their business and understand whether they count as Applicable Large Employers for the year,

- Small business owners who want to understand whether their business is eligible to apply for a tax credit in the amount of 50% of employer-paid health care premiums, and

- Business owners who want to understand whether their business is eligible to apply for a Paycheck Protection Program.

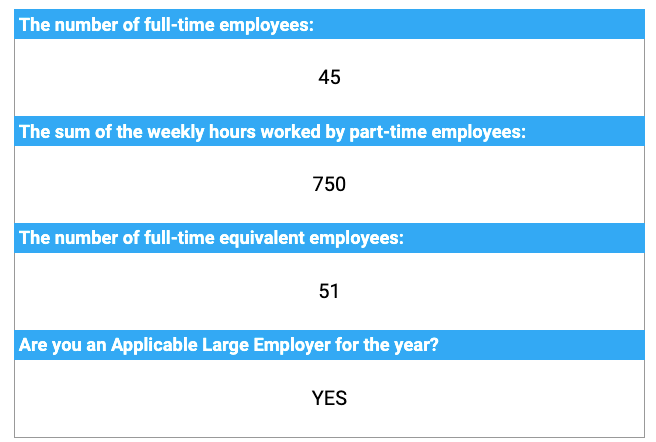

The role of FTEs in determining whether an employee qualifies as an ALE

In the context of the Health Care Reform Act, the Affordable Health Care Act requires the calculations that determine whether a business is classified as owned by a large employer or a small business. These calculations are used to clarify the company’s obligations regarding employee health benefits.

How to use FTE to determine whether you are an ALE?

Since we’ve already explained which specific requirements an employer must meet to qualify as an Applicable Large Employer (ALE) in the FTEs under the Affordable Care Act (ACA) section, here is how you can use FTE to determine whether you are an Applicable Large Employer:

- To calculate the full-time equivalent for the actual full-time employees, simply do a headcount.

- To calculate the full-time equivalent for part-time employees, add up their work hours and divide that number by 120.

Example: You have 50 full-time employees and 50 part-time employees. Out of the 50 part-time employees:

- 10 work 20 hours,

- 10 work 22 hours,

- 20 work 25 hours, and

- 10 work 28 hours.

Here is the calculation that shows how many full-time equivalent employees they represent:

50 (full-time employees) + (10 x 20 + 10 x 22 + 20 x 25 + 10 x 28) / 120 = 60 full-time equivalent employees

If your final FTE for all your full-time and part-time employees shows 50 FTEs or more, you are an Applicable Large Employer for the year.

However, here’s who you DO NOT include in the calculation:

- Partners in a partnership,

- Company employees who work outside of the US (regardless of whether they are US citizens or not),

- Shareholders of an S corporation who hold at least 2% of the said S corporation,

- Real estate agents (or direct sellers of real estate), and

- Employees leased from leasing agencies.

FTE calculator for ALE

To easily calculate whether you are an Applicable Large Employer for this year, you can use the following calculators free of charge:

⏬ Download the FTE calculator for ALE in Excel

⏬ Download the FTE calculator for ALE in Google Sheets

The calculation is straightforward — enter the number of full-time employees together with the total number of hours worked by part-time employees per week. The calculator will tell how many full-time employees that represents and whether or not you are an Applicable Large Employer.

The role of FTEs in calculating eligibility for a tax credit

As stated in the Eligibility for the Small Business Tax Credit Program section above, small businesses are eligible for such a tax credit if they employ less than 50 full-time equivalent employees (and subsequently have less than 50 FTE for all employees in total).

If you are such an employer, then you are eligible to apply for a tax credit in the amount of 50% of employer-paid health care premiums.

To help you determine if you are eligible for a small-employer healthcare tax credit, you need to count the number of employees employed in your company throughout the year.

However, here’s who you DO NOT include in the calculation:

- Owners (sole proprietors included),

- Partners in a partnership,

- Shareholders of an S corporation who hold more than 2% of the said S corporation,

- Shareholders of a corporation who hold more than 5% of the said corporation,

- Family members or relatives that work for you, and

- Seasonal workers who work less than 120 hours during a year.

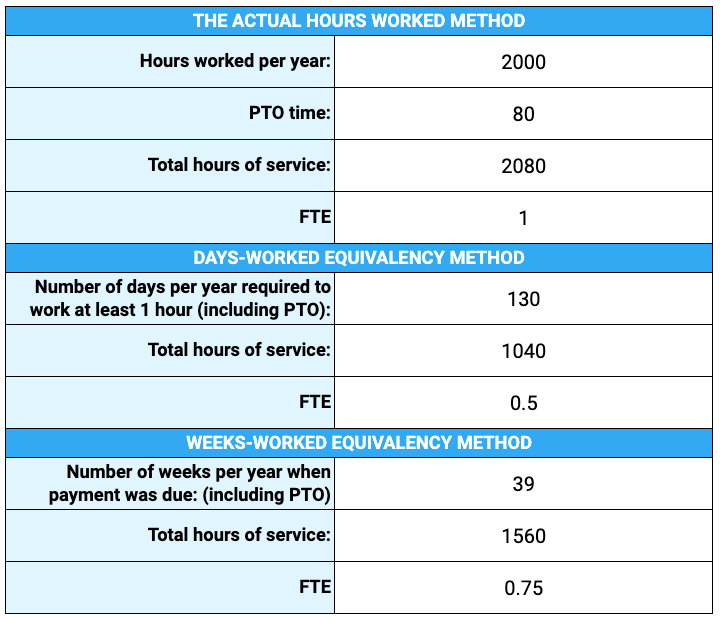

How to use FTE to help you determine whether you qualify for a tax credit

There are three methods to calculate FTEs for a healthcare tax credit for small businesses. Each requires that you divide the number of hours by 2,080 to get the employee’s FTE:

- Method #1: The actual hours worked,

- Method #2: Days-worked equivalency, and

- Method #3: Weeks-worked equivalency.

The first method uses the actual hours worked.

Within this method, you add up all actual hours worked (including PTO).

Example: An employee worked 2,000 hours within a year and spent an additional 80 hours during that year on time off:

2,000 + 80 = 2,080 hours of service / 2,080 = 1.0 FTE

The second method is based on the days-worked equivalency.

Within this method, the employee is credited with 8 hours for each day they would be required to work at least 1 hour (including PTO).

Example: An employee worked from 7.00 a.m. to 12.00 p.m. every day for 100 days (5 hours worked per day for 130 days = 130 days an employee was required to work at least 1 hour):

8 x 130 = 1,040 hours of service / 2,080 = 0.5 FTE

Finally, the third method is based on the weeks-worked equivalency.

Within this method, the employee is credited with 40 hours for each week when payment was due (including PTO).

Example: An employee worked for 37 weeks, took 2 weeks for a paid vacation, and took 9 weeks of unpaid leave (you only count 37 weeks worked and the 2 weeks of paid vacation, without the unpaid leave):

(37 + 2) x 40 = 1,560 hours of service / 2,080 = 0.75 FTE

Whatever method you choose, repeat it for each employee, and add up the numbers to get the final FTE (round the number down). Alternatively, add up the hours of service for all your employees, and divide that number by 2,080. For example, 15,600 hours of service equals 7 FTE (15,600 / 2,080 = 7.5, rounded down).

FTE calculator for the small businesses tax credit program

To easily calculate the hours of service per employee in your small business and see if you qualify for a tax credit, you can use the following calculators free of charge:

⏬ Download the FTE calculator for small businesses tax credit program in Excel

⏬ Download the FTE calculator for small businesses tax credit program in Google Sheets

To calculate FTEs and see if you qualify for tax credit, you can choose one of the said methods (we’ve provided calculators for each). If you, for instance, choose the first method, enter all the actual hours worked (including PTO) and divide that number with 2,080 to get the final FTE.

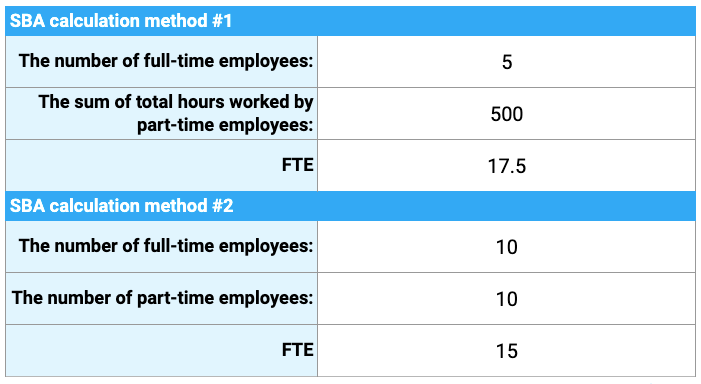

The role of FTE in calculating eligibility for the Paycheck Protection Program (PPP)

As we’ve already mentioned, the Paycheck Protection Program (PPP), established by the CARES Act, provides funds to small business owners to help them keep their workers on payroll or cover other costs such as utilities, rent, and more (up to 24 weeks).

How to calculate FTE for the Paycheck Protection Program (PPP)?

To make sure you are eligible to have your loan fully forgiven due to maintaining the FTE in your small business, you’ll need to calculate your FTEs according to the calculation methods prescribed by the Small Business Administration (SBA):

SBA calculation method #1:

- For full-time employees — Each employee who worked 40 or more hours per week on average, during a specific calculation period counts as 1.0 FTE. No employee can be greater than 1.0 FTE, as overtime is not counted for this calculation.

- For part-time employees — Employees who worked less than 40 hours per week on average during a specific calculation period will have their average hours worked on a weekly basis added together. Divide this total number by 40, and then round the total to the nearest tenth to get the total FTE.

Example: You have 5 full-time employees who work 40 hours per week and 8 part-time employees who work 25 hours per week.

5 + 8 x 25 / 40 = 10 FTE

Note: This method is the same as the example of how to calculate FTE for all employees discussed earlier.

SBA calculation method #2: (the simpler alternative)

- For full-time employees — Each employee who worked more than 40 hours per week on average during a specific calculation period counts as 1.0 FTE.

- For part-time employees — Each employee who worked less than 40 hours per week on average during a specific calculation period counts as 0.5 FTE.

Example: You have 7 full-time employees who work 40 hours per week and 8 part-time employees who work 28 hours per week. In numbers, that would be:

7 + 8 x 0.5 = 12 FTE

Note: Whatever SBA calculation method you choose to use, you’ll need to use it consistently for all calculation time periods.

FTE calculators for the Paycheck Protection Program (PPP)

To easily calculate FTE to check eligibility for full forgiveness in the Paycheck Protection Program, you can use the following calculators free of charge:

⏬ Download FTE calculator for PPP in Excel

⏬ Download FTE calculator for PPP in Google Sheets

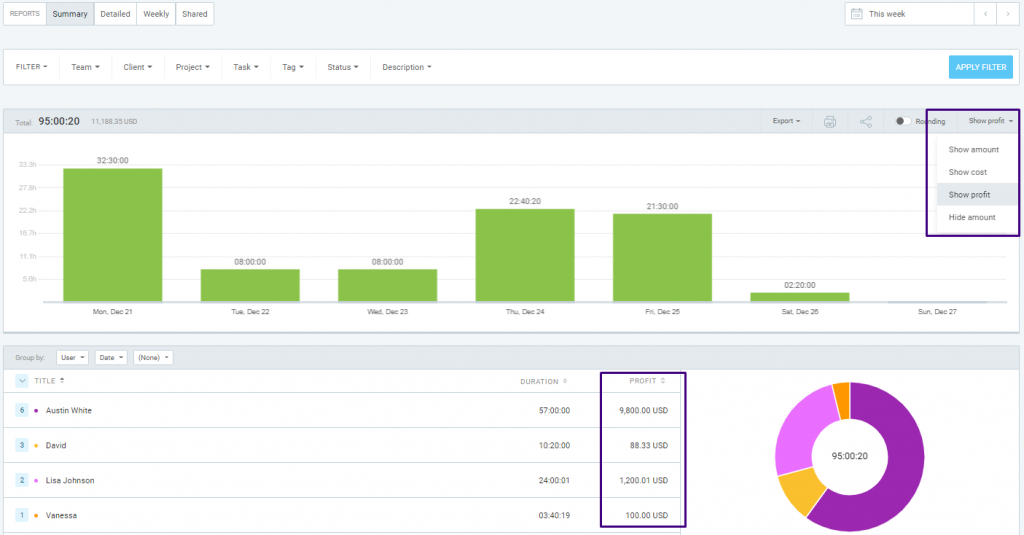

Calculating employee rates with Clockify

Want an easy way to track your actual labor costs?

With Clockify, you can easily track your cost rates per employee and then compare and contrast them with employee billable hourly rates.

Follow the steps below to keep track of the cost of services that involve human resources in Clockify:

- First, define cost and billable hourly rates for each employee (or for your project or workspace on the whole),

- Have your employees track the time they spend working on projects, and

- Finally, run reports to see what you charge your clients, what you pay your employees, and whether you are making a profit (or have costs that exceed revenue).

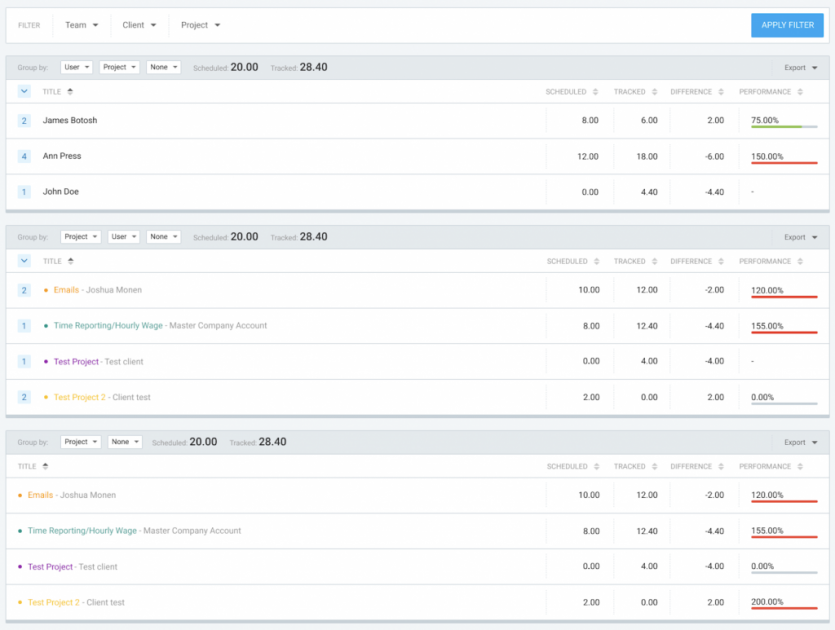

Checking an employee’s FTE with Clockify

To see your employees’ FTEs, you can view their daily/weekly/monthly assignments in Clockify.

Then, as people track time on their assignments, you can run the Assignments Report that shows you tracked vs scheduled hours.

Summing up: FTE may serve in a variety of different contexts

💡Clockify Pro Tip

Learn about how to set the right rate for your services and find free labor-cost calculators to get the estimations hassle-free here:

FTE has several different uses and several different calculation methods, depending on why you want to calculate it. It will help you plan your project work, set deadlines, and work out your budget.

Moreover, having accurate FTEs for all employees will also help employers determine responsibilities towards them, their PTO rates, and whether the business is eligible for certain federal programs. Once you decide why you want to use FTE, identify the appropriate calculation method, and follow it through.

✉️ Have you ever heard about the FTE? In which context do you often make use of it? Let us know at blogfeedback@clockify.me so we can try out your technique next. And, if you liked this blog post, share it with someone you think would be interested in reading it.